No link available

| Seasonally Adjusted Gross Household Saving by Component | €million | ||

| Gross Disposable Income (B.6g + D.8) | Final Consumption Expenditure (P.3) | Gross Saving (B.8g) | |

| Q1 2017 | 24,934 | 23,214 | 1,518 |

| Q2 2017 | 25,785 | 23,182 | 2,720 |

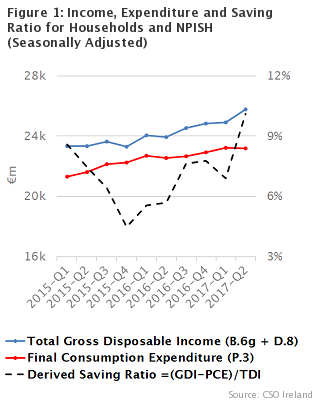

The quarterly gross saving of households (B.8g) increased by €1,202m in the second quarter of 2017 (see table above) with adjusted household expenditure (P.3) remaining almost static while gross disposable income (B.6g and D.8) continued to increase. The derived gross saving ratio, which expresses saving as a percentage of gross disposable income, increased from 6.9 per cent in the first quarter of 2017 to 10.1 per cent in the current quarter (see Background Notes).

Decreased Saving for the Overall Economy in Q2 2017

Gross saving for the total economy (S.1) decreased by almost 10 per cent in the seasonally adjusted series. While gross saving of government and households rose, these increases were outweighed by falls in the saving of both the financial and non-financial corporations sectors.

|

Increase in Net Lending of Government (S.13)

Gross saving (B.8g) of Government was €1,195m in the second quarter of 2017, down €396m (year-on-year) from a surplus of €1,591m in the equivalent period of 2016. An increase of €429m in final consumption expenditure (P.3) and of €278m in pay to employees (D.1) were the main contributors to this reduction in gross saving. While taxes on income and wealth (D.5) were up €724m on the equivalent quarter last year, this was partially offset by taxes on products (D.2) declining by €269m on the same period last year.

As the value of capital spending by government was similar to the second quarter of 2016, the change in net saving was similar to that in gross saving, down €389m year-on-year. Government was a net borrower (B.9) of €222m in the quarter.

Non-financial (S.11) and Financial (S.12) Corporations

Gross value added (B.1g) of non-financial corporations was €48,990m in the quarter, €4,235m higher than in the second quarter of 2016. Of this, €1,087m was growth in compensation of employees (D.1). The remaining growth in operating surplus (B.2g, €3,130m) was offset by the increase in profit and other outflows to the rest of the world (uses of D.42 and D.43 were up €3,711m). This left the gross saving of non-financial corporations at €19,047m in the second quarter 2017 – a decrease of €681m on the same period last year. Continued high spending on capital assets drove down net lending/borrowing (B.9): the sector was a net borrower of €12,280m in the quarter.

Financial corporations had a gross saving deficit of €1,281m in Q2 2017 - a decrease of €1,168m on Q2 2016, with a decrease of €1,351m in net property income (D.4) being the main reason for the decrease in saving.

Rest of the World Sector (S.2)

The net lending* (B.9) of the Rest of the World Sector (the equal and opposite of net borrowing of the Irish economy) was up from €2,077m in the second quarter of 2016 to €12,660m in this period. This was largely due to changes on the capital side of the account. On the current side, net exports (P.6 less P.7) grew by €5,801m year-on-year but this was largely offset by net outflows of investment income (D.4) being €4,592m greater.

*Please note: An earlier version of this text incorrectly referred to B.9 as net saving.

| Summary Table Quarterly Accounts by Institutional Sector, Q1 2016 - Q2 2017 | €million | |||||||||

| Key Variables | Quarter | S.2 Rest of World | S.1 Total Economy | S.1N Not Sectorised | S.11 Non-Financial Corporations | S.12 Financial Corporations | S.13 General Government | S.14+S.15 Households incl. NPISH | ||

| (a) | B.1*g | Gross Domestic Product | Q1 2016 | 64,608 | 5,518 | 43,207 | 3,923 | 6,104 | 5,855 | |

| Q2 2016 | 65,447 | 4,400 | 44,755 | 4,318 | 5,998 | 5,975 | ||||

| Q3 2016 | 70,351 | 5,658 | 47,841 | 4,550 | 5,801 | 6,500 | ||||

| Q4 2016 | 75,162 | 4,720 | 52,976 | 5,118 | 5,737 | 6,612 | ||||

| 2016 | 275,567 | 20,297 | 188,779 | 17,910 | 23,640 | 24,942 | ||||

| Q1 2017 | 67,914 | 5,541 | 45,611 | 4,244 | 6,417 | 6,101 | ||||

| Q2 2017 | 70,741 | 4,083 | 48,990 | 4,729 | 6,305 | 6,633 | ||||

| (b) | B.2g/B.3g | Gross Operating Surplus / | Q1 2016 | 38,861 | 21 | 30,404 | 2,324 | 1,072 | 5,040 | |

| Mixed income | Q2 2016 | 40,507 | 21 | 31,638 | 2,466 | 1,072 | 5,311 | |||

| Q3 2016 | 44,066 | 23 | 34,298 | 2,775 | 1,072 | 5,899 | ||||

| Q4 2016 | 50,425 | 24 | 39,084 | 3,312 | 1,072 | 6,933 | ||||

| 2016 | 173,860 | 89 | 135,424 | 10,877 | 4,287 | 23,183 | ||||

| Q1 2017 | 40,671 | 23 | 31,851 | 2,427 | 1,101 | 5,270 | ||||

| Q2 2017 | 44,527 | 3 | 34,768 | 2,755 | 1,101 | 5,900 | ||||

| (c) | D.1_D.4 | Net Primary Income | Q1 2016 | 13,260 | 0 | -10,403 | -1,402 | 4,325 | 20,740 | |

| Q2 2016 | 14,116 | 0 | -9,797 | -1,988 | 4,610 | 21,290 | ||||

| Q3 2016 | 12,812 | 0 | -11,224 | -1,662 | 4,630 | 21,067 | ||||

| Q4 2016 | 13,701 | 0 | -10,743 | -1,312 | 3,820 | 21,937 | ||||

| 2016 | 53,889 | 0 | -42,167 | -6,364 | 17,385 | 85,034 | ||||

| Q1 2017 | 14,885 | 0 | -11,244 | -706 | 4,940 | 21,896 | ||||

| Q2 2017 | 10,760 | 0 | -13,247 | -3,338 | 4,210 | 23,135 | ||||

| (d) | B.5g | Gross National Income | Q1 2016 | 52,121 | 21 | 20,001 | 922 | 5,396 | 25,780 | |

| = (b + c) | Q2 2016 | 54,624 | 21 | 21,841 | 478 | 5,682 | 26,601 | |||

| Q3 2016 | 56,878 | 23 | 23,074 | 1,113 | 5,702 | 26,967 | ||||

| Q4 2016 | 64,126 | 24 | 28,341 | 2,000 | 4,891 | 28,869 | ||||

| 2016 | 227,748 | 89 | 93,257 | 4,514 | 21,671 | 108,217 | ||||

| Q1 2017 | 55,556 | 23 | 20,606 | 1,721 | 6,040 | 27,165 | ||||

| Q2 2017 | 55,286 | 3 | 21,521 | -583 | 5,311 | 29,035 | ||||

| (e) | D.5_D.7 | Net Current Transfers | Q1 2016 | -944 | 0 | -668 | 472 | 2,231 | -2,979 | |

| Q2 2016 | -665 | 0 | -2,113 | 51 | 4,261 | -2,865 | ||||

| Q3 2016 | -816 | 0 | -908 | 408 | 2,292 | -2,608 | ||||

| Q4 2016 | -1009 | 0 | -2,840 | -86 | 6,846 | -4,928 | ||||

| 2016 | -3,435 | 0 | -6,529 | 845 | 15,629 | -13,380 | ||||

| Q1 2017 | -920 | 0 | -564 | 527 | 2,733 | -3,615 | ||||

| Q2 2017 | -1,263 | 0 | -2,474 | -41 | 4,664 | -3,412 | ||||

| (f) | B.6g | Gross Disposable Income | Q1 2016 | 51,177 | 21 | 19,333 | 1,394 | 7,627 | 22,801 | |

| = (d + e) | Q2 2016 | 53,958 | 21 | 19,728 | 530 | 9,943 | 23,737 | |||

| Q3 2016 | 56,062 | 23 | 22,166 | 1,521 | 7,993 | 24,359 | ||||

| Q4 2016 | 63,117 | 24 | 25,501 | 1,914 | 11,737 | 23,941 | ||||

| 2016 | 224,313 | 89 | 86,728 | 5,359 | 37,300 | 94,838 | ||||

| Q1 2017 | 54,636 | 23 | 20,042 | 2,248 | 8,773 | 23,550 | ||||

| Q2 2017 | 54,023 | 3 | 19,047 | -625 | 9,975 | 25,623 | ||||

| (g) | P.3 + D.8 | Use of Disposable Income | Q1 2016 | -30,789 | 0 | 0 | -635 | -8,085 | -22,069 | |

| Q2 2016 | -30,270 | 0 | 0 | -643 | -8,351 | -21,277 | ||||

| Q3 2016 | -31,012 | 0 | 0 | -646 | -8,968 | -21,399 | ||||

| Q4 2016 | -32,896 | 0 | 0 | -657 | -8,717 | -23,522 | ||||

| 2016 | -124,968 | 0 | 0 | -2,580 | -34,121 | -88,267 | ||||

| Q1 2017 | -31,756 | 0 | 0 | -660 | -8,490 | -22,606 | ||||

| Q2 2017 | -31,264 | 0 | 0 | -657 | -8,780 | -21,828 | ||||

| (h) | B.8g | Gross Saving | Q1 2016 | 20,387 | 21 | 19,333 | 759 | -458 | 732 | |

| = (f + g) | Q2 2016 | 23,688 | 21 | 19,728 | -113 | 1,591 | 2,460 | |||

| Q3 2016 | 25,050 | 23 | 22,166 | 875 | -974 | 2,960 | ||||

| Q4 2016 | 30,221 | 24 | 25,501 | 1,257 | 3,020 | 419 | ||||

| 2016 | 99,346 | 89 | 86,728 | 2,779 | 3,179 | 6,571 | ||||

| Q1 2017 | 22,881 | 23 | 20,042 | 1,588 | 283 | 944 | ||||

| Q2 2017 | 22,759 | 3 | 19,047 | -1,281 | 1,195 | 3,795 | ||||

| (i) | Changes in Capital Accounts | Q1 2016 | -600 | 21 | -259 | -34 | -427 | 99 | ||

| Q2 2016 | -10,165 | 21 | -8,227 | -365 | -490 | -1,104 | ||||

| Q3 2016 | -7,880 | 23 | -6,910 | -323 | 251 | -921 | ||||

| Q4 2016 | -13,479 | 24 | -11,289 | -421 | -588 | -1,206 | ||||

| 2016 | -32,125 | 89 | -26,684 | -1,144 | -1,254 | -3,132 | ||||

| Q1 2017 | -9,127 | 23 | -7,553 | -132 | -639 | -826 | ||||

| Q2 2017 | -18,879 | 3 | -17,246 | -330 | -483 | -822 | ||||

| (j) | P.51C | Consumption of Fixed Capital1 | Q1 2016 | 15,539 | 13,178 | 270 | 935 | 1,156 | ||

| Q2 2016 | 15,600 | 13,233 | 271 | 935 | 1,161 | |||||

| Q3 2016 | 15,692 | 13,316 | 273 | 935 | 1,168 | |||||

| Q4 2016 | 16,062 | 13,650 | 280 | 935 | 1,198 | |||||

| 2016 | 62,893 | 53,377 | 1,094 | 3,738 | 4,683 | |||||

| Q1 2017 | 16,320 | 13,883 | 285 | 935 | 1,218 | |||||

| Q2 2017 | 16,540 | 14,081 | 289 | 935 | 1,235 | |||||

| (k) | B.9 | Net lending (+) / Net borrowing (-) | Q1 2016 | -4,248 | 4,248 | 42 | 5,897 | 455 | -1,820 | -325 |

| = (h + i) - j | Q2 2016 | 2,077 | -2,077 | 42 | -1,732 | -749 | 167 | 195 | ||

| Q3 2016 | -1,477 | 1,477 | 45 | 1,940 | 279 | -1,658 | 871 | |||

| Q4 2016 | -679 | 679 | 49 | 562 | 556 | 1,497 | -1,985 | |||

| 2016 | -4,328 | 4,328 | 178 | 6,667 | 541 | -1,813 | -1,244 | |||

| Q1 2017 | 2,567 | -2,567 | 46 | -1,394 | 1,172 | -1,290 | -1,100 | |||

| Q2 2017 | 12,660 | -12,660 | 5 | -12,280 | -1,900 | -222 | 1,738 | |||

| Table 1.2 Generation of Income Account | €million | ||||||||

| RESOURCES (RECEIVED) | S.1+S.2 Sum Over Sectors | S.2 Rest of World | S.1 Total Economy | S.1N Not Sectorised | S.11 Non-Financial Corporations | S.12 Financial Corporations | S.13 General Government | S.14+S.15 Households incl. NPISH | |

| B.1*g | Gross Domestic Product | 70,741 | 4,083 | 48,990 | 4,729 | 6,305 | 6,633 | ||

| D.3 | Subsidies, Received | 432 | 432 | 231 | 135 | 0 | 0 | 66 | |

| USES (PAID) | |||||||||

| D.1 | Compensation of Employees | 21,664 | 136 | 21,529 | 13,860 | 1,790 | 5,205 | 674 | |

| D.2 | Taxes on Production and Imports, Paid | 5,118 | 5,118 | 4,311 | 497 | 184 | 0 | 125 | |

| B.2g/ B.3g | Gross Operating Surplus/ Gross Mixed Income | 44,527 | 3 | 34,768 | 2,755 | 1,101 | 5,900 | ||

| Table 1.3 Allocation of Primary Income Account | €million | ||||||||

| RESOURCES (RECEIVED) | S.1+S.2 Sum Over Sectors | S.2 Rest of World | S.1 Total Economy | S.1N Not Sectorised | S.11 Non-Financial Corporations | S.12 Financial Corporations | S.13 General Government | S.14+S.15 Households incl. NPISH | |

| B.2g/ B.3g | Gross Operating Surplus/ Gross Mixed income | 44,527 | 3 | 34,768 | 2,755 | 1,101 | 5,900 | ||

| D.1 | Compensation of Employees | 21,664 | 158 | 21,506 | 21,506 | ||||

| D.2 | Taxes on Production and Imports, Received | 5,118 | 180 | 4,938 | 4,938 | ||||

| D.4 | Property Income | 59,059 | 35,233 | 23,826 | 3,132 | 17,739 | 1,090 | 1,865 | |

| D.41 | Interest | 17,790 | 5,505 | 12,285 | -177 | 12,295 | 19 | 148 | |

| D.42 | Distributed Income of Corporations | 12,712 | 6,074 | 6,638 | 365 | 4,342 | 1,044 | 888 | |

| D.43 | Reinvested Earnings on Direct Foreign Investment | 15,810 | 12,446 | 3,364 | 2,945 | 419 | 0 | 0 | |

| D.44 | Other Investment Income | 12,670 | 11,209 | 1,462 | 0 | 683 | 0 | 779 | |

| D.45 | Rents | 77 | 77 | 0 | 0 | 26 | 51 | ||

| USES (PAID) | |||||||||

| D.3 | Subsidies, Paid | 432 | 38 | 395 | 395 | ||||

| D.4 | Property Income | 59,059 | 19,944 | 39,115 | 16,379 | 21,077 | 1,423 | 236 | |

| D.41 | Interest | 17,790 | 11,196 | 6,594 | 1,388 | 3,598 | 1,423 | 185 | |

| D.42 | Distributed Income of Corporations | 12,712 | 4,702 | 8,010 | 6,302 | 1,708 | 0 | 0 | |

| D.43 | Reinvested Earnings on Direct Foreign Investment | 15,810 | 3,364 | 12,446 | 8,663 | 3,783 | 0 | 0 | |

| D.44 | Other Investment Income | 12,670 | 683 | 11,988 | 0 | 11,988 | 0 | 0 | |

| D.45 | Rents | 77 | 77 | 26 | 0 | 0 | 51 | ||

| B.5g | Gross National Income | 55,286 | 3 | 21,521 | -583 | 5,311 | 29,035 | ||

| Table 1.5 Secondary Distribution of Income Account | €million | ||||||||

| RESOURCES (RECEIVED) | S.1+S.2 Sum Over Sectors | S.2 Rest of World | S.1 Total Economy | S.1N Not Sectorised | S.11 Non-Financial Corporations | S.12 Financial Corporations | S.13 General Government | S.14+S.15 Households incl. NPISH | |

| B.5g | Gross National Income | 55,286 | 3 | 21,521 | -583 | 5,311 | 29,035 | ||

| D.5 | Current Taxes on Income, Wealth, etc. | 8,038 | 20 | 8,018 | 8,018 | ||||

| D.61 | Social Contributions | 4,430 | 0 | 4,430 | 0 | 1,464 | 2,966 | 0 | |

| D.62 | Social Benefits other than Social Transfers in kind | 6,422 | 81 | 6,340 | 6,340 | ||||

| D.7 | Other Current Transfers | 6,116 | 2,306 | 3,810 | 137 | 2,144 | 52 | 1,478 | |

| USES (PAID) | |||||||||

| D.5 | Current Taxes on Income, Wealth, etc. | 8,038 | 19 | 8,019 | 2,377 | 684 | 0 | 4,958 | |

| D.61 | Net Social Contributions | 4,430 | 0 | 4,430 | 4,430 | ||||

| D.62 | Social Benefits other than Social Transfers in kind | 6,422 | 79 | 6,343 | 0 | 807 | 5,535 | 0 | |

| D.7 | Other Current Transfers | 6,116 | 1,046 | 5,071 | 234 | 2,158 | 836 | 1,843 | |

| B.6g | Gross Disposable Income | 54,023 | 3 | 19,047 | -625 | 9,975 | 25,623 | ||

| Table 1.6 Use of Disposable Income Account | €million | ||||||||

| RESOURCES (RECEIVED) | S.1+S.2 Sum Over Sectors | S.2 Rest of World | S.1 Total Economy | S.1N Not Sectorised | S.11 Non-Financial Corporations | S.12 Financial Corporations | S.13 General Government | S.14+S.15 Households incl. NPISH | |

| B.6g | Gross Disposable Income | 54,023 | 3 | 19,047 | -625 | 9,975 | 25,623 | ||

| D.8 | Adjustment for the Change in Pension Entitlements | 657 | 0 | 657 | 657 | ||||

| USES (PAID) | |||||||||

| P.3 | Final Consumption Expenditure | 31,264 | 8,780 | 22,484 | |||||

| D.8 | Adjustment for the Change in Pension Entitlements | 657 | 0 | 657 | 657 | ||||

| B.8g | Gross Saving | 22,759 | 3 | 19,047 | -1,281 | 1,195 | 3,795 | ||

| Table 1.7 External Account | €million | ||||||||

| RESOURCES (RECEIVED) | S.1+S.2 Sum Over Sectors | S.2 Rest of World | S.1 Total Economy | S.1N Not Sectorised | S.11 Non-Financial Corporations | S.12 Financial Corporations | S.13 General Government | S.14+S.15 Households incl. NPISH | |

| P.7 | Imports of Goods and Services | 70,220 | |||||||

| D.1 to D.8 | Primary Incomes and Current Transfers | 111,936 | 37,978 | 73,958 | |||||

| USES (PAID) | |||||||||

| P.6 | Exports of Goods and Services | 85,856 | |||||||

| B.11 | External Balance of Goods & Services | -15,636 | |||||||

| D.1 to D.8 | Primary Incomes and Current Transfers | 111,936 | 21,261 | 90,676 | |||||

| B.12 | Current External Balance | 1,081 | |||||||

| Table 1.8 Change in Net Worth due to Saving and Capital Transfers Account | €million | ||||||||

| LIABILITIES | S.1+S.2 Sum Over Sectors | S.2 Rest of World | S.1 Total Economy | S.1N Not Sectorised | S.11 Non-Financial Corporations | S.12 Financial Corporations | S.13 General Government | S.14+S.15 Households incl. NPISH | |

| B.8g | Gross Saving | 22,759 | 3 | 19,047 | -1,281 | 1,195 | 3,795 | ||

| B.12 | Current External Balance | 1,081 | |||||||

| D.9 | Capital Transfers | 499 | 5 | 494 | 185 | 0 | 134 | 175 | |

| ASSETS | |||||||||

| D.9 | Capital Transfers | 499 | 2 | 496 | 73 | 0 | 360 | 63 | |

| P.51c | Consumption of Fixed Capital | 16,540 | 14,081 | 289 | 935 | 1,235 | |||

| B.10.1 | Changes in Net Worth due to Saving and Capital Transfers | 7,300 | 1,084 | 6,217 | 3 | 5,078 | -1,570 | 35 | 2,671 |

| Table 1.9 Acquisition of Non-Financial Assets Account | €million | ||||||||

| LIABILITIES | S.1+S.2 Sum Over Sectors | S.2 Rest of World | S.1 Total Economy | S.1N Not Sectorised | S.11 Non-Financial Corporations | S.12 Financial Corporations | S.13 General Government | S.14+S.15 Households incl. NPISH | |

| B.10.1 | Changes in Net Worth due to Saving and Capital Transfers | 7,300 | 1,084 | 6,217 | 3 | 5,078 | -1,570 | 35 | 2,671 |

| P.51c | Consumption of Fixed Capital | 16,540 | 16,540 | 14,081 | 289 | 935 | 1,235 | ||

| ASSETS | |||||||||

| P.5 | Gross Capital Formation | 23,840 | 23,840 | -3 | 19,863 | 619 | 1,191 | 2,169 | |

| NP | Acquisitions less Disposals of Non-Produced Assets | 0 | -11,576 | 11,576 | 11,576 | 0 | 0 | 0 | |

| B.9 | Net Lending (+)/ Net Borrowing (-) | 0 | 12,660 | -12,660 | 5 | -12,280 | -1,900 | -222 | 1,738 |

Description of Institutional Sectors

In the sector accounts, Institutional Sectors are distinguished not in terms of the nature of their production activity (such as agriculture, industry, services, etc.) but rather in terms primarily of the institutional form of the units that make them up. Thus companies, whether engaged in commercial non-financial or financial business, are grouped in a different sector from households, even though the latter are in many cases also engaged in commercial production, and from government or other non-market producers such as voluntary agencies.

Institutional Sectors

The classification system is that of the European System of Accounts 2010 (ESA2010). The sectors and sub-sectors distinguished in the present publication are as follows:

S.1 Resident Economy is the sum of all the sectors of the domestic economy.

S.11 Non-Financial Corporations are corporate bodies producing goods and non-financial services on a commercial basis. They include public limited companies, private companies and other corporate forms of business, whether owned by residents (including the government) or non-residents or both. In particular, therefore, Irish subsidiaries of foreign companies and the Irish branches of foreign companies operating in Ireland on a branch basis are included; while the foreign subsidiaries of Irish companies and the foreign branches of Irish companies operating abroad are excluded (they form part of the Rest of the World sector S.2). The business activities of self-employed persons (quasi-corporations) are in principle to be included here if separate accounts are available for statistical purposes. Under the implementation of ESA2010, entities which operate as holding companies for non-financial corporations are now classified in the financial sector.

S.12 Financial Corporations are corporate bodies producing financial services on a commercial basis. As with S.11, they can take various legal forms, with a range of ownership arrangements. They include monetary financial institutions, other financial intermediaries, financial auxiliaries and insurance corporations and pension funds.

S.13 General Government consists of central and local government. Central government includes the Ireland Strategic Investment Fund (formerly the NPRF), and non-commercial agencies owned and funded by government, but does not include commercial state-owned companies (which are proper to S.11 or S.12 as appropriate).

S.1M: S.14 + S.15 Households and Non-Profit Institutions Serving Households. S.14 consists of persons in their capacity as holders of financial assets or as borrowers. The business assets and liabilities of unincorporated self-employed persons are also mainly reflected in this sector. S.15 consists of non-profit institutions such as charities and non-commercial agencies not owned by the government, such as some schools and hospitals.

S.2 Rest of the World. The figures represent the economy's transactions with non-residents. The conceptual definition is the same as in the Balance of Payments (BOP) statistics. In particular, non-residents include foreign subsidiaries of Irish companies, the foreign branches of Irish companies that operate abroad on a branch basis, and the head offices of foreign companies that operate in Ireland on a branch basis.

S.1N Not Sectorised. In the non-financial accounts an additional residual sector is used to report taxes and subsidies on products (D.29) in the Generation of Income Account (Account 1.2) as it is not possible to allocate these amounts to Institutional Sectors. In addition, throughout these accounts S.1N is used to report the amounts that appear as the statistical discrepancy in the National Income and Expenditure GDP accounts, arising from the use of two independent estimates of GDP (from the Income and Expenditure approaches). In the Annual National Accounts NIE tables 3 and 5, the official estimate of GDP is reported as the average of the two measures, and the discrepancy is therefore displayed as half the difference between the two independent estimates (and thus with different signs in the two tables). The discrepancy is projected forward on a quarterly basis in line with the trends in the Expenditure components and is presented in Table 2 of the Quarterly National Accounts. In the Quarterly Sector Accounts it appears in Gross Domestic Product, the opening item in the Generation of Income Account and is then carried through successive accounts via the balancing item. In the final non-financial account, the full amount of the discrepancy then emerges as the unallocated net lending or borrowing in the economy.

Description of Detailed Non-Financial Accounts

Sector accounts present a coherent overview of all economic processes and the roles played by the various sectors. Each economic process is described in a separate account. The accounts describe successively: generation of income, primary and secondary income distribution, final consumption, redistribution by means of capital transfers, and capital formation. Note that the Production Account (1.1) from the Annual Accounts is not included in these quarterly accounts as the data is not available on a quarterly basis. The accounts record economic transactions, distinguishing between uses and resources (e.g. the resources side of the transaction category Interest (D.41) records the amounts of interest receivable by the different sectors of the economy and the uses side shows interest payable) with a special item to balance the two sides of each account. By passing on the balancing item from one account to the next a connection is created between successive accounts.

The accounts are compiled for the total economy and include accounts for separate domestic sectors and the Rest of the World sector. In this way the sector accounts describe:

The successive accounts are explained in more detail below.

Current Accounts

1.1 Production Account

This account is not presented in the Quarterly Non-Financial Accounts as quarterly data is not available.

1.2 Generation of Income Account

This account displays the transactions through which Gross Domestic Product at market prices is distributed to labour (compensation of employees), capital (operating surplus) and government (the balance of taxes and subsidies on production). The balancing item for the Household and NPISH sector in this account is called mixed income, because apart from operating surplus it also contains compensation for work by self-employed persons and their family members. Gross Operating Surplus/Gross Mixed Income (B.2g/B.3g) is the balancing item for the entire account.

1.3 Allocation of Primary Income Account

This account records, as resources, the income from direct participation in the production process, as well as property income received in exchange for the use of land, financial resources and other intangible assets. In addition, this account records the taxes on production and imports received by the government. On the uses side, property income (including interest, dividends, reinvested earnings and land rent) is recorded as well as the subsidies paid by the government.

On this account the interest paid and received are recorded excluding imputed bank services (financial intermediation services indirectly measured - FISIM). In the national accounts insurance technical reserves are seen as a liability of insurance enterprises and pension funds to policyholders. Therefore, the receipts from investing these reserves are recorded as payments from insurance enterprises and pension funds to households, under Other Investment Income (D.44). The balancing item of this account for each sector is Gross National Income (B.5g). The Primary Income for the total economy is the National Income.

1.4 Memorandum-Entrepreneurial Income Account

This account is not presented in the Quarterly series.

1.5 Secondary Distribution of Income Account

The Secondary Distribution of Income Account shows how primary income is redistributed by means of current taxes on income and wealth, social contributions (including contributions to pension schemes), social benefits (including pension benefits) and other current transfers. The balancing item of this account is Gross Disposable Income (B.6g). For the consuming sectors (Households, NPISH and General Government) this item is passed on to Use of Disposable Income Account (1.6). For the other sectors the disposable income is generally equal to saving. This is then passed on to the Change in Net Worth due to Saving and Capital Transfers Account (1.8).

1.6 Use of Disposable Income Account

This account shows the element of disposable income that is spent on final consumption and also the element that is saved. As mentioned above, final consumption only exists for Households, NPISH and General Government. The net equity of Households in pension funds is seen as a financial asset that belongs to Households. Changes in these reserves need to be included in the saving of Households. However, contributions to pension schemes and pension benefits have already been recorded on the Secondary Distribution of Income Account (1.5) as social contributions and social benefits. Therefore, an adjustment is needed in the saving of Households to include the change in pension funds reserves on which they have a definite claim. This adjustment is called Adjustment for the Change in Pension Entitlements (D.8). There is no need for a similar adjustment concerning life insurance because life insurance premiums and benefits are not recorded as current transactions. The balancing item for this account is Gross Saving (B.8g).

1.7 External Account

This account records the summarised transactions of the Rest of the World Sector (S.2), including on the uses side exports of goods and services, primary incomes and current transfers receivable. The resources side of this account includes imports of goods and services together with primary incomes and transfers payable. The balancing item is Current External Balance (B.12), which records the balance on current accounts with the Rest of the World.

Capital Accounts

1.8 Change in Net Worth due to Saving and Capital Transfers

On this account the capital transfers are recorded and combined with gross saving and the current external balance. The resulting balancing item is Changes in Net Worth due to Saving and Capital Transfers (B.10.1).

1.9 Acquisition of Non-Financial Assets Account

On this account, Gross Fixed Capital Formation (P.51), Changes in Inventories (P.52) and Acquisitions less Disposals of Valuables and Non-Produced Non-Financial Assets (N.P.) are recorded among the uses. The decline in the value of fixed capital goods caused by consumption of fixed capital goods is recorded among the resources (P.51c). The balancing item is Net Lending(+) or Borrowing(-) (B.9). It shows the amount a sector can lend/invest or has to borrow as a result of its current and capital transactions.

Seasonal Adjustment

Seasonal adjustment is conducted using the direct seasonal adjustment approach. Under this approach, each individual time series is independently adjusted, i.e. aggregate series are adjusted without reference to the component series.

As part of the seasonal adjustment process, ARIMA models are identified for each series based on unadjusted data spanning Q1 1999 to Q1 2017. These models are then applied to the entire series (Q1 1999 to Q2 2017). Seasonal factors and the parameters of the ARIMA models are updated each quarter.

The adjustments are completed by applying the X-13-ARIMA model, developed by the U.S. Census Bureau to the unadjusted data. This methodology estimates seasonal factors while also taking into consideration factors that impact on the quality of the seasonal adjustment such as, for example:

For additional information on the use of X-13-ARIMA, see https://www.census.gov/srd/www/x13as/.

Derived Seasonally Adjusted Household Saving Ratio

Seasonally adjusted estimates of Household Saving are compiled using the indirect seasonal adjustment approach. Under this approach the two main aggregates, Household Disposable Income (B.6g + D.8) and Final Consumption Expenditure of Households (P.3), are independently adjusted. The derived saving is the difference between the two adjusted series of Household Disposable Income and Final Expenditure of Households. This method for estimating the seasonally adjusted value for a small net residual of two large aggregates, such as Household Saving, is considered to be a more appropriate estimation procedure.

The use of these saving either for financial investment or debt reduction is not recorded in these accounts but is recorded in the financial account (see Quarterly Financial Accounts http://www.centralbank.ie/polstats/stats/qfaccounts/Pages/releases.aspx published by the Central Bank of Ireland and http://www.cso.ie/en/releasesandpublications/ep/p-isanff/isanff2015/ for annual integrated financial and non financial accounts).

Hide Background Notes

Hide Background Notes

Scan the QR code below to view this release online or go to

http://www.cso.ie/en/releasesandpublications/er/isanf/institutionalsectoraccountsnonfinancialquarter22017/