| €million | |||||

| Tax type | 2010 | 2011 | 2012 | 2013 | 2014 |

| Energy | 2,508 | 2,694 | 2,621 | 2,704 | 2,798 |

| Transport | 1,522 | 1,449 | 1,472 | 1,629 | 1,742 |

| Pollution and Resource | 62 | 61 | 66 | 64 | 57 |

| Total | 4,092 | 4,204 | 4,159 | 4,397 | 4,597 |

| % of total taxes | |||||

| 9.1% | 9.1% | 8.7% | 8.8% | 8.4% | |

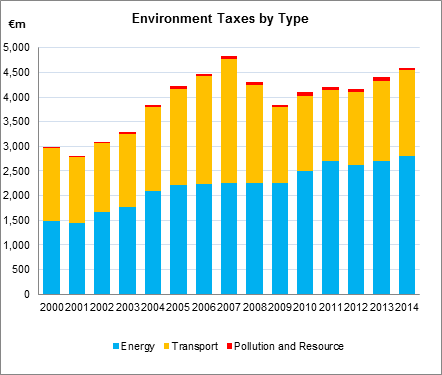

€4.6 billion of environment related taxes were collected in 2014, an increase of 4.5% on 2013 but still 4.7% below their highest level of €4.8 billion in 2007. Energy taxes (mainly taxes on transport fuels) accounted for 61% of total environment taxes in 2014 with another 38% coming from Transport taxes (including motor tax and vehicle registration tax VRT).

Table 1 shows that environment taxes increased from €3.0 billion in 2000 to €4.8 billion in 2007 before falling to €3.8 billion 2009. Taxes have since increased to €4.6 billion in 2014. As a percentage of total taxes environment taxes decreased from 9.0% in 2000 to a low of 7.7% in 2006. This percentage share reached a high of 9.1% in 2010 before falling to 8.4% in 2014.

Energy taxes increased from €1.5 billion in 2000 to €2.8 billion in 2014. The share of energy tax as a percentage of total environment taxes has also increased from 50.1% in 2000 to 60.1% in 2014 with combined Carbon tax and the Public Service Obligation levy accounting for 23% of energy taxes in 2014.

In 2000 Transport taxes (mainly vehicle registration and motor taxes) were €1.5 billion with vehicle registration accounting for 66%. Transport taxes reached a high of €2.5 billion in 2007 before falling to €1.45 billion in 2011 and then rising to €1.74 billion in 2014. A combination of a large drop in vehicle sales coupled with the change to an emissions basis for vehicle registration tax in 2008 explains the drop of 40% in transport taxes between 2007 and 2009.

Pollution and resource taxes increased from €1 million in 2000 to €66 million in 2012 before falling back to €57 million in 2014. The increase in 2002 and 2003 is due to the introduction of two new taxes in 2002, a plastic bag levy and a landfill levy. The plastic bag levy raised €12 million in 2002. The landfill levy increased from €8 million in 2002 to high of €51 million in 2012 before dropping to €41 million in 2014.

Overall environment taxes which include newer categories of tax such as Carbon taxes and the Public Service Obligation levy, as well as more traditional categories of taxes such as fuel, motor and vehicle registration tax among others are reported in the National Tax List compiled for National Accounts. In this release environment taxes are also compiled and presented according to the NACE Rev. 2 sector of the tax payer - NACE Rev. 2 is the EU’s statistical classification of economic activity. The method used to compile the NACE Rev. 2 Sector Analysis of environment taxes depends on whether tax relief is available in that sector and on the particular environment tax which is then allocated to NACE Rev. 2 sector using Personal Consumption Expenditure, Supply-Use tables, CO2 emission data and other statistical sources.

Table 2 shows environment taxes by NACE Rev. 2 sector of Payee. In 2000 estimated environment taxes levied on households were €1.9 billion, representing a 63% share of total environment taxes. Household environment taxes reached €3.3 billion in 2007 before falling to €2.5 billion 2009. In 2014 household environment taxes were €2.9 billion and represented a 63% share of total environment taxes.

Environment taxes levied on Service industries were €0.8 billion in 2000, representing a 26% share of total environment taxes. In 2014 environment taxes paid by Service industries reached €1.3 billion, their highest level and represented a 29% share of total environment taxes. The upward movement in the percentage share in 2014 being largely attributable to increases in Carbon tax and the Public Service Obligation levy.

Environment taxes levied on Industry increased from €0.28 billion in 2000 to a high of €0.34 billion in 2004 before falling back to €0.27 billion in 2012. In 2014 environment taxes levied on Industry were €0.32 billion. In 2000 the percentage share of total environment taxes levied on industry was 9% while in 2014 it has fallen to 7%.

Environment taxes levied on the Agriculture sector were €0.04 billion in 2000, representing a 1.3% share of total environment taxes. In 2014 environment taxes levied on the Agriculture sector were €0.07 billion and represented a 1.5% share of total environment taxes.

| Agriculture | Industry | Services | Households | |

| 2000 | 38 | 278 | 781 | 1878 |

| 2001 | 36 | 267 | 701 | 1775 |

| 2002 | 33 | 289 | 846 | 1915 |

| 2003 | 29 | 265 | 884 | 2122 |

| 2004 | 35 | 343 | 1043 | 2412 |

| 2005 | 32 | 334 | 1150 | 2704 |

| 2006 | 43 | 322 | 1138 | 2968 |

| 2007 | 39 | 288 | 1211 | 3284 |

| 2008 | 28 | 336 | 1147 | 2803 |

| 2009 | 30 | 300 | 1009 | 2506 |

| 2010 | 39 | 301 | 1025 | 2728 |

| 2011 | 58 | 302 | 1079 | 2765 |

| 2012 | 57 | 274 | 1072 | 2756 |

| 2013 | 63 | 293 | 1200 | 2842 |

| 2014 | 68 | 315 | 1327 | 2887 |

| Table 1 Environment Tax by Tax type | |||||||||||||||

| €million | |||||||||||||||

| Tax | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 |

| Total | 2,974 | 2,780 | 3,083 | 3,300 | 3,833 | 4,220 | 4,471 | 4,822 | 4,314 | 3,845 | 4,092 | 4,204 | 4,159 | 4,397 | 4,597 |

| Annual % change | 10.9% | -6.5% | 10.9% | 7.0% | 16.1% | 10.1% | 6.0% | 7.9% | -10.5% | -10.9% | 6.4% | 2.7% | -1.1% | 5.7% | 4.5% |

| % of total taxes | 9.0% | 8.0% | 8.2% | 7.9% | 8.3% | 8.4% | 7.7% | 8.0% | 8.0% | 8.3% | 9.1% | 9.1% | 8.7% | 8.8% | 8.4% |

| Energy taxes | 1,491 | 1,436 | 1,674 | 1,763 | 2,084 | 2,212 | 2,232 | 2,250 | 2,250 | 2,265 | 2,508 | 2,694 | 2,621 | 2,704 | 2,798 |

| Duty on light hydrocarbon oil products | 753 | 744 | 862 | 871 | 979 | 1,017 | 1,031 | 1,051 | 1,046 | 1,064 | 993 | 991 | 911 | 854 | 798 |

| Duty on other hydrocarbon oil products | 739 | 660 | 779 | 859 | 996 | 1,056 | 1,120 | 1,153 | 1,122 | 1,106 | 1,106 | 1,128 | 1,124 | 1,182 | 1,239 |

| Electricity tax | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 2 | 7 | 7 | 7 | 6 | 6 |

| National Oil Reserves Agency levy | 0 | 31 | 33 | 33 | 35 | 36 | 37 | 47 | 81 | 93 | 140 | 130 | 123 | 123 | 123 |

| Carbon tax | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 223 | 298 | 354 | 388 | 390 |

| Public Service Obligation levy | 0 | 0 | 0 | 0 | 75 | 103 | 44 | 0 | 0 | 0 | 39 | 140 | 102 | 151 | 242 |

| Transport taxes | 1,482 | 1,343 | 1,388 | 1,494 | 1,708 | 1,961 | 2,186 | 2,516 | 2,003 | 1,523 | 1,522 | 1,449 | 1,472 | 1,629 | 1,742 |

| Vehicle registration tax | 985 | 787 | 802 | 809 | 956 | 1,153 | 1,301 | 1,554 | 938 | 373 | 395 | 394 | 384 | 459 | 572 |

| Air travel tax | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 92 | 103 | 44 | 34 | 34 | 11 |

| Motor tax (business) | 124 | 137 | 145 | 170 | 187 | 201 | 220 | 239 | 265 | 264 | 256 | 253 | 264 | 284 | 290 |

| Motor tax (households) | 372 | 410 | 436 | 510 | 560 | 602 | 660 | 718 | 795 | 793 | 768 | 758 | 791 | 853 | 869 |

| Vehicle & driving licence expenses | 1 | 9 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 0 | 0 | 0 | 0 | 0 | 0 |

| Pollution and Resource taxes | 1 | 1 | 21 | 43 | 40 | 47 | 53 | 56 | 62 | 57 | 62 | 61 | 66 | 64 | 57 |

| Plastic bag levy | 0 | 0 | 12 | 24 | 23 | 26 | 28 | 29 | 29 | 23 | 20 | 16 | 14 | 15 | 15 |

| Landfill levy | 0 | 0 | 8 | 18 | 17 | 20 | 23 | 26 | 31 | 32 | 41 | 44 | 51 | 48 | 41 |

| Fisheries protection | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 2 | 1 | 1 | 1 | 1 | 1 | 1 |

| Table 2 Environment Taxes by NACE Sector of Payee | |||||||||||||||

| €million | |||||||||||||||

| NACE Rev. 2 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 |

| Total environment taxes | 2,974 | 2,780 | 3,083 | 3,300 | 3,833 | 4,220 | 4,471 | 4,822 | 4,314 | 3,845 | 4,092 | 4,204 | 4,159 | 4,397 | 4,597 |

| Agriculture, forestry and fishing (01-03) | 38 | 36 | 33 | 29 | 35 | 32 | 43 | 39 | 28 | 30 | 39 | 58 | 57 | 63 | 68 |

| Industry (05-43) | 278 | 267 | 289 | 265 | 343 | 334 | 322 | 288 | 291 | 300 | 301 | 302 | 274 | 293 | 315 |

| Mining and quarrying (05-09) | 38 | 22 | 21 | 19 | 25 | 21 | 17 | 14 | 16 | 12 | 9 | 14 | 11 | 13 | 17 |

| Food, beverages and tobacco (10-12) | 43 | 38 | 43 | 41 | 45 | 32 | 32 | 22 | 34 | 30 | 40 | 37 | 32 | 32 | 35 |

| Textiles and pharmaceuticals (13-21) | 14 | 13 | 14 | 14 | 22 | 21 | 18 | 14 | 8 | 6 | 8 | 13 | 12 | 16 | 22 |

| Plastic and non-metallic minerals (22-23) | 16 | 17 | 18 | 22 | 26 | 25 | 22 | 15 | 16 | 15 | 17 | 18 | 15 | 15 | 15 |

| Metals, machinery and equipment (24-33) | 78 | 68 | 74 | 64 | 86 | 80 | 78 | 82 | 107 | 117 | 108 | 139 | 133 | 147 | 159 |

| Electricity and gas (35) | 13 | 20 | 20 | 16 | 19 | 20 | 19 | 3 | 4 | 3 | 6 | 5 | 5 | 4 | 4 |

| Water and Waste (36-39) | 4 | 6 | 7 | 9 | 15 | 15 | 15 | 20 | 17 | 34 | 22 | 21 | 16 | 14 | 14 |

| Construction (41-43) | 71 | 83 | 92 | 78 | 105 | 120 | 120 | 117 | 89 | 81 | 91 | 56 | 50 | 50 | 50 |

| Services (45-96) | 781 | 701 | 846 | 884 | 1,043 | 1,150 | 1,138 | 1,203 | 1,147 | 1,009 | 1,025 | 1,079 | 1,072 | 1,200 | 1,327 |

| Wholesale and retail trade (45-47) | 156 | 175 | 251 | 269 | 349 | 429 | 421 | 387 | 316 | 261 | 263 | 264 | 272 | 302 | 327 |

| Transport, postal and warehousing (49-53) | 469 | 386 | 444 | 448 | 467 | 455 | 446 | 498 | 501 | 411 | 457 | 517 | 520 | 573 | 605 |

| Accommodation and food (55-56) | 40 | 30 | 28 | 33 | 23 | 25 | 17 | 31 | 36 | 49 | 27 | 29 | 23 | 24 | 25 |

| Information and computing (62-63) | 2 | 4 | 3 | 8 | 20 | 30 | 41 | 52 | 54 | 50 | 42 | 22 | 20 | 24 | 29 |

| Rental and leasing (77) | 6 | 9 | 11 | 16 | 36 | 42 | 58 | 71 | 76 | 79 | 106 | 88 | 86 | 97 | 107 |

| Public administration (84) | 43 | 36 | 43 | 48 | 43 | 59 | 54 | 37 | 24 | 21 | 36 | 47 | 45 | 48 | 50 |

| Other (58-61, 64-66, 68-75, 78-82, 85-88, 90-96) | 65 | 61 | 64 | 62 | 105 | 111 | 102 | 127 | 140 | 140 | 93 | 112 | 106 | 132 | 184 |

| Households and non-residents | 1,878 | 1,775 | 1,915 | 2,122 | 2,412 | 2,704 | 2,968 | 3,292 | 2,848 | 2,506 | 2,728 | 2,765 | 2,756 | 2,842 | 2,887 |

| Table 3 Energy Taxes by NACE Sector of Payee | |||||||||||||||

| €million | |||||||||||||||

| NACE Rev. 2 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 |

| Total energy taxes | 1,491 | 1,436 | 1,674 | 1,763 | 2,084 | 2,212 | 2,232 | 2,250 | 2,250 | 2,265 | 2,508 | 2,694 | 2,621 | 2,704 | 2,798 |

| -4.0% | -3.7% | 16.6% | 5.3% | 18.2% | 6.1% | 0.9% | 0.8% | -0.0% | 0.7% | 10.7% | 7.4% | -2.7% | 3.2% | 3.5% | |

| Agriculture, forestry and fishing (01-03) | 37 | 36 | 32 | 28 | 33 | 28 | 39 | 35 | 24 | 28 | 37 | 54 | 54 | 59 | 64 |

| Industry (05-43) | 139 | 122 | 131 | 143 | 208 | 198 | 190 | 162 | 142 | 142 | 152 | 150 | 126 | 132 | 145 |

| Mining and quarrying (05-09) | 34 | 18 | 18 | 18 | 23 | 21 | 17 | 13 | 16 | 12 | 9 | 13 | 11 | 13 | 16 |

| Food, beverages and tobacco (10-12) | 28 | 22 | 28 | 32 | 39 | 30 | 30 | 19 | 32 | 28 | 38 | 35 | 30 | 31 | 33 |

| Textiles and pharmaceuticals (13-21) | 10 | 6 | 7 | 9 | 18 | 19 | 15 | 12 | 5 | 5 | 7 | 12 | 11 | 15 | 21 |

| Plastic and non-metallic minerals (22-23) | 12 | 14 | 13 | 20 | 23 | 24 | 21 | 13 | 15 | 14 | 16 | 16 | 14 | 14 | 14 |

| Metals, machinery and equipment (24-33) | 12 | 6 | 6 | 14 | 29 | 23 | 18 | 17 | 10 | 9 | 9 | 16 | 14 | 17 | 21 |

| Electricity and gas (35) | 12 | 19 | 17 | 14 | 17 | 18 | 16 | 3 | 3 | 3 | 6 | 5 | 5 | 4 | 4 |

| Water and Waste (36-39) | 4 | 2 | 3 | 5 | 9 | 8 | 7 | 12 | 17 | 34 | 22 | 21 | 15 | 14 | 13 |

| Construction (41-43) | 27 | 36 | 39 | 32 | 50 | 55 | 66 | 72 | 43 | 36 | 45 | 31 | 26 | 24 | 23 |

| Services (45-96) | 634 | 576 | 705 | 757 | 880 | 950 | 886 | 910 | 885 | 776 | 780 | 877 | 876 | 986 | 1,101 |

| Wholesale and retail trade (45-47) | 141 | 154 | 227 | 250 | 329 | 409 | 366 | 324 | 280 | 244 | 245 | 238 | 247 | 275 | 298 |

| Transport, postal and warehousing (49-53) | 376 | 323 | 378 | 397 | 415 | 398 | 392 | 435 | 442 | 371 | 419 | 486 | 490 | 540 | 570 |

| Accommodation and food (55-56) | 38 | 25 | 23 | 28 | 17 | 17 | 10 | 23 | 35 | 46 | 25 | 28 | 22 | 23 | 24 |

| Information and computing (62-63) | 1 | 3 | 2 | 2 | 5 | 6 | 5 | 8 | 8 | 4 | 2 | 6 | 4 | 7 | 12 |

| Rental and leasing (77) | 2 | 2 | 2 | 7 | 13 | 8 | 15 | 21 | 20 | 8 | 4 | 7 | 8 | 11 | 16 |

| Public administration (84) | 37 | 31 | 37 | 41 | 37 | 52 | 45 | 28 | 18 | 18 | 33 | 38 | 36 | 38 | 40 |

| Other (58-61, 64-66, 68-75, 78-82, 85-88, 90-96) | 39 | 37 | 36 | 33 | 64 | 61 | 52 | 71 | 82 | 85 | 52 | 73 | 67 | 90 | 141 |

| Households and non-residents | 681 | 702 | 806 | 835 | 963 | 1,036 | 1,117 | 1,143 | 1,199 | 1,320 | 1,539 | 1,613 | 1,565 | 1,528 | 1,488 |

| Table 4 Transport Taxes by NACE Sector of Payee | |||||||||||||||

| €million | |||||||||||||||

| NACE Rev. 2 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 |

| Total transport taxes | 1,482 | 1,343 | 1,388 | 1,494 | 1,708 | 1,961 | 2,186 | 2,516 | 2,003 | 1,523 | 1,522 | 1,449 | 1,472 | 1,629 | 1,742 |

| 18.6% | -9.4% | 3.4% | 7.7% | 14.3% | 14.8% | 11.5% | 15.1% | -20.4% | -24.0% | -0.0% | -4.8% | 1.6% | 10.7% | 6.9% | |

| Agriculture, forestry and fishing (01-03) | 1 | 1 | 1 | 1 | 2 | 3 | 4 | 4 | 4 | 1 | 2 | 3 | 3 | 3 | 3 |

| Industry (05-43) | 139 | 145 | 152 | 112 | 125 | 127 | 122 | 118 | 140 | 151 | 142 | 144 | 139 | 153 | 163 |

| Mining and quarrying (05-09) | 5 | 4 | 3 | 2 | 1 | 0 | 1 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Food, beverages and tobacco (10-12) | 14 | 17 | 15 | 7 | 5 | 1 | 1 | 1 | 0 | 1 | 1 | 1 | 0 | 0 | 0 |

| Textiles and pharmaceuticals (13-21) | 3 | 7 | 7 | 5 | 3 | 2 | 2 | 2 | 2 | 1 | 1 | 1 | 1 | 1 | 1 |

| Plastic and non-metallic minerals (22-23) | 4 | 3 | 5 | 3 | 2 | 1 | 1 | 1 | 1 | 0 | 0 | 0 | 0 | 0 | 0 |

| Metals, machinery and equipment (24-33) | 67 | 63 | 67 | 49 | 56 | 56 | 60 | 64 | 95 | 108 | 98 | 119 | 115 | 127 | 135 |

| Electricity and gas (35) | 1 | 1 | 2 | 2 | 2 | 2 | 2 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Water and Waste (36-39) | 1 | 3 | 3 | 4 | 5 | 6 | 6 | 6 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Construction (41-43) | 44 | 47 | 50 | 41 | 50 | 59 | 51 | 43 | 42 | 42 | 42 | 22 | 21 | 23 | 25 |

| Services (45-96) | 146 | 126 | 138 | 120 | 156 | 191 | 239 | 275 | 253 | 223 | 233 | 193 | 186 | 205 | 218 |

| Wholesale and retail trade (45-47) | 15 | 20 | 23 | 18 | 19 | 18 | 51 | 58 | 33 | 16 | 17 | 24 | 24 | 26 | 28 |

| Transport, postal and warehousing (49-53) | 93 | 64 | 66 | 50 | 51 | 56 | 52 | 62 | 57 | 38 | 36 | 30 | 29 | 32 | 33 |

| Accommodation and food (55-56) | 3 | 5 | 5 | 5 | 5 | 6 | 5 | 5 | 1 | 2 | 2 | 0 | 0 | 1 | 1 |

| Information and computing (62-63) | 1 | 1 | 1 | 6 | 14 | 23 | 35 | 43 | 46 | 46 | 40 | 15 | 14 | 16 | 17 |

| Rental and leasing (77) | 4 | 8 | 9 | 9 | 22 | 34 | 42 | 50 | 54 | 70 | 100 | 80 | 77 | 85 | 90 |

| Public administration (84) | 6 | 5 | 6 | 5 | 5 | 6 | 7 | 7 | 6 | 3 | 2 | 9 | 9 | 10 | 10 |

| Other (58-61, 64-66, 68-75, 78-82, 85-88, 90-96) | 26 | 24 | 28 | 28 | 39 | 47 | 46 | 51 | 56 | 49 | 34 | 35 | 34 | 37 | 39 |

| Households and non-residents | 1,196 | 1,072 | 1,097 | 1,261 | 1,425 | 1,640 | 1,821 | 2,118 | 1,606 | 1,147 | 1,146 | 1,109 | 1,144 | 1,269 | 1,358 |

| Table 5 Pollution and Resource Taxes by NACE Sector of Payee | |||||||||||||||

| €million | |||||||||||||||

| NACE Rev. 2 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 |

| Total pollution and resource taxes | 1 | 1 | 21 | 43 | 40 | 47 | 53 | 56 | 62 | 57 | 62 | 61 | 66 | 64 | 57 |

| - | 2.0% | 1723.3% | 103.2% | -6.5% | 15.9% | 13.2% | 6.5% | 9.9% | -8.0% | 9.2% | -1.5% | 8.3% | -4.0% | -10.3% | |

| Agriculture, forestry and fishing (01-03) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | 0 |

| Industry (05-43) | 0 | 0 | 6 | 10 | 9 | 10 | 9 | 8 | 9 | 7 | 7 | 9 | 9 | 9 | 7 |

| Mining and quarrying (05-09) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Food, beverages and tobacco (10-12) | 0 | 0 | 0 | 1 | 1 | 1 | 1 | 1 | 2 | 1 | 1 | 1 | 1 | 1 | 1 |

| Textiles and pharmaceuticals (13-21) | 0 | 0 | 0 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 0 | 0 | 0 | 0 | 0 |

| Plastic and non-metallic minerals (22-23) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | 0 | 1 | 1 | 1 | 1 |

| Metals, machinery and equipment (24-33) | 0 | 0 | 0 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 3 | 4 | 4 | 3 |

| Electricity and gas (35) | 0 | 0 | 1 | 1 | 1 | 0 | 1 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Water and Waste (36-39) | 0 | 0 | 0 | 1 | 1 | 1 | 2 | 2 | 0 | 1 | 0 | 0 | 0 | 0 | 0 |

| Construction (41-43) | 0 | 0 | 3 | 6 | 5 | 5 | 3 | 2 | 3 | 3 | 4 | 3 | 3 | 3 | 2 |

| Services (45-96) | 0 | 0 | 3 | 7 | 7 | 9 | 13 | 18 | 8 | 10 | 12 | 9 | 10 | 9 | 8 |

| Wholesale and retail trade (45-47) | 0 | 0 | 1 | 2 | 2 | 2 | 3 | 5 | 3 | 1 | 1 | 1 | 1 | 1 | 1 |

| Transport, postal and warehousing (49-53) | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| Accommodation and food (55-56) | 0 | 0 | 0 | 1 | 1 | 1 | 2 | 3 | 1 | 1 | 1 | 0 | 0 | 0 | 0 |

| Information and computing (62-63) | 0 | 0 | 0 | 0 | 0 | 1 | 1 | 1 | 0 | 0 | 0 | 1 | 1 | 1 | 1 |

| Rental and leasing (77) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | 1 | 2 | 1 | 2 | 2 | 1 |

| Public administration (84) | 0 | 0 | 1 | 2 | 1 | 1 | 1 | 2 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Other (58-61, 64-66, 68-75, 78-82, 85-88, 90-96) | 0 | 0 | 1 | 2 | 2 | 3 | 4 | 5 | 2 | 6 | 7 | 4 | 5 | 4 | 4 |

| Households and non-residents | 1 | 1 | 13 | 26 | 24 | 27 | 30 | 31 | 44 | 39 | 43 | 43 | 47 | 45 | 41 |

This release contains an analysis of environment taxes by category of tax and economic sector of the payee.

The starting point for the production of Environment taxes is the National Tax List (NTL) prepared by the CSO for the National Accounts and submitted to Eurostat under the ESA (European System of Accounts) transmission programme. A number of different data sources are used to allocate revenues to payee sectors. These include the Supply-Use tables and Personal Consumption Expenditure (PCE) data from the National Accounts along with specific information about individual taxes.

The figures will be updated on an annual basis at which point all periods may be subject to revision.

An environment tax is defined by Regulation (EU) 691/2011 as:

“A tax whose tax base is a physical unit (or a proxy of a physical unit) of something that has a proven, specific negative impact on the environment, and which is identified in ESA as a tax.”

Once a tax base has been included in the list of environment tax bases, any tax levied on that base is considered an environment tax, irrespective of the motivation behind it. A list of Environment tax bases was agreed by Eurostat, the EU Commission, the OECD and the IEA and has been periodically revised. Table 1 contains national level data for each tax.

Energy taxes (including fuel for transport): This category includes taxes on energy production and energy products, including taxes on fuels for transport and stationary purposes. By definition Carbon taxes are included as an Energy tax rather than a Pollution tax, largely to aid international comparability. In Ireland’s case, taxes on transport fuels make up the bulk of energy taxes.

Transport taxes: This category includes taxes related to the ownership and use of motor vehicles. In Ireland this mainly relates to Vehicle Registration Tax (VRT) and Motor tax.

Pollution taxes: This category includes taxes levied on emissions to air and water, management of solid waste and noise. Carbon taxes are not included in this category.

Resource taxes: Included are taxes linked to the extraction or use of natural resources. Taxes on land are generally not included, nor are taxes designed to capture the resource rent from the extraction of natural resources.

Payees are classified by household and industry according to NACE Revision (Rev.) 2 classification - the European Union’s Statistical Classification of Economic Activity in the European Communities. The tax payer is considered to be the unit using the tax base (e.g. user of electricity or transport fuel) or undertaking the activity being taxed (e.g. disposing of waste). This principle (often called the "polluter pays principle") holds regardless of where the tax is collected. Taxes on transport fuels are, for efficiency reasons, collected from mineral oil tax warehouses. The tax has been allocated to the unit purchasing the fuel for use.

For further information on the NACE Rev. 2 classification of industrial activity, visit the CSO website:

http://www.cso.ie/en/surveysandmethodology/classifications/classificationofindustrialactivity/

All NACE Rev. 2 sectors are covered in Tables 2 to 5 using abbreviated titles as follows:

|

Abbreviated Titles |

Full Titles |

|

Agriculture, forestry and fishing (01-03) |

Agriculture, forestry and fishing (01-03) |

|

|

|

|

Industry (05-43) |

Industry (05-43) |

|

Mining and quarrying (05-09) |

Mining and quarrying (05-09) |

|

Food, beverages and tobacco (10-12) |

Food products, beverages and tobacco products (10-12) |

|

Textiles and pharmaceuticals (13-21) |

Textiles, wood, leather, petroleum, chemical and pharmaceutical products (13-21) |

|

Plastic and non-metallic minerals (22-23) |

Rubber, plastic and non-metallic mineral products (22-23) |

|

Metals, machinery and equipment (24-33) |

Metals, computers, electronic, electrical, machinery and equipment, transport and other manufacturing, repair and installation (24-33) |

|

Electricity and gas (35) |

Electricity, gas, steam and air conditioning supply (35) |

|

Water and Waste (36-39) |

Water collection/treatment/supply, sewerage, waste collection, treatment, disposal, materials recovery, remediation and other waste management (36-39) |

|

Construction (41-43) |

Construction (41-43) |

|

|

|

|

Services (45-96) |

Services (45-96) |

|

Wholesale and retail trade (45-47) |

Wholesale and retail trade including motor vehicles and their repair (45-47) |

|

Transport, postal and warehousing (49-53) |

Transport, postal, courier activities including warehousing and support (49-53) |

|

Accommodation and food (55-56) |

Accommodation; food and beverage service activities (55-56) |

|

Information and computing (62-63) |

Computer programming, consultancy, information services activities (62-63) |

|

Rental and leasing (77) |

Rental and leasing (77) |

|

Public administration (84) |

Public administration and defence; compulsory social security (84) |

|

Other (58-61, 64-66, 68-75, 78-82, 85-88, 90-96) |

Other Services (58-61, 64-66, 68-75, 78-82, 85-88, 90-96) |

The method used to allocate environment taxes to tax payers varies depending on the tax in question, using Supply-Use tables (SUT) in some instances and more detailed sources where such are available.

Energy taxes

The largest component of energy taxes relates to taxes levied on fuel purchases. The overall environment taxes reported in the NTL is split according to fuel type excise data available from the Revenue Commissioners. Separately, PCE is also available for each fuel type within the National Accounts. The household component of tax revenue associated with each fuel type is estimated by combining these two sources. The residual (i.e. non-household) component of tax revenue is then allocated across all NACE Rev. 2 sectors. Transport fuels are allocated according to NACE sector analysis of CO2 emissions from the air emissions accounts while the SUT is used for non-transport fuels. Importantly, the excise data allows identification of sectors for which relief is available, e.g. aviation; sea fishing, electricity generation and these sectors are consequently excluded from the list of payees. For other non-fuel Energy taxes including the Carbon tax, Electricity tax and the National Oil Reserves Agency Levy, allocation of the respective tax to payee NACE Rev. 2 sector is also accomplished using SUT.

Transport taxes

Revenues from transport taxes are predominantly derived from two sources, Motor tax and Vehicle Registration Tax. The NTL splits motor tax into household and business components with the business portion further allocated to payee NACE Rev. 2 sector using SUT. Vehicle Registration Tax (VRT) is payable by consumers on purchase or private import of a motor vehicle. The rate of tax varies by type of vehicle and CO2 emissions rating. The SUT are used to allocate the tax revenues to tax payers with non-applicable sectors (e.g. the motor trade itself) excluded.

Transport taxes also include an “Air travel tax” payable by all passengers travelling by air. This revenue is allocated to business and private travel using data from the CSO’s “Household Travel Survey”. The remaining business travel portion is then allocated using the SUT.

Pollution and Resource taxes

There are four taxes currently classified as Pollution or Resource taxes, namely a landfill levy, a plastic bag levy, a fisheries levy and a Petroleum Act levy. Revenue raised from the landfill levy (a “per tonne” levy on waste disposed of via landfill) is allocated using the SUT excluding not-applicable industries (e.g. intermediaries). The plastic bag levy is levied on shoppers; accordingly it is entirely allocated to households.

The fisheries levy is a very small resource tax levied on fishing. The bulk of this tax is allocated to households (arising from rod-licences) with the residual allocated to NACE 03 (fishing sector).

The NTL excludes most of the Petroleum Act levy as a “resource rent”, with the amount remaining being paid by the mining and quarrying industries.

The manual, "Environment taxes - a statistical guide", published by Eurostat is the relevant source for defining what tax bases are to be considered within the remit of environment taxes. All taxes levied on these bases are thereafter considered to be environment type taxes regardless of the reason why the tax was originally introduced. The 2013 update of the manual lists the following environment tax bases:

Energy taxes (including fuel for transport)

— Energy products for transport purposes

Unleaded and Leaded Petrol, Diesel and other energy products for transport purposes (e.g. LPG, natural gas, kerosene or fuel oil)

— Energy products for stationary purposes

Light fuel oil, Heavy fuel oil, Natural gas, Coal, Coke, Biofuels, Electricity consumption and production, District heat consumption and production and other energy products for stationary use

— Greenhouse gases

Carbon content of fuels and emissions of greenhouse gases (including proceeds from emission permits recorded as taxes in the national accounts)

Transport (excluding fuel for transport)

— Motor vehicles import or sale (one off taxes)

— Registration or use of motor vehicles, recurrent (e.g. yearly taxes)

— Road use (e.g. motorway taxes)

— Congestion charges and city tolls (if taxes in national accounts)

— Other means of transport (ships, airplanes, railways, etc.)

— Flights and flight tickets

— Vehicle insurance (excludes general insurance taxes)

Pollution

— Measured or estimated emissions to air

Measured or estimated NOx emissions, Measured or estimated SOx emissions and other measured or estimated emissions to air (excluding CO2)

— Ozone depleting substances (e.g. CFCs or halons)

— Measured or estimated effluents to water

Measured or estimated effluents of oxydisable matter (BOD, COD) and other measured or estimated effluents to water

— Waste management

Collection, treatment or disposal, and Individual products (e.g. packaging, beverage containers, batteries, tyres, lubricants)

— Noise (e.g. aircraft take-off and landings)

Resources

— Water abstraction

— Harvesting of biological resources (e.g. timber, hunted and fished species)

— Extraction of raw materials (e.g. minerals, oil and gas)

— Landscape changes and cutting of trees

— Energy products for transport purposes

Table 1 presents the total environment taxes from 2000, broken down by category of environment tax and individual tax type. Tables 2 to 5 present the environment tax categories broken down by economic activity of the payee.

Hide Background Notes

Hide Background Notes

Scan the QR code below to view this release online or go to

http://www.cso.ie/en/releasesandpublications/er/eaet/environmenttaxes2014/