The Supply and Use Tables for 2016 provide a detailed picture of the transactions of goods and services by industries and consumers across the Irish economy in a single year. They highlight the inter-industry flows that lie behind the National Accounts main aggregates. These tables also serve as an integrated framework for all production statistics and are used as a statistical tool to compile and reconcile independent estimates of National Accounts aggregates. The Supply and Use framework shows the components of gross value added (GVA) by industry. The GVA in the Use table measures the contribution to GDP made by each particular industry branch.

This publication contains Supply and Use Tables in current prices (Table 1 and Table 2 respectively) and previous year prices (PYP) (Table 3 and Table 4 respectively). Supply and Use Tables in PYP allow for the detailed examination of volume changes by sector. Further details on the compilation of both the current and PYP tables are provided below and in the Background Notes section at the foot of this page. An explanatory note and a visual overview guide to the tables are provided in links on the right hand side of this page.

Summaries are provided below of the four 2016 tables in this publication. The four tables in full are provided below these summaries.

This table provides estimates of the supply of goods and services (products) by domestic industries as well as imports of goods and services. The supply of products is presented in the rows while the columns show the industry branches that produce these goods and services. Each industry is classified according to whichever product accounts for the largest part of their output. The principal production, shown on the diagonal elements of the Supply table, is therefore larger than the secondary production shown on the off-diagonal elements. A summary of the 2016 Supply table at basic prices is shown below.

| Table A Summary of 2016 Supply Table at basic prices €m | |||||||||||

| Industries | €m | ||||||||||

| Agriculture, forestry & fishing | Manufacturing | Construction | Distribution, transport & communication | Business services | Other services | Total Domestic | Imports c.i.f. (cost, insurance & freight inclusive) | Margins | Product taxes less subsidies | Total Supply (purchasers' prices) | |

| Products | (1-3) | (5-39) | (41-43) | (45-61) | (62-82) | (84-97) | |||||

| Agriculture, forestry & fishing | 8,467 | 0 | 0 | 0 | 0 | 0 | 8,467 | 2,129 | 2,271 | 35 | 12,902 |

| Manufacturing | 19 | 182,171 | 0 | 1,066 | 0 | 0 | 183,257 | 77,474 | 19,397 | 13,292 | 293,420 |

| Construction | 38 | 0 | 19,965 | 0 | 0 | 0 | 20,002 | 0 | 0 | 2,397 | 22,399 |

| Distribution, transport & communication | 14 | 9,027 | 0 | 86,683 | 5,062 | 0 | 100,788 | 26,320 | -21,668 | 2,065 | 107,504 |

| Business services | 0 | 10,026 | 0 | 8,313 | 159,820 | 560 | 178,719 | 174,330 | 0 | 2,806 | 355,855 |

| Other services | 9 | 0 | 0 | 150 | 0 | 49,287 | 49,446 | 502 | 0 | -457 | 49,492 |

| Output at basic prices | 8,547 | 201,225 | 19,965 | 96,212 | 164,882 | 49,847 | 540,679 | 280,755 | 0 | 20,137 | 841,571 |

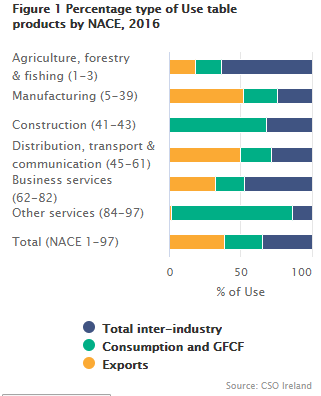

This table shows the use of products by domestic industry and by the final demand sectors ("final demand" comprises consumption by households, government, non-profit organisations serving households (NPISH), gross fixed capital formation (GFCF) and exports). As in the Supply table, industries are shown in the columns and products in the rows. Thus the columns of figures for industries NACE 1 - 97 show the goods and services used by each industry for the purposes of achieving their output. The purchases in these columns relate to intermediate consumption only. The capital purchases are shown separately but a breakdown by industry is not provided. The purchases of households in their private (non-business) capacity as consumers are included under household consumption with the exception of the purchase of dwellings, which is included with gross fixed capital formation. A summary of the 2016 Use table at purchasers' prices is shown below.

| Table B Summary of 2016 Use Table at purchasers' prices €m | ||||||||||

| Industries | €m | |||||||||

| Agriculture, forestry & fishing | Manufacturing | Construction | Distribution, transport & communication | Business services | Other services | Total inter-industry | Consumption and GFCF | Exports f.o.b. (free on board) | Total Uses | |

| Products | (1-3) | (5-39) | (41-43) | (45-61) | (62-82) | (84-97) | ||||

| Agriculture, forestry & fishing | 1,973 | 5,933 | 126 | 77 | 2 | 49 | 8,159 | 2,362 | 2,381 | 12,902 |

| Manufacturing | 3,079 | 44,488 | 5,466 | 7,904 | 3,997 | 5,221 | 70,155 | 70,835 | 152,430 | 293,420 |

| Construction | 110 | 1,089 | 3,463 | 1,084 | 730 | 566 | 7,041 | 15,358 | 0 | 22,399 |

| Distribution, transport & communication | 178 | 8,435 | 2,173 | 8,688 | 9,312 | 1,346 | 30,132 | 23,257 | 54,115 | 107,504 |

| Business services | 619 | 47,653 | 2,696 | 32,059 | 78,001 | 5,943 | 166,971 | 74,029 | 114,854 | 355,855 |

| Other services | 32 | 330 | 136 | 458 | 1,738 | 3,979 | 6,673 | 42,103 | 715 | 49,492 |

| Total Intermediate consumption | 5,990 | 107,928 | 14,061 | 50,270 | 93,780 | 17,104 | 289,132 | 227,944 | 324,494 | 841,571 |

| Compensation of Employees (COE) | 688 | 11,789 | 3,198 | 19,315 | 21,497 | 26,186 | 82,673 | |||

| Gross Operating Surplus (GOS) | 3,418 | 80,647 | 2,678 | 26,075 | 48,791 | 6,540 | 168,150 | |||

| Taxes less subsidies on production | -1,549 | 861 | 28 | 552 | 815 | 17 | 723 | |||

| Gross Value Added (GVA) at basic prices | 2,557 | 93,297 | 5,904 | 45,942 | 71,102 | 32,743 | 251,546 | |||

| Output at basic prices | 8,547 | 201,225 | 19,965 | 96,212 | 164,882 | 49,847 | 540,679 | |||

These two tables are derived from the preceding Supply table and Use table valued in current prices. These deflated tables use the double deflation approach, which is the internationally preferred and recommended approach. The concept of value added is defined as output minus intermediate consumption. Consequently value added at previous year prices is best measured by separately deflating the output and the intermediate consumption and deriving the residual. The value added so deflated to previous year prices can be compared with the value added of the previous year in its current prices to determine the “volume” growth. Double deflation takes account of changing levels of intermediate consumption required to produce the output and the relationship of both to value added.

The levels of intermediate consumption may change for a variety of reasons. For example improved production methods may be employed. Better fuel efficiency may be achieved. Increased levels of marketing and advertising may be required. Advances in scientific knowledge may allow much improved output, particularly in the high technology sectors, without proportional increases in inputs since the inputs include regular, stable items such as accountancy fees, rent, heat and light. A summary of the 2016 Supply table at previous year prices and the 2016 Use table at previous year prices is shown below.

| Table C Summary of 2016 Supply Table at previous year prices €m | |||||||||||

| Industries | €m | ||||||||||

| Agriculture, forestry & fishing | Manufacturing | Construction | Distribution, transport & communication | Business services | Other services | Total Domestic | Imports c.i.f. (cost, insurance & freight inclusive) | Margins | Product taxes less subsidies | Total Supply (purchasers' prices) | |

| Products | (1-3) | (5-39) | (41-43) | (45-61) | (62-82) | (84-97) | |||||

| Agriculture, forestry & fishing | 8,820 | 0 | 0 | 0 | 0 | 0 | 8,820 | 2,104 | 2,351 | 32 | 13,306 |

| Manufacturing | 22 | 195,595 | 0 | 1,162 | 0 | 0 | 196,779 | 80,292 | 21,662 | 13,644 | 312,377 |

| Construction | 35 | 0 | 18,782 | 0 | 0 | 0 | 18,818 | 0 | 0 | 2,226 | 21,044 |

| Distribution, transport & communication | 13 | 10,440 | 0 | 90,213 | 5,215 | 0 | 105,881 | 29,712 | -24,013 | 1,986 | 113,566 |

| Business services | 0 | 9,854 | 0 | 8,186 | 154,454 | 527 | 173,022 | 172,132 | 0 | 2,711 | 347,865 |

| Other services | 8 | 0 | 0 | 152 | 0 | 48,415 | 48,575 | 480 | 0 | -460 | 48,595 |

| Output at basic prices | 8,899 | 215,888 | 18,782 | 99,714 | 159,669 | 48,942 | 551,894 | 284,720 | 284,720 | 284,720 | 856,753 |

| Table D Summary of 2016 Use Table at previous year prices €m | ||||||||||

| Industries | €m | |||||||||

| Agriculture, forestry & fishing | Manufacturing | Construction | Distribution, transport & communication | Business services | Other services | Total inter-industry | Consumption and GFCF | Exports f.o.b. (free on board) | Total Uses | |

| Products | (1-3) | (5-39) | (41-43) | (45-61) | (62-82) | (84-97) | ||||

| Agriculture, forestry & fishing | 2,054 | 6,190 | 126 | 78 | 2 | 52 | 8,502 | 2,368 | 2,436 | 13,306 |

| Manufacturing | 3,299 | 47,579 | 5,683 | 8,802 | 4,413 | 5,761 | 75,537 | 75,985 | 160,856 | 312,377 |

| Construction | 104 | 1,035 | 3,291 | 1,031 | 693 | 538 | 6,693 | 14,351 | 0 | 21,044 |

| Distribution, transport & communication | 187 | 9,500 | 2,575 | 9,193 | 10,513 | 1,362 | 33,330 | 22,875 | 57,361 | 113,566 |

| Business services | 622 | 48,338 | 2,698 | 32,369 | 78,948 | 5,924 | 168,899 | 70,424 | 108,542 | 347,865 |

| Other services | 31 | 324 | 135 | 459 | 1,723 | 3,899 | 6,572 | 41,355 | 668 | 48,595 |

| Total Intermediate consumption | 6,298 | 112,968 | 14,508 | 51,933 | 96,291 | 17,535 | 299,533 | 228,247 | 329,863 | 856,753 |

| Gross Value Added (GVA) at PYP | 2,601 | 102,920 | 4,275 | 47,781 | 63,378 | 31,407 | 252,361 | |||

| Output at basic prices | 8,899 | 215,888 | 18,782 | 99,714 | 159,669 | 48,942 | 551,894 | |||

Table 1 is the Supply Table at basic prices €m: Supply and Use Tables 2016 Table 1 (XLS 33KB)

Table 2 is the Use Table at purchasers' prices €m: Supply and Use Tables 2016 Table 2 (XLS 71KB) .

Table 3 is the Supply Table at previous year prices €m: Supply and Use Tables 2016 Table 3 (XLS 34KB)

Table 4 is the Use Table at previous year prices €m: Supply and Use Tables 2016 Table 4 (XLS 67KB)

The main aggregates in the current price Supply and Use Tables (value added, final consumption, imports and exports) are consistent with the current price estimates shown in the publication National Income and Expenditure 2018 (NIE18) based on the revised European System of Accounts methodology (ESA 2010). However, the starting point of the tables is the CSO business surveys (e.g. Census of Industrial Production, the Prodcom Inquiry and Annual Services Inquiry). Considerable use is also made of published reports of government departments, semi-state bodies and financial institutions. Producing Supply and Use Tables thus requires the examination of consistency and coherency of data and aggregates from national accounts, external trade statistics, balance of international payments results and data provided by the business surveys.

In general, data on purchases is more difficult to assemble than data on turnover. The manufacturing inputs in this 2016 publication however have been assembled with reference to data gathered by the Census of Industrial Production (CIP) Inputs Survey. This is a five-yearly survey of manufacturing industry which was conducted as an integral part of the 2005, 2010 and 2015 CIP. Annual CIP data is also used to disaggregate purchase totals. In the case of non-manufacturing industry, estimates were made based on data from the Annual Services Inquiry and on other limited information. A degree of balancing is necessary in the construction of any Supply and Use Tables to fit the national accounts data with data from other surveys. Consequently allowances must be made for a lack of absolute accuracy in the figures in this report. They are overall estimates and not absolute definitive data.

The Supply and Use and Input-Output Tables display details of the economy in terms of 58 industry groups and 58 product groups. The starting point of the sectoral classification used is the two-digit level of the NACE Rev. 2 referred to as the A64 coding of industry activities. The product classification used is the sixty four product grouping referred to as the P64. The tables are initially constructed using 82 industry and 82 product groups and are then condensed for confidentiality and quality purposes.

The basis of the methodology used is described in the Eurostat Manual of Supply, Use and Input-Output Tables and in the UN Handbook of Input-Output Table Compilation and Analysis.

This table provides estimates of the supply of goods and services (products) by domestic industries as well as imports of goods and services. The supply of products is presented in the rows while the columns show the industry branches that produce these goods and services. Each industry is classified according to whichever product accounts for the largest part of their output. The principal production, shown on the diagonal elements of the Supply table, is therefore larger than the secondary production shown on the off-diagonal elements. A summary of the 2016 Supply table is shown above.

Treatment of the motor trade, retail and wholesale

The outputs of the distribution sector are defined in a special way for national accounts purposes and may not be as expected. The motor trade, retail and wholesale activities are regarded as producing a service which is measured as the price at which their products are sold minus the purchase price of these products (which they purchased for direct resale). This is referred to as the gross margin. Thus the retail supermarket is not regarded as providing food or drink nor is the drapery outlet regarded as providing clothes. In the Supply and Use framework, the food and clothes are the products of their respective industries or are imported and retailers are regarded as providing a sales service (see the distribution rows 45 – 47 of the Supply table).

The gross margin is also used to measure the output of distribution activity by firms that are mainly involved in another activity such as manufacturing.

Valuation

The values of the domestically produced products in the Supply table are shown initially at basic prices while they are transformed to purchasers’ prices in the final columns. The basic price is the price receivable by the producer for a unit of a good or service produced, minus any tax payable as a consequence of its production or sale (i.e. taxes on products), plus any subsidy receivable on that unit as a consequence of its production or sale (i.e. subsidies on products). Thus the basic price excludes the well-known product taxes such as VAT, excise duties, import duties, etc. In theory, the basic price excludes any transport charges invoiced separately by the producer but includes any transport charges charged on the same invoice. It does not include any trade margin earned by reselling the product by another trader following manufacture or importation. The basic price measures the amount retained by the producer and is therefore the price most relevant for the producer’s decision making.

The purchaser’s price is the price the purchaser actually pays for the product including any taxes less subsidies on the product (but excluding deductible taxes). The conversion from basic prices to purchasers’ prices involves distributing the trade margins of retailers and wholesalers among the products on which they are charged. The mechanism for doing this can be seen in the "trade margins" column of the Supply table. Here the margin in the motor trade and domestic wholesale and retail trades appears as negative values in rows 45 to 47 as these margins are distributed in the same column among the products on which they fall.

Imports in the Supply table are shown by detailed product at c.i.f. (cost, insurance and freight inclusive) prices as in the published merchandise trade statistics. Imports are shown at f.o.b. (free on board) prices in the NIE. Cost, insurance and freight (c.i.f.) requires the seller to arrange for the carriage of goods by sea to a port of destination, and provide the buyer with the documents necessary to obtain the goods from the carrier. Free on board (f.o.b.) on the other hand requires the seller to deliver goods on board a vessel designated by the buyer. The seller fulfils their obligations to deliver when the goods have passed over the ship's rail. The difference between the two valuations is shown as an adjustment in the imports column of the Supply table to move from a c.i.f. to a f.o.b. valuation. The adjusted imports total is consistent with the imports figure from the NIE. Given that the supply of a product must, by necessity, equal total use of a product, a similar adjustment is included for exports on the Use table. As with imports, the adjusted exports total is consistent with the exports figure from the NIE.

This table shows the use of products by domestic industry and by the final demand sectors ("final demand" comprises consumption by households, government, non-profit organisations serving households (NPISH), capital formation (GFCF) and exports). As in the previous table, industries are shown in the columns and products in the rows. Thus the columns of figures for industries NACE 1 - 97 show the goods and services used by each industry for the purposes of achieving their output. The purchases in these columns relate to intermediate consumption only. The capital purchases are shown separately but a breakdown by industry is not provided. The purchases of households in their private (non-business) capacity as consumers are included under household consumption with the exception of the purchase of dwellings, which is included with gross fixed capital formation. The purchases include domestically produced and imported products indistinguishably.

Additional information for each industry is shown at the end of the industry columns, where estimates of the components of the gross value added by each industry are supplied. These are in the form of compensation of employees (COE), non-product (i.e. overhead) taxes (e.g. rates) and non-product subsidies (e.g. employment subsidies), net operating surplus (or profits) and consumption of capital (this term encompasses depreciation and amortisation). The latter two items, when combined, are referred to as gross operating surplus (GOS). The sum of these rows is referred to as the gross value added of the industry and is equal to the output of the industry minus its intermediate consumption costs. A summary of the 2016 Use table at purchasers' prices is shown above.

Valuation

The purchases of the products in the Use table are valued at purchasers’ prices, which have already been explained in the note on the Supply table above. There is no distinction in this table between imported and home produced products. The gross value added of the industries shown in the second last row, being equal to the output of the industries valued at basic prices minus their intermediate consumption at purchasers’ prices is regarded as being valued at basic prices.

Balancing the Supply Table with the Use Table

The total supply of each product in the last column of the Supply table is equal to the total use of the product in the last column of the Use table. Similarly, the total output of each industry in the last row of the Supply table is equal to the sum of the intermediate consumption and value added of that industry, which is the last row of the Use table.

and

As with the current price S&UT, PYP Tables are compiled, balanced and deflated for 82 business sectors and published at a more aggregated level of 58 business sectors for confidentiality and reliability purposes. The 2016 S&UT in current prices were deflated by the most appropriate price indices available to obtain the PYP versions of the tables. A summary table of the deflators employed to produce the PYP tables by NACE are provided below in Background Notes Table A along with a list of abbreviations and acronyms.

Supply and Use Tables 2016 Background Notes Table A

One of the benefits of S&UT in previous year prices is that they facilitate the compilation of “real” or volume changes from year to year in the value added generated by detailed business sectors. It is necessary to have Gross Value Added (GVA) in current prices for the previous year for the detailed business sectors to which the data in PYP relates. It is also necessary that both sets of data are comparable. National accounts data are regularly revised. If one set of data incorporates revisions that equally apply to the other but have not yet been incorporated in them then any comparisons can be affected by the methodological differences in the two sets of data. Volume changes derived alternatively by comparing GVA in current prices from the published 2015 S&UT (based on 2015 data in NIE2017) with GVA in PYP from the 2016 S&UT in PYP (based on 2016 data in NIE2018) will be affected by different data vintages.

The values of the main National Accounts aggregates (e.g. GDP, PCE, Capital Formation, etc.) can be compared in PYP terms with their counterparts in current terms from the current price Supply and Use Tables. These are consistent with the NIE publication with which they were aligned when compiling the Supply and Use Tables (NIE 2018 published in July 2019 in the case of the 2016 S&UT). The Supply and Use Tables in previous year prices were mechanically balanced and adjusted to ensure aggregate and sub-aggregate consistency with the published national accounts. The required intervention at an aggregate level was generally small. The tables in this publication are balanced so that total deflated Supply equals total deflated Use for each product group. The degree of “automatic” balancing which was required to remove the residual imbalances remaining at the end of the deflation process was small, with total deflated Supply and total deflated Use differing by 0.24%. The Supply and Use Tables in previous year prices shown above are experimental and will continue to be compiled annually as part of the European Union Program of Statistics to which member states subscribe.

In the output method gross value added (GVA) equals output minus intermediate consumption. Using double deflation described above, we have separately deflated the outputs (from the Supply Table) and the intermediate inputs (from the Use Table) by product for each industry. Consequently it is possible to arrive at implied price changes by industry for output and intermediate consumption in addition to, by subtraction, GVA. Price changes by industry for output, intermediate consumption and GVA as well as the total implied price change by product are presented below in Background Notes Table B.

Supply and Use Tables 2016 Background Notes Table B (XLS 18KB)

Note that because GVA in the output method is a residual (output minus intermediate consumption) it can be subject to extreme movements. For example GVA will be affected by the relationship between the size of output and intermediate consumption. Two simple examples are presented below for illustrative purposes.

| Industry 1 | Industry 2 | |||||||||||

| Current € | PYP € |

% Price change |

Current € | PYP € |

% Price change |

|||||||

| Output | 100 | 110 | -10% | 100 | 110 | -10% | ||||||

| Intermediate consumption | 90 | 81 | 10% | 50 | 45 | 10% | ||||||

| Gross value added (GVA) | 10 | 29 | -290% | 50 | 65 | -30% | ||||||

Reconciliation with the National Accounts

In these current price tables the final demand aggregates and the components of value added are taken from the national accounts which provide control totals. This concordance is with the 2014 estimates as published in National Income and Expenditure 2018 (NIE18). Background Notes Table C below shows the aggregate figures in the 2016 Supply and Use Tables that agree with figures from NIE18.

Supply and Use Tables 2016 Background Notes Table C (XLS 13KB)

Details of new developments in the national accounts and various information notes to assist our users are available at the following website:

https://www.cso.ie/en/methods/nationalaccounts/din/

Comparison with other CSO sources

Although the current price Supply and Use Tables are consistent with national accounts data published in NIE18 and thereby consistent with the balance of payments data compiled by the CSO, it is not possible to achieve full agreement with all CSO publications. The exercise of compiling Supply and Use Tables helps to identify discrepancies that exist within different data sources. It is hoped that some of these discrepancies will be removed or reduced over time.

There are four main reasons for differences that occur between the aggregates presented in the Supply and Use Tables and the aggregates presented in other publications, e.g. the Census of Industrial Production (CIP) and Annual Services Inquiry (ASI). Some examples of these are set out here.

Terminology

For the most part, the underlying definitions are consistent throughout CSO publications, but certain differences do arise. For example, the output in the Supply table is inclusive of freight and of the margin gained on goods resold without further processing. These two items may not be part of the term ‘gross output’ in the CIP. Another example is that the term ‘compensation of employees’ in national accounts includes the employer’s contribution to social insurance and other labour costs, which are not included in the wages and salaries variable in CIP and ASI.

Accounting practices

Some international sales by Irish companies are included in the CIP gross turnover but are treated on a net basis (i.e. sales less purchases) in the balance of payments. This can arise particularly where Irish companies sell products abroad which they have also purchased abroad. The products purchased may never have come into Ireland or undergone any further processing following purchase by the Irish enterprise. Supply and Use adjusts the CIP data and includes the net amount as an export of a service. Conversely, there are companies manufacturing on a fee basis whose transactions may be recorded gross in the international trade statistics. This can arise where companies process goods for another company in their enterprise group abroad. The goods are imported and exported and may therefore have been included in the merchandise trade statistics although ownership of the goods did not change in the process. Generally in these cases the merchandise trade is adjusted to convert the goods imported and exported to a fee based service for use in the balance of payments and national accounts. In the case of telecommunications, some of the turnover in the ASI arises from importing and exporting telecommunications services, whereas balance of payments uses a net treatment. Supply and Use adopts the balance of payments practice in these situations.

Classifications

Output by product may be classified differently in the Prodcom Inquiry to the export statistics. This difficulty is corrected by realigning at a product level the production with the exports or vice versa. Sometimes the classifications in the two systems are quite unrelated. For example, what appears in one classification as a chemical may be classified as food and beverages in another system.

Conflicts in classification also occur at the overall activity level of companies. The company’s NACE code in the national accounts and balance of payments may differ from the NACE code used by CIP or ASI. Usually the classification used in the CIP or ASI is adopted in the Supply and Use Tables. It can also happen that the mismatch highlights a problem that is resolved by transferring the company within the CIP or ASI.

Conflicting data

The Supply and Use Tables are compiled using data from different sources. It is therefore not surprising that there are occasional instances of contradictory and conflicting information. Some examples are: the value of production by a company, measured in the CIP, may be less than their exports, measured by the international merchandise trade statistics; the value added of a company, measured by national accounts from administrative sources, may not concur with the same variable derived in the CIP or the ASI; compensation of employees calculated in national accounts based on employment figures can conflict with the wages and salaries figures in the CIP and ASI, which are assembled from company data. Reconciliation of these types of problem can result in differences between the variable presented in the Supply and Use tables and the same variable in the CIP or ASI.

The Supply & Use Tables in the current publication are presented using the NACE Rev. 2 sectoral classification.

In the 2010 tables a change was made to the treatment of NIE item 82(a) Net additions to the breeding stocks. Previously this was included in the changes in inventories figure (NIE item 82), but has been included in GFCF (NIE item 81).

There were three significant changes in treatment in the 2011 tables. These were the exclusion of purchases of goods for direct resale from the output of certain service industries, secondly the use of Balance of Payments (BOP) data to more comprehensively describe the secondary production of certain industries and thirdly the implementation of the latest version of the European System of Accounts; ESA 2010.

The 2012 tables included significant methodological revisions due to the recording of trade in aircraft on a "transfer of economic ownership" basis. Under the new National Accounts methodology, all trade in aircraft with the rest of the world is recorded as imports and exports of goods – regardless of where the aircraft is registered for aviation purposes. There are offsetting effects as both imports and exports increase but generally the new methodology has a greater effect on aircraft imports with the inclusion of purchases of aircraft by resident operational leasing companies in Ireland’s imports of goods. The net increase to Imports of Goods and Services (item 84 in NIE Table 5) in the National Accounts was offset by an increase in Capital Formation (item 81 in NIE Table 5) and the new methodology had no effect generally on GDP and GNP. However, there was a significant increase to the National Accounts provision for depreciation (item 28 in NIE Table 2) based on the higher capital stock, which resulted in an offsetting change in the level of Net Value Added at Factor Cost (item 13/27 in NIE Tables 1 and 2 respectively) and related aggregates.

These changes were seen most clearly in the S&UT for 2012 as an increase in imports of NACE 30 (Other transport equipment) products with an accompanying increase in NACE 30 Gross Fixed Capital Formation (GFCF). Similarly the consumption of fixed capital (CFC) total in the primary inputs figures in the lower rows at the bottom of the inter-industry use table was higher than in previous Supply & Use Tables. A technical note on the topic is available here. It provides additional information on the revised trade in aircraft methodology and explains the impact the revisions have on Trade in Goods, National Accounts and Balance of Payments.

In addition, a small number of codes had new entries in 2012 for imports and/or exports. These figures are based on a more detailed split of Balance of Payments data than was previously used for S&UT purposes. Given the degree of uncertainty regarding such detailed splits, these data should be treated with some caution. A number of codes also had new entries in 2012 for final consumption expenditure of households based on further disaggregation for S&UT purposes of PCE data used in the national accounts. Again such disaggregated estimates should be treated with caution and as indicative only.

In the 2013 tables an explicit cif/fob adjustment for both imports and exports was included for the first time, as explained above. These adjustments have been retained in these 2014 tables.

The 2014 tables included adjustments to imports, exports and PCE for expenditure outside the state and expenditure by non-residents. Direct purchases abroad by residents are regarded as imports while purchases on the domestic territory by non-residents are regarded as exports. As mentioned above the imports and exports totals, including adjustments, in the current price Supply and Use Tables are consistent with the 2015 imports and exports figures in NIE17.

The 2014 tables also included, for both imports and exports, more detailed product split estimates of goods for processing using detailed National Accounts and Balance of Payments (BoP) data.

The 2014 tables feature an amended NACE code split as well as product versus non-product split of Taxes and Subsidies. This is most evident in NACE 1-3 (Agriculture, forestry and fishing) where the estimates provided in the Supply and Use tables are now consistent with the estimates provided in the Output, Input and Income in Agriculture (OIIA) release published by the CSO. Similarly, the NACE code split of Gross Operating Surplus (GOS), which is the sum of Net Operating Surplus (NOS) and Consumption of Fixed Capital (CFC) has been made available in greater detail and are consistent in most (but not all) codes with the estimates contained within the calculations for NIE Table 21 Gross Value Added at current basic prices.

A further new aggregation was introduced in the 2015 tables in light of the well publicised 'level shift' in the national accounts that year. Rather than marking the affected codes as confidential, these have been aggregated into a single code (NACE 19, 21, 26, 28, 31-32) which can then be shown. Other codes previously aggregated have been split, for example NACE 55 and NACE 56 are now separate. The result is that the published tables remain 58 industry groups by 58 product groups as for previous editions, but with a different structure from 2015 onwards.

The 2014 tables were based in part on the revised CIP and ASI time-series first published by the CSO on the 27th October 2016 and 4th November 2016 respectively. Output by industry from the Supply Table remains, as previously, generally consistent (except for specific methodological reasons) with the production values by 2-digit NACE sector from both the CIP and ASI. The 2015 tables are consistent with the CIP and ASI data published on September 7th 2017. The output by industry data in these 2016 tables are consistent with the CIP and ASI data published on the 20th September 2018.

Conventions used

The following conventions are used throughout the tables of this publication:

" - " is used to denote zero

" 0 " represents less than €0.5 million but more than zero

Hide Background Notes

Hide Background Notes

Scan the QR code below to view this release online or go to

http://www.cso.ie/en/releasesandpublications/ep/p-saucup/supplyandusetablesforireland2016/