| € billion | ||||||

| 30 Jun 2015 | 30 Sep 2015 | |||||

| Assets | Liabilities | NET | Assets | Liabilities | NET | |

| General Government | 11.0 | 134.0 | -123.0 | 11.3 | 133.8 | -122.6 |

| Monetary Authority | 18.7 | 26.9 | -8.1 | 18.9 | 18.9 | -0.0 |

| Monetary Financial Institutions | 742.1 | 702.8 | 39.3 | 741.5 | 702.4 | 39.1 |

| Other Financial Intermediaries | 2,294.9 | 2,240.5 | 54.4 | 2,178.9 | 2,125.9 | 53.0 |

| Non-Financial Companies | 688.1 | 812.2 | -124.1 | 648.0 | 776.8 | -128.8 |

| Total | 3,754.9 | 3,916.3 | -161.5 | 3,598.5 | 3,757.8 | -159.3 |

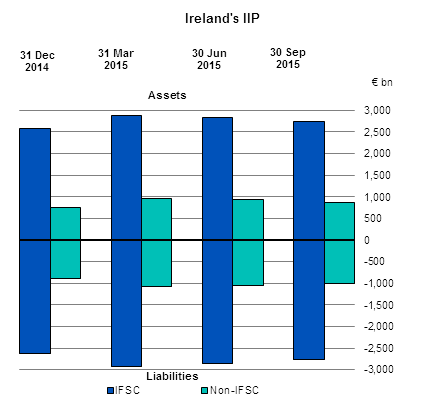

At 30th September 2015, Ireland’s quarterly international investment position (IIP) results show overall stocks of foreign financial assets of €3,599bn – a decrease of €156bn on the end-June 2015 level, while the corresponding stocks of foreign financial liabilities decreased by €158bn to €3,758bn over the quarter. Irish residents had an overall net foreign liability of €159bn at end-September 2015, a decrease of €2bn on the net foreign liability level at end-June 2015 – see Table 1a.

Some points of note in the Quarter 3 2015 IIP are

| X-axis label | General Government | Monetary Financial Intermediaries | Other Financial Intermediaries | Non-Financial Companies |

|---|---|---|---|---|

| 30 Jun 2015 | 442 | 485 | 496 | 696 |

| 30 Sep 2015 | 456 | 478 | 465 | 651 |

With the implementation of the new methodology in June 2014 for Portfolio Investment assets, equity and debt securities (see table 3a for this breakdown), the sector of the non-resident issuer is collected. Analysing this data shows that Irish residents hold debt as follows:

The data shown are consistent with that transmitted bi-annually to the International Monetary Fund (IMF) for their Coordinated Portfolio Investment Survey (CPIS). More information and comparable country data are available http://cpis.imf.org/

These results are also consistent with the national annual Resident Holdings of Portfolio Investment release

| X-axis label | Direct Investment | Other Sectors | Monetary Financial Institutions | Monetary Authority | General Government |

|---|---|---|---|---|---|

| 30 Sep 2014 | 335.473 | 800.596 | 260.562 | 39.244 | 134.372 |

| 31 Dec 2014 | 371.015 | 822.636 | 251.351 | 38.758 | 130.574 |

| 31 Mar 2015 | 410.919 | 900.079 | 243.44 | 34.269 | 132.794 |

| 30 Jun 2015 | 432.057 | 896.016 | 229.597 | 26.872 | 134.005 |

Figure 3 shows the net IIP over time along with the contribution of each instrument type to it. We can see that in the last six quarters while direct investment has a positive contribution both portfolio investment and other investment have a negative contribution. Reserve assets have a positive contribution but this is very small relative to the other instrument types.

| X-axis label | Direct Investment | Other Sectors | Monetary Financial Institutions | Monetary Authority | General Government |

|---|---|---|---|---|---|

| 30 Sep 2014 | 335.473 | 800.596 | 260.562 | 39.244 | 134.372 |

| 31 Dec 2014 | 371.015 | 822.636 | 251.351 | 38.758 | 130.574 |

| 31 Mar 2015 | 410.919 | 900.079 | 243.44 | 34.269 | 132.794 |

| 30 Jun 2015 | 432.057 | 896.016 | 229.597 | 26.872 | 134.005 |

Gross External Debt 1 is €1.65 trillion at end-June 2015

At 30th September 2015, the gross external debt of all resident sectors (i.e. general government, the monetary authority, financial and non-financial corporations and households) amounted to €1,648bn. This represents a decrease of €70bn in the stock of financial liabilities to non-residents (other than those arising from issues of Irish equities and derivatives contracts) compared to the level shown at 30th June 2015 (€1,719bn) – see Table 6a. Points of note are:

1Gross external debt represents the stock of Ireland's liabilities to non-residents other than equity and financial derivatives.

| Table 1(a) International Investment Position (IIP) classified by Financial Instrument | € million | ||||||||

| Item | Q3 2013 | Q4 2013 | Q1 2014 | Q2 2014 | Q3 2014 | Q4 2014 | Q1 2015 | Q2 2015 | Q3 2015 |

| Foreign Assets | |||||||||

| Direct Investment Abroad 1 | 335,132 | 390,651 | 400,936 | 435,069 | 475,372 | 522,824 | 714,072 | 701,856 | 661,362 |

| Portfolio Investment | 1,593,678 | 1,625,384 | 1,686,882 | 1,749,344 | 1,871,269 | 1,935,118 | 2,155,294 | 2,121,012 | 2,038,455 |

| Other Investment 2 | 834,856 | 791,672 | 807,206 | 825,465 | 859,668 | 871,308 | 957,099 | 930,075 | 896,846 |

| Reserve Assets | 1,213 | 1,178 | 1,192 | 1,206 | 1,250 | 1,426 | 1,637 | 1,909 | 1,872 |

| Total Foreign Assets | 2,764,879 | 2,808,885 | 2,896,216 | 3,011,084 | 3,207,559 | 3,330,676 | 3,828,102 | 3,754,852 | 3,598,535 |

| Foreign Liabilities | |||||||||

| Direct Investment in Ireland 1 | 284,508 | 284,907 | 268,155 | 280,914 | 307,285 | 311,508 | 327,025 | 325,635 | 334,007 |

| Portfolio Investment | 1,805,324 | 1,859,476 | 1,906,242 | 2,012,584 | 2,150,624 | 2,261,937 | 2,685,047 | 2,622,130 | 2,495,971 |

| Other Investment 2 | 914,353 | 886,881 | 925,045 | 926,165 | 955,135 | 954,333 | 1,000,951 | 968,570 | 927,817 |

| Total Foreign Liabilities | 3,004,185 | 3,031,264 | 3,099,442 | 3,219,663 | 3,413,044 | 3,527,778 | 4,013,023 | 3,916,335 | 3,757,795 |

| Net International Investment Position (IIP) | |||||||||

| Direct Investment 1 | 50,624 | 105,744 | 132,781 | 154,155 | 168,087 | 211,316 | 387,047 | 376,221 | 327,355 |

| Portfolio Investment | -211,646 | -234,092 | -219,360 | -263,240 | -279,355 | -326,819 | -529,753 | -501,118 | -457,516 |

| Other Investment 2 | -79,497 | -95,209 | -117,839 | -100,700 | -95,467 | -83,025 | -43,852 | -38,495 | -30,971 |

| Reserve Assets | 1,213 | 1,178 | 1,192 | 1,206 | 1,250 | 1,426 | 1,637 | 1,909 | 1,872 |

| Total (Net IIP) | -239,306 | -222,379 | -203,226 | -208,579 | -205,485 | -197,102 | -184,921 | -161,483 | -159,260 |

| 1Reflecting the so-called directional principle for reclassifying Direct Investment (see background notes). | |||||||||

| 2Includes financial derivatives and trade credits; in the case of liabilities this category also includes life insurance liabilities to non-residents. | |||||||||

| Table 1(b) International Investment Position (IIP) classified by Institutional Sector | € million | ||||||||

| Item | Q3 2013 | Q4 2013 | Q1 2014 | Q2 2014 | Q3 2014 | Q4 2014 | Q1 2015 | Q2 2015 | Q3 2015 |

| Foreign Assets | |||||||||

| General Government | 17,113 | 17,954 | 16,507 | 13,063 | 13,762 | 10,844 | 10,798 | 11,038 | 11,288 |

| Monetary Authority 1 | 20,287 | 20,401 | 20,543 | 20,612 | 20,762 | 20,781 | 18,980 | 18,726 | 18,863 |

| Monetary Financial Institutions 2 | 633,278 | 605,385 | 713,310 | 722,683 | 743,160 | 749,588 | 805,544 | 742,095 | 741,463 |

| Other Sectors 3 | 2,094,202 | 2,165,145 | 2,145,857 | 2,254,726 | 2,429,875 | 2,549,462 | 2,992,778 | 2,982,992 | 2,826,921 |

| of which: | |||||||||

| Other Financial Intermediaries | 1,773,944 | 1,785,735 | 1,750,715 | 1,824,705 | 1,963,194 | 2,031,662 | 2,288,960 | 2,294,897 | 2,178,876 |

| Non-Financial Companies4 | 320,258 | 379,410 | 395,142 | 430,021 | 466,681 | 517,800 | 703,818 | 688,095 | 648,045 |

| Total Foreign Assets | 2,764,879 | 2,808,885 | 2,896,216 | 3,011,084 | 3,207,559 | 3,330,676 | 3,828,102 | 3,754,852 | 3,598,535 |

| Foreign Liabilities | |||||||||

| General Government | 129,794 | 126,038 | 129,664 | 131,933 | 134,373 | 130,574 | 132,794 | 134,005 | 133,844 |

| Monetary Authority 1 | 72,687 | 71,594 | 61,790 | 44,854 | 39,244 | 38,758 | 34,269 | 26,872 | 18,869 |

| Monetary Financial Institutions 2 | 642,642 | 617,348 | 691,413 | 699,088 | 729,737 | 718,979 | 764,373 | 702,766 | 702,403 |

| Other Sectors 3 | 2,159,063 | 2,216,285 | 2,216,578 | 2,343,788 | 2,509,692 | 2,639,468 | 3,081,588 | 3,052,694 | 2,902,679 |

| of which: | |||||||||

| Other Financial Intermediaries | 1,722,325 | 1,730,838 | 1,712,412 | 1,795,365 | 1,917,192 | 1,993,241 | 2,254,298 | 2,240,495 | 2,125,882 |

| Non-Financial Companies4 | 436,738 | 485,447 | 504,166 | 548,423 | 592,500 | 646,227 | 827,290 | 812,199 | 776,797 |

| Total Foreign Liabilities | 3,004,185 | 3,031,264 | 3,099,442 | 3,219,663 | 3,413,044 | 3,527,778 | 4,013,023 | 3,916,335 | 3,757,795 |

| Net International Investment Position (IIP) | |||||||||

| General Government | -112,681 | -108,084 | -113,157 | -118,870 | -120,611 | -119,729 | -121,996 | -122,967 | -122,556 |

| Monetary Authority1 | -52,400 | -51,193 | -41,247 | -24,242 | -18,482 | -17,977 | -15,289 | -8,146 | -6 |

| Monetary Financial Institutions 2 | -9,364 | -11,963 | 21,897 | 23,595 | 13,423 | 30,609 | 41,171 | 39,329 | 39,060 |

| Other Sectors 3 | -64,861 | -51,140 | -70,721 | -89,062 | -79,817 | -90,006 | -88,810 | -69,702 | -75,758 |

| of which: | |||||||||

| Other Financial Intermediaries | 51,619 | 54,897 | 38,303 | 29,340 | 46,002 | 38,421 | 34,662 | 54,402 | 52,994 |

| Non-Financial Companies4 | -116,480 | -106,037 | -109,024 | -118,402 | -125,819 | -128,427 | -123,472 | -124,104 | -128,752 |

| Total (Net IIP) | -239,306 | -222,379 | -203,226 | -208,579 | -205,485 | -197,102 | -184,921 | -161,483 | -159,260 |

| 1Central Bank of Ireland. | |||||||||

| 2Covering licensed credit institutions and money market funds. | |||||||||

| 3Other sectors includes financial corporations other than the Monetary Authority and Monetary Financial Institutions, non-financial | |||||||||

| service and manufacturing companies and other industrial enterprises as well as (implicitly) households (see Background Notes). | |||||||||

| The gross liabilities to non-residents of financial corporations covered in other sectors tend to be very significant. | |||||||||

| 4Including households. | |||||||||

| Table 2 International Investment Position (IIP) - IFSC and non-IFSC activity by Institutional Sector | € million | ||||||

| 30 Jun 2015 | 30 sep 2015 | ||||||

| Item | IFSC | non-IFSC | Total | IFSC | non-IFSC | Total | |

| Foreign Assets | |||||||

| General Government | 0 | 11,038 | 11,038 | 0 | 11,288 | 11,288 | |

| Monetary Authority 1 | 0 | 18,726 | 18,726 | 0 | 18,863 | 18,863 | |

| Monetary Financial Institutions 2 | 651,480 | 90,615 | 742,095 | 665,715 | 75,748 | 741,463 | |

| Other Sectors 3 | 2,174,114 | 808,878 | 2,982,992 | 2,064,022 | 762,899 | 2,826,921 | |

| of which: | |||||||

| Other Financial Intermediaries | 2,174,114 | 120,783 | 2,294,897 | 2,064,022 | 114,854 | 2,178,876 | |

| Non-Financial Companies4 | 0 | 688,095 | 688,095 | 0 | 648,045 | 648,045 | |

| Total Foreign Assets | 2,825,594 | 929,258 | 3,754,852 | 2,729,737 | 868,798 | 3,598,535 | |

| Foreign Liabilities | |||||||

| General Government | 0 | 134,005 | 134,005 | 0 | 133,844 | 133,844 | |

| Monetary Authority 1 | 0 | 26,872 | 26,872 | 0 | 18,869 | 18,869 | |

| Monetary Financial Institutions 2 | 607,584 | 95,182 | 702,766 | 619,291 | 83,112 | 702,403 | |

| Other Sectors 3 | 2,252,146 | 800,548 | 3,052,694 | 2,137,515 | 765,164 | 2,902,679 | |

| of which: | |||||||

| Other Financial Intermediaries | 2,252,146 | -11,651 | 2,240,495 | 2,137,515 | -11,633 | 2,125,882 | |

| Non-Financial Companies4 | 0 | 812,199 | 812,199 | 0 | 776,797 | 776,797 | |

| Total Foreign Liabilities | 2,859,730 | 1,056,605 | 3,916,335 | 2,756,806 | 1,000,989 | 3,757,795 | |

| Net International Investment Position (IIP) | |||||||

| General Government | 0 | -122,967 | -122,967 | 0 | -122,556 | -122,556 | |

| Monetary Authority 1 | 0 | -8,146 | -8,146 | 0 | -6 | -6 | |

| Monetary Financial Institutions 2 | 43,896 | -4,567 | 39,329 | 46,424 | -7,364 | 39,060 | |

| Other Sectors 3 | -78,032 | 8,330 | -69,702 | -73,493 | -2,265 | -75,758 | |

| of which: | |||||||

| Other Financial Intermediaries | -78,032 | 132,434 | 54,402 | -73,493 | 126,487 | 52,994 | |

| Non-Financial Companies4 | 0 | -124,104 | -124,104 | 0 | -128,752 | -128,752 | |

| Total (Net IIP) | -34,136 | -127,347 | -161,483 | -27,069 | -132,191 | -159,260 | |

| 1Central Bank of Ireland. | |||||||

| 2Covering licensed credit institutions and money market funds. | |||||||

| 3Other sectors includes financial corporations other than the Monetary Authority and Monetary Financial Institutions, non-financial | |||||||

| service and manufacturing companies and other industrial enterprises as well as (implicitly) households (see Background Notes). | |||||||

| The gross liabilities to non-residents of financial corporations covered in other sectors tend to be very significant. | |||||||

| 4Including households. | |||||||

| Table 3(a) International Investment Position (IIP) - Detailed Data | € million | |||

| Item | Q4 2014 | Q1 2015 | Q2 2015 | Q3 2015 |

| Foreign Assets | ||||

| Direct Investment Abroad 1 | 522,824 | 714,072 | 701,856 | 661,362 |

| Equity capital and reinvested earnings | 444,890 | 635,795 | 643,624 | 584,238 |

| Other capital | 77,934 | 78,277 | 58,231 | 77,124 |

| Portfolio Investment | 1,935,118 | 2,155,294 | 2,121,012 | 2,038,455 |

| Equity | 743,723 | 851,319 | 860,192 | 798,161 |

| Monetary authority 2 | 0 | 0 | 0 | 0 |

| General government | 3,534 | 3,971 | 3,357 | 3,395 |

| Monetary financial institutions 3 | 2,963 | 3,226 | 3,258 | 2,563 |

| Other sectors | 737,226 | 844,122 | 853,578 | 792,203 |

| Debt instruments | 1,191,395 | 1,303,975 | 1,260,819 | 1,240,294 |

| Bonds and notes | 792,661 | 853,950 | 840,705 | 841,796 |

| Monetary authority 2 | 14,948 | 13,517 | 14,560 | 14,694 |

| General government | 580 | 605 | 569 | 573 |

| Monetary financial institutions 3 | 126,040 | 119,743 | 115,192 | 110,883 |

| Other sectors | 651,093 | 720,084 | 710,382 | 715,646 |

| Money market instruments | 398,734 | 450,026 | 420,115 | 398,498 |

| Monetary authority 2 | 3,872 | 3,152 | 2,090 | 1,935 |

| General government | 0 | 0 | 0 | 0 |

| Monetary financial institutions 3 | 277,303 | 310,615 | 285,588 | 301,440 |

| Other sectors | 117,559 | 136,259 | 132,437 | 95,123 |

| Other Investment | 871,308 | 957,099 | 930,075 | 896,846 |

| Loans, currency and deposits | 642,333 | 692,274 | 671,025 | 654,655 |

| Monetary authority 2 | 535 | 674 | 167 | 362 |

| General government | 6,551 | 5,779 | 5,536 | 5,198 |

| Monetary financial institutions 3 | 272,239 | 296,294 | 277,383 | 265,105 |

| Other sectors | 363,009 | 389,527 | 387,937 | 383,990 |

| Trade Credits | 41,313 | 42,005 | 43,386 | 39,737 |

| General government | 0 | 0 | 0 | 0 |

| Other sectors | 41,313 | 42,005 | 43,386 | 39,737 |

| Other assets 4 | 187,662 | 222,821 | 215,664 | 202,454 |

| Monetary authority 2 | 0 | 0 | 0 | 0 |

| General government | 49 | 313 | 1,444 | 1,992 |

| Monetary financial institutions 3 | 67,235 | 71,646 | 56,818 | 58,098 |

| Other sectors | 120,378 | 150,862 | 157,402 | 142,364 |

| Reserve assets | 1,426 | 1,637 | 1,909 | 1,872 |

| Monetary gold | 180 | 201 | 191 | 183 |

| Special drawing rights | 776 | 836 | 818 | 815 |

| Reserve Position in the IMF | 308 | 332 | 325 | 324 |

| Foreign Exchange | 3 | 4 | 3 | 3 |

| Other | 159 | 264 | 572 | 547 |

| Total Foreign Assets | 3,330,676 | 3,828,102 | 3,754,852 | 3,598,535 |

| 1Reflecting the so-called directional principle for reclassifying Direct Investment (see background notes). | ||||

| 2Central Bank of Ireland. | ||||

| 3Covering licensed credit institutions and money market funds. | ||||

| 4Includes financial derivatives. | ||||

| Table 3(b) International Investment Position (IIP) - Detailed Data | € million | |||

| Item | Q4 2014 | Q1 2015 | Q2 2015 | Q3 2015 |

| Foreign Liabilities | ||||

| Direct Investment in Ireland 1 | 311,508 | 327,025 | 325,635 | 334,007 |

| Equity capital and reinvested earnings | 339,260 | 355,681 | 363,321 | 382,201 |

| Other capital | -27,752 | -28,657 | -37,685 | -48,194 |

| Portfolio Investment | 2,261,937 | 2,685,047 | 2,622,130 | 2,495,971 |

| Equity | 1,938,526 | 2,341,800 | 2,274,809 | 2,149,259 |

| Monetary authority 2 | 0 | 0 | 0 | 0 |

| General government | 0 | 0 | 0 | 0 |

| Monetary financial institutions 3 | 379,955 | 435,262 | 397,610 | 414,806 |

| Other sectors | 1,558,570 | 1,906,538 | 1,877,199 | 1,734,453 |

| Debt instruments | 323,412 | 343,247 | 347,321 | 346,712 |

| Bonds and notes | 309,548 | 327,101 | 331,731 | 328,858 |

| Monetary authority 2 | 0 | 0 | 0 | 0 |

| General government | 65,060 | 73,652 | 75,285 | 76,044 |

| Monetary financial institutions 3 | 34,458 | 29,462 | 29,506 | 30,027 |

| Other sectors | 210,030 | 223,987 | 226,940 | 222,787 |

| Money market instruments | 13,864 | 16,147 | 15,589 | 17,854 |

| Monetary authority 2 | 0 | 0 | 0 | 0 |

| General government | 2,756 | 4,732 | 4,041 | 2,882 |

| Monetary financial institutions 3 | 7,296 | 7,543 | 7,641 | 11,086 |

| Other sectors | 3,812 | 3,871 | 3,906 | 3,886 |

| Other Investment | 954,333 | 1,000,951 | 968,570 | 927,817 |

| Loans, currency and deposits | 551,179 | 535,988 | 511,569 | 478,291 |

| Monetary authority 2 | 38,758 | 34,269 | 26,872 | 18,869 |

| General government | 62,758 | 54,410 | 54,572 | 54,533 |

| Monetary financial institutions 3 | 197,785 | 198,013 | 186,876 | 164,482 |

| Other sectors | 251,879 | 249,296 | 243,250 | 240,407 |

| Trade Credits | 17,745 | 17,811 | 17,546 | 17,597 |

| General government | 0 | 0 | 0 | 0 |

| Other sectors | 17,745 | 17,811 | 17,546 | 17,597 |

| Other liabilities 4 | 385,408 | 447,152 | 439,455 | 431,929 |

| Monetary authority2 | 0 | 0 | 0 | 0 |

| General government | 0 | 0 | 106 | 253 |

| Monetary financial institutions 3 | 45,365 | 41,751 | 34,451 | 35,362 |

| Other sectors | 340,043 | 405,401 | 404,898 | 396,314 |

| Total Foreign Liabilities | 3,527,778 | 4,013,023 | 3,916,335 | 3,757,795 |

| 1Reflecting the so-called directional principle for reclassifying Direct Investment (see background notes). | ||||

| 2Central Bank of Ireland. | ||||

| 3Covering licensed credit institutions and money market funds. | ||||

| 4Includes financial derivatives and also includes life insurance liabilities to non-residents. | ||||

| Table 4 International Investment Position (IIP) showing IFSC and non–IFSC activity | € million | |||

| Item | Q4 2014 | Q1 2015 | Q2 2015 | Q3 2015 |

| Foreign Assets | ||||

| Direct Investment Abroad 1 | 522,824 | 714,072 | 701,856 | 661,362 |

| - IFSC | 32,397 | 37,120 | 40,495 | 40,898 |

| - Non-IFSC | 490,427 | 676,952 | 661,361 | 620,464 |

| Portfolio Investment | 1,935,118 | 2,155,294 | 2,121,012 | 2,038,455 |

| - IFSC | 1,789,185 | 2,004,988 | 1,976,643 | 1,902,866 |

| - Non-IFSC | 145,933 | 150,306 | 144,369 | 135,589 |

| Other Investment 2 | 871,308 | 957,099 | 930,075 | 896,846 |

| - IFSC | 759,067 | 837,009 | 808,456 | 785,973 |

| - Non-IFSC | 112,241 | 120,090 | 121,619 | 110,873 |

| Reserve Assets | 1,426 | 1,637 | 1,909 | 1,872 |

| - IFSC | 0 | 0 | 0 | 0 |

| - Non-IFSC | 1,426 | 1,637 | 1,909 | 1,872 |

| Total Foreign Assets | 3,330,676 | 3,828,102 | 3,754,852 | 3,598,535 |

| - IFSC | 2,580,649 | 2,879,117 | 2,825,594 | 2,729,737 |

| - Non-IFSC | 750,027 | 948,985 | 929,258 | 868,798 |

| Foreign Liabilities | ||||

| Direct Investment in Ireland 1 | 311,508 | 327,025 | 325,635 | 334,007 |

| - IFSC | 112,865 | 125,636 | 124,119 | 108,638 |

| - Non-IFSC | 198,643 | 201,389 | 201,516 | 225,369 |

| Portfolio Investment | 2,261,937 | 2,685,047 | 2,622,130 | 2,495,971 |

| - IFSC | 1,799,162 | 2,030,025 | 1,985,646 | 1,912,204 |

| - Non-IFSC | 462,775 | 655,022 | 636,484 | 583,767 |

| Other Investment 2 | 954,333 | 1,000,951 | 968,570 | 927,817 |

| - IFSC | 718,603 | 774,446 | 749,965 | 735,964 |

| - Non-IFSC | 235,730 | 226,505 | 218,605 | 191,853 |

| Total Foreign Liabilities | 3,527,778 | 4,013,023 | 3,916,335 | 3,757,795 |

| - IFSC | 2,630,630 | 2,930,107 | 2,859,730 | 2,756,806 |

| - Non-IFSC | 897,148 | 1,082,916 | 1,056,605 | 1,000,989 |

| Net International Investment Position (IIP) | ||||

| Direct Investment 1 | 211,316 | 387,047 | 376,221 | 327,355 |

| - IFSC | -80,468 | -88,516 | -83,624 | -67,740 |

| - Non-IFSC | 291,784 | 475,563 | 459,845 | 395,095 |

| Portfolio Investment | -326,819 | -529,753 | -501,118 | -457,516 |

| - IFSC | -9,977 | -25,037 | -9,003 | -9,338 |

| - Non-IFSC | -316,842 | -504,716 | -492,115 | -448,178 |

| Other Investment 2 | -83,025 | -43,852 | -38,495 | -30,971 |

| - IFSC | 40,464 | 62,563 | 58,491 | 50,009 |

| - Non-IFSC | -123,489 | -106,415 | -96,986 | -80,980 |

| Reserve Assets | 1,426 | 1,637 | 1,909 | 1,872 |

| - IFSC | 0 | 0 | 0 | 0 |

| - Non-IFSC | 1,426 | 1,637 | 1,909 | 1,872 |

| Total (Net IIP) | -197,102 | -184,921 | -161,483 | -159,260 |

| - IFSC | -49,981 | -50,990 | -34,136 | -27,069 |

| - Non-IFSC | -147,121 | -133,931 | -127,347 | -132,191 |

| 1Reflecting the so-called directional principle for reclassifying Direct Investment (see background notes). | ||||

| 2Includes financial derivatives and trade credits; in the case of liabilities this category also includes life insurance | ||||

| liabilities to non-residents. | ||||

| Table 5 International Investment Position (IIP) - 30 September 2015 - Reconciliation of IIP and BOP Flows | € million | ||||||

| Item | Closing Position 01/07/15 | Bop Flows in Quarter | Valuation and Other Changes | Closing Position 30/09/15 | |||

| Foreign Assets | |||||||

| Direct Investment Abroad 1 | 701,856 | 16,744 | -57,238 | 661,362 | |||

| Equity capital and reinvested earnings | 643,624 | -2,482 | -56,904 | 584,238 | |||

| Other capital | 58,231 | 19,226 | -333 | 77,124 | |||

| Portfolio Investment | 2,121,012 | 1,476 | -84,033 | 2,038,455 | |||

| Equity | 860,192 | 7,243 | -69,274 | 798,161 | |||

| Debt instruments | 1,260,819 | -5,766 | -14,759 | 1,240,294 | |||

| Bonds and notes | 840,705 | 15,190 | -14,099 | 841,796 | |||

| Money market instruments | 420,115 | -20,957 | -660 | 398,498 | |||

| Other Investment | 930,075 | -34,384 | 1,155 | 896,846 | |||

| Loans, currency and deposits | 671,025 | -10,996 | -5,373 | 654,656 | |||

| Other 2 | 259,050 | -23,388 | 6,528 | 242,190 | |||

| Reserve Assets | 1,909 | -25 | -12 | 1,872 | |||

| Total Foreign Assets | 3,754,852 | -16,189 | -140,128 | 3,598,535 | |||

| Foreign Liabilities | |||||||

| Direct Investment in Ireland 1 | 325,635 | 4,616 | 3,756 | 334,007 | |||

| Equity capital and reinvested earnings | 363,321 | 19,147 | -267 | 382,201 | |||

| Other capital | -37,685 | -14,531 | 4,022 | -48,194 | |||

| Portfolio Investment | 2,622,130 | 28,951 | -155,110 | 2,495,971 | |||

| Equity | 2,274,809 | 28,028 | -153,578 | 2,149,259 | |||

| Debt instruments | 347,321 | 923 | -1,532 | 346,712 | |||

| Bonds and notes | 331,731 | -1,720 | -1,153 | 328,858 | |||

| Money market instruments | 15,589 | 2,643 | -378 | 17,854 | |||

| Other Investment | 968,570 | -49,476 | 8,723 | 927,817 | |||

| Loans, currency and deposits | 511,569 | -24,917 | -8,361 | 478,291 | |||

| Other 2 | 457,001 | -24,559 | 17,084 | 449,526 | |||

| Total Foreign Liabilities | 3,916,335 | -15,909 | -142,631 | 3,757,795 | |||

| 1Reflecting the so-called directional principle for reclassifying Direct Investment (see background notes). | |||||||

| 2Includes financial derivatives and trade credits; in the case of liabilities this category also includes life insurance liabilities to non-residents. | |||||||

| Table 6(a) Gross External Debt1 | € million | ||||||||||

| 30 Jun 2015 | 30 Sep 2015 | ||||||||||

| Item | IFSC | non-IFSC | Total | IFSC | non-IFSC | Total | |||||

| General Government | 0 | 134,005 | 134,005 | 0 | 133,459 | 133,459 | |||||

| Short-term | 0 | 6,661 | 6,661 | 0 | 5,411 | 5,411 | |||||

| Money market instruments | 0 | 4,041 | 4,041 | 0 | 2,882 | 2,882 | |||||

| Loans | 0 | 2,620 | 2,620 | 0 | 2,529 | 2,529 | |||||

| Long-term | 0 | 127,344 | 127,344 | 0 | 128,048 | 128,048 | |||||

| Bonds and notes | 0 | 75,285 | 75,285 | 0 | 76,044 | 76,044 | |||||

| Loans | 0 | 52,059 | 52,059 | 0 | 52,004 | 52,004 | |||||

| Monetary Authority 2 | 0 | 26,872 | 26,872 | 0 | 18,869 | 18,869 | |||||

| Short-term | 0 | 26,872 | 26,872 | 0 | 18,869 | 18,869 | |||||

| Loans and deposits | 0 | 26,872 | 26,872 | 0 | 18,869 | 18,869 | |||||

| Long-term | 0 | 0 | 0 | 0 | 0 | 0 | |||||

| Other debt liabilities | 0 | 0 | 0 | 0 | 0 | 0 | |||||

| Monetary Financial Institutions 3 | 164,455 | 65,142 | 229,597 | 163,269 | 50,617 | 213,886 | |||||

| Short-term | * | * | 168,710 | * | * | 153,856 | |||||

| Money market instruments | * | * | 7,641 | * | * | 11,086 | |||||

| Loans and deposits | 111,010 | 50,059 | 161,069 | 102,064 | 40,706 | 142,770 | |||||

| Long-term | * | * | 60,887 | * | * | 60,030 | |||||

| Bonds and notes | 20,725 | 8,781 | 29,506 | 21,351 | 8,676 | 30,027 | |||||

| Loans | 19,640 | 6,166 | 25,806 | 20,684 | 1,028 | 21,712 | |||||

| Other debt liabilities | * | * | 5,575 | * | * | 8,291 | |||||

| Other Sectors 4 | 818,506 | 77,511 | 896,016 | 805,847 | 74,426 | 880,273 | |||||

| Short-term | * | * | 119,590 | * | * | 116,433 | |||||

| Money market instruments | * | * | 3,906 | * | * | 3,886 | |||||

| Loans and deposits | 88,075 | 10,063 | 98,138 | 85,043 | 9,907 | 94,950 | |||||

| Trade credits | 8,423 | 9,123 | 17,546 | 8,452 | 9,145 | 17,597 | |||||

| Long-term | * | * | 776,426 | * | * | 763,840 | |||||

| Bonds and notes | * | * | 226,940 | * | * | 222,787 | |||||

| Loans | 117,295 | 27,817 | 145,112 | 119,603 | 25,854 | 145,457 | |||||

| Other debt liabilities | 378,983 | 25,391 | 404,374 | 371,385 | 24,211 | 395,596 | |||||

| Direct Investment 5 | 198,077 | 233,980 | 432,057 | 164,565 | 237,088 | 401,653 | |||||

| Debt liabilities to affiliated enterprises | 5,953 | 105,317 | 111,270 | 4,552 | 104,646 | 109,198 | |||||

| Debt liabilities to direct investors | 192,124 | 128,663 | 320,787 | 160,013 | 132,442 | 292,455 | |||||

| Gross External Debt | 1,181,038 | 537,510 | 1,718,548 | 1,133,681 | 514,459 | 1,648,140 | |||||

| 1Gross external debt represents the stock of Ireland's liabilities to non-residents other than equity and financial derivatives. | |||||||||||

| 2Central Bank of Ireland. | |||||||||||

| 3Covering licensed credit institutions and money market funds. | |||||||||||

| 4Other sectors includes financial corporations other than the Monetary Authority and Monetary Financial Institutions, | |||||||||||

| non-financial service and manufacturing companies and other industrial enterprises as well as (implicitly) | |||||||||||

| households (see Background Notes). The gross liabilities to non-residents of financial corporations covered in other sectors | |||||||||||

| tend to be very significant. | |||||||||||

| 5Covering inter affiliate loans, non-equity securities, trade credits and other debt liabilities. Debt liabilities to affiliated | |||||||||||

| enterprises refers to direct investment abroad while debt liabilities to direct investorsrefers to direct investment in Ireland. | |||||||||||

| *Suppressed for confidentiality reasons. | |||||||||||

| Table 6(b) External Assets in Debt Instruments 1 | € million | ||||||||||

| 30 Jun 2015 | 30 Sep 2015 | ||||||||||

| Item | IFSC | non-IFSC | Total | IFSC | non-IFSC | Total | |||||

| General Government | 0 | 6,105 | 6,105 | 0 | 5,771 | 5,771 | |||||

| Short-term | 0 | 4,006 | 4,006 | 0 | 3,668 | 3,668 | |||||

| Money market instruments | 0 | 0 | 0 | 0 | 0 | 0 | |||||

| Loans and Deposits | 0 | 4,006 | 4,006 | 0 | 3,668 | 3,668 | |||||

| Long-term | 0 | 2,099 | 2,099 | 0 | 2,103 | 2,103 | |||||

| Bonds and notes | 0 | 569 | 569 | 0 | 573 | 573 | |||||

| Loans | 0 | 1,530 | 1,530 | 0 | 1,530 | 1,530 | |||||

| Monetary Authority 2 | 0 | 16,817 | 16,817 | 0 | 16,991 | 16,991 | |||||

| Short-term | 0 | 2,257 | 2,257 | 0 | 2,297 | 2,297 | |||||

| Money market instruments | 0 | 2,090 | 2,090 | 0 | 1,935 | 1,935 | |||||

| Loans and deposits | 0 | 167 | 167 | 0 | 362 | 362 | |||||

| Long-term | 0 | 14,560 | 14,560 | 0 | 14,694 | 14,694 | |||||

| Bonds and notes | 0 | 14,560 | 14,560 | 0 | 14,694 | 14,694 | |||||

| Monetary Financial Institutions 3 | 630,410 | 80,652 | 711,062 | 646,004 | 66,783 | 712,787 | |||||

| Short-term | * | * | 528,939 | * | * | 536,077 | |||||

| Money market instruments | * | * | 285,588 | * | * | 301,440 | |||||

| Loans and deposits | 197,253 | 46,098 | 243,351 | 194,376 | 40,261 | 234,637 | |||||

| Long-term | * | * | 182,123 | * | * | 176,710 | |||||

| Bonds and notes | 92,873 | 22,320 | 115,193 | 92,974 | 17,909 | 110,883 | |||||

| Loans | 23,038 | 10,994 | 34,032 | 22,944 | 7,524 | 30,468 | |||||

| Other debt Assets | * | * | 32,898 | * | * | 35,359 | |||||

| Other Sectors 4 | 1,327,607 | 86,432 | 1,414,039 | 1,278,447 | 86,259 | 1,364,706 | |||||

| Short-term | 299,447 | 35,184 | 334,631 | 254,127 | 35,372 | 289,499 | |||||

| Money market instruments | 132,248 | 189 | 132,437 | 94,236 | 887 | 95,123 | |||||

| Loans and deposits | 144,836 | 13,972 | 158,808 | 137,962 | 16,677 | 154,639 | |||||

| Trade credit assets | 22,363 | 21,023 | 43,386 | 21,929 | 17,808 | 39,737 | |||||

| Long-term | 1,028,160 | 51,248 | 1,079,408 | 1,024,320 | 50,887 | 1,075,207 | |||||

| Bonds and notes | * | * | 710,382 | * | * | 715,646 | |||||

| Loans | * | * | 229,130 | * | * | 229,353 | |||||

| Other debt Assets | 134,166 | 5,730 | 139,896 | 124,658 | 5,550 | 130,208 | |||||

| Direct Investment 5 | 230,682 | 297,292 | 527,974 | 212,247 | 314,724 | 526,971 | |||||

| Debt asset claims on affiliated enterprises | 6,791 | 162,710 | 169,501 | 5,301 | 181,021 | 186,322 | |||||

| Debt asset claims on direct investors | 223,891 | 134,582 | 358,473 | 206,946 | 133,703 | 340,649 | |||||

| Reserve Assets | 0 | 575 | 575 | 0 | 550 | 550 | |||||

| External Assets in Debt Instruments | 2,188,699 | 487,873 | 2,676,572 | 2,136,698 | 491,078 | 2,627,776 | |||||

| Net External Debt 6 | -1,007,661 | 49,637 | -958,024 | -1,003,017 | 23,381 | -979,636 | |||||

| 1External Assets in Debt Instruments represents the stock of Ireland's claims on non-residents other than equity and financial | |||||||||||

| derivatives. | |||||||||||

| 2Central Bank of Ireland. | |||||||||||

| 3Covering licensed credit institutions and money market funds. | |||||||||||

| 4Other sectors includes financial corporations other than the Monetary Authority and Monetary Financial Institutions, | |||||||||||

| non-financial service and manufacturing companies and other industrial enterprises as well as (implicitly) . | |||||||||||

| households (see Background Notes)The gross claims on non-residents of financial corporations covered in other sectors | |||||||||||

| tend to be very significant. | |||||||||||

| 5Covering inter affiliate loans, non-equity securities, trade credits and other debt assets. Debt claims on affiliated enterprises | |||||||||||

| refers to direct investment abroad while debt claims on direct investors refers to direct investment in Ireland. | |||||||||||

| 6Net External Debt equals Gross External Debt (from table 6a) minus External Assets in Debt Instruments. | |||||||||||

| A negative sign indicates a net Asset position. | |||||||||||

| *Data suppressed for confidentiality reasons. | |||||||||||

The international investment position (or IIP) is a point in time statistical statement of: the value and composition of the stock of an economy’s foreign financial assets, or the economy’s claims on the rest of the world, and the value and composition of the stock of an economy’s financial liabilities (or obligations) to the rest of the world.

The IMF External Debt Manual defines external debt to be a point in time statistical statement of the value and composition of the stock of an economy’s gross foreign financial liabilities to the rest of the world. The liabilities referred to cover those arising from Irish residents issuing debt securities such as bonds, notes and money market instruments to non-residents, as well as any loans received from and outstanding to non-residents, and any trade payables due to non-residents. In essence, external debt refers to financial obligations to non-residents other than those arising from transactions in equity or financial derivative contracts.

For more detailed methodological information see the Quarterly International Investment Position and External Debt - Background Notes at the following link: Quarterly International Investment Position and External Debt - Background Notes (PDF 298KB)

Hide Background Notes

Hide Background Notes

Scan the QR code below to view this release online or go to

http://www.cso.ie/en/releasesandpublications/er/iiped/internationalinvestmentpositionandexternaldebtseptember2015/