| Quarter | Average Weekly Earnings | Average Hourly Earnings | Average Weekly Paid Hours | Average Hourly Total Labour Costs |

| € | € | Hours | € | |

| Q1 2015 | 700.63 | 22.25 | 31.5 | 25.70 |

| Q4 2015 | 710.16 | 21.89 | 32.4 | 25.33 |

| Q1 2016* | 707.99 | 22.40 | 31.6 | 25.86 |

| Quarterly change % | -0.3 | +2.3 | -2.5 | +2.1 |

| Annual change % | +1.1 | +0.7 | +0.3 | +0.6 |

| * Preliminary Estimates | ||||

Preliminary estimates show that average weekly earnings were €707.99 in Q1 2016, a rise of 1.1% from €700.63 a year earlier. Revised average weekly earnings were €710.16 in Q4 2015 and showed an increase of 1.1% over the same period in 2014. See table 1.

Other features of the preliminary results for Q1 2016 include:

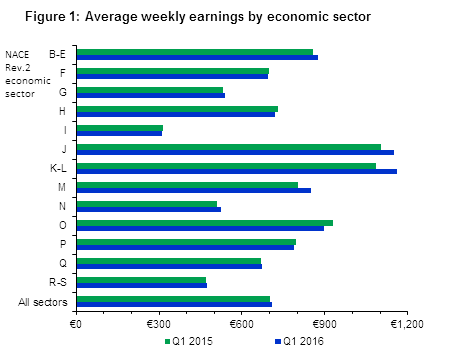

Unadjusted average weekly earnings increase in 8 of the 13 sectors in year to Q1 2016

Across the economic sectors average weekly earnings increased in 8 of the 13 sectors in the year to Q1 2016. The largest percentage increase was recorded in the Financial, insurance & real estate sector (+6.9%) rising from €1,086.33 to €1,161.75. The Public administration & defence sector experienced the largest percentage sectoral decrease falling 3.8% from €930.55 to €894.88. This fall is due to the temporary recruitment of Census 2016 field staff who had lower than average weekly paid hours. See table 1 and table A2.

Average weekly earnings in the private sector showed an increase of 2.2% from €639.73 to €654.11 in the year to Q1 2016. The public sector (including semi-state) average weekly earnings decreased 1.2% from €906.57 to €895.58 in the same period. Excluding Census field staff public sector average weekly earnings decreased 0.1% to €905.96. See table 1 and table A2.

Over the 5 year period Q1 2011 to Q1 2016 average weekly earnings across individual sectors showed changes ranging between -6.1% (Human health & social work sector) and +20.8% (Information and communication sector). See table 1 and figure 2.

|

Note: Census temporary field staff are included in the earnings, hours, labour costs and employment estimates for Q1 2016. The impact of Census field staff on estimates is illustrated in table A4. |

|

Note: While there is no internationally agreed methodology for assessing the public / private sector wage gap, the CSO has published an analysis of the differential using the National Employment Survey (NES) for 2009 and 2010. This analysis took account of compositional differences between sectors, such as occupational mix, sectors of activity, gender balance, union membership etc. Using a variety of criteria and assumptions, the public sector pay gap was estimated to range from 6.1% to 18.9% for NES 2010. See analysis here and here. |

| 5 year % Change | |

| J | 20.8433102289435 |

| M | 14.5580121676492 |

| R-S | 12.8691682122985 |

| K-L | 12.629425679606 |

| G | 8.51871290726312 |

| B-E | 8.06593216356914 |

| N | 6.37301797309124 |

| F | 3.99015960638427 |

| Total | 3.07781902890005 |

| I | 3.01300244208302 |

| H | 0.862262352083443 |

| O | 0.605965216022653 |

| P | -5.40469031870114 |

| Q | -6.10439192955077 |

| Total | All Sectors | K-L | Financial, insurance and real estate activities |

| B-E | Industry | M | Professional, scientific and technical activities |

| F | Construction | N | Administrative and support service activities |

| G | Wholesale and retail trade; repair of motor vehicles and motorcycles | O | Public Administration and defence; compulsory social security |

| H | Transportation and storage | P | Education |

| I | Accommodation and food service activities | Q | Human health and social work activities |

| J | Information and communication | R-S | Arts, entertainment, recreation and other service activities |

Average hourly earnings increase 0.7% to €22.40 in year to Q1 2016

Average hourly earnings increased from €22.25 per hour in Q1 2015 to €22.40 in Q1 2016, representing an increase of 0.7% or €0.15. Revised average hourly earnings decreased 0.7% in the year to Q4 2015 from €22.04 to €21.89 per hour. Seasonally adjusted average hourly earnings showed an increase of 1.8% in the quarter to Q1 2016, increasing from €21.74 to €22.13. See table 2, table 4 and figure 3.

| Unadjusted Series | Adjusted Series | |

| Q108 | 21.53 | 21.5008200862111 |

| Q208 | 21.51 | 21.4532963653336 |

| Q308 | 21.21 | 21.7707182582726 |

| Q408 | 22.17 | 21.9808482028626 |

| Q109 | 22.44 | 22.1671420749118 |

| Q209 | 22.02 | 22.0599566643556 |

| Q309 | 21.89 | 22.2317422322989 |

| Q409 | 22.42 | 22.1260716474472 |

| Q110 | 22.11 | 21.9404757093461 |

| Q210 | 21.95 | 21.9884900632778 |

| Q310 | 21.64 | 21.8813915415966 |

| Q410 | 22.07 | 21.9080887644632 |

| Q111 | 22.22 | 21.917034078039 |

| Q211 | 21.9 | 21.9393708836176 |

| Q311 | 21.58 | 21.9524380283968 |

| Q411 | 22.03 | 21.9862425218482 |

| Q112 | 22.15 | 22.0116943182509 |

| Q212 | 21.97 | 22.0107870402783 |

| Q312 | 21.8 | 21.9459574424763 |

| Q412 | 21.89 | 21.8637747501026 |

| Q113 | 22.2 | 21.8587693872461 |

| Q213 | 22.01 | 21.9458307618705 |

| Q313 | 21.36 | 21.8702705194538 |

| Q413 | 21.73 | 21.7758126624501 |

| Q114 | 22.14 | 21.6249757518781 |

| Q214 | 21.52 | 21.5555220949353 |

| Q314 | 21.02 | 21.5970722057153 |

| Q414 | 22.04 | 21.8500992223341 |

| Q115 | 22.25 | 21.9634065619176 |

| Q215 | 21.84 | 21.878374487618 |

| Q315 | 21.46 | 21.86 |

| Q415 | 21.89 | 21.74 |

| Q116 | 22.4 | 22.13 |

Average hourly earnings increased in 8 of the 13 main sectors in the year to Q1 2016. The largest increase was recorded in the Information and communication sector, increasing 4.4% from €30.56 to €31.91 per hour in the year. The Public administration & defence sector saw the largest annual fall in average hourly earnings to Q1 2016, decreasing 1.3% (-0.8% excluding Census field staff) from €25.66 to €25.33 per hour. See table 2, table A2 and figure 4.

| Q1 2015 | Q1 2016 | |

| B-E | 22.67 | 22.82 |

| F | 19.2 | 19.3 |

| G | 17.83 | 17.78 |

| H | 20.25 | 20.21 |

| I | 12.27 | 12.48 |

| J | 30.56 | 31.91 |

| K-L | 31.96 | 32.84 |

| M | 24.66 | 25.26 |

| N | 17.19 | 17.9 |

| O | 25.66 | 25.33 |

| P | 33.76 | 33.87 |

| Q | 22.05 | 22.01 |

| R-S | 17.33 | 17.28 |

| All sectors | 22.25 | 22.4 |

In the five years to Q1 2016 overall average hourly earnings increased by 0.8% (€0.18) from €22.22 to €22.40. Across the sectors over this period average hourly earnings have increased in 10 of the 13 sectors. The largest percentage increase was recorded in the Information and communication sector (+18.5%) rising from €26.93 to €31.91. The largest percentage decrease in average hourly earnings over the same period was recorded in the Human health and social work sector (-6.6%) falling from €23.56 to €22.01.

Enterprises with less than 50 employees showed an annual increase of 0.6% in average hourly earnings in Q1 2016, from €18.19 to €18.30. Enterprises with between 50 and 250 employees recorded an increase in average hourly earnings of 2.0%, from €20.34 to €20.74 over the same period. Results for enterprises with greater than 250 employees showed an increase of 0.7% in the year to Q1 2016 with values rising from €25.71 to €25.89 in average hourly earnings.

Private sector average hourly earnings rose 1.5% from €20.45 to €20.75 in the year to Q1 2016, while public sector average hourly earnings decreased by 0.4%, from €28.19 to €28.08 in the same period.

Average weekly paid hours increase 0.3% in the year to Q1 2016

Average weekly paid hours increased 0.3% to 31.6 in the year to Q1 2016. Revised average weekly paid hours were 32.4 in Q4 2015 and showed an increase of 1.6% in the year. In the five years to Q1 2016 average weekly paid hours increased by 2.3% from the Q1 2011 level of 30.9.

Seasonally adjusted average weekly paid hours have decreased by 0.9% to 31.8 from 32.1 in the quarter to Q1 2016. See table 3, table 4 and figure 5.

| Unadjusted Series | Adjusted Series | |

| Q108 | 32.7 | 32.864160118 |

| Q208 | 32.9 | 32.930705501 |

| Q308 | 32.9 | 32.695415194 |

| Q408 | 32.5 | 32.506201359 |

| Q109 | 31.7 | 32.065267119 |

| Q209 | 31.9 | 31.928918017 |

| Q309 | 32 | 31.835153558 |

| Q409 | 32.1 | 31.797493263 |

| Q110 | 31.1 | 31.753345395 |

| Q210 | 31.6 | 31.628512599 |

| Q310 | 32.1 | 31.638218434 |

| Q410 | 31.8 | 31.517566121 |

| Q111 | 30.9 | 31.521182564 |

| Q211 | 31.4 | 31.423505036 |

| Q311 | 31.9 | 31.476459685 |

| Q411 | 31.7 | 31.516049714 |

| Q112 | 31.5 | 31.625402082 |

| Q212 | 31.6 | 31.617144633 |

| Q312 | 31.8 | 31.568907163 |

| Q412 | 31.6 | 31.541967984 |

| Q113 | 31.2 | 31.585025596 |

| Q213 | 31.6 | 31.609602128 |

| Q313 | 31.7 | 31.561859896 |

| Q413 | 31.7 | 31.629232976 |

| Q114 | 31.3 | 31.692475416 |

| Q214 | 31.8 | 31.804907407 |

| Q314 | 31.9 | 31.784273064 |

| Q414 | 31.9 | 31.829662955 |

| Q115 | 31.5 | 31.887414483 |

| Q215 | 32 | 32.004682012 |

| Q315 | 32.2 | 32.113692443 |

| Q415 | 32.4 | 32.096411602 |

| Q116 | 31.6 | 31.788664901 |

The largest annual percentage increase in average weekly paid hours in Q1 2016 was recorded in the Financial, insurance and real estate sector (+4.1%), from 34.0 to 35.4 hours. The largest percentage decreases over the same period was seen in the Public administration & defence sector (-2.8%) from 36.3 to 35.3 hours and the Accomodation and food services sector (-2.0%) from 25.5 to 25.0 hours. Excluding Census field staff the Public administration & defence sector rose 0.8% to 36.6 hours in the period.

Enterprises with less than 50 employees and with between 50 and 250 employees both showed increases in the year, with average weekly paid hours rising 0.7% and 0.9% respectively. Enterprises with greater than 250 employees saw no change in average weekly paid hours in the year to Q1 2016 remaining at 32.5. See table 3 and table A4.

Average hourly total labour costs increase by 0.6% in year to Q1 2016

Average hourly total labour costs increased by 0.6% over the year to Q1 2016. The largest percentage increase in average hourly total labour costs was seen in the Administrative and support services sector, rising by 4.4% from €19.50 to €20.35 per hour. The Arts , entertainment, recreation and other services sector recorded the largest percentage decrease in average hourly total labour costs, decreasing by 2.3% from €20.76 to €20.28. Seasonally adjusted average hourly total labour costs increased by 1.0% in the quarter to Q1 2016.

In the year to Q1 2016 the average hourly total labour costs in firms with less than 50 employees increased by 0.8% (from €20.64 to €20.81), while there was a 1.8% increase for firms with 50 to 250 employees (from €23.69 to €24.11). Enterprises with 250 plus employees recorded an increase of 0.5% in average hourly total labour costs over the same period (from €29.86 to €30.02). See table 6c.

The public sector average hourly total labour costs decreased by €0.01 in the year to Q1 2016, falling from €31.20 to €31.19 while the private sector recorded an increase in average hourly total labour costs of 1.2% from €24.03 to €24.31 in the year.

Average hourly total labour costs increased by 2.0% over the five years to Q1 2016, from €25.36 per hour to €25.86. The percentage changes across the sectors ranged from -4.9% in the Human health and social work sector (from €25.70 to €24.45) to +20.2% in the Information and communication sector (from €31.96 to €38.42). See table 6c and figure 6.

| 5 Year % change | |

| J | 20.2127659574468 |

| R-S | 12.7292940522513 |

| G | 7.34137388568431 |

| K-L | 7.30217737652682 |

| N | 5.82423296931878 |

| M | 4.31680342490188 |

| B-E | 4.221635883905 |

| H | 2.1505376344086 |

| Total | 1.97160883280757 |

| F | 1.44522144522146 |

| I | 0.583090379008747 |

| O | -2.54867256637168 |

| P | -4.09731113956465 |

| Q | -4.86381322957198 |

Average weekly earnings decrease 1.2% across the public sector in year to Q1 2016

Average weekly earnings decreased by 1.2% across the public sector in the year to Q1 2016. Excluding Census field staff publis sector earnings decreased by 0.1% in the year. Four of the seven public sector sub-sectors had annual increases in average weekly earnings, with the Semi-state sector recording the largest rise of 2.4% in the year to Q1 2016. The Civil service sub-sector showed a decrease in average weekly earnings in the year of 9.8%, from €922.23 to €831.59. Civil service showed a fall of 0.1% to €921.56 when Census field staff are excluded. See table 8a, table A2 and figure 7.

| Q1 2015 | Q1 2016 | |

| Civil service | 922.23 | 831.59 |

| Defence | 807.82 | 811.03 |

| Garda Siochana | 1235.67 | 1206.15 |

| Education | 901.82 | 886.68 |

| Regional bodies | 827.17 | 833.18 |

| Health | 858.23 | 862.64 |

| Semi-state | 992.8 | 1016.52 |

| All sectors | 906.57 | 895.58 |

Annual increase of 3.2% in public sector employment in Q1 2016

The estimated number of persons employed in the public sector showed an increase of 3.2% over the year to Q1 2016 from 374,500 to 386,600, including the 4,600 Census temporary field staff in Q1 2016.

In the year to Q1 2016 the largest and only percentage decrease was recorded in Defence (-2.1%), a fall of 200 over the Q1 2015 figure. The largest percentage increase over the same period was recorded in the Civil service sector, increasing 12.6% from 38,100 to 42,900. Excluding Census field staff the Civil service sector increased by 0.8% in the period to 38,400.

Over the five years from Q1 2011 to Q1 2016 overall employment numbers in the public sector fell by 22,800 (-5.6%) from 409,400 to 386,600. See table 8e, table A4 and figure 8.

| Q1 2015 | Q1 2016 | |

| Civil service | 38.1 | 42.9 |

| Defence | 9.7 | 9.5 |

| Garda Siochana | 12.8 | 12.8 |

| Education | 110.9 | 112.7 |

| Regional bodies | 32 | 32.6 |

| Health | 119.6 | 123.1 |

| Semi-state | 51.4 | 52.8 |

Table 8e contains estimates of public sector employment numbers by sub-sector within the overall public sector. Public sector employment is spread across a number of NACE economic sectors and includes Semi-state bodies in sectors such as Transportation and storage and Information and communication. Furthermore, while employment in the Public administration and defence, Education, Human health and social work sectors is for the most part comprised of public sector employees, there is some element of private sector employment across these sectors.

Job vacancy rate decreases to 0.9% in Q1 2016

The job vacancy rate at the end of Q1 2016 was 0.9%, decreasing from 1.0% a year earlier. In Q1 2016 the Information and communication sector had the highest vacancy rate of 2.5%, followed by the Financial, insurance and real estate sector with a vacancy rate of 2.3%. The Transportation and storage sector and The Education sector shared the lowest vacancy rate of 0.3% at the end of Q1 2016. See table 7c and figure 9.

The rounded number of job vacancies at the end of Q1 2016 was 14,900 representing a fall of 800 from the number of vacancies at the end of Q1 2015 and an increase of 900 on the vacancies reported at the end of Q4 2015. See table 7b.

| Job Vacancy Rate | |

| Q108 | 1 |

| Q208 | 0.9 |

| Q308 | 0.7 |

| Q408 | 0.5 |

| Q109 | 0.4 |

| Q209 | 0.4 |

| Q309 | 0.3 |

| Q409 | 0.3 |

| Q110 | 0.4 |

| Q210 | 0.5 |

| Q310 | 0.5 |

| Q410 | 0.5 |

| Q111 | 0.5 |

| Q211 | 0.6 |

| Q311 | 0.5 |

| Q411 | 0.5 |

| Q112 | 0.6 |

| Q212 | 0.5 |

| Q312 | 0.6 |

| Q412 | 0.6 |

| Q113 | 0.6 |

| Q213 | 0.7 |

| Q313 | 0.7 |

| Q413 | 0.7 |

| Q114 | 0.7 |

| Q214 | 0.7 |

| Q314 | 0.8 |

| Q414 | 0.7 |

| Q115 | 1 |

| Q215 | 0.9 |

| Q315 | 1 |

| Q415 | 0.9 |

| Q116 | 0.9 |

|

It should be noted that all earnings are gross amounts before deductions for PRSI, tax and other levies. This is particularly relevant to the public sector since March 2009 when the pension levy was introduced. The terms of the Haddington Road agreement have implications on public sector earnings, for example, some public sector workers have increased hours resulting in a fall in hourly earnings. For the full text of the agreement see the following link: http://per.gov.ie/haddington-road-agreement/ Changes in the composition of employees in a given sector or group has an effect on the average levels of earnings and paid hours over time. For example, if the proportion of part-time employees increases within a sector then it would be expected that the average weekly earnings and paid hours would fall in that sector even if the hourly pay rates were unchanged. Also, estimated averages do not reflect differences in characteristics of the job or the employees, and since EHECS collects aggregate data from each enterprise it is not possible to correct for such differences using EHECS data. Many public sector employees are paid on the basis of incremental scales. Recruitment, particularly at lower levels, to these sectors would generally result in a depression to average earnings. The absence of recruitment has the opposite effect. Earnings are inclusive of overtime and irregular earnings. The variability of these components can impact on trends over time. The reduction in employee numbers across the public sector will also impact on average earnings. Consideration to these factors should be given when interpreting results. |

| Table 1 Average weekly earnings by economic sector and other characteristics and quarter¹ | ||||||||||||

| NACE Principal Activity | 2011 | 2012 | 2013 | 2014 | 2015 | 2015 | 2016 | Quarterly change | Annual change | |||

| Q1 | Q1 | Q1 | Q1 | Q1 | Q4 | Q1* | ||||||

| € | € | € | € | € | € | € | € | % | € | % | ||

| B-E | Industry | 808.71 | 832.17 | 824.23 | 864.28 | 856.42 | 858.41 | 873.94 | +15.53 | +1.8 | +17.52 | +2.0 |

| F | Construction | 666.64 | 655.56 | 640.22 | 699.23 | 696.96 | 749.57 | 693.24 | -56.33 | -7.5 | -3.72 | -0.5 |

| G | Wholesale and retail trade; repair of motor vehicles and motorcycles | 495.38 | 518.47 | 518.83 | 520.44 | 530.43 | 549.15 | 537.58 | -11.57 | -2.1 | +7.15 | +1.3 |

| H | Transportation and storage | 713.24 | 709.19 | 723.54 | 706.45 | 731.49 | 755.46 | 719.39 | -36.07 | -4.8 | -12.10 | -1.7 |

| I | Accommodation and food services | 303.02 | 297.67 | 293.01 | 309.59 | 313.40 | 327.13 | 312.15 | -14.98 | -4.6 | -1.25 | -0.4 |

| J | Information and communication | 952.20 | 1,042.64 | 1,039.00 | 1,037.38 | 1,101.41 | 1,070.55 | 1,150.67 | +80.12 | +7.5 | +49.26 | +4.5 |

| K-L | Financial, insurance and real estate | 1,031.48 | 1,022.02 | 1,044.79 | 1,111.29 | 1,086.33 | 1,022.29 | 1,161.75 | +139.46 | +13.6 | +75.42 | +6.9 |

| M | Professional, scientific and technical activities | 741.31 | 857.00 | 826.39 | 829.87 | 803.57 | 829.03 | 849.23 | +20.20 | +2.4 | +45.66 | +5.7 |

| N | Administrative and support services | 491.29 | 491.24 | 507.98 | 510.26 | 507.91 | 526.94 | 522.60 | -4.34 | -0.8 | +14.69 | +2.9 |

| O | Public administration and defence2 | 889.49 | 936.41 | 940.82 | 920.92 | 930.55 | 928.81 | 894.88 | -33.93 | -3.7 | -35.67 | -3.8 |

| P | Education | 831.50 | 828.09 | 814.13 | 802.20 | 796.70 | 822.45 | 786.56 | -35.89 | -4.4 | -10.14 | -1.3 |

| Q | Human health and social work | 717.68 | 711.91 | 689.02 | 667.90 | 669.48 | 691.16 | 673.87 | -17.29 | -2.5 | +4.39 | +0.7 |

| R-S | Arts, entertainment, recreation and other service activities | 420.54 | 468.60 | 484.24 | 461.87 | 469.05 | 470.55 | 474.66 | +4.11 | +0.9 | +5.61 | +1.2 |

| Total2 | 686.85 | 697.03 | 693.06 | 692.86 | 700.63 | 710.16 | 707.99 | -2.17 | -0.3 | +7.36 | +1.1 | |

| Public/Private Sector | ||||||||||||

| Private sector | 610.88 | 624.32 | 624.26 | 631.04 | 639.73 | 647.73 | 654.11 | +6.38 | +1.0 | +14.38 | +2.2 | |

| Public sector2 | 893.83 | 917.46 | 915.62 | 902.98 | 906.57 | 927.83 | 895.58 | -32.25 | -3.5 | -10.99 | -1.2 | |

| Size of Enterprise | ||||||||||||

| Less than 50 employees | 520.16 | 536.49 | 534.05 | 553.10 | 546.44 | 558.13 | 551.98 | -6.15 | -1.1 | +5.54 | +1.0 | |

| 50-250 employees | 645.54 | 656.07 | 653.25 | 619.02 | 643.15 | 659.58 | 662.11 | +2.53 | +0.4 | +18.96 | +2.9 | |

| Greater than 250 employees2 | 821.25 | 825.02 | 828.12 | 824.82 | 835.28 | 842.43 | 842.48 | +0.05 | - | +7.20 | +0.9 | |

| ¹ Average weekly earnings by Public sector sub-sector are set out in Table 8a. | ||||||||||||

| 2 Includes Census 2016 temporary field staff. See Table A4. | ||||||||||||

| * Preliminary Estimates | ||||||||||||

| Table 2 Average hourly earnings by economic sector and other characteristics and quarter¹ | ||||||||||||

| NACE Principal Activity | 2011 | 2012 | 2013 | 2014 | 2015 | 2015 | 2016 | Quarterly change | Annual change | |||

| Q1 | Q1 | Q1 | Q1 | Q1 | Q4 | Q1* | ||||||

| € | € | € | € | € | € | € | € | % | € | % | ||

| B-E | Industry | 22.10 | 22.27 | 22.06 | 22.83 | 22.67 | 22.09 | 22.82 | +0.73 | +3.3 | +0.15 | +0.7 |

| F | Construction | 18.97 | 18.55 | 18.32 | 19.25 | 19.20 | 20.29 | 19.30 | -0.99 | -4.9 | +0.10 | +0.5 |

| G | Wholesale and retail trade; repair of motor vehicles and motorcycles | 16.60 | 17.07 | 17.33 | 17.45 | 17.83 | 17.65 | 17.78 | +0.13 | +0.7 | -0.05 | -0.3 |

| H | Transportation and storage | 19.71 | 19.96 | 20.25 | 20.27 | 20.25 | 20.50 | 20.21 | -0.29 | -1.4 | -0.04 | -0.2 |

| I | Accommodation and food services | 12.37 | 12.10 | 12.06 | 12.20 | 12.27 | 12.42 | 12.48 | +0.06 | +0.5 | +0.21 | +1.7 |

| J | Information and communication | 26.93 | 28.82 | 28.39 | 28.82 | 30.56 | 29.39 | 31.91 | +2.52 | +8.6 | +1.35 | +4.4 |

| K-L | Financial, insurance and real estate | 30.92 | 30.17 | 30.70 | 32.24 | 31.96 | 28.91 | 32.84 | +3.93 | +13.6 | +0.88 | +2.8 |

| M | Professional, scientific and technical activities | 24.08 | 26.17 | 25.33 | 25.34 | 24.66 | 24.68 | 25.26 | +0.58 | +2.4 | +0.60 | +2.4 |

| N | Administrative and support services | 16.81 | 15.94 | 16.94 | 16.99 | 17.19 | 16.99 | 17.90 | +0.91 | +5.4 | +0.71 | +4.1 |

| O | Public administration and defence2 | 26.30 | 26.41 | 26.51 | 25.55 | 25.66 | 25.63 | 25.33 | -0.30 | -1.2 | -0.33 | -1.3 |

| P | Education | 35.96 | 35.47 | 35.25 | 34.35 | 33.76 | 34.26 | 33.87 | -0.39 | -1.1 | +0.11 | +0.3 |

| Q | Human health and social work | 23.56 | 23.31 | 22.84 | 22.35 | 22.05 | 21.97 | 22.01 | +0.04 | +0.2 | -0.04 | -0.2 |

| R-S | Arts, entertainment, recreation and other service activities | 15.73 | 16.64 | 17.22 | 16.86 | 17.33 | 16.87 | 17.28 | +0.41 | +2.4 | -0.05 | -0.3 |

| Total2 | 22.22 | 22.15 | 22.20 | 22.14 | 22.25 | 21.89 | 22.40 | +0.51 | +2.3 | +0.15 | +0.7 | |

| Public/Private Sector | ||||||||||||

| Private sector | 19.76 | 19.88 | 20.06 | 20.29 | 20.45 | 20.04 | 20.75 | +0.71 | +3.5 | +0.30 | +1.5 | |

| Public sector2 | 28.90 | 28.96 | 29.04 | 28.29 | 28.19 | 28.25 | 28.08 | -0.17 | -0.6 | -0.11 | -0.4 | |

| Size of Enterprise | ||||||||||||

| Less than 50 employees | 17.54 | 17.72 | 17.88 | 18.53 | 18.19 | 18.16 | 18.30 | +0.14 | +0.8 | +0.11 | +0.6 | |

| 50-250 employees | 20.31 | 20.57 | 20.62 | 19.76 | 20.34 | 20.10 | 20.74 | +0.64 | +3.2 | +0.40 | +2.0 | |

| Greater than 250 employees2 | 26.04 | 25.63 | 25.82 | 25.51 | 25.71 | 25.11 | 25.89 | +0.78 | +3.1 | +0.18 | +0.7 | |

| ¹ Average hourly earnings by Public sector sub-sector are set out in Table 8b. | ||||||||||||

| 2 Includes Census 2016 temporary field staff. See Table A4. | ||||||||||||

| * Preliminary Estimates | ||||||||||||

| Table 3 Average weekly paid hours by economic sector and other characteristics and quarter¹ | ||||||||||||

| NACE Principal Activity | 2011 | 2012 | 2013 | 2014 | 2015 | 2015 | 2016 | Quarterly change | Annual change | |||

| Q1 | Q1 | Q1 | Q1 | Q1 | Q4 | Q1* | ||||||

| hours | hours | hours | hours | hours | hours | hours | hours | % | hours | % | ||

| B-E | Industry | 36.6 | 37.4 | 37.4 | 37.9 | 37.8 | 38.9 | 38.3 | -0.6 | -1.5 | 0.5 | +1.3 |

| F | Construction | 35.1 | 35.3 | 34.9 | 36.3 | 36.3 | 36.9 | 35.9 | -1.0 | -2.7 | -0.4 | -1.1 |

| G | Wholesale and retail trade; repair of motor vehicles and motorcycles | 29.8 | 30.4 | 29.9 | 29.8 | 29.7 | 31.1 | 30.2 | -0.9 | -2.9 | 0.5 | +1.7 |

| H | Transportation and storage | 36.2 | 35.5 | 35.7 | 34.9 | 36.1 | 36.9 | 35.6 | -1.3 | -3.5 | -0.5 | -1.4 |

| I | Accommodation and food services | 24.5 | 24.6 | 24.3 | 25.4 | 25.5 | 26.3 | 25.0 | -1.3 | -4.9 | -0.5 | -2.0 |

| J | Information and communication | 35.4 | 36.2 | 36.6 | 36.0 | 36.0 | 36.4 | 36.1 | -0.3 | -0.8 | 0.1 | +0.3 |

| K-L | Financial, insurance and real estate | 33.4 | 33.9 | 34.0 | 34.5 | 34.0 | 35.4 | 35.4 | - | - | 1.4 | +4.1 |

| M | Professional, scientific and technical activities | 30.8 | 32.8 | 32.6 | 32.8 | 32.6 | 33.6 | 33.6 | - | - | 1.0 | +3.1 |

| N | Administrative and support services | 29.2 | 30.8 | 30.0 | 30.0 | 29.6 | 31.0 | 29.2 | -1.8 | -5.8 | -0.4 | -1.4 |

| O | Public administration and defence2 | 33.8 | 35.5 | 35.5 | 36.0 | 36.3 | 36.2 | 35.3 | -0.9 | -2.5 | -1.0 | -2.8 |

| P | Education | 23.1 | 23.3 | 23.1 | 23.4 | 23.6 | 24.0 | 23.2 | -0.8 | -3.3 | -0.4 | -1.7 |

| Q | Human health and social work | 30.5 | 30.5 | 30.2 | 29.9 | 30.4 | 31.5 | 30.6 | -0.9 | -2.9 | 0.2 | +0.7 |

| R-S | Arts, entertainment, recreation and other service activities | 26.7 | 28.2 | 28.1 | 27.4 | 27.1 | 27.9 | 27.5 | -0.4 | -1.4 | 0.4 | +1.5 |

| Total2 | 30.9 | 31.5 | 31.2 | 31.3 | 31.5 | 32.4 | 31.6 | -0.8 | -2.5 | 0.1 | +0.3 | |

| Public/Private Sector | ||||||||||||

| Private sector | 30.9 | 31.4 | 31.1 | 31.1 | 31.3 | 32.3 | 31.5 | -0.8 | -2.5 | 0.2 | +0.6 | |

| Public sector2 | 30.9 | 31.7 | 31.5 | 31.9 | 32.2 | 32.8 | 31.9 | -0.9 | -2.7 | -0.3 | -0.9 | |

| Size of Enterprise | ||||||||||||

| Less than 50 employees | 29.7 | 30.3 | 29.9 | 29.9 | 30.0 | 30.7 | 30.2 | -0.5 | -1.6 | 0.2 | +0.7 | |

| 50-250 employees | 31.8 | 31.9 | 31.7 | 31.3 | 31.6 | 32.8 | 31.9 | -0.9 | -2.7 | 0.3 | +0.9 | |

| Greater than 250 employees2 | 31.5 | 32.2 | 32.1 | 32.3 | 32.5 | 33.5 | 32.5 | -1.0 | -3.0 | - | - | |

| ¹ Average weekly paid hours by Public sector sub-sector are set out in Table 8c. | ||||||||||||

| 2 Includes Census 2016 temporary field staff. See Table A4. | ||||||||||||

| * Preliminary Estimates | ||||||||||||

| Table 4 Earnings, hours and Labour Costs, unadjusted and seasonally adjusted by other characteristics and quarter | |||||||||||||||||

| Unadjusted Series | Seasonally Adjusted Series | ||||||||||||||||

| Quarter | Average weekly earnings | Average weekly paid hours | Average hourly earnings | Average hourly other labour costc | Average hourly total labour costs | Average weekly earnings | Average weekly paid hours | Average hourly earnings | Average hourly other labour cost | Average hourly total labour costs | |||||||

| Q108 | 704.85 | 32.7 | 21.53 | 3.50 | 25.03 | 705.00 | 32.9 | 21.50 | 3.40 | 24.84 | |||||||

| Q208 | 706.56 | 32.9 | 21.51 | 3.40 | 24.91 | 705.27 | 32.9 | 21.45 | 3.47 | 24.94 | |||||||

| Q308 | 697.63 | 32.9 | 21.21 | 3.42 | 24.63 | 709.23 | 32.7 | 21.77 | 3.51 | 25.08 | |||||||

| Q408 | 721.27 | 32.5 | 22.17 | 3.60 | 25.77 | 712.81 | 32.5 | 21.98 | 3.48 | 25.47 | |||||||

| Q109 | 710.77 | 31.7 | 22.44 | 3.59 | 26.03 | 712.03 | 32.1 | 22.17 | 3.62 | 25.76 | |||||||

| Q209 | 702.63 | 31.9 | 22.02 | 3.65 | 25.66 | 705.68 | 31.9 | 22.06 | 3.66 | 25.78 | |||||||

| Q309 | 700.05 | 32.0 | 21.89 | 3.49 | 25.38 | 706.46 | 31.8 | 22.23 | 3.64 | 25.82 | |||||||

| Q409 | 719.11 | 32.1 | 22.42 | 3.64 | 26.07 | 702.68 | 31.8 | 22.13 | 3.58 | 25.79 | |||||||

| Q110 | 687.15 | 31.1 | 22.11 | 3.33 | 25.45 | 696.69 | 31.8 | 21.94 | 3.37 | 25.23 | |||||||

| Q210 | 693.77 | 31.6 | 21.95 | 3.27 | 25.22 | 696.06 | 31.6 | 21.99 | 3.32 | 25.27 | |||||||

| Q310 | 694.14 | 32.1 | 21.64 | 3.11 | 24.75 | 692.46 | 31.6 | 21.88 | 3.28 | 25.20 | |||||||

| Q410 | 702.27 | 31.8 | 22.07 | 3.26 | 25.33 | 691.86 | 31.5 | 21.91 | 3.01 | 25.07 | |||||||

| Q111 | 686.85 | 30.9 | 22.22 | 3.14 | 25.36 | 691.24 | 31.5 | 21.92 | 3.20 | 25.07 | |||||||

| Q211 | 688.61 | 31.4 | 21.90 | 3.14 | 25.04 | 690.14 | 31.4 | 21.94 | 3.15 | 25.13 | |||||||

| Q311 | 688.24 | 31.9 | 21.58 | 3.08 | 24.66 | 691.81 | 31.5 | 21.95 | 3.12 | 25.13 | |||||||

| Q411 | 698.10 | 31.7 | 22.03 | 3.29 | 25.32 | 692.24 | 31.5 | 21.99 | 3.12 | 25.08 | |||||||

| Q112 | 697.03 | 31.5 | 22.15 | 3.24 | 25.39 | 692.60 | 31.6 | 22.01 | 3.19 | 25.08 | |||||||

| Q212 | 693.05 | 31.6 | 21.97 | 3.29 | 25.26 | 693.79 | 31.6 | 22.01 | 3.32 | 25.32 | |||||||

| Q312 | 692.67 | 31.8 | 21.80 | 3.31 | 25.11 | 693.20 | 31.6 | 21.95 | 3.43 | 25.61 | |||||||

| Q412 | 692.30 | 31.6 | 21.89 | 3.57 | 25.46 | 692.50 | 31.5 | 21.86 | 3.47 | 25.23 | |||||||

| Q113 | 693.06 | 31.2 | 22.20 | 3.45 | 25.65 | 692.14 | 31.6 | 21.86 | 3.44 | 25.37 | |||||||

| Q213 | 696.17 | 31.6 | 22.01 | 3.31 | 25.32 | 691.88 | 31.6 | 21.95 | 3.39 | 25.30 | |||||||

| Q313 | 677.40 | 31.7 | 21.36 | 3.19 | 24.55 | 690.59 | 31.6 | 21.87 | 3.38 | 25.09 | |||||||

| Q413 | 689.41 | 31.7 | 21.73 | 3.69 | 25.43 | 689.48 | 31.6 | 21.78 | 3.39 | 25.21 | |||||||

| Q114 | 692.86 | 31.3 | 22.14 | 3.36 | 25.50 | 687.40 | 31.7 | 21.62 | 3.38 | 25.09 | |||||||

| Q214 | 685.44 | 31.8 | 21.52 | 3.31 | 24.84 | 685.51 | 31.8 | 21.56 | 3.33 | 24.92 | |||||||

| Q314 | 670.91 | 31.9 | 21.02 | 3.23 | 24.25 | 683.57 | 31.8 | 21.60 | 3.33 | 24.82 | |||||||

| Q414 | 702.61 | 31.9 | 22.04 | 3.50 | 25.55 | 698.09 | 31.8 | 21.85 | 3.37 | 25.33 | |||||||

| Q115 | 700.63 | 31.5 | 22.25 | 3.44 | 25.70 | 699.44 | 31.9 | 21.96 | 3.43 | 25.29 | |||||||

| Q215 | 698.65 | 32.0 | 21.84 | 3.43 | 25.28 | 698.77 | 32.0 | 21.88 | 3.48 | 25.32 | |||||||

| Q315 | 691.81 | 32.2 | 21.46 | 3.33 | 24.79 | 699.84 | 32.1 | 21.86 | 3.48 | 25.39 | |||||||

| Q415 | 710.16 | 32.4 | 21.89 | 3.44 | 25.33 | 700.27 | 32.1 | 21.74 | 3.43 | 25.23 | |||||||

| Q116* | 707.99 | 31.6 | 22.40 | 3.45 | 25.86 | 705.39 | 31.8 | 22.13 | 3.39 | 25.47 | |||||||

| *Preliminary Results | |||||||||||||||||

| Table 5a Average hourly earnings excluding irregular earnings by economic sector and other characteristics and quarter¹² | ||||||||||||

| NACE Principal Activity | 2011 | 2012 | 2013 | 2014 | 2015 | 2015 | 2016 | Quarterly change | Annual change | |||

| Q1 | Q1 | Q1 | Q1 | Q1 | Q4 | Q1* | ||||||

| € | € | € | € | € | € | € | € | % | € | % | ||

| B-E | Industry | 20.53 | 20.46 | 20.44 | 20.79 | 20.77 | 20.71 | 20.82 | +0.11 | +0.5 | +0.05 | +0.2 |

| F | Construction | 18.78 | 18.43 | 18.18 | 18.91 | 18.91 | 19.38 | 19.14 | -0.24 | -1.2 | +0.23 | +1.2 |

| G | Wholesale and retail trade; repair of motor vehicles and motorcycles | 15.71 | 16.08 | 16.39 | 16.37 | 16.55 | 16.56 | 16.76 | +0.20 | +1.2 | +0.21 | +1.3 |

| H | Transportation and storage | 18.89 | 18.78 | 19.10 | 19.42 | 19.32 | 19.36 | 19.30 | -0.06 | -0.3 | -0.02 | -0.1 |

| I | Accommodation and food services | 12.23 | 11.86 | 11.87 | 12.01 | 12.03 | 12.04 | 12.18 | +0.14 | +1.2 | +0.15 | +1.2 |

| J | Information and communication | 24.26 | 25.25 | 25.04 | 25.49 | 26.04 | 26.40 | 27.03 | +0.63 | +2.4 | +0.99 | +3.8 |

| K-L | Financial, insurance and real estate | 27.29 | 27.00 | 26.71 | 26.77 | 26.86 | 27.15 | 26.76 | -0.39 | -1.4 | -0.10 | -0.4 |

| M | Professional, scientific and technical activities | 22.57 | 23.58 | 23.69 | 23.92 | 22.99 | 23.18 | 23.58 | +0.40 | +1.7 | +0.59 | +2.6 |

| N | Administrative and support services | 15.41 | 14.90 | 15.24 | 15.37 | 16.18 | 16.00 | 16.29 | +0.29 | +1.8 | +0.11 | +0.7 |

| O | Public administration and defence3 | 25.00 | 25.17 | 25.29 | 24.38 | 24.46 | 24.48 | 24.24 | -0.24 | -1.0 | -0.22 | -0.9 |

| P | Education | 35.39 | 34.96 | 34.66 | 33.90 | 33.37 | 33.77 | 33.53 | -0.24 | -0.7 | +0.16 | +0.5 |

| Q | Human health and social work | 22.43 | 22.22 | 21.80 | 21.41 | 21.17 | 21.05 | 21.10 | +0.05 | +0.2 | -0.07 | -0.3 |

| R-S | Arts, entertainment, recreation and other service activities | 15.39 | 15.96 | 16.41 | 16.16 | 16.41 | 16.03 | 16.23 | +0.20 | +1.2 | -0.18 | -1.1 |

| Total3 | 20.98 | 20.81 | 20.86 | 20.69 | 20.78 | 20.74 | 20.86 | +0.12 | +0.6 | +0.08 | +0.4 | |

| Public/Private Sector | ||||||||||||

| Private sector | 18.53 | 18.51 | 18.68 | 18.74 | 18.85 | 18.89 | 19.07 | +0.18 | +1.0 | +0.22 | +1.2 | |

| Public sector3 | 27.66 | 27.71 | 27.81 | 27.17 | 27.10 | 27.09 | 27.02 | -0.07 | -0.3 | -0.08 | -0.3 | |

| Size of Enterprise | ||||||||||||

| Less than 50 employees | 16.98 | 17.05 | 17.20 | 17.56 | 17.40 | 17.37 | 17.46 | +0.09 | +0.5 | +0.06 | +0.3 | |

| 50-250 employees | 19.01 | 18.99 | 19.13 | 18.46 | 18.83 | 18.93 | 19.05 | +0.12 | +0.6 | +0.22 | +1.2 | |

| Greater than 250 employees3 | 24.37 | 23.92 | 24.06 | 23.68 | 23.78 | 23.73 | 23.91 | +0.18 | +0.8 | +0.13 | +0.5 | |

| ¹ Average hourly earnings excluding irregular earnings plus the average hourly irregular earnings in Table 5b equal average hourly earnings as set out in Table 2. | ||||||||||||

| ² Average hourly earnings excluding irregular earnings by Public sector sub-sector are set out in Table 8d. | ||||||||||||

| 3 Includes Census 2016 temporary field staff. See Table A4. | ||||||||||||

| * Preliminary Estimates | ||||||||||||

| Table 5b Average hourly irregular earnings by economic sector and other characteristics and quarter¹ | ||||||||||

| NACE Principal Activity | 2011 | 2012 | 2013 | 2014 | 2015 | 2015 | 2016 | Quarterly change | Annual change | |

| Q1 | Q1 | Q1 | Q1 | Q1 | Q4 | Q1* | ||||

| € | € | € | € | € | € | € | € | € | ||

| B-E | Industry | 1.56 | 1.81 | 1.63 | 2.03 | 1.90 | 1.38 | 2.00 | +0.62 | +0.10 |

| F | Construction | 0.19 | 0.12 | 0.14 | 0.34 | 0.29 | 0.92 | 0.16 | -0.76 | -0.13 |

| G | Wholesale and retail trade; repair of motor vehicles and motorcycles | 0.89 | 1.00 | 0.94 | 1.09 | 1.29 | 1.09 | 1.02 | -0.07 | -0.27 |

| H | Transportation and storage | 0.82 | 1.19 | 1.14 | 0.84 | 0.93 | 1.13 | 0.91 | -0.22 | -0.02 |

| I | Accommodation and food services | 0.14 | 0.23 | 0.19 | 0.18 | 0.24 | 0.38 | 0.31 | -0.07 | +0.07 |

| J | Information and communication | 2.67 | 3.56 | 3.35 | 3.33 | 4.52 | 2.99 | 4.88 | +1.89 | +0.36 |

| K-L | Financial, insurance and real estate | 3.63 | 3.17 | 3.99 | 5.47 | 5.09 | 1.75 | 6.08 | +4.33 | +0.99 |

| M | Professional, scientific and technical activities | 1.50 | 2.58 | 1.64 | 1.41 | 1.67 | 1.50 | 1.68 | +0.18 | +0.01 |

| N | Administrative and support services | 1.41 | 1.04 | 1.70 | 1.62 | 1.00 | 0.99 | 1.61 | +0.62 | +0.61 |

| O | Public administration and defence2 | 1.30 | 1.24 | 1.22 | 1.16 | 1.20 | 1.15 | 1.10 | -0.05 | -0.10 |

| P | Education | 0.57 | 0.52 | 0.59 | 0.44 | 0.38 | 0.49 | 0.34 | -0.15 | -0.04 |

| Q | Human health and social work | 1.13 | 1.09 | 1.04 | 0.94 | 0.87 | 0.92 | 0.91 | -0.01 | +0.04 |

| R-S | Arts, entertainment, recreation and other service activities | 0.34 | 0.68 | 0.80 | 0.70 | 0.92 | 0.84 | 1.06 | +0.22 | +0.14 |

| Total2 | 1.24 | 1.34 | 1.35 | 1.45 | 1.48 | 1.15 | 1.55 | +0.40 | +0.07 | |

| Public/Private Sector | ||||||||||

| Private sector | 1.23 | 1.38 | 1.38 | 1.55 | 1.60 | 1.15 | 1.69 | +0.54 | +0.09 | |

| Public sector2 | 1.24 | 1.24 | 1.23 | 1.12 | 1.08 | 1.16 | 1.06 | -0.10 | -0.02 | |

| Size of Enterprise | ||||||||||

| Less than 50 employees | 0.55 | 0.67 | 0.68 | 0.97 | 0.79 | 0.79 | 0.84 | +0.05 | +0.05 | |

| 50-250 employees | 1.30 | 1.58 | 1.49 | 1.30 | 1.51 | 1.16 | 1.69 | +0.53 | +0.18 | |

| Greater than 250 employees2 | 1.68 | 1.71 | 1.77 | 1.84 | 1.93 | 1.39 | 1.98 | +0.59 | +0.05 | |

| ¹ Average hourly irregular earnings plus the average hourly earnings excluding irregular earnings in Table 5a equal average hourly earnings as set out in Table 2. | ||||||||||

| 2 Includes Census 2016 temporary field staff. See Table A4. | ||||||||||

| * Preliminary Estimates | ||||||||||

| Table 6a Average hourly other labour costs by economic sector and other characteristics and quarter | ||||||||||||

| NACE Principal Activity | 2011 | 2012 | 2013 | 2014 | 2015 | 2015 | 2016 | Quarterly change | Annual change | |||

| Q1 | Q1 | Q1 | Q1 | Q1 | Q4 | Q1* | ||||||

| € | € | € | € | € | € | € | € | % | € | % | ||

| B-E | Industry | 4.44 | 4.34 | 4.93 | 4.68 | 4.74 | 4.89 | 4.84 | -0.05 | -1.0 | +0.10 | +2.1 |

| F | Construction | 2.48 | 2.26 | 2.29 | 2.41 | 2.37 | 2.55 | 2.46 | -0.09 | -3.5 | +0.09 | +3.8 |

| G | Wholesale and retail trade; repair of motor vehicles and motorcycles | 2.46 | 2.53 | 2.52 | 2.72 | 2.72 | 2.86 | 2.68 | -0.18 | -6.3 | -0.04 | -1.5 |

| H | Transportation and storage | 3.54 | 4.48 | 3.59 | 3.42 | 3.48 | 3.64 | 3.54 | -0.10 | -2.7 | +0.06 | +1.7 |

| I | Accommodation and food services | 1.35 | 1.13 | 1.08 | 1.28 | 1.31 | 1.34 | 1.31 | -0.03 | -2.2 | - | - |

| J | Information and communication | 5.03 | 6.09 | 7.32 | 5.99 | 6.43 | 6.92 | 6.51 | -0.41 | -5.9 | +0.08 | +1.2 |

| K-L | Financial, insurance and real estate | 6.74 | 6.69 | 7.48 | 7.53 | 8.03 | 7.05 | 7.58 | +0.53 | +7.5 | -0.45 | -5.6 |

| M | Professional, scientific and technical activities | 3.96 | 4.09 | 4.04 | 4.17 | 3.88 | 4.05 | 3.98 | -0.07 | -1.7 | +0.10 | +2.6 |

| N | Administrative and support services | 2.41 | 2.21 | 2.31 | 2.32 | 2.32 | 2.42 | 2.46 | +0.04 | +1.7 | +0.14 | +6.0 |

| O | Public administration and defence1 | 1.95 | 2.01 | 2.09 | 2.09 | 2.16 | 2.13 | 2.20 | +0.07 | +3.3 | +0.04 | +1.9 |

| P | Education | 3.09 | 3.40 | 3.52 | 3.52 | 3.48 | 3.59 | 3.58 | -0.01 | -0.3 | +0.10 | +2.9 |

| Q | Human health and social work | 2.14 | 2.36 | 2.37 | 2.42 | 2.43 | 2.41 | 2.44 | +0.03 | +1.2 | +0.01 | +0.4 |

| R-S | Arts, entertainment, recreation and other service activities | 2.26 | 3.04 | 3.54 | 3.12 | 3.43 | 2.35 | 2.99 | +0.64 | +27.2 | -0.44 | -12.8 |

| Total1 | 3.14 | 3.24 | 3.45 | 3.36 | 3.44 | 3.44 | 3.45 | +0.01 | +0.3 | +0.01 | +0.3 | |

| Public/Private Sector | ||||||||||||

| Private sector | 3.26 | 3.34 | 3.59 | 3.49 | 3.58 | 3.56 | 3.55 | -0.01 | -0.3 | -0.03 | -0.8 | |

| Public sector1 | 2.82 | 2.94 | 2.98 | 2.95 | 3.01 | 3.05 | 3.11 | +0.06 | +2.0 | +0.10 | +3.3 | |

| Size of Enterprise | ||||||||||||

| Less than 50 employees | 2.24 | 2.41 | 2.57 | 2.56 | 2.45 | 2.41 | 2.51 | +0.10 | +4.1 | +0.06 | +2.4 | |

| 50-250 employees | 3.47 | 3.35 | 3.34 | 3.20 | 3.35 | 3.24 | 3.37 | +0.13 | +4.0 | +0.02 | +0.6 | |

| Greater than 250 employees1 | 3.64 | 3.76 | 4.11 | 3.97 | 4.15 | 4.22 | 4.13 | -0.09 | -2.1 | -0.02 | -0.5 | |

| 1 Includes Census 2016 temporary field staff. See Table A4. | ||||||||||||

| * Preliminary Estimates | ||||||||||||

| Table 6b Average hourly benefits in kind (BIK) by economic sector and other characteristics and quarter¹ | ||||||||||

| NACE Principal Activity | 2011 | 2012 | 2013 | 2014 | 2015 | 2015 | 2016 | Quarterly change | Annual change | |

| Q1 | Q1 | Q1 | Q1 | Q1 | Q4 | Q1* | ||||

| € | € | € | € | € | € | € | € | € | ||

| B-E | Industry | 0.27 | 0.25 | 0.24 | 0.25 | 0.20 | 0.23 | 0.26 | +0.03 | +0.06 |

| F | Construction | 0.11 | 0.09 | 0.06 | 0.06 | 0.05 | 0.06 | 0.05 | -0.01 | - |

| G | Wholesale and retail trade; repair of motor vehicles and motorcycles | 0.22 | 0.21 | 0.22 | 0.27 | 0.24 | 0.31 | 0.23 | -0.08 | -0.01 |

| H | Transportation and storage | 0.08 | 0.11 | 0.15 | 0.12 | 0.13 | 0.10 | 0.10 | - | -0.03 |

| I | Accommodation and food services | 0.03 | 0.02 | 0.01 | 0.02 | 0.02 | 0.02 | 0.01 | -0.01 | -0.01 |

| J | Information and communication | 0.36 | 0.79 | 0.48 | 0.91 | 0.91 | 1.79 | 1.02 | -0.77 | +0.11 |

| K-L | Financial, insurance and real estate | 0.29 | 0.31 | 0.35 | 0.48 | 0.53 | 0.29 | 0.39 | +0.10 | -0.14 |

| M | Professional, scientific and technical activities | 0.22 | 0.31 | 0.45 | 0.34 | 0.19 | 0.42 | 0.37 | -0.05 | +0.18 |

| N | Administrative and support services | 0.16 | 0.07 | 0.17 | 0.10 | 0.12 | 0.16 | 0.15 | -0.01 | +0.03 |

| O | Public administration and defence2 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | - | - |

| P | Education | 0.01 | 0.01 | 0.02 | 0.01 | 0.00 | 0.01 | 0.00 | -0.01 | - |

| Q | Human health and social work | 0.00 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | - | - |

| R-S | Arts, entertainment, recreation and other service activities | 0.08 | 0.85 | 0.67 | 0.69 | 1.08 | 0.23 | 0.73 | +0.50 | -0.35 |

| Total2 | 0.15 | 0.18 | 0.18 | 0.20 | 0.20 | 0.23 | 0.20 | -0.03 | - | |

| Public/Private Sector | ||||||||||

| Private sector | 0.20 | 0.24 | 0.23 | 0.26 | 0.25 | 0.29 | 0.26 | -0.03 | +0.01 | |

| Public sector2 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | - | - | |

| Size of Enterprise | ||||||||||

| Less than 50 employees | 0.16 | 0.20 | 0.19 | 0.21 | 0.14 | 0.15 | 0.15 | - | +0.01 | |

| 50-250 employees | 0.23 | 0.20 | 0.19 | 0.19 | 0.21 | 0.17 | 0.21 | +0.04 | - | |

| Greater than 250 employees2 | 0.11 | 0.16 | 0.17 | 0.20 | 0.23 | 0.30 | 0.23 | -0.07 | - | |

| ¹ Average hourly beneifts in kind (BIK) are a sub-component of average hourly other labour costs as set out in Table 6a. Eurostat consider BIK to be a part of Earnings rather than an Other Labour Costs. | ||||||||||

| 2 Includes Census 2016 temporary field staff. See Table A4. | ||||||||||

| * Preliminary Estimates | ||||||||||

| Table 6c Average hourly total labour costs by economic sector and other characteristics and quarter¹ | |||||||||||||

| NACE Principal Activity | 2011 | 2012 | 2013 | 2014 | 2015 | 2015 | 2016 | Quarterly change | Annual change | ||||

| Q1 | Q1 | Q1 | Q1 | Q1 | Q4 | Q1* | |||||||

| € | € | € | € | € | € | € | € | % | € | % | |||

| B-E | Industry | 26.53 | 26.61 | 26.99 | 27.50 | 27.41 | 26.98 | 27.65 | +0.67 | +2.5 | +0.24 | +0.9 | |

| F | Construction | 21.45 | 20.81 | 20.61 | 21.66 | 21.57 | 22.84 | 21.76 | -1.08 | -4.7 | +0.19 | +0.9 | |

| G | Wholesale and retail trade; repair of motor vehicles and motorcycles | 19.07 | 19.60 | 19.86 | 20.17 | 20.56 | 20.51 | 20.47 | -0.04 | -0.2 | -0.09 | -0.4 | |

| H | Transportation and storage | 23.25 | 24.44 | 23.84 | 23.69 | 23.73 | 24.13 | 23.75 | -0.38 | -1.6 | +0.02 | +0.1 | |

| I | Accommodation and food services | 13.72 | 13.23 | 13.14 | 13.47 | 13.58 | 13.77 | 13.80 | +0.03 | +0.2 | +0.22 | +1.6 | |

| J | Information and communication | 31.96 | 34.91 | 35.71 | 34.80 | 36.99 | 36.31 | 38.42 | +2.11 | +5.8 | +1.43 | +3.9 | |

| K-L | Financial, insurance and real estate | 37.66 | 36.86 | 38.18 | 39.77 | 39.99 | 35.95 | 40.41 | +4.46 | +12.4 | +0.42 | +1.1 | |

| M | Professional, scientific and technical activities | 28.03 | 30.25 | 29.37 | 29.51 | 28.54 | 28.73 | 29.24 | +0.51 | +1.8 | +0.70 | +2.5 | |

| N | Administrative and support services | 19.23 | 18.15 | 19.26 | 19.31 | 19.50 | 19.41 | 20.35 | +0.94 | +4.8 | +0.85 | +4.4 | |

| O | Public administration and defence2 | 28.25 | 28.42 | 28.60 | 27.64 | 27.82 | 27.76 | 27.53 | -0.23 | -0.8 | -0.29 | -1.0 | |

| P | Education | 39.05 | 38.87 | 38.77 | 37.86 | 37.23 | 37.85 | 37.45 | -0.40 | -1.1 | +0.22 | +0.6 | |

| Q | Human health and social work | 25.70 | 25.66 | 25.22 | 24.76 | 24.47 | 24.39 | 24.45 | +0.06 | +0.2 | -0.02 | -0.1 | |

| R-S | Arts, entertainment, recreation and other service activities | 17.99 | 19.68 | 20.76 | 19.98 | 20.76 | 19.22 | 20.28 | +1.06 | +5.5 | -0.48 | -2.3 | |

| Total2 | 25.36 | 25.39 | 25.65 | 25.50 | 25.70 | 25.33 | 25.86 | +0.53 | +2.1 | +0.16 | +0.6 | ||

| Public/Private Sector | |||||||||||||

| Private sector | 23.02 | 23.22 | 23.66 | 23.77 | 24.03 | 23.59 | 24.31 | +0.72 | +3.1 | +0.28 | +1.2 | ||

| Public sector2 | 31.72 | 31.89 | 32.02 | 31.23 | 31.20 | 31.30 | 31.19 | -0.11 | -0.4 | -0.01 | - | ||

| Size of Enterprise | |||||||||||||

| Less than 50 employees | 19.78 | 20.14 | 20.45 | 21.08 | 20.64 | 20.57 | 20.81 | +0.24 | +1.2 | +0.17 | +0.8 | ||

| 50-250 employees | 23.78 | 23.92 | 23.96 | 22.96 | 23.69 | 23.34 | 24.11 | +0.77 | +3.3 | +0.42 | +1.8 | ||

| Greater than 250 employees2 | 29.68 | 29.39 | 29.93 | 29.48 | 29.86 | 29.34 | 30.02 | +0.68 | +2.3 | +0.16 | +0.5 | ||

| ¹ Average hourly total labour costs equal the average hourly earnings in Table 2 plus the average hourly other labour costs as set out in Table 6a. | |||||||||||||

| 2 Includes Census 2016 temporary field staff. See Table A4. | |||||||||||||

| * Preliminary Estimates | |||||||||||||

| Table 7a Employment by economic sector and other characteristics and quarter¹ | |||||||||||

| NACE Principal Activity | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2015 | 2016 | ||

| Q1 | Q1 | Q1 | Q1 | Q1 | Q1 | Q1 | Q4 | Q1* | |||

| B-E | Industry | 215,200 | 200,100 | 197,900 | 192,800 | 194,400 | 193,600 | 202,900 | 205,700 | 204,400 | |

| F | Construction | 113,600 | 77,500 | 64,300 | 62,700 | 54,400 | 60,400 | 73,400 | 77,600 | 81,300 | |

| G | Wholesale and retail trade; repair of motor vehicles and motorcycles | 297,000 | 277,900 | 273,000 | 276,400 | 278,400 | 270,300 | 275,200 | 286,200 | 280,200 | |

| H | Transportation and storage | 64,500 | 63,200 | 64,500 | 61,000 | 61,600 | 61,100 | 62,500 | 65,300 | 65,700 | |

| I | Accommodation and food services | 128,800 | 134,000 | 112,600 | 120,200 | 126,600 | 140,000 | 139,200 | 149,700 | 148,400 | |

| J | Information and communication | 54,700 | 55,600 | 51,800 | 55,900 | 55,500 | 58,000 | 59,800 | 62,600 | 62,400 | |

| K-L | Financial, insurance and real estate | 92,200 | 92,200 | 86,400 | 87,200 | 86,700 | 85,800 | 88,000 | 85,300 | 87,300 | |

| M | Professional, scientific and technical activities | 75,800 | 74,100 | 73,900 | 69,200 | 72,200 | 84,100 | 79,000 | 86,500 | 80,400 | |

| N | Administrative and support services | 81,300 | 72,700 | 76,900 | 72,800 | 69,300 | 73,200 | 76,100 | 81,300 | 81,700 | |

| O | Public administration and defence2 | 117,800 | 116,900 | 116,300 | 110,700 | 105,100 | 107,000 | 108,300 | 110,300 | 108,600 | |

| P | Education | 135,200 | 132,000 | 131,800 | 131,700 | 130,900 | 133,400 | 137,500 | 134,900 | 136,600 | |

| Q | Human health and social work | 205,400 | 212,900 | 215,200 | 216,600 | 224,900 | 222,900 | 225,000 | 232,400 | 227,100 | |

| R-S | Arts, entertainment, recreation and other service activities | 48,800 | 45,700 | 50,500 | 48,700 | 47,000 | 43,900 | 48,200 | 48,000 | 50,000 | |

| Total2 | 1,630,300 | 1,554,800 | 1,515,100 | 1,505,900 | 1,507,100 | 1,533,800 | 1,575,200 | 1,625,800 | 1,614,200 | ||

| Public/Private Sector | |||||||||||

| Private sector | 1,208,800 | 1,147,900 | 1,105,700 | 1,116,800 | 1,129,100 | 1,158,200 | 1,200,700 | 1,245,700 | 1,200,700 | ||

| Public sector2 | 421,200 | 406,800 | 409,400 | 389,200 | 378,000 | 375,600 | 374,500 | 380,000 | 386,600 | ||

| ¹ It should be noted that the Quarterly National Household Survey (QNHS) is the official source of estimates of employment. The estimated trend in the number of employees refers to | |||||||||||

| QHNS employee estimates, but differs in coverage in certain ways, such as the fact that a person with two jobs could be counted twice in the table and the exclusion of the Agriculture, | |||||||||||

| forestry and fishing sector which is covered by the QNHS. | |||||||||||

| 2 Includes Census 2016 temporary field staff. See Table A4. | |||||||||||

| * Preliminary Estimates | |||||||||||

| Table 7b Job vacancies by economic sector and other characteristics and quarter | ||||||||||

| NACE Principal Activity | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2015 | 2016 | |

| Q1 | Q1 | Q1 | Q1 | Q1 | Q1 | Q1 | Q4 | Q1* | ||

| B-E | Industry | 700 | 800 | 1,100 | 1,000 | 1,100 | 1,000 | 1,200 | 1,100 | 1,300 |

| F | Construction | 400 | 300 | 100 | 500 | 200 | 600 | 1,000 | 200 | 400 |

| G | Wholesale and retail trade; repair of motor vehicles and motorcycles | 1,500 | 1,400 | 1,300 | 800 | 800 | 1,300 | 2,100 | 1,400 | 1,500 |

| H | Transportation and storage | 200 | 200 | 200 | 100 | 100 | 300 | 400 | 200 | 200 |

| I | Accommodation and food services | 300 | 500 | 400 | 400 | 900 | 600 | 1,200 | 700 | 1,100 |

| J | Information and communication | 400 | 600 | 900 | 1,000 | 800 | 1,100 | 1,600 | 1,500 | 1,600 |

| K-L | Financial, insurance and real estate | 400 | 1,100 | 1,500 | 2,300 | 1,800 | 2,100 | 2,100 | 1,600 | 2,100 |

| M | Professional, scientific and technical activities | 300 | 300 | 500 | 600 | 800 | 1,000 | 1,300 | 1,500 | 1,300 |

| N | Administrative and support services | 300 | 100 | 400 | 500 | 800 | 700 | 800 | 1,200 | 700 |

| O | Public administration and defence | 1,100 | 400 | 300 | 500 | 500 | 600 | 1,300 | 1,400 | 1,500 |

| P | Education | 300 | 200 | 300 | 300 | 400 | 400 | 700 | 500 | 400 |

| Q | Human health and social work | 900 | 700 | 700 | 800 | 1,100 | 1,500 | 1,600 | 2,400 | 2,300 |

| R-S | Arts, entertainment, recreation and other service activities | 400 | 200 | 600 | 300 | 200 | 300 | 500 | 400 | 500 |

| Total | 7,000 | 6,800 | 8,100 | 9,200 | 9,500 | 11,300 | 15,700 | 14,000 | 14,900 | |

| Public/Private Sector | ||||||||||

| Private sector | 4,900 | 5,600 | 7,200 | 8,000 | 8,200 | 9,600 | 12,900 | 10,500 | 11,500 | |

| Public sector | 2,100 | 1,200 | 1,000 | 1,200 | 1,300 | 1,800 | 2,800 | 3,500 | 3,500 | |

| * Preliminary Estimates | ||||||||||

| Table 7c Job vacancy rate by economic sector and other characterisics and quarter | ||||||||||

| NACE Principal Activitity | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2015 | 2016 | |

| Q1 | Q1 | Q1 | Q1 | Q1 | Q1 | Q1 | Q4 | Q1* | ||

| % | % | % | % | % | % | % | % | % | ||

| B-E | Industry | 0.3 | 0.4 | 0.5 | 0.5 | 0.5 | 0.5 | 0.6 | 0.5 | 0.6 |

| F | Construction | 0.3 | 0.3 | 0.1 | 0.8 | 0.4 | 1.0 | 1.3 | 0.3 | 0.4 |

| G | Wholesale and retail trade; repair of motor vehicles and motorcycles | 0.5 | 0.5 | 0.5 | 0.3 | 0.3 | 0.5 | 0.8 | 0.5 | 0.5 |

| H | Transportation and storage | 0.2 | 0.3 | 0.3 | 0.2 | 0.2 | 0.5 | 0.6 | 0.2 | 0.3 |

| I | Accommodation and food services | 0.3 | 0.4 | 0.3 | 0.3 | 0.7 | 0.4 | 0.8 | 0.5 | 0.7 |

| J | Information and communication | 0.7 | 1.0 | 1.7 | 1.7 | 1.4 | 1.8 | 2.6 | 2.4 | 2.5 |

| K-L | Financial, insurance and real estate | 0.4 | 1.1 | 1.7 | 2.6 | 2.0 | 2.4 | 2.3 | 1.8 | 2.3 |

| M | Professional, scientific and technical activities | 0.4 | 0.4 | 0.6 | 0.9 | 1.1 | 1.2 | 1.6 | 1.7 | 1.6 |

| N | Administrative and support services | 0.3 | 0.2 | 0.5 | 0.7 | 1.2 | 1.0 | 1.1 | 1.5 | 0.9 |

| O | Public administration and defence | 0.9 | 0.4 | 0.3 | 0.5 | 0.5 | 0.5 | 1.2 | 1.2 | 1.4 |

| P | Education | 0.3 | 0.1 | 0.2 | 0.3 | 0.3 | 0.3 | 0.5 | 0.4 | 0.3 |

| Q | Human health and social work | 0.4 | 0.3 | 0.3 | 0.4 | 0.5 | 0.7 | 0.7 | 1.0 | 1.0 |

| R-S | Arts, entertainment, recreation and other service activities | 0.7 | 0.5 | 1.1 | 0.6 | 0.5 | 0.6 | 1.1 | 0.8 | 0.9 |

| Total | 0.4 | 0.4 | 0.5 | 0.6 | 0.6 | 0.7 | 1.0 | 0.9 | 0.9 | |

| Public/Private Sector | ||||||||||

| Private Sector | 0.4 | 0.5 | 0.6 | 0.7 | 0.7 | 0.8 | 1.1 | 0.8 | 0.9 | |

| Public Sector | 0.5 | 0.3 | 0.2 | 0.3 | 0.4 | 0.5 | 0.8 | 1.0 | 0.9 | |

| * Preliminary Estimates | ||||||||||

| Table 8a Average weekly earnings by public sector sub-sector and quarter | |||||||||||

| Public sector sub-sector | 2011 | 2012 | 2013 | 2014 | 2015 | 2015 | 2016 | Quarterly change | Annual change | ||

| Q1 | Q1 | Q1 | Q1 | Q1 | Q4 | Q1* | |||||

| € | € | € | € | € | € | € | € | % | € | % | |

| Civil service1 | 811.95 | 935.26 | 936.86 | 925.06 | 922.23 | 926.83 | 831.59 | -95.24 | -10.3 | -90.64 | -9.8 |

| Defence | 833.86 | 844.68 | 825.97 | 805.43 | 807.82 | 807.19 | 811.03 | +3.84 | +0.5 | +3.21 | +0.4 |

| Garda Siochana | 1,234.61 | 1,218.26 | 1,245.62 | 1,227.64 | 1,235.67 | 1,229.13 | 1,206.15 | -22.98 | -1.9 | -29.52 | -2.4 |

| Education | 888.11 | 917.88 | 917.23 | 906.04 | 901.82 | 932.25 | 886.68 | -45.57 | -4.9 | -15.14 | -1.7 |

| Regional bodies | 847.06 | 822.18 | 829.38 | 809.20 | 827.17 | 834.77 | 833.18 | -1.59 | -0.2 | +6.01 | +0.7 |

| Health | 867.39 | 883.15 | 874.48 | 851.64 | 858.23 | 893.84 | 862.64 | -31.20 | -3.5 | +4.41 | +0.5 |

| Semi-state | 992.32 | 982.55 | 977.90 | 992.01 | 992.80 | 998.92 | 1,016.52 | +17.60 | +1.8 | +23.72 | +2.4 |

| Total public sector1 | 893.83 | 917.46 | 915.62 | 902.98 | 906.57 | 927.83 | 895.58 | -32.25 | -3.5 | -10.99 | -1.2 |

| Total public sector excluding semi-state bodies1 | 879.59 | 907.90 | 906.19 | 888.94 | 892.54 | 916.37 | 876.27 | -40.10 | -4.4 | -16.27 | -1.8 |

| Semi-state by sub-sector | |||||||||||

| Non Commercial Semi-state bodies | 998.69 | 1,050.28 | 1,021.26 | 974.70 | 972.68 | 952.35 | 995.60 | +43.25 | +4.5 | +22.92 | +2.4 |

| Commercial Semi-state bodies | 990.61 | 963.22 | 965.81 | 998.30 | 1,000.48 | 1,016.29 | 1,023.56 | +7.27 | +0.7 | +23.08 | +2.3 |

| 1 Includes Census 2016 temporary field staff. See Table A4. | |||||||||||

| * Preliminary Estimates | |||||||||||

| Table 8b Average hourly earnings by public sector sub-sector and quarter | |||||||||||

| Public sector sub-sector | 2011 | 2012 | 2013 | 2014 | 2015 | 2015 | 2016 | Quarterly change | Annual change | ||

| Q1 | Q1 | Q1 | Q1 | Q1 | Q4 | Q1* | |||||

| € | € | € | € | € | € | € | € | % | € | % | |

| Civil service1 | 26.31 | 26.75 | 26.96 | 25.57 | 25.58 | 25.50 | 24.96 | -0.54 | -2.1 | -0.62 | -2.4 |

| Defence | 23.21 | 23.73 | 23.13 | 22.59 | 22.74 | 22.68 | 22.80 | +0.12 | +0.5 | +0.06 | +0.3 |

| Garda Siochana | 29.14 | 29.61 | 29.97 | 30.17 | 30.04 | 29.31 | 28.80 | -0.51 | -1.7 | -1.24 | -4.1 |

| Education | 38.05 | 38.52 | 38.93 | 38.01 | 37.43 | 38.12 | 37.64 | -0.48 | -1.3 | +0.21 | +0.6 |

| Regional bodies | 24.97 | 23.64 | 23.90 | 23.17 | 23.23 | 23.50 | 23.25 | -0.25 | -1.1 | +0.02 | +0.1 |

| Health | 26.43 | 26.44 | 26.54 | 25.44 | 25.27 | 25.22 | 25.05 | -0.17 | -0.7 | -0.22 | -0.9 |

| Semi-state | 26.40 | 27.26 | 26.98 | 27.02 | 27.17 | 27.48 | 27.44 | -0.04 | -0.1 | +0.27 | +1.0 |

| Total public sector1 | 28.90 | 28.96 | 29.04 | 28.29 | 28.19 | 28.25 | 28.08 | -0.17 | -0.6 | -0.11 | -0.4 |

| Total public sector excluding semi-state bodies1 | 29.35 | 29.25 | 29.41 | 28.52 | 28.38 | 28.39 | 28.21 | -0.18 | -0.6 | -0.17 | -0.6 |

| Semi-state by sub-sector | |||||||||||

| Non Commercial Semi-state bodies | 29.32 | 30.41 | 30.47 | 28.06 | 28.28 | 28.72 | 28.48 | -0.24 | -0.8 | +0.20 | +0.7 |

| Commercial Semi-state bodies | 25.71 | 26.40 | 26.10 | 26.66 | 26.78 | 27.07 | 27.11 | +0.04 | +0.1 | +0.33 | +1.2 |

| 1 Includes Census 2016 temporary field staff. See Table A4. | |||||||||||

| * Preliminary Estimates | |||||||||||

| Table 8c Average weekly paid hours by public sector sub-sector and quarter | |||||||||||

| Public sector sub-sector | 2011 | 2012 | 2013 | 2014 | 2015 | 2015 | 2016 | Quarterly change | Annual change | ||

| Q1 | Q1 | Q1 | Q1 | Q1 | Q4 | Q1* | |||||

| hours | hours | hours | hours | hours | hours | hours | hours | % | hours | % | |

| Civil service1 | 30.9 | 35.0 | 34.7 | 36.2 | 36.1 | 36.4 | 33.3 | -3.1 | -8.5 | -2.8 | -7.8 |

| Defence | 35.9 | 35.6 | 35.7 | 35.6 | 35.5 | 35.6 | 35.6 | - | - | +0.1 | +0.3 |

| Garda Siochana | 42.4 | 41.1 | 41.6 | 40.7 | 41.1 | 41.9 | 41.9 | - | - | +0.8 | +1.9 |

| Education | 23.3 | 23.8 | 23.6 | 23.8 | 24.1 | 24.5 | 23.6 | -0.9 | -3.7 | -0.5 | -2.1 |

| Regional bodies | 33.9 | 34.8 | 34.7 | 34.9 | 35.6 | 35.5 | 35.8 | +0.3 | +0.8 | +0.2 | +0.6 |

| Health | 32.8 | 33.4 | 33.0 | 33.5 | 34.0 | 35.4 | 34.4 | -1.0 | -2.8 | +0.4 | +1.2 |

| Semi-state | 37.6 | 36.0 | 36.2 | 36.7 | 36.5 | 36.4 | 37.0 | +0.6 | +1.6 | +0.5 | +1.4 |

| Total public sector1 | 30.9 | 31.7 | 31.5 | 31.9 | 32.2 | 32.8 | 31.9 | -0.9 | -2.7 | -0.3 | -0.9 |

| Total public sector excluding semi-state bodies1 | 30.0 | 31.0 | 30.8 | 31.2 | 31.5 | 32.3 | 31.1 | -1.2 | -3.7 | -0.4 | -1.3 |

| Semi-state by sub-sector | |||||||||||

| Non Commercial Semi-state bodies | 34.1 | 34.5 | 33.5 | 34.7 | 34.4 | 33.2 | 35.0 | +1.8 | +5.4 | +0.6 | +1.7 |

| Commercial Semi-state bodies | 38.5 | 36.5 | 37.0 | 37.4 | 37.4 | 37.5 | 37.8 | +0.3 | +0.8 | +0.4 | +1.1 |

| 1 Includes Census 2016 temporary field staff. See Table A4. | |||||||||||

| * Preliminary Estimates | |||||||||||

| Table 8d Average hourly earnings excluding irregular earnings by public sector sub-sector and quarter¹ | |||||||||||

| Public sector sub-sector | 2011 | 2012 | 2013 | 2014 | 2015 | 2015 | 2016 | Quarterly change | Annual change | ||

| Q1 | Q1 | Q1 | Q1 | Q1 | Q4 | Q1* | |||||

| € | € | € | € | € | € | € | € | % | € | % | |

| Civil service2 | 25.79 | 26.24 | 26.47 | 25.09 | 25.09 | 24.93 | 24.44 | -0.49 | -2.0 | -0.65 | -2.6 |

| Defence | 22.25 | 22.78 | 22.20 | 21.89 | 22.08 | 21.93 | 21.97 | +0.04 | +0.2 | -0.11 | -0.5 |

| Garda Siochana | 24.34 | 24.50 | 25.00 | 25.03 | 24.92 | 25.05 | 24.86 | -0.19 | -0.8 | -0.06 | -0.2 |

| Education | 37.44 | 37.94 | 38.37 | 37.67 | 37.07 | 37.59 | 37.35 | -0.24 | -0.6 | +0.28 | +0.8 |

| Regional bodies | 24.15 | 23.00 | 23.25 | 22.48 | 22.49 | 22.74 | 22.59 | -0.15 | -0.7 | +0.10 | +0.4 |

| Health | 24.86 | 24.87 | 24.92 | 24.02 | 23.94 | 23.87 | 23.70 | -0.17 | -0.7 | -0.24 | -1.0 |

| Semi-state | 25.30 | 26.01 | 25.88 | 25.82 | 26.06 | 26.01 | 26.07 | +0.06 | +0.2 | +0.01 | - |

| Total public sector2 | 27.66 | 27.71 | 27.81 | 27.17 | 27.10 | 27.09 | 27.02 | -0.07 | -0.3 | -0.08 | -0.3 |

| Total public sector excluding semi-state bodies2 | 28.09 | 28.00 | 28.16 | 27.42 | 27.30 | 27.29 | 27.20 | -0.09 | -0.3 | -0.10 | -0.4 |

| Semi-state by sub-sector | |||||||||||

| Non Commercial Semi-state bodies | 29.19 | 30.28 | 30.28 | 27.93 | 27.97 | 28.11 | 27.67 | -0.44 | -1.6 | -0.30 | -1.1 |

| Commercial Semi-state bodies | 24.37 | 24.85 | 24.77 | 25.11 | 25.39 | 25.32 | 25.58 | +0.26 | +1.0 | +0.19 | +0.7 |

| ¹ To calculate average hourly irregular earnings subtract values in Table 8d from Table 8b. | |||||||||||

| 2 Includes Census 2016 temporary field staff. See Table A4. | |||||||||||

| * Preliminary Estimates | |||||||||||

| Table 8e Public sector employment by sub-sector and quarter¹ | |||||||||

| Public sector sub-sector | 2011 | 2012 | 2013 | 2014 | 2015 | 2015 | 2016 | Annual change | |

| Q1 | Q1 | Q1 | Q1 | Q1 | Q4 | Q1* | |||

| '000 | '000 | '000 | '000 | '000 | '000 | '000 | '000 | % | |

| Civil service2 | 44.5 | 39.7 | 39.2 | 38.7 | 38.1 | 38.1 | 42.9 | 4.8 | 12.6 |

| Defence | 10.3 | 9.8 | 9.8 | 9.7 | 9.7 | 9.5 | 9.5 | -0.2 | -2.1 |

| Garda Siochana | 14.3 | 13.7 | 13.3 | 13.0 | 12.8 | 12.8 | 12.8 | - | - |

| Education | 117.7 | 111.9 | 110.3 | 111.2 | 110.9 | 111.3 | 112.7 | 1.8 | 1.6 |

| Regional bodies | 34.6 | 33.9 | 32.1 | 33.0 | 32.0 | 32.9 | 32.6 | 0.6 | 1.9 |

| Health | 132.9 | 128.8 | 123.6 | 118.7 | 119.6 | 122.2 | 123.1 | 3.5 | 2.9 |

| Semi-state | 55.1 | 51.4 | 49.7 | 51.2 | 51.4 | 52.8 | 52.8 | 1.4 | 2.7 |

| Total public sector2 | 409.4 | 389.2 | 378.0 | 375.6 | 374.5 | 379.6 | 386.6 | 12.1 | 3.2 |

| Total public sector excluding semi-state bodies2 | 354.3 | 337.7 | 328.3 | 324.4 | 323.1 | 326.8 | 333.7 | 10.6 | 3.3 |

| Semi-state by sub-sector | |||||||||

| Non Commercial Semi-state bodies | 11.1 | 10.1 | 9.8 | 12.6 | 12.2 | 12.1 | 12.2 | - | - |

| Commercial Semi-state bodies | 44.0 | 41.3 | 39.9 | 38.6 | 39.1 | 40.7 | 40.6 | 1.5 | 3.8 |

| ¹ Source: Earnings, Hours and Employment Costs Survey. Public Sector employment includes all those who received a payment which would include both full-time and part-time employees as well as contract workers. | |||||||||

| Total public sector numbers are also published by the Department of Public Expenditure and Reform on a quarterly basis. Those differ in coverage from the estimates in Table A1 as Department of Public Expenditure and | |||||||||

| Reform estimates are based on full-time equivalents which will change over time based on both changes in working hours and number of persons employed. | |||||||||

| 2 Includes Census 2016 temporary field staff. See Table A4. | |||||||||

| * Preliminary Estimates | |||||||||

| Table A1 Estimates of average weekly earnings by broad occupational categories1 | ||||||

| Occupation by NACE groups | 2013 | 2014 | 2015 | Quarterly change | Annual change | |

| Q4 | Q4 | Q3 | Q4 | |||

| € | € | € | € | % | % | |

| Managers, professionals and associated professionals | ||||||

| B-E | 1,438.18 | 1,454.07 | 1,448.62 | 1,475.48 | +1.9 | +1.5 |

| B-N, R-S | 1,256.41 | 1,259.83 | 1,281.91 | 1,288.37 | +0.5 | +2.3 |

| O-Q | 1,102.06 | 1,153.66 | 1,097.91 | 1,141.17 | +3.9 | -1.1 |

| Total (B-S) | 1,170.03 | 1,173.25 | 1,184.03 | 1,197.45 | +1.1 | +2.1 |

| Clerical, sales and service employees | ||||||

| B-E | 767.71 | 721.50 | 762.71 | 770.97 | +1.1 | +6.9 |

| B-N, R-S | 446.72 | 457.90 | 453.36 | 460.87 | +1.7 | +0.6 |

| O-Q | 537.33 | 516.10 | 543.31 | 537.15 | -1.1 | +4.1 |

| Total (B-S) | 475.14 | 468.33 | 467.08 | 470.33 | +0.7 | +0.4 |

| Production, transport, craft and other manual workers | ||||||

| B-E | 627.04 | 693.51 | 701.93 | 710.21 | +1.2 | +2.4 |

| B-N, R-S | 494.17 | 508.92 | 505.55 | 526.25 | +4.1 | +3.4 |

| O-Q | 455.58 | 436.25 | 419.84 | 442.75 | +5.5 | +1.5 |

| Total (B-S) | 489.05 | 495.87 | 489.61 | 501.43 | +2.4 | +1.1 |

| 1 These estimates have been generated using a sub sample of EHECS respondents and therefore caution is advised when | ||||||

| interpreting these results. See background notes. | ||||||

| Table A2 Response rates in selected sectors by quarter1 | ||||||||||||||

| NACE Principal Activity | Employer Response Rate % | Employee Response Rate % | Total number of respondent enterprises in Q4 2015 | |||||||||||

| Final Q4 2014 | Preliminary Q4 2015 | Final Q4 2015 | Preliminary Q1 2016 | Final Q4 2014 | Preliminary Q4 2015 | Final Q4 2015 | Preliminary Q1 2016 | |||||||

| B-E | Industry | 65.2 | 52.8 | 64.9 | 56.6 | 84.8 | 73.7 | 83.8 | 73.2 | 705 | ||||

| F | Construction | 44.6 | 37.7 | 44.0 | 36.3 | 74.6 | 63.4 | 70.5 | 55.3 | 113 | ||||

| G | Wholesale and retail trade; repair of motor vehicles and motorcycles | 62.6 | 52.2 | 62.8 | 52.2 | 81.3 | 70.8 | 78.3 | 72.7 | 833 | ||||

| H | Transportation and storage | 55.1 | 48.9 | 59.3 | 48.9 | 87.4 | 76.9 | 89.0 | 84.3 | 160 | ||||

| I | Accommodation and food services | 47.8 | 42.3 | 52.5 | 44.0 | 66.4 | 60.3 | 70.6 | 60.0 | 438 | ||||

| J | Information and communication | 66.1 | 57.4 | 67.6 | 58.3 | 87.6 | 77.7 | 84.0 | 78.0 | 209 | ||||

| K-L | Financial, insurance and real estate | 70.9 | 63.6 | 70.8 | 62.0 | 92.9 | 87.3 | 90.3 | 82.7 | 226 | ||||

| M | Professional, scientific and technical activites | 59.0 | 51.5 | 57.0 | 52.7 | 80.8 | 72.2 | 78.6 | 65.2 | 247 | ||||

| N | Administrative and support service activities | 63.5 | 58.2 | 68.8 | 56.3 | 83.5 | 77.0 | 88.2 | 79.0 | 269 | ||||

| O | Public administration and defence | 91.5 | 86.2 | 90.8 | 84.2 | 98.0 | 97.0 | 99.1 | 97.4 | 118 | ||||

| P | Education | 69.4 | 62.3 | 69.9 | 64.4 | 92.3 | 84.4 | 90.4 | 86.8 | 172 | ||||

| Q | Human health and social work | 76.1 | 66.9 | 73.8 | 65.6 | 94.2 | 86.1 | 91.1 | 87.1 | 528 | ||||

| R-S | Arts, entertainment, recreation and other service activities | 64.1 | 53.9 | 65.2 | 56.0 | 82.4 | 74.4 | 86.0 | 75.6 | 266 | ||||

| Total | 62.9 | 54.1 | 63.7 | 54.8 | 87.1 | 79.0 | 86.1 | 79.3 | 4,284 | |||||

| 1 This table presents the response rates achieved by sector. Greater caution should be taken in the interpretation of estimates for sectors with lower response rates as these sectors could be subject | ||||||||||||||

| to greater revisions if response levels are increased for final estimates. | ||||||||||||||

| Table A3 Preliminary data versus final data1 | ||||||||||||

| NACE Principal Activity | Preliminary Q4 2015 | Final Q4 2015 | Percentage Change | |||||||||

| Average weekly earnings | Average hourly earnings | Average weekly hours | Average weekly earnings | Average hourly earnings | Average weekly hours | Average weekly earnings | Average hourly earnings | Average weekly hours | ||||

| B-E | Industry | 864.09 | 22.20 | 38.9 | 858.41 | 22.09 | 38.9 | -0.7 | -0.5 | - | ||

| F | Construction | 749.79 | 20.04 | 37.4 | 749.57 | 20.29 | 36.9 | - | +1.2 | -1.3 | ||

| G | Wholesale and retail trade; repair of motor vehicles and motorcycles | 549.62 | 17.61 | 31.2 | 549.15 | 17.65 | 31.1 | -0.1 | +0.2 | -0.3 | ||

| H | Transportation and storage | 758.90 | 20.61 | 36.8 | 755.46 | 20.50 | 36.9 | -0.5 | -0.5 | +0.3 | ||

| I | Accommodation and food services | 321.51 | 12.36 | 26.0 | 327.13 | 12.42 | 26.3 | +1.7 | +0.5 | +1.2 | ||

| J | Information and communication | 1,075.03 | 29.23 | 36.8 | 1,070.55 | 29.39 | 36.4 | -0.4 | +0.5 | -1.1 | ||

| K-L | Financial, insurance and real estate | 1,029.58 | 28.83 | 35.7 | 1,022.29 | 28.91 | 35.4 | -0.7 | +0.3 | -0.8 | ||

| M | Professional, scientific and technical activities | 824.08 | 25.03 | 32.9 | 829.03 | 24.68 | 33.6 | +0.6 | -1.4 | +2.1 | ||

| N | Administrative and support service | 549.76 | 17.20 | 32.0 | 526.94 | 16.99 | 31.0 | -4.2 | -1.2 | -3.1 | ||

| O | Public administration and defence2 | 937.89 | 25.62 | 36.6 | 928.81 | 25.63 | 36.2 | -1.0 | - | -1.1 | ||

| P | Education | 822.51 | 34.48 | 23.9 | 822.45 | 34.26 | 24.0 | - | -0.6 | +0.4 | ||

| Q | Human health and social work | 687.98 | 21.95 | 31.3 | 691.16 | 21.97 | 31.5 | +0.5 | +0.1 | +0.6 | ||

| R-S | Arts, entertainment, recreation and other service activities | 475.49 | 17.07 | 27.9 | 470.55 | 16.87 | 27.9 | -1.0 | -1.2 | - | ||

| Total2 | 712.75 | 21.94 | 32.5 | 710.16 | 21.89 | 32.4 | -0.4 | -0.2 | -0.3 | |||

| Public/Private Sector | ||||||||||||

| Private sector | 648.99 | 20.06 | 32.4 | 647.73 | 20.04 | 32.3 | -0.2 | -0.1 | -0.3 | |||

| Public sector2 | 930.67 | 28.26 | 32.9 | 927.83 | 28.25 | 32.8 | -0.3 | - | -0.3 | |||

| Size of Enterprise | ||||||||||||

| Less than 50 employees | 560.90 | 18.23 | 30.8 | 558.13 | 18.16 | 30.7 | -0.5 | -0.4 | -0.3 | |||

| 50-250 employees | 647.44 | 19.87 | 32.6 | 659.58 | 20.10 | 32.8 | +1.9 | +1.2 | +0.6 | |||

| Greater than 250 employees2 | 846.38 | 25.14 | 33.7 | 842.43 | 25.11 | 33.5 | -0.5 | -0.1 | -0.6 | |||

| 1 See background notes. | ||||||||||||

| 2 Includes Census 2016 temporary field staff. See Table A4. | ||||||||||||

| Table A4 Effect of Census field staff on earnings, hours, labour costs and employment | ||||||||

| Q1 2016* | Average Weekly Earnings | Average Hourly Earnings | Average Weekly Paid Hours | Average Hourly Earnings ex Irregular Earnings | Average Hourly Irregular Earnings | Average Hourly Other Labour Costs | Average Hourly Total Labour Costs | Employment |

| € | € | Hours | € | € | € | € | ||

| Including Census 2016 temporary field staff | ||||||||

| Public administration and defence | 894.88 | 25.33 | 35.3 | 24.24 | 1.10 | 2.20 | 27.53 | 108,600 |

| Civil service | 831.59 | 24.96 | 33.3 | 24.44 | 0.52 | 1.83 | 26.80 | 42,900 |

| Total public sector ex semi-state | 876.27 | 28.21 | 31.1 | 27.20 | 1.01 | 2.69 | 30.90 | 333,700 |

| Total public sector | 895.58 | 28.08 | 31.9 | 27.02 | 1.06 | 3.11 | 31.19 | 386,600 |

| Greater than 250 employees | 842.48 | 25.89 | 32.5 | 23.91 | 1.98 | 4.13 | 30.02 | 752,700 |

| Total all sectors | 707.99 | 22.40 | 31.6 | 20.86 | 1.55 | 3.45 | 25.86 | 1,614,200 |

| Excluding Census 2016 temporary field staff | ||||||||

| Public administration and defence | 930.69 | 25.45 | 36.6 | 24.34 | 1.11 | 2.21 | 27.65 | 104,000 |

| Civil service | 921.56 | 25.27 | 36.5 | 24.73 | 0.53 | 1.85 | 27.12 | 38,400 |

| Total public sector ex semi-state | 888.05 | 28.26 | 31.4 | 27.25 | 1.01 | 2.7 | 30.96 | 329,200 |

| Total public sector | 905.96 | 28.13 | 32.2 | 27.06 | 1.07 | 3.12 | 31.24 | 382,000 |

| Greater than 250 employees | 847.08 | 25.91 | 32.7 | 23.92 | 1.98 | 4.14 | 30.04 | 748,100 |

| Total all sectors | 709.75 | 22.41 | 31.7 | 20.86 | 1.55 | 3.45 | 25.86 | 1,609,700 |

| * Preliminary Estimates | ||||||||

Introduction

The Earnings, Hours and Employment Costs Survey (EHECS) replaced the four-yearly Labour Cost Survey, and also replaced all other CSO short-term earnings inquiries. The EHECS results are comparable across sectors and include more detail on components of earnings and labour costs than was previously available.

Legislation

The survey information is collected by the Central Statistics Office (CSO) under the S.I. No 140 of 2013 Statistics (Labour Costs Surveys) Order 2013. The information collected is treated as strictly confidential in accordance with the Statistics Act 1993. The survey results meet the requirements for Labour Costs statistics set out in Council Regulation (EC) 530/1999.

Business Register

The CSO’s Business Register provides the register of relevant enterprises for the survey. An enterprise is defined as the smallest legally independent unit.

Business Classification

The business classification used for the EHECS is based on the Statistical Classification of Economic Activities in the European Community (NACE Rev.2). The NACE code of each enterprise included in the survey was determined from the predominant activity of the enterprise, based on information provided in this or other CSO inquiries.

Nace Classification

NACE Rev.2 is the latest classification system for economic activities, updated from NACE Rev 1.1. A major revision of NACE was conducted between 2000 and 2007, in order to ensure that the NACE classification system remained relevant for the economy. The main changes that affected the release was the reclassification of some industrial enterprises from industry to services (principally in the software and publishing sectors) and the inclusion of air conditioning supply, sewerage, water management and remediation activities in industry. See web link to NACE coder :-

http://www.cso.ie/px/u/NACECoder/NACEItems/searchnace.asp

Coverage

The survey results relate to enterprises in the Nace Rev 2 Sections B – E (Industry), F (Construction), G (Wholesale & retail trade: repair of motor vehicles & motorcycles), H (Transportation & storage), I (Accommodation & food services activities), J (Information & communication), K-L (Financial, insurance & real estate activities), M (Professional, scientific & technical activities), N (Administrative & support services activities), O (Public administration & defence), P (Education), Q (Human health & social work activities) and R-S (Arts, entertainment, recreation & other service activities) with 3 or more employees. The data was collected at the enterprise level.

All enterprises with 50 or more employees and a sample of those with 3 to 49 employees are surveyed each quarter. The sample is based on the proportion of companies in each NACE 2 digit economic sectors in the 3 to 49 size classes (3 to 9, 10 to 19 and 20 to 49).

Earnings in the public sector are calculated before the deduction of the pension levy that was introduced in March 2009.

For Q1 and Q2 2011 and Q1 2016 temporary Census field staff are included in all tables due to the large numbers involved.

Data Collection

The survey is conducted by post and questionnaires are issued in the last week of the relevant quarter. Some returns are received electronically. All returns are scrutinised for accuracy. Where appropriate, firms are queried by post or telephone regarding incompleteness, apparent inconsistencies, etc. Information about the survey is on the CSO website and all questionnaires and instructions are available electronically there.

Differences with discontinued sources

The EHECS is not directly comparable with other discontinued short-term earnings surveys such as the Quarterly Industrial Inquiry (QII), the Quarterly Services Inquiry (QSI) and the Quarterly Earnings and Hours worked in Construction (QEC). The main differences are:

The EHECS collects data on the entire reference quarter while the QII, QSI and QEC only collected data for a reference week in the quarter.

Employees

All full-time or part-time workers paid a specific wage or salary or who had a contract of employment are defined as employees. Persons not working for salary e.g. family members, directors, partners, outside pieceworkers etc., are not considered employees but other persons engaged. These workers are included separately but not used in the calculation of derived variables. All employment figures are rounded to the nearest hundred.

Part-time Employees

Part-time employees are defined as those who normally worked less than around 30 hours per week. These included persons who worked for some whole days per week as well as those who worked for part of the day each day.

Apprentices

Apprentices are defined as those whose wages/salaries are governed by the fact that they work either under an apprenticeship contract or as part of a training program. They are included in the calculation of earnings and hours data. They were also combined with full-time and part-time employees in determining the size group to which enterprises were classified.

Category of employees by occupation

For some enterprises information was collected separately for three occupational groups. The three groups are:

1. Managers, Administrators, Professionals and Associate Professionals.

2. Clerical, Sales and Service workers.

3. Production, Transport workers, Craft & Tradespersons and other Manual workers.

Wages and Salaries

All wages and salaries payments are gross (i.e. before deduction of income tax and employees’ PRSI contributions and levies such as the public sector pension levy). In the analysis, the total wages and salaries are divided into:

Hours

Weekly paid hours include total contracted hours plus overtime hours.

Other Costs

The following are the other categories of labour costs:

Benefits in Kind

Benefits in Kind (BIK) are considered to be an “Other Labour Cost” in the Earnings and Labour Costs release and is included in the Other Labour Costs data reported in Table 6a of the release. Eurostat consider Benefits in Kind to be a part of Earnings rather than Other Labour Costs; this is reflected in Eurostat’s Labour Costs Index, Labour Costs Survey and Structure of Earnings Survey. Average hourly benefits in kind are detailed in Table 6b of the Earnings and Labour Costs release to ensure users can make the most informed comparisons between data sources.

Subsidies and Refunds

These are amounts received by firms under the various state schemes (IDA employment incentive scheme, grants etc.) as well as refunds from the Department of Social Protection (DSP) for sick and maternity leave. These are deducted from the firms’ labour costs in the analysis.

Job Vacancies

Respondents are asked to provide the number of job vacancies in their firm as at the last working day of the quarter. A job vacancy is defined as a newly created post, an unoccupied post or post about to become vacant in the near future, where the employer is actively looking for (i.e. advertising, contacting employment agencies, etc.) and willing to recruit a suitable candidate immediately or very soon. The posts must be open to external candidates, although it may be filled by an internal candidate. Due to one off recruitments by individual firms and a low number of firms reporting vacancies, the job vacancies series can be volatile and should be interpreted with caution. Job vacancy information is collected by the Central Statistics Office under EU regulation (EC) No. 453/2008. For more information on job vacancies please see the link below.

http://ec.europa.eu/eurostat/web/labour-market/job-vacancies

Job Vacancy Rate

The job vacancy rate (JVR) measures the proportion of total posts that are vacant, according to the definition of job vacancy above, expressed as a percentage as follows

Job Vacancy Rate = ( Number of job vacancies / Number of occupied jobs + Number of job vacancies ) * 100

National Minimum Wage (NMW)