Your feedback can help us improve and enhance our services to the public. Tell us what matters to you in our online Customer Satisfaction Survey.

| Table 5.1: Volume and Value of Non-Household market dwelling transactions filed with Revenue, 2010 - 2020 | ||||||||||||

| Direction | Indicator | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

| Purchases | Volume | 774 | 760 | 1,421 | 1,737 | 4,538 | 6,892 | 6,266 | 8,765 | 9,145 | 12,378 | 11,701 |

| Value (€ million) | 171.9 | 176.2 | 297.0 | 325.3 | 913.5 | 1,274.1 | 1,360.5 | 2,078.7 | 2,396.8 | 3,475.0 | 3,496.4 | |

| Sales | Volume | 4,482 | 3,153 | 4,109 | 4,819 | 8,788 | 13,263 | 12,590 | 16,027 | 16,692 | 18,926 | 16,881 |

| Value (€ million) | 1,066.7 | 662.4 | 763.9 | 842.3 | 1,595.6 | 2,516.1 | 2,902.9 | 4,315.4 | 4,925.3 | 5,928.1 | 5,500.6 | |

|

In the process of reviewing data, some transactions by non-household entities in the year 2020 were identified to include multiple dwelling units. These have now been corrected. As a result the data tables and the text of this chapter were revised in July 2021. |

The non-household sector comprises private companies, charitable organisations and state institutions. The non-household sector is a significant actor in the Irish residential property market, both in terms of purchases and sales. This chapter provides additional detail on non-household sector dwelling transactions, on an annual basis, for the years 2010 to 2020. This information is updated annually.

In 2020, the total of 49,711 dwelling purchases at market prices were filed with the Revenue Commissioners, with a value of €14.8 billion. Of these, 11,701 purchases were made by non-household entities, a decrease of 5.5% on the 12,378 purchases made by them in 2019. The total value of the purchases by non-household entities in 2020 was €3.5 billion, an increase of just 0.6% on the 2019 value.

In contrast, the non-household entities sold 16,881 dwellings at market prices in 2020, a decrease of 10.8% on 18,926 dwellings sold by them in 2019. The total value of sales by non-household entities in 2020 amounted to €5.5 billion, a decrease of 7.2% on the 2019 value of €5.9 billion.

For all years from 2010 to 2020, sales of dwellings at market prices by non-household entities exceeded the purchases both in terms of the volume and value. See Figure 5.1.

| Year | Purchases | Sales |

|---|---|---|

| 2010 | 0.2 | 1.1 |

| 2011 | 0.2 | 0.7 |

| 2012 | 0.3 | 0.8 |

| 2013 | 0.3 | 0.8 |

| 2014 | 0.9 | 1.6 |

| 2015 | 1.3 | 2.5 |

| 2016 | 1.4 | 2.9 |

| 2017 | 2.1 | 4.3 |

| 2018 | 2.4 | 4.9 |

| 2019 | 3.5 | 5.9 |

| 2020 | 3.5 | 5.5 |

| Table 5.2A: Value of Non-Household Sector market purchases filed with Revenue by NACE sector, 2010-2020 | (€ million) | ||||||||||

| NACE Sector | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

| Construction (F) | 20.3 | 18.3 | 35.3 | 32.6 | 154.2 | 177.1 | 156.0 | 190.5 | 202.2 | 166.4 | 188.8 |

| Financial & Insurance (K) | 16.4 | 19.4 | 73.5 | 84.5 | 180.8 | 586.6 | 326.8 | 553.2 | 650.3 | 737.0 | 1,120.5 |

| Real Estate (L) | 7.2 | 14.4 | 46.3 | 23.5 | 369.7 | 138.5 | 170.9 | 320.4 | 309.3 | 640.6 | 435.5 |

| Public/Education/Health (O,P,Q) | 87.0 | 71.4 | 65.9 | 74.3 | 63.5 | 163.3 | 434.1 | 543.7 | 707.6 | 1,142.7 | 1,062.3 |

| Extra-Territorial (U) | 8.0 | 16.6 | 41.3 | 48.0 | 63.5 | 69.2 | 99.6 | 276.1 | 296.7 | 454.4 | 453.0 |

| Other | 33.1 | 36.1 | 34.8 | 62.4 | 81.7 | 139.4 | 173.1 | 194.9 | 230.7 | 333.9 | 236.2 |

| All | 171.9 | 176.2 | 297.0 | 325.3 | 913.5 | 1,274.1 | 1,360.5 | 2,078.7 | 2,396.8 | 3,475.0 | 3,496.4 |

Within the non-household sector, entities belonging to NACE sector K: Finance (i.e. banks, holding companies, trusts, funds and similar financial entities) purchased dwellings in the residential market with a value of €1,120.5 million in 2020. This is more than in any other NACE sector according to transactions filed with the Revenue Commissioners. Purchases of dwellings by entities in the NACE section O,P,Q: Public/Education/Health were the second largest, with a value of €1,062.3 million* See Figure 5.2.

*It should be noted that the aggregate of NACE sections O, P, Q is a broad grouping. It includes transactions involving state or semi-state agencies, such as those made by local authorities and Approved Housing Bodies. However, it also covers all other transactions of residential properties made by public institutions, as well as purchases and sales made by private companies within the education and health sectors.

| F: Construction | K: Financial & Insurance | L: Real Estate | O,P,Q: Public/Education/Health | U: Extra-Territorial | Other | |

| 2010 | 20.3 | 16.4 | 7.2 | 87 | 8 | 33.1 |

| 2011 | 18.3 | 19.4 | 14.4 | 71.4 | 16.6 | 36.1 |

| 2012 | 35.3 | 73.5 | 46.3 | 65.9 | 41.3 | 34.8 |

| 2013 | 32.6 | 84.5 | 23.5 | 74.3 | 48 | 62.4 |

| 2014 | 154.2 | 180.8 | 369.7 | 63.5 | 63.5 | 81.7 |

| 2015 | 177.1 | 586.6 | 138.5 | 163.3 | 69.2 | 139.4 |

| 2016 | 156 | 326.8 | 170.9 | 434.1 | 99.6 | 173.1 |

| 2017 | 190.5 | 553.2 | 320.4 | 543.7 | 276.1 | 194.9 |

| 2018 | 202.2 | 650.3 | 309.3 | 707.6 | 296.7 | 230.7 |

| 2019 | 166.4 | 737 | 640.6 | 1142.7 | 454.4 | 333.9 |

| 2020 | 188.8 | 1120.5 | 435.5 | 1062.3 | 453 | 236.2 |

| F: Construction | K: Financial & Insurance | L: Real Estate | O,P, Q: Public/Eduaction/Health | U:Extra Terretorial | Other | |

| 2010 | 20.3 | 16.4 | 7.2 | 87 | 8 | 33.1 |

| 2011 | 18.3 | 19.4 | 14.4 | 71.4 | 16.6 | 36.1 |

| 2012 | 35.3 | 73.5 | 46.3 | 65.9 | 41.3 | 34.8 |

| 2013 | 32.6 | 84.5 | 23.5 | 74.3 | 48 | 62.4 |

| 2014 | 154.2 | 180.8 | 369.7 | 63.5 | 63.5 | 81.7 |

| 2015 | 177.1 | 586.6 | 138.5 | 163.3 | 69.2 | 139.4 |

| 2016 | 156 | 326.8 | 170.9 | 434.1 | 99.6 | 173.1 |

| 2017 | 190.5 | 553.2 | 320.4 | 543.7 | 276.1 | 194.9 |

| 2018 | 202.2 | 650.3 | 309.3 | 707.6 | 296.7 | 230.7 |

| 2019 | 166.4 | 737 | 640.6 | 1142.7 | 454.3 | 333.9 |

| Table 5.2B: Value of Non-Household Sector market sales filed with Revenue by NACE sector, 2010-2020 | (€ million) | ||||||||||

| NACE Sector | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

| Construction (F) | 654.7 | 350.0 | 344.6 | 329.7 | 600.2 | 935.4 | 1,176.9 | 1,803.8 | 2,397.3 | 2,800.5 | 2,984.3 |

| Financial & Insurance (K) | 119.6 | 112.8 | 196.2 | 234.6 | 510.8 | 874.0 | 920.4 | 1,468.6 | 1,484.4 | 1,872.2 | 1,503.1 |

| Real Estate (L) | 109.3 | 60.9 | 62.0 | 77.4 | 143.6 | 261.4 | 316.4 | 388.7 | 411.3 | 618.9 | 602.9 |

| Public/Education/Health (O,P,Q) | 49.8 | 18.4 | 18.6 | 25.4 | 27.6 | 22.3 | 16.1 | 43.0 | 52.9 | 73.1 | 91.6 |

| Extra-Territorial (U) | 13.4 | 22.1 | 26.2 | 50.2 | 31.5 | 45.0 | 47.4 | 59.9 | 75.5 | 75.7 | 68.1 |

| Other | 119.9 | 98.3 | 116.2 | 125.0 | 282.0 | 378.1 | 425.7 | 551.4 | 503.9 | 487.6 | 250.6 |

| All | 1,066.7 | 662.4 | 763.9 | 842.3 | 1,595.6 | 2,516.1 | 2,902.9 | 4,315.4 | 4,925.3 | 5,928.1 | 5,500.6 |

In terms of the value of non-household sales, entities in the NACE section F: Construction were the most active in 2020, selling residential properties with a value of €3.0 billion. The construction sector had the highest value of sales in all years from 2010 to 2020. In 2020 the second largest NACE section in terms of sales of dwellings was section K: Financial and Insurance, with a value of €1.5 billion. See Table 5.2B.

| Table 5.3A: Value of Non-Household Sector market purchases filed with Revenue by registered address, 2010-2020 | (€ million) | ||||||||||

| Address | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

| Ireland | 164.0 | 159.6 | 255.7 | 277.3 | 850.0 | 1204.9 | 1260.9 | 1802.6 | 2100.0 | 3020.6 | 3043.4 |

| Northern Ireland | 1.4 | 2.6 | 1.4 | 3.9 | 3.4 | 9.2 | 10.0 | 13.1 | 9.9 | 14.1 | 9.2 |

| Great Britain | 1.0 | 1.9 | 6.1 | 4.3 | 5.4 | 11.9 | 11.0 | 10.8 | 17.9 | 11.7 | 17.8 |

| British Crown Dependencies1 | 3.3 | 5.2 | 16.0 | 4.4 | 16.6 | 23.2 | 46.0 | 53.3 | 151.0 | 18.1 | 3.1 |

| Other Europe2 | * | 4.2 | 3.5 | * | 9.7 | 7.7 | 15.0 | * | 93.8 | 388.2 | 383.4 |

| North America3 | 0.0 | * | 13.7 | * | 19.5 | 12.5 | 14.9 | 47.6 | 16.1 | 19.3 | 30.5 |

| Other | * | * | 0.6 | 15.9 | 8.9 | 4.6 | 2.7 | * | 8.1 | 3.0 | 9.0 |

| All | 171.9 | 176.2 | 297 | 325.3 | 913.5 | 1274.1 | 1360.5 | 2078.7 | 2396.8 | 3475 | 3496.4 |

| 1: The Channel Islands and the Isle of Man | |||||||||||

| 2: Europe excluding Northern Ireland, Great Britain and the British Crown Dependencies | |||||||||||

| 3: Canada, USA, Mexico, Central America and the Caribbean | |||||||||||

| *: Supressed for reasons of confidentiality | |||||||||||

In 2020 Irish registered companies and institutions accounted for €3.0 billion (87%) of the €3.5 billion spent on dwellings by the non-household sector. Purchases by companies with a Northern Ireland address accounted for €9.2 million, €17.8 million was spent by the companies with a Great Britain address and €3.1 million by companies with a British Crown Dependency address. A total of €422.9 million was spent by companies with another address outside of Ireland. See Table 5.3A.

| Northern Ireland | Great Britain | British Crown Dependencies | Other | |

| 2010 | 17.4 | 13.1 | 41 | 28.5 |

| 2011 | 15.9 | 11.3 | 31.3 | 41.5 |

| 2012 | 3.4 | 14.7 | 38.8 | 43.1 |

| 2013 | 8 | 9 | 9.2 | 73.7 |

| 2014 | 5.3 | 8.5 | 26.1 | 60.1 |

| 2015 | 13.4 | 17.2 | 33.5 | 35.9 |

| 2016 | 10 | 11.1 | 46.2 | 32.7 |

| 2017 | 4.7 | 3.9 | 19.3 | 72 |

| 2018 | 3.3 | 6 | 50.9 | 39.8 |

| 2019 | 3.1 | 2.6 | 4 | 90.3 |

| 2020 | 2 | 3.9 | 0.7 | 93.4 |

| Northern Ireland | Great Britain | British Crown Dependencies | Other Europe | North America | Other | |

| 2010 | 15.4 | 12.8 | 42.3 | 21.8 | 0 | 7.7 |

| 2011 | 15.7 | 11.4 | 31.3 | 25.3 | 14.5 | 1.8 |

| 2012 | null | 15.6 | null | 8.4 | 32.8 | 1.4 |

| 2013 | 7.3 | 7 | 8.3 | 42.5 | 5.3 | 29.9 |

| 2014 | null | null | 26.4 | 15.4 | 31.1 | 14.2 |

| 2015 | 13.2 | null | null | 11.1 | 18 | 6.6 |

| 2016 | 10 | 11 | 46.6 | 15 | 14.9 | 2.7 |

| 2017 | 4.7 | 5.2 | 19 | 52.3 | 17 | 1.8 |

Companies and institutions with registered address outside of Ireland spent €453 million on purchases of residential dwellings, a decrease of 0.3% on the €454.4 million spent in 2019. Of these, entities with addresses in Northern Ireland, Great Britain and British Crown dependencies accounted for 2.0%, 3.9% and 0.7% of the expenditure, respectively, while the bulk of purchases (93.4%) were made by the companies with addresses in other parts of the world. See Figure 5.3.

| Table 5.3B: Value of Non-Household Sector market sales filed with Revenue by registered address, 2010-2020 | (€ million) | ||||||||||

| Address | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

| Ireland | 1053.3 | 640.3 | 737.6 | 792.0 | 1564.1 | 2471.1 | 2855.5 | 4255.5 | 4849.8 | 5852.3 | 5432.5 |

| Northern Ireland | 6.4 | 6.8 | 3.4 | 10.9 | 7.5 | 6.2 | 17.1 | 17.7 | * | 24.7 | 19.5 |

| Great Britain | 1.3 | * | * | 26.9 | * | 9.9 | 10.0 | 9.4 | * | 8.0 | 12.9 |

| British Crown Dependencies1 | 3.6 | * | * | 10.8 | 1.8 | 15.2 | 13.3 | 23.8 | 7.1 | 19.3 | 11.4 |

| Other Europe2 | * | 0.0 | 1.5 | * | * | * | * | 6.0 | 4.3 | 4.1 | 12.7 |

| North America3 | * | 0.9 | 5.1 | * | 6.4 | * | * | * | 9.9 | 18.5 | * |

| Other | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | * | * | * | 4.2 | 1.1 | * |

| All | 1066.7 | 662.4 | 763.9 | 842.3 | 1595.6 | 2516.1 | 2902.9 | 4315.4 | 4925.3 | 5928.1 | 5500.6 |

| 1: The Channel Islands and the Isle of Man | |||||||||||

| 2: Europe excluding Northern Ireland, Great Britain and the British Crown Dependencies | |||||||||||

| 3: Canada, USA, Mexico, Central America and the Caribbean | |||||||||||

| *: Supressed for reasons of confidentiality | |||||||||||

In 2020, Irish registered companies and institutions accounted for just under €5.5 billion (98.8%) of the value of all dwellings sold by the non-household sector. Europe (excluding Ireland, the United Kingdom and British Crown Dependencies) accounted for just €12.7 million (0.2%) and companies and institutions registered outside of Europe accounted for €11.6 million (0.2%) of sales. See Table 5.3B.

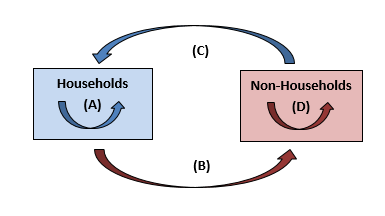

The Household and Non-Household sectors of the residential property market interact and overlap to a significant degree. Each dwelling transaction involves two parties, the buyer and the seller. A household may sell to another household or to the Non-Household Sector (represented by flows A and B respectively in figure 4 below). Conversely, a non-household company or institution may sell to the Household Sector or to another company or institution (flows C and D). Net inter-sectoral flows can be established to show the overall direction of the flow of dwellings (in volume or value terms). For example, the net value flow (C-B) represents the overall transfer of money from the Household to the Non-Household sector in the residential property market. See Figure 5.4.

Figure 5.4: Household and Non-Household residential property flows

| Table 5.4: Value of market residential dwelling sales filed with Revenue by Sectoral Flow, 2010-2020 | (€ million) | |||||||||

| Year | Sales by Households | Sales by Non-Households | All Sales (A+B+C+D) | Net Non-Household Sales (C-B) | ||||||

| Sales to Households (A) | Sales to Non-Households (B) | Total (A+B) | Sales to Households (C) | Sales to Non-Households (D) | Total (C+D) | |||||

| 2010 | 4,018.2 | 102.6 | 4,120.8 | 997.4 | 69.3 | 1,066.7 | 5,187.5 | 894.8 | ||

| 2011 | 3,242.5 | 118.2 | 3,360.7 | 604.3 | 58.0 | 662.4 | 4,023.1 | 486.2 | ||

| 2012 | 3,629.9 | 152.5 | 3,782.3 | 619.3 | 144.5 | 763.9 | 4,546.2 | 466.9 | ||

| 2013 | 4,396.7 | 182.0 | 4,578.8 | 699.0 | 143.2 | 842.3 | 5,421.1 | 517.0 | ||

| 2014 | 6,316.1 | 458.7 | 6,774.9 | 1,140.8 | 454.8 | 1,595.6 | 8,370.4 | 682.1 | ||

| 2015 | 7,323.7 | 527.5 | 7,851.2 | 1,769.5 | 746.6 | 2,516.1 | 10,367.4 | 1,242.0 | ||

| 2016 | 7,655.9 | 735.3 | 8,391.2 | 2,277.7 | 625.2 | 2,902.9 | 11,294.2 | 1,542.4 | ||

| 2017 | 8,751.4 | 804.6 | 9,556.0 | 3,041.3 | 1,274.1 | 4,315.4 | 13,871.4 | 2,236.7 | ||

| 2018 | 9,316.7 | 1,100.7 | 10,417.4 | 3,629.2 | 1,296.0 | 4,925.3 | 15,342.7 | 2,528.5 | ||

| 2019 | 9,806.5 | 1,129.2 | 10,935.7 | 3,582.2 | 2,345.8 | 5,928.1 | 16,863.8 | 2,453.0 | ||

| 2020 | 8,230.7 | 1,055.7 | 9,286.4 | 3,059.9 | 2,440.6 | 5,500.6 | 14,787.0 | 2,004.2 | ||

In 2020 non-household entities sold dwellings valued at €3.1 billion to the households, whereas sales within its own sector amounted to just €2.4 billion. In contrast, households sold predominately to other households, with the intra-household market accounting for €8.2 billion of dwelling sales, and sales to the non-household sector accounting for just €1.1 billion. On balance, this represented a net monetary flow of €2.0 billion to the non-household sector. See Table 5.4.

In each year represented in the table a net flow of money was directed to the non-household sector, with the value of the flow being at its lowest in 2012 at just €466.9 million.

For further Information see tables on PxStat

Go to next chapter >>> Background Notes

Learn about our data and confidentiality safeguards, and the steps we take to produce statistics that can be trusted by all.