| Turnover and number of persons engaged in Irish-owned foreign affiliates, 2015 - 2017 | |||||||||

| Turnover (€millions) | % | Number of persons engaged | % | ||||||

| 2015 | 20161 | 2017 | 2017 | 2015 | 20161 | 2017 | 2017 | ||

| United States | 58,263 | 85,062 | 88,524 | 38.8 | 167,896 | 225,735 | 228,433 | 23.5 | |

| United Kingdom | 44,217 | 41,423 | 41,894 | 18.3 | 103,934 | 106,916 | 108,950 | 11.2 | |

| Other countries | 69,155 | 92,456 | 98,002 | 42.9 | 506,672 | 599,518 | 636,365 | 65.4 | |

| All countries | 171,635 | 218,941 | 228,420 | 100.0 | 778,502 | 932,169 | 973,748 | 100.0 | |

| 1 Outward Foreign Affiliates Statistics were revised for 2016 | |||||||||

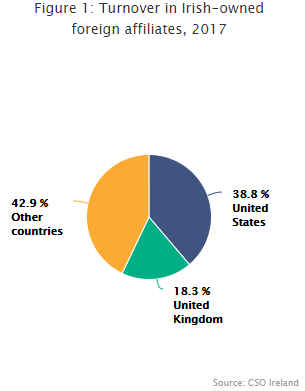

In 2017, Irish multinationals abroad had turnover in excess of €228 billion, with US and UK affiliates accounting for 57.1% of this. There were almost 974,000 persons employed in Irish multinationals abroad, 34.7% of whom were in the US and the UK. Turnover in Irish affiliates in the UK increased by 1.1% from 2016 to 2017, while employment increased by 2,034 or 1.9%.

Comparing 2017 to 2015, employment in Irish affiliates in the US rose by over 60,500 or a 36.1% increase, while turnover increased by 51.9%. There was also a rise on 2015 levels in employment for the UK with an increase of 4.8% while turnover dropped by 5.3%. See Figures 1 & 2 and Headline table.

|

Outward Foreign Affiliates Statistics (OFATS) cover the activities of Irish multinationals abroad. The purpose of the survey is to allow analysis of the sectoral and geographical composition of the affiliates controlled by Irish multinationals. Care should be taken when analysing the Outward Foreign Affiliates Statistics as the register of Irish multinationals abroad can be subject to significant change in the short term. An enterprise is deemed to be Irish owned if over 50% of its controlling interest is in Ireland. The population of foreign affiliates is subject to fluctuation based on international market conditions and the buying and selling of affiliates by Irish multinationals. Any enterprise that redomiciles their controlling operations to Ireland will have a bearing on the results, provided the above criteria are satisfied, as it would from that point be considered an Irish enterprise. Please click the following link to access details of the methodology used:Compiling Foreign Affiliates Statistics (FATS) (PDF 228KB) |

In terms of employment in Irish multinationals abroad by continent, Europe, Asia and America each accounted for approximately a third of the total, with employment in the remaining regions amounting to 2.5%. See Figure 3.

| For long labels below use to display on multiple lines | Persons engaged |

|---|---|

| United States | 23.5 |

| United Kingdom | 11.2 |

| Other countries | 65.4 |

Figure 3: Employment in Irish affiliates abroad, 2017

Canada and France show highest percentage growth in turnover

Aside from the UK and the US, a number of other countries had a significant contribution to turnover and employment in 2017, with employment of over 37,000 in China, almost 30,000 in Germany and over 25,000 in France and Mexico. Employment levels increased in the majority of countries except for China and Mexico which had slight decreases of 1.1% and 2.2%. Irish affiliates in Mexico also showed a decrease in turnover of 5.3% but conversely, turnover in China increased by 0.6%.

In terms of turnover, affiliates in Germany and France produced close to €9 billion each while the Netherlands produced over €6.5 billion. Irish affiliates in Poland had an increase of 7.2% in persons engaged but only 1.4% in turnover. Affiliates in Canada, France and Italy had the highest increase in turnover between 2016 and 2017 with growth rates between 10.7% and 16.2%. Other countries had over 425,000 persons engaged, 43.7% of total employment and produced almost €49 billion, or 21.4% of total turnover. See Figures 4 and 5.

| X-axis label | 2015 | 2016 | 2017 |

|---|---|---|---|

| Germany | 22527 | 27379 | 29183 |

| Netherlands | 16199 | 16798 | 17359 |

| France | 20820 | 24802 | 25541 |

| Poland | 8691 | 11274 | 12087 |

| Spain | 18103 | 19266 | 20451 |

| Belgium | 7113 | 7726 | 7823 |

| Canada | 12637 | 15007 | 15782 |

| Italy | 16473 | 17888 | 19374 |

| China | 27330 | 37628 | 37203 |

| Mexico | 20875 | 26658 | 26084 |

| X-axis label | 2015 | 2016 | 2017 |

|---|---|---|---|

| Germany | 6215 | 8850 | 8993 |

| Netherlands | 5645 | 6634 | 6664 |

| France | 4449 | 7908 | 8998 |

| Poland | 3669 | 2453 | 2487 |

| Spain | 2795 | 3911 | 3949 |

| Belgium | 2123 | 2550 | 2452 |

| Canada | 2747 | 4761 | 5531 |

| Italy | 2720 | 3615 | 4001 |

| China | 1401 | 3922 | 3947 |

| Mexico | 1406 | 2202 | 2086 |

Employment abroad in Irish multinationals dominated by Services sector

Services, which includes Distribution, was the dominant sector for employment in Irish affiliates abroad in 2017 with 79.7% of total persons engaged. Manufacturing affiliates accounted for nearly 20% of total foreign affiliate employment while other Industrial and Construction sectors employed just 0.5%. There is a similar picture when looking at turnover, where three quarters of turnover was generated in Services and over 20% in Manufacturing. See Figures 6 & 7.

Services continues to be the largest sector for Irish affiliates abroad

When looking at the sectoral composition of turnover generated by Irish affiliates abroad, the Services sector held the largest share with 44.0% of the overall figure, followed by Distribution and Manufacturing with 31.1% and 22.8% respectively. The rest of the sectoral activities combined accounted for just 2.1% of total turnover. See Figure 8.

| For long labels below use to display on multiple lines | Persons engaged |

|---|---|

| Construction | 0.2 |

| Manufacturing | 19.8 |

| Services | 79.7 |

| Other industrial | 0.3 |

| For long labels below use to display on multiple lines | Turnover |

|---|---|

| Construction | 0.4 |

| Manufacturing | 22.8 |

| Services | 75.1 |

| Other industrial | 1.7 |

| Turnover | |

| Services | 44 |

| Distribution | 31.1 |

| Manufacturing | 22.8 |

| Other Industrial | 1.7 |

| Construction | 0.4 |

France still the largest contributor to European multinational emploment outside the EU

In 2016 Ireland's contribution to employment increased to over 4% for the first time since the series began in 2010. This accounted for 601,000 of the 14.6 million persons employed by European multinationals outside the EU. The largest contributors to this employment were French-owned foreign affiliates at 25.6%, German-owned foreign affiliates at 21.2% and British-owned foreign affiliates at 15.5%. See Figure 9.

European multinational turnover outside EU dominated by Germany and France

The turnover of Irish-owned foreign affiliates outside the EU was over €108 billion in 2016. This represented 2.6% of the €4,160 billion turnover of European multinationals outside the EU. The largest contributors to turnover were German-owned foreign affiliates at 29.9%, French-owned foreign affiliates at 18.4%, followed by British and Dutch-owned foreign affiliates at 13.1% and 12.8%. See Figure 10.

| For long labels below use to display on multiple lines | % Employment |

|---|---|

| Irish | 4.1 |

| Dutch | 5.3 |

| Italian | 7 |

| Other | 21.3 |

| German | 21.2 |

| French | 25.6 |

| British | 15.5 |

Employment in Services for Irish multinationals almost twice EU28 average

In the Services sector, Irish-owned affiliates located outside of Europe employed just over half a million people, almost twice the EU average of 295,130. See Figure 11.

| For long labels below use to display on multiple lines | % Employment |

|---|---|

| Irish | 2.6 |

| Dutch | 12.8 |

| Italian | 6.2 |

| Other | 17 |

| German | 29.9 |

| French | 18.4 |

| British | 13.1 |

| X-axis label | EU28 average | Irish owned outside the EU |

|---|---|---|

| 2016 | 295130 | 527058 |

Average turnover in the Services sector for European multinationals outside of Europe was €76 billion. Irish-owned affiliates located outside of Europe had a turnover of €93 billion. See Figure 12.

| X-axis label | EU28 average | Irish owned outside the EU |

|---|---|---|

| 2016 | 75753 | 92951 |

| Table 1 Persons engaged in Irish-owned foreign affiliates by sector, 2011 - 2017 | |||||||

| 2011 | 2012 | 2013 | 2014 | 2015 | 20161 | 2017 | |

| Manufacturing | 119,631 | 123,857 | 142,420 | 152,584 | 158,013 | 201,810 | 192,520 |

| Other industrial | 3,070 | 2,395 | 4,715 | 4,287 | 4,400 | 4,127 | 3,253 |

| Construction | 2,362 | 1,118 | 882 | 623 | 1,353 | 1,249 | 1,654 |

| Services | 569,519 | 560,506 | 580,500 | 588,279 | 614,736 | 724,983 | 776,321 |

| All sectors | 694,582 | 687,876 | 728,517 | 745,773 | 778,502 | 932,169 | 973,748 |

| 1 Outward Foreign Affiliates Statistics were revised for 2016 | |||||||

| Table 2 Turnover in Irish-owned foreign affiliates by sector, 2011 - 2017 | |||||||

| 2011 | 2012 | 2013 | 2014 | 2015 | 20161 | 2017 | |

| €m | €m | €m | €m | €m | €m | €m | |

| Manufacturing | 29,581 | 31,636 | 38,034 | 37,891 | 39,483 | 54,282 | 52,134 |

| Other industrial | 3,258 | 3,342 | 3,585 | 3,547 | 3,616 | 3,812 | 3,933 |

| Construction | 687 | 563 | 485 | 364 | 1,074 | 742 | 902 |

| Services | 95,839 | 95,658 | 111,371 | 112,932 | 127,462 | 160,105 | 171,451 |

| All sectors | 129,365 | 131,199 | 153,475 | 154,734 | 171,635 | 218,941 | 228,420 |

| 1 Outward Foreign Affiliates Statistics were revised for 2016 | |||||||

The target population for outward FATS comprises all foreign-based affiliates that are controlled by an institutional unit resident in the compiling country. The units that complete the CSO Outward FATS survey are resident institutional units i.e. Irish multinationals. The Outward FATS survey requires the CSO to survey domestic-based Irish multinationals and request information about their foreign-based affiliates.

The CSO carry out a survey to capture the outward FATS information. On the survey form respondents are required to complete a list of foreign affiliates that are under the control of the Irish multinational.

The required variables for each foreign affiliate are as follows:

• Name of foreign affiliate

• Country in which foreign affiliate is located

• Description of the activity of the foreign affiliate (which is coded to NACE Rev. 2 activity codes)

• Shares in registered capital of foreign affiliate (only a shareholding of 51% or greater in a foreign affiliate is taken for compilation purposes).

• Turnover

• Number of persons engaged

1. Institutional unit

An institutional unit is an elementary economic decision-making centre characterised by uniformity of behaviour and decision-making autonomy in the exercise of its principal function. A unit is regarded as constituting an institutional unit if it has decision-making autonomy in respect of its principal function and keeps a complete set of accounts.

2. Foreign Affiliate

A foreign affiliate is enterprise not resident in the compiling country over which an institutional unit resident in the compiling country has control (Outward FATS).

3. Control

The concept of control is used for the breakdown of the FATS variables. Control means the ability to determine the general policy of an enterprise by choosing appropriate directors, if necessary. In this context, enterprise A is deemed to be controlled by an institutional unit B when B controls, whether directly or indirectly, more than half of the shareholders’ voting power or more than half of the shares.

Indirect control means that an institutional unit may have control through another affiliate which has control over enterprise A.

Therefore, control implies the ability to determine the strategy of an enterprise, to guide its activities and to appoint a majority of directors. In most cases, this ability can be exercised by a single investor holding a majority (more than 50 %) of the voting power or of the shares, directly or indirectly.

4. Ultimate controlling institution (UCI)

The ultimate controlling institution (UCI) of a foreign affiliate is an institutional unit, proceeding up a foreign affiliate’s chain of control, which is not controlled by another institutional unit. FATS data are compiled according to the UCI concept. The crucial characteristic of a UCI is that it should effectively control and manage the group, i.e. take global strategic decisions.

Therefore, in the case of Ireland, Outward FATS describes the activities of affiliates abroad where the UCI is an Irish resident institutional unit.

5. Residency

The place of residency of an UCI is the country of registration of the UCI in the case of legal entities and the country of residence in the case of natural persons acting as UCI. Residency is often but not always the nationality of the UCI.

The Outward FATS variables are broken down by the resident country of the foreign affiliates. These countries have been amalgamated into geographical aggregates which are listed separately.

The NACE Rev. 2 sectors covered by the Outward FATS data are as follows:

A - Agriculture, forestry and fishing

B - Mining and quarrying

C - Manufacturing

D - Electricity, gas, steam and air conditioning supply

E - Water supply; sewerage, waste management and remediation activities

F - Construction

G - Wholesale and retail trade; repair of motor vehicles and motorcycles

H - Transportation and storage

I - Accommodation and food service activities

J - Information and communication

K - Financial and insurance activities

L - Real estate activities

M - Professional, scientific and technical activities

N - Administrative and support service activities

P - Education

Q - Human health and social work activities

R - Arts, entertainment and recreation

S - Other service activities

Compiling Foreign Affiliates Statistics (PDF 263KB)

Hide Background Notes

Hide Background Notes

Scan the QR code below to view this release online or go to

http://www.cso.ie/en/releasesandpublications/er/ofats/outwardforeignaffiliatesstatistics2017/