Your feedback can help us improve and enhance our services to the public. Tell us what matters to you in our online Customer Satisfaction Survey.

| Census of Industrial Production (CIP) - Industrial Enterprises 2008-2014 | |||||||||

| % change | |||||||||

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2008 - 2014 | 2013 - 2014 | |

| Industrial Enterprises (Number) | 15,955 | 16,285 | 16,050 | 16,132 | 16,385 | 16,540 | 16,497 | 3.4 | -0.3 |

| Persons engaged (Number) | 240,946 | 218,279 | 202,301 | 201,695 | 199,193 | 200,991 | 210,545 | -12.6 | 4.8 |

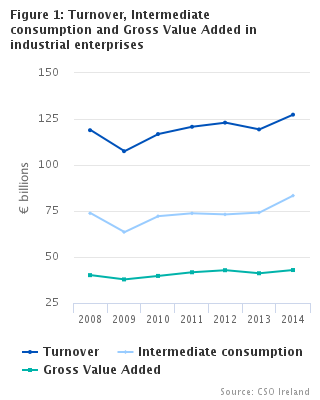

| Turnover (€ million) | 118,919 | 107,499 | 116,815 | 120,772 | 123,020 | 119,345 | 127,366 | 7.1 | 6.7 |

| Intermediate consumption (€ million) | 73,757 | 63,545 | 72,195 | 73,750 | 73,159 | 74,153 | 83,358 | 13.0 | 12.4 |

| Gross Value Added (€ million) | 40,137 | 37,826 | 39,714 | 41,701 | 42,828 | 41,165 | 42,920 | 6.9 | 4.3 |

This release provides data on the Industrial sector in Ireland for the period 2008 - 2014. Revised figures for 2008 - 2012 are included, along with newly published figures for 2013 and 2014. The detailed tables present a breakdown of the numbers of active industrial enterprises, numbers of persons engaged in industrial sectors, as well as a range of financial information classified by: economic activity, employment size and nationality.

The Industry series 2008 - 2012 has been revised due to a number of factors:

(i)There are now more active enterprises on the CSO Business Register. There are now more enterprises considered active in the Industrial sector per the CSO Business Register. These enterprises need to be measured. What is considered an active enterprise per the register of active enterprises in Ireland will determine its inclusion in the Industry series. Size class thresholds will no longer be applied. For example, the Industry series previously didn't estimate for enterprises employing less than 3 persons engaged, but will do so now.

(ii) Updates in the National Accounts series. Under rules for the compilation of EU National Accounts (ESA 2010) a number of data series have been updated. For the Industry series, this principally concerns our estimates for Research & Development (R&D). Estimates of R&D spend are now higher, and more of this R&D spend is being capitalised. This has the effect of increasing the estimate of Industrial Gross Value Added (GVA).

(iii) Non-response treatment & the greater use of administrative data. As part of the methodological review we have examined our methodology for non-respondents. We have aligned our non-response methodology more closely to the use of available administrative (tax) data and changed how we estimate for non-response. These new estimates for non-response are now incorporated into the Industry series, replacing the previous imputation methodology.

(iv) Other adjustments. During the review, the opportunity was taken to update the series for some sectoral NACE adjustments (enterprises being reclassified from one particular NACE sector to another), and updates to some Multinational Enterprise data measured by our National Accounts Large Cases Unit are also incorporated.

Main differences following revisions

Impact on number of enterprises & employment

As a result of incorporating the above revisions, more enterprises are now being measured for the industrial sector in Ireland. The original series measured around 4,500 enterprises. The revised series measures approximately 16,000 enterprises. This increase is mainly due to the removal of the size class threshold, which excluded industrial enterprises which employed less than 3 persons. See Figure 2.