Your feedback can help us improve and enhance our services to the public. Tell us what matters to you in our online Customer Satisfaction Survey.

SILC data 2020 to 2022 was revised on 7 March 2024 due to changes made to weights, reflecting updated household population benchmarks, because of the availability of Census 2022 data. The data in this publication does not reflect these revisions.

The primary focus of the Survey on Income and Living Conditions (SILC) is the collection of information on the income and living conditions of different types of households in Ireland, in order to derive indicators on poverty, deprivation and social exclusion. It is a voluntary survey (for selected households). Up until 2021 the SILC was carried out under EU legislation (Council Regulation No 1177/2003) and commenced in Ireland in June 2003. On 01/01/2021 Council Regulation No 1177/2003 was repealed by Regulation (EU) 2019/1700.

With the release of SILC 2021 results on 06/05/2022, the results for SILC 2020 have been updated to better reflect the tenure distribution of households in Ireland. In SILC, weights are applied to the data to ensure the results are reflective of the population as a whole.The survey weights for 2020 SILC results have been adjusted to better reflect the estimated household distribution within the rental sector. While this has not impacted the overall at risk of poverty rate (unchanged at 13.2%), it has resulted in a reduction in the consistent poverty rate (4.7% compared with 5.0%). Please see the which gives information regarding the impact of the adjusted survey weights on the published SILC 2020 results.

SILC has been running as an annual survey in Ireland since 2003. The changes in regulation across household surveys introduced by Regulation 2019/1700 provided us with an opportunity to review and revise SILC methodology throughout the collection, processing and analysis phases of SILC production. We introduced these changes for the 2020 SILC survey, and therefore this year will represent a break in series for the survey.

Key changes are:

Information is collected from January to June with household interviews being conducted on a weekly basis. The income reference period for SILC is the previous calendar year. Therefore, the income referenced for the 2020 survey spans the period from January to December 2019. In 2020, the achieved sample size was 4,243 households and 10,683 individuals.

The processing time was extended for 2020 to facilitate the changes outlined above and the data was published in December 2021. These changes will lead to improvements in timeliness of the annual SILC publication in the long term.

The SILC sample is a rotational sample. In 2020, a fifth wave was added to the sample.

There is both a cross-sectional and a longitudinal element to the SILC sample. Households interviewed for the first time are Wave 1 households. Households who are interviewed in subsequent years are Wave 2 households (2nd year in the sample), Wave 3 households (3rd year in the sample), Wave 4 (4th year in the sample) or Wave 5 (5th and final year in the sample). The initial sample design attempts to seed the sample with 20% for each new wave. However, due to non-response and sample attrition the waves are not evenly balanced in the sample with Wave 1 households usually tending to dominate.

The overall response rate for the SILC survey in 2020 was 41.7%. The response rate is heavily influenced by the Wave 1 response rate which was 25.6% in 2020. The response rates tend to be a lot higher for Wave 2-5 households and in 2020 the response rate for Wave 2-4 households was 66.6%.

In 2014, a new sampling methodology was introduced to improve the robustness of the SILC Sample. The sample methodology takes into account response rates and attrition rates to ensure the CSO achieves the required effective sample size required by Eurostat. In 2018, a new sample was introduced. This means that waves 1, 2 and 3 for the 2020 SILC comes from the 2018 sampling frame, while waves 4 and 5 come from the 2014 sampling frame. The following is a brief overview of the revised SILC sample methodology:

A design weight is assigned to each household which is calculated as the inverse proportion to the probability with which the household was sampled. For SILC, the probability of the selection of a household is based on two elements; the probability of the selection of a block and the probability of selection of a household within that block. The design weights were calculated for Wave 1 households each year as outlined above.

Design weights are adjusted each year for each wave separately for non-response to bring the weights up to the current year. These weights are combined and scaled back and then calibrated to population totals for the current year.

In accordance with Eurostat recommendation, CALMAR was used to calculate the household cross-sectional weights. Benchmark information was used to gross up the data to population estimates. The benchmark estimates were based on:

Due to the “integrative” calibration method, the personal weight generated in CALMAR is equal to the household weight. Because there is no individual non-response within a household, the weights for personal cross-sectional respondents aged 16 and over are the same as the overall personal weight.

Estimates were calculated in SAS using the Jackknife and the Taylor Linearisation methodology. For the mean equivalised net disposable income, the ‘At Risk of Poverty’ rate, the ‘Deprivation’ rate and the ‘Consistent Poverty’ rate, the Jackknife Method in PROC SURVEYMEANS was used. The Taylor Linearisation Method in PROC SURVEYMEANS was used to measure the precision of the quantiles.

SAS routines and macros were developed to calculate the precision of the more complex statistics, i.e. the Gini Coefficient and the Quintile Share Ratio (QSR), using the Jackknife Method. The variance of the Gini and the QSR was estimated using the methodology outlined in Lohr1 Ch. 9 (Variance Estimation in Complex Surveys). The calculations of the precision estimates took into account the weighting, the complex structure of the sample, (i.e. the fact that the sample was a cluster sample as opposed to a simple random sample) and other complications arising from the methods adopted.

When measuring the year on year change of a statistic, we take into account both the variance of the statistic in each year (sample) and the covariance of the statistic between samples.

1Sampling: Design and Analysis, 2nd Edition, Sharon L. Lohr (2010).

The annual SILC survey is the main data source for SILC. In response to growing concerns related to community transmission of COVID-19, the CSO suspended all household survey fieldwork activities in mid-March 2020. SILC information before the onset of COVID-19 was collected from household members (16 years and older) by CSO interviewers, using Computer-Assisted Personal Interview (CAPI) in the respondents' homes. In March 2020 the CSO developed a SILC data collection instrument suitable for conducting SILC longitudinal interviews by telephone (Computer-Assisted Telephone Interview (CATI)). This mode was subsequently used by field staff from Mid-March 2020.

In addition, CSO uses primary micro data sources in its statistical programs to complement or replace survey data, to make its statistical operations more efficient or to create new insights or products. These data enable CSO to fill information needs about the Irish society, economy and environment, reduce response burden and costs imposed by surveys, and improve data quality and timeliness. All data obtained by CSO are used solely for statistical purposes.

The primary micro data sources are the Department of Social Protection (DSP) social welfare data, Office of the Revenue Commissioners’ Income Tax Form 11 and PAYE Income data, Department of Agriculture, Food and the Marine Animal Identification and Movement Data, Student Universal Support Ireland Grant Application and Payment Data, Local Authority HAP Shared Services Centre Housing Assistance Payments and the Residential Tenancies Board Rent Data. The CSO continues to work with these sources to ensure good quality data is available on a timely basis.

Income details are collected at both a household and individual level in SILC. In analysis, each individual’s income is summed up to household level and in turn added to household level income components to calculate gross household income.

The components of gross household income are:

Total income before tax, minus income from government social transfers.

Refers to cash benefits received from local and state government.

Tax and social insurance contributions are also summed to household level and subtracted from the gross household income to calculate the total disposable household income. The components of disposable household income are gross household income less:

Both nominal and real income figures are included in this release. Real income figures have been adjusted for inflation by applying a deflator to the nominal income figures. The deflator is derived from the monthly CPI and takes into account the rolling nature of the income data collected by SILC.

Equivalence scales are used to calculate the equivalised household size in a household. Although there are numerous scales, we focus on the national scale in this release. The national scale attributes a weight of 1 to the first adult, 0.66 to each subsequent adult (aged 14+ living in the household) and 0.33 to each child aged less than 14. The weights for each household are then summed to calculate the equivalised household size.

Disposable household income is divided by the equivalised household size to calculate equivalised disposable income for each person, which essentially is an approximate measure of how much of the income can be attributed to each member of the household. This equivalised income is then applied to each member of the household.

From 2020 the question on Principal Economic Status was standardised under Regulation (EU) 2019/1700. The categories are:

From 2020, the highest level of education achieved is mapped using the International Standard Classification of Education (ISCED 2011) coding system and categorised as follows:

| ISCED code | Highest Level of Education Classification |

|---|---|

| 000 Less than primary education | Primary or below |

| 100 Primary education | |

| 200 Lower secondary education | Lower secondary (including transition year) |

| 300 Upper secondary education (not further specified) | Upper secondary |

| 343 Level completion, without direct access to tertiary education | |

| 300 Upper secondary education (not further specified) | |

| 344 Level completion, with direct access to tertiary education | |

| 300 Upper secondary education (not further specified) | |

| 450 Vocational education | Post leaving certificate |

| 400 Post-secondary non-tertiary education (not further specified) | |

| 500 Short cycle tertiary | Third level non-degree |

| 600 Bachelor or equivalent | Third level degree or higher |

| 700 Master or equivalent | |

| 800 Doctorate or equivalent |

For the purposes of deriving household composition, a child was defined as any member of the household aged 17 or under. Households were analysed as a whole, regardless of the number of family units within the household. The categories of household composition are:

The number of persons at work in the household is the number of persons that described their Principal Economic Status as Employed.

Tenure status refers to the nature of the accommodation in which the household resides. The status is provided by the respondent during the interview and responses are classified into the following two categories:

Further tenure specification is also provided for at risk of poverty after rent and mortgage interest:

Households categorised as Rented: from Local Authority are those that stated they rent from the Local Authority and for whom there is no indication of a housing support in the form of Rent Supplement, Rental Accommodation Scheme (RAS), or Housing Assistance Payment (HAP). Those categorised as Rented: other forms of social housing support were in receipt of Rent Supplement, RAS, or HAP. Households Rented: without housing supports are those households paying rent but not living in local authority housing nor found to be in receipt of Rent Supplement, RAS or HAP.

From 2020 onwards, areas are now classified as Urban or Rural based on the following area populations derived from Census of Population 2016:

Urban

Rural

The regional classifications in this release are based on the NUTS (Nomenclature of Territorial Units) classification used by Eurostat. The NUTS boundaries were amended on 21st November 2016 under Regulation (EC) No.2066/2016 and took effect from 1st January 2018. Results are presented at NUTS 2 level. See .

This is the share of persons with an equivalised income below a given percentage (usually 60%) of the national median income. It is also calculated at 40%, 50% and 70% for comparison. The rate is calculated by ranking persons by equivalised income from smallest to largest and then extracting the median or middle value. Anyone with an equivalised income of less than 60% of the median is considered at risk of poverty at a 60% level.

Households that are excluded and marginalised from consuming goods and services which are considered the norm for other people in society, due to an inability to afford them, are considered to be deprived. The identification of the marginalised or deprived is currently achieved on the basis of a set of eleven basic deprivation indicators:

Individuals who experience two or more of the eleven listed items are considered to be experiencing enforced deprivation. This is the basis for calculating the deprivation rate.

The consistent poverty measure looks at those persons who are defined as being at risk of poverty and experiencing enforced deprivation (experiencing two or more types of deprivation).

An individual is defined as being in ‘consistent poverty’ if they are

This is the difference between the median equivalised income of persons below the at-risk-of-poverty threshold and the at-risk-of-poverty threshold, expressed as a percentage of the at-risk-of-poverty threshold. The purpose of the indicator is to measure how far below the poverty threshold the median income of people at risk of poverty is. The closer the median income of those at risk of poverty is to the at risk of poverty threshold the smaller the percentage will be.

This indicator is calculated based on an alternative measure of equivalised income, excluding all social transfers. From 2020, social transfers in SILC refers to cash benefits received from local and state government. Any person with an equivalised income before social transfers of less than 60% of the median after social transfers is considered at risk of poverty before social transfers (i.e. the same threshold is used for calculating the rate before and after social transfers).

This indicator is calculated based on an alternative measure of equivalised income, excluding the total rent paid and mortgage interest. The total rent paid includes housing supports such as the Housing Assistance Payment (HAP), Rent Supplement, Rental Assistance Scheme (RAS) which were included in the household income. Any person with an equivalised income after rent and mortgage interest of less than 60% of the median before rent and mortgage interest is considered at risk of poverty after rent and mortgage interest (i.e. the same threshold is used for calculating the rate before and after rent and mortgage interest is deducted).

This is the relationship between cumulative shares of the population (ranked according to the level of income from lowest to highest) and the cumulative share of total income received by them, i.e. the Lorenz Curve. If there was perfect equality (i.e. each person receives the same income) the Gini coefficient would be 0%. A Gini coefficient of 100% would indicate there was total inequality and the entire national income was in the hands of one person.

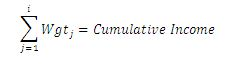

Calculation of the Gini Coefficient

Wgti = Final calibrated weight per individual

Eq_Inci= Equivalised disposable income

Inequality of income distribution (S80/S20) quintile share ratio

This is the ratio of the total equivalised income received by the 20% of persons with the highest income (top quintile) to that received by the 20% of persons with the lowest income (lowest quintile).

Estimates produced from SILC data by the CSO are based on national definitions of income, equivalence scale, deprivation etc. These are not directly comparable with EU-SILC estimates produced on the Eurostat website. See Eurostat - Income and Living Conditions.

The Central Statistics Office wishes to thank the participating households for their co-operation in agreeing to take part in the SILC survey and for facilitating the collection of the relevant data.

Go to next chapter >>> Contact Details

Learn about our data and confidentiality safeguards, and the steps we take to produce statistics that can be trusted by all.