| Number of persons engaged and turnover in Irish-owned foreign affiliates, 2017 - 2019 | |||||||||

| Number of persons engaged | % of total | Turnover (€millions) | % of total | ||||||

| 20171 | 20181 | 2019 | 2019 | 20171 | 20181 | 2019 | 2019 | ||

| United States | 236,003 | 233,236 | 263,009 | 22.5% | 93,292 | 94,329 | 101,903 | 39.9% | |

| United Kingdom | 110,432 | 120,631 | 125,476 | 10.7% | 43,065 | 44,965 | 42,730 | 16.7% | |

| Germany | 34,271 | 36,033 | 34,324 | 2.9% | 11,312 | 12,227 | 10,583 | 4.1% | |

| France | 26,458 | 27,808 | 28,638 | 2.5% | 9,427 | 9,700 | 10,283 | 4.0% | |

| Netherlands | 17,403 | 20,119 | 16,578 | 1.4% | 6,753 | 7,331 | 6,347 | 2.5% | |

| Other countries | 621,759 | 647,184 | 700,708 | 60.0% | 80,498 | 81,333 | 83,840 | 32.8% | |

| All countries | 1,046,326 | 1,085,011 | 1,168,733 | 100.0% | 244,347 | 249,885 | 255,686 | 100.0% | |

| 1Outward Foreign Affiliates Statistics were revised for 2017 and 2018 | |||||||||

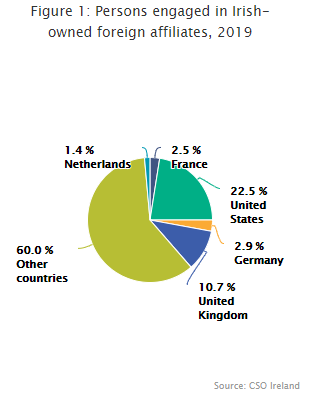

In 2019, there were 1,168,733 persons employed in Irish multinationals abroad, 33.2% of them in the US or the UK. Irish multinationals abroad had turnover of almost €256bn, with US and UK affiliates accounting for 56.6% of this.

Employment in Irish affiliates in the UK increased by 4,845, or 4.0% from 2018 to 2019, while turnover decreased by 5.0%. Employment in Irish affiliates in the US increased by 29,773, or 12.8%, while turnover increased by 8.0%.

Irish affiliates in Germany, France and the Netherlands together accounted for 6.8% of persons employed in Irish multinationals abroad in 2019, while affiliates in these three countries accounted for 10.6% of turnover. See Figures 1 & 2 and Headline table.

|

Outward Foreign Affiliates Statistics (OFATS) cover the activities of Irish multinationals abroad. The purpose of the survey is to allow analysis of the sectoral and geographical composition of the affiliates controlled by Irish multinationals. Care should be taken when analysing the Outward Foreign Affiliates Statistics as the register of Irish multinationals abroad can be subject to significant change in the short term. An enterprise is deemed to be Irish owned if over 50% of its controlling interest is in Ireland. The population of foreign affiliates is subject to fluctuation based on international market conditions and the buying and selling of affiliates by Irish multinationals. Any enterprise that redomiciles their controlling operations to Ireland will have a bearing on the results, provided the above criteria are satisfied, as it would from that point be considered an Irish enterprise. Please click the following link to access details of the methodology used: |

In terms of employment in Irish multinationals abroad by continent, America, Asia and Europe each accounted for around a third of total persons engaged, while employment in the remaining regions amounted to 2.5%. See Figure 3.

| For long labels below use to display on multiple lines | Turnover |

|---|---|

| United States | 39.9 |

| United Kingdom | 16.7 |

| Germany | 4.1 |

| Other countries | 32.8 |

| Netherlands | 2.5 |

| France | 4 |

Figure 3: Employment in Irish affiliates abroad, 2019

(Please note that Europe figure of 360,974 excludes Russian Federation)

Italy and Canada show highest percentage growth of employment in Irish affiliates

Between 2018 and 2019, Irish affiliates in Italy had an increase of 31.1% in persons engaged and 23.0% in turnover. Canada had the second largest increase in persons engaged at 26.2% and saw an increase of 9.3% in turnover. Aside from the UK and the US, a number of other countries had a significant contribution to turnover and employment in 2019, with employment of over 38,600 in China, over 34,300 in Germany, almost 30,000 in Brazil and over 28,600 in France. Employment levels rose in all countries selected in Figure 4, except for the Netherlands, Germany and China which had declines of 17.6%, 4.7% and 2.0% respectively.

In terms of turnover, affiliates in Germany and France accounted for over €10bn each, while Japan accounted for over €7.25bn. Irish-owned affiliates in Japan showed growth of 15.0% in turnover, while those in the Netherlands decreased by 13.4%. See Figures 4 & 5 and Tables 1 & 2.

| X-axis label | 2017 | 2018 | 2019 |

|---|---|---|---|

| Germany | 34271 | 36033 | 34324 |

| Netherlands | 17403 | 20119 | 16578 |

| France | 26458 | 27808 | 28638 |

| Poland | 17307 | 18951 | 20967 |

| Spain | 22622 | 23777 | 26561 |

| Italy | 19418 | 20503 | 26888 |

| Brazil | 26380 | 26319 | 29900 |

| Canada | 15944 | 16720 | 21103 |

| China | 37468 | 39427 | 38637 |

| Japan | 17107 | 16813 | 21050 |

| X-axis label | 2017 | 2018 | 2019 |

|---|---|---|---|

| Germany | 11.312 | 12.227 | 10.583 |

| Netherlands | 6.753 | 7.331 | 6.347 |

| France | 9.427 | 9.7 | 10.283 |

| Poland | 3.29 | 3.289 | 3.548 |

| Spain | 4.635 | 5.232 | 5.399 |

| Italy | 4.001 | 4.056 | 4.987 |

| Brazil | 4.255 | 3.342 | 3.114 |

| Canada | 5.61 | 5.691 | 6.222 |

| China | 4.455 | 4.744 | 5.012 |

| Japan | 6.503 | 6.306 | 7.252 |

Services sector has highest employment and turnover abroad in Irish multinationals

Services, which excludes Distribution, was the dominant sector for employment in Irish affiliates abroad in 2019 with 58.7% of total persons engaged. Manufacturing affiliates accounted for 23.9% of total foreign affiliate employment, while Distribution and Other sectors employed 15.1% and 2.3% respectively. See Figures 6 and Table 3.

When looking at the sectoral composition of turnover generated by Irish affiliates abroad, the Services sector (excluding Distribution) held the largest share with 35.1% of the overall figure, followed by Distribution and Manufacturing with 29.4% and 27.3% respectively. The rest of sectoral activities together accounted for 8.2% of total turnover. See Figure 7 and Table 4.

| For long labels below use to display on multiple lines | Persons engaged |

|---|---|

| Services | 58.7 |

| Distribution | 15.1 |

| Other | 2.3 |

| Manufacturing | 23.9 |

| Turnover | |

| Services | 35.1 |

| Distribution | 29.4 |

| Manufacturing | 27.3 |

| Other | 8.2 |

European multinational employment outside EU dominated by affiliates of UK, France and Germany

The number of persons engaged in Irish-owned foreign affiliates outside the EU in 2018 was over 752,300. This represented 4.7% of the 16.0 million persons employed by European multinationals outside the EU. The largest contributors to employment by EU multinationals were French-owned foreign affiliates at 24.7%, German-owned foreign affiliates at 20.6%, and British-owned foreign affiliates at 17.5%. See Figure 8.

Germany still the largest contributor to European multinational turnover outside the EU

The turnover of Irish-owned foreign affiliates outside the EU was over €147 billion in 2018. This represented 3.3% of the €4,477 billion turnover of European multinationals outside the EU. The largest contributors to turnover were German-owned foreign affiliates at 28.4%, French-owned foreign affiliates at 19.3%, followed by British and Dutch-owned foreign affiliates at 14.6% and 10.7% respectively. See Figure 9.

| For long labels below use to display on multiple lines | % Employment |

|---|---|

| Irish | 4.7 |

| Dutch | 5.1 |

| Italian | 6.6 |

| Other | 20.7 |

| German | 20.6 |

| French | 24.7 |

| British | 17.5 |

Irish multinational Services employment almost 72% higher than EU average

In the Services sector (including Distribution), Irish-owned affiliates located outside the EU employed 553,315 people, almost 72% higher than the EU average of 321,880 per member state. See Figure 10.

| For long labels below use to display on multiple lines | % Employment |

|---|---|

| Irish | 3.3 |

| Dutch | 10.7 |

| Italian | 6.3 |

| Other | 17.3 |

| German | 28.4 |

| French | 19.3 |

| British | 14.6 |

| X-axis label | EU28-owned outside the EU | Irish-owned outside the EU |

|---|---|---|

| 2018 | 321880 | 553315 |

Average turnover in the Services sector (including Distribution) for EU-owned multinationals' affiliates located outside the EU was €85.5 billion per member state. Irish-owned affiliates located outside the EU had a Services sector (including Distribution) turnover of €99.6 billion. See Figure 11.

| X-axis label | EU28-owned outside the EU | Irish-owned outside the EU |

|---|---|---|

| 2018 | 85460 | 99596 |

| Table 1 Persons engaged in Irish-owned foreign affiliates by country, 2017 - 2019 | ||||

| 20171 | 20181 | 2019 | 2018-2019 | |

| No. | No. | No. | % | |

| Germany | 34,271 | 36,033 | 34,324 | -4.7 |

| Netherlands | 17,403 | 20,119 | 16,578 | -17.6 |

| France | 26,458 | 27,808 | 28,638 | 3.0 |

| Poland | 17,307 | 18,951 | 20,967 | 10.6 |

| Spain | 22,622 | 23,777 | 26,561 | 11.7 |

| Japan | 17,107 | 16,813 | 21,050 | 25.2 |

| Canada | 15,944 | 16,720 | 21,103 | 26.2 |

| Italy | 19,418 | 20,503 | 26,888 | 31.1 |

| China | 37,468 | 39,427 | 38,637 | -2.0 |

| Brazil | 26,380 | 26,319 | 29,900 | 13.6 |

| US | 236,003 | 233,236 | 263,009 | 12.8 |

| UK | 110,432 | 120,631 | 125,476 | 4.0 |

| Other Countries | 465,513 | 484,674 | 515,602 | 6.4 |

| Total | 1,046,326 | 1,085,011 | 1,168,733 | 7.7 |

| 1 Outward Foreign Affiliates Statistics were revised for 2017 and 2018 | ||||

| Table 2 Turnover in Irish-owned foreign affiliates by country, 2017 - 2019 | ||||

| 20171 | 20181 | 2019 | 2018-2019 | |

| €m | €m | €m | % | |

| Germany | 11,312 | 12,227 | 10,583 | -13.4 |

| Netherlands | 6,753 | 7,331 | 6,347 | -13.4 |

| France | 9,427 | 9,700 | 10,283 | 6.0 |

| Poland | 3,290 | 3,289 | 3,548 | 7.9 |

| Spain | 4,635 | 5,232 | 5,399 | 3.2 |

| Japan | 6,503 | 6,306 | 7,252 | 15.0 |

| Canada | 5,610 | 5,691 | 6,222 | 9.3 |

| Italy | 4,001 | 4,056 | 4,987 | 23.0 |

| China | 4,455 | 4,744 | 5,012 | 5.6 |

| Brazil | 4,255 | 3,342 | 3,114 | -6.8 |

| US | 93,292 | 94,329 | 101,903 | 8.0 |

| UK | 43,065 | 44,965 | 42,730 | -5.0 |

| Other Countries | 47,749 | 48,673 | 48,306 | -0.8 |

| Total | 244,347 | 249,885 | 255,686 | 2.3 |

| 1 Outward Foreign Affiliates Statistics were revised for 2017 and 2018 | ||||

| Table 3 Persons engaged in Irish-owned foreign affiliates by sector, 2013 - 20191 | |||||||

| 2013 | 2014 | 2015 | 2016 | 20172 | 20182 | 2019 | |

| Manufacturing | 142,420 | 152,584 | 158,013 | 201,810 | 264,962 | 297,500 | 279,089 |

| Services | 458,772 | 453,923 | 480,103 | 550,078 | 613,789 | 602,888 | 685,603 |

| Distribution | 121,728 | 134,356 | 134,633 | 174,905 | 162,262 | 168,481 | 176,613 |

| Other | 5,597 | 4,910 | 5,753 | 5,376 | 5,313 | 16,142 | 27,428 |

| All sectors | 728,517 | 745,773 | 778,502 | 932,169 | 1,046,326 | 1,085,011 | 1,168,733 |

| 1 Data is subject to changes in classification of NACE activity of affiliates | |||||||

| 2 Outward Foreign Affiliates Statistics were revised for 2017 and 2018 | |||||||

| Table 4 Turnover in Irish-owned foreign affiliates by sector, 2013 - 20191 | |||||||

| 2013 | 2014 | 2015 | 2016 | 20172 | 20182 | 2019 | |

| €m | €m | €m | €m | €m | €m | €m | |

| Manufacturing | 38,034 | 37,891 | 39,483 | 54,282 | 68,838 | 75,062 | 69,686 |

| Services | 78,965 | 78,014 | 88,537 | 90,951 | 101,983 | 96,172 | 89,854 |

| Distribution | 32,406 | 34,917 | 38,924 | 69,154 | 70,979 | 73,694 | 75,282 |

| Other | 1,872 | 1,714 | 2,493 | 2,357 | 2,547 | 4,957 | 20,864 |

| All sectors | 151,277 | 152,536 | 169,437 | 216,744 | 244,347 | 249,885 | 255,686 |

| 1 Data is subject to changes in classification of NACE activity of affiliates | |||||||

| 2 Outward Foreign Affiliates Statistics were revised for 2017 and 2018 | |||||||

The target population for outward FATS comprises all foreign-based affiliates that are controlled by an institutional unit resident in the compiling country. The units that complete the CSO Outward FATS survey are resident institutional units i.e. Irish multinationals. The Outward FATS survey requires the CSO to survey domestic-based Irish multinationals and request information about their foreign-based affiliates.

The CSO carry out a survey to capture the outward FATS information. On the survey form respondents are required to complete a list of foreign affiliates that are under the control of the Irish multinational.

The required variables for each foreign affiliate are as follows:

• Name of foreign affiliate

• Country in which foreign affiliate is located

• Description of the activity of the foreign affiliate (which is coded to NACE Rev. 2 activity codes)

• Shares in registered capital of foreign affiliate (only a shareholding of 51% or greater in a foreign affiliate is taken for compilation purposes)

• Turnover

• Number of persons engaged

1. Institutional unit

An institutional unit is an elementary economic decision-making centre characterised by uniformity of behaviour and decision-making autonomy in the exercise of its principal function. A unit is regarded as constituting an institutional unit if it has decision-making autonomy in respect of its principal function and keeps a complete set of accounts.

2. Foreign Affiliate

A foreign affiliate is enterprise not resident in the compiling country over which an institutional unit resident in the compiling country has control (Outward FATS).

3. Control

The concept of control is used for the breakdown of the FATS variables. Control means the ability to determine the general policy of an enterprise by choosing appropriate directors, if necessary. In this context, enterprise A is deemed to be controlled by an institutional unit B when B controls, whether directly or indirectly, more than half of the shareholders’ voting power or more than half of the shares.

Indirect control means that an institutional unit may have control through another affiliate which has control over enterprise A.

Therefore, control implies the ability to determine the strategy of an enterprise, to guide its activities and to appoint a majority of directors. In most cases, this ability can be exercised by a single investor holding a majority (more than 50 %) of the voting power or of the shares, directly or indirectly.

4. Ultimate controlling institution (UCI)

The ultimate controlling institution (UCI) of a foreign affiliate is an institutional unit, proceeding up a foreign affiliate’s chain of control, which is not controlled by another institutional unit. FATS data are compiled according to the UCI concept. The crucial characteristic of a UCI is that it should effectively control and manage the group, i.e. take global strategic decisions.

Therefore, in the case of Ireland, Outward FATS describes the activities of affiliates abroad where the UCI is an Irish resident institutional unit.

5. Residency

The place of residency of an UCI is the country of registration of the UCI in the case of legal entities and the country of residence in the case of natural persons acting as UCI. Residency is often but not always the nationality of the UCI.

The Outward FATS variables are broken down by the resident country of the foreign affiliates. These countries have been amalgamated into geographical aggregates which are listed separately.

The NACE Rev. 2 sectors covered by the Outward FATS data are as follows:

A - Agriculture, forestry and fishing

B - Mining and quarrying

C - Manufacturing

D - Electricity, gas, steam and air conditioning supply

E - Water supply; sewerage, waste management and remediation activities

F - Construction

G - Wholesale and retail trade; repair of motor vehicles and motorcycles

H - Transportation and storage

I - Accommodation and food service activities

J - Information and communication

K - Financial and insurance activities

L - Real estate activities

M - Professional, scientific and technical activities

N - Administrative and support service activities

P - Education

Q - Human health and social work activities

R - Arts, entertainment and recreation

S - Other service activities

As a result of the ongoing development of the survey and register of Irish multinationals new information becomes available each year, including information regarding enterprises that re-domicile their controlling operations to Ireland. Consequently, revisions are made to published annual data for previous years.

Data published in the OFATS 2018 release was collected during the COVID-19 pandemic, as a consequence response rates were affected. New information provided by companies has been included in the 2018 revisions.

Compiling Foreign Affiliates Statistics (FATS)

Hide Background Notes

Hide Background Notes

Scan the QR code below to view this release online or go to

http://www.cso.ie/en/releasesandpublications/er/ofats/outwardforeignaffiliatesstatistics2019/