This release is categorised as a CSO Frontier Series Output. Particular care must be taken when interpreting the statistics in this release as it may use new methods which are under development and/or data sources which may be incomplete, for example, new administrative data sources.

The results of this release are based primarily on a data-linking exercise of two pseudonymised Central Statistics Office data sources:

With additional insights included by data-linking with the following additional pseudonymised data sources:

The linkage and analysis were undertaken by the CSO for statistical purposes in line with the Statistics Act, 1993 and the CSO Data Protocol.

Before using personal administrative data for statistical purposes, the CSO removes all identifying personal information including the PPSN. The Personal Public Service Number (PPSN) is a unique number that enables individuals to access social welfare benefits, personal taxation and other public services in Ireland. The CSO removes the PPSN and creates a pseudonymised Protected Identifier Key (PIK). The PIK is a unique and non-identifiable number which is internal to the CSO. Using the PIK enables the CSO to link and analyse data for statistical purposes, while protecting the security and confidentiality of the individual data. All records in the matched datasets are pseudonymised and the results are in the form of statistical aggregates which do not identify any individuals.

All income data referenced in the release spans the period from 1 January 2023 to 31 December 2023.

The geographic and demographic variables, such as long-lasting condition or difficulty status, were collected on Census reference day, 3rd April 2022.

The State Examinations Commission (SEC) data used for Leaving Certificate is related to the year 2022 to allow for follow on analysis to further and higher education.

The COPA is a pseudonymised copy of the Census of Population 2022 dataset held internally within the CSO for analysis purposes. It contains Census attribute information for individuals and households of which 91.5% of records have a PIK which allows them to be linked to pseudonymised administrative data sources to create new analysis.

The PIR is a pseudonymised income register held internally within the CSO. It contains information on income received by individuals relating to employment, self-employment and social transfers. It is derived from administrative holdings held by the Revenue Commissioners and Department of Social Protection. Therefore, the PIR provides a near complete picture on individual level income, for a calendar year. All linkage is carried out by using a PIK assigned to each contributing data source. The PIK is then used to link the pseudonymised data sources together in order to create the PIR. The PIK protects a person’s identity but also enables linking across data sources, and over time. The PIK enables high quality deterministic matching thus significantly reducing/eliminating linkage error.

The State Examinations Commission is responsible for the development, assessment, accreditation and certification of the second-level examinations of the Irish state: the Junior Certificate/Cycle and the Leaving Certificate. The State Examinations Commission is a non-departmental public body under the aegis of the Department of Education.

Student Universal Support Ireland contains funding information for all higher and further education grants. SUSI offers funding to eligible students in approved full-time, third-level education in Ireland and, in some cases, funding for students studying outside the State. It offers support to all types of students, from school leavers to mature students returning to education.

SOLAS is Ireland's Further Education and Training authority, with responsibilities in the management, funding, promotion and monitoring of Further Education in Ireland. SOLAS manages a database for courses and participants known as the Programme and Learner Support System, or PLSS. The CSO receives the portion of the PLSS which relates to learners' enrolment and course completion. The PLSS contains course details such as course name, field of study, National Framework of Qualifications (NFQ) level and programme category. Learner details such as sex, date of birth and nationality are included, as are the start and end dates for each learner. The PLSS also includes a description of the outcome for each learner, specifying not only whether a learner successfully completed a course, but also their first destination after the course, or the reason for leaving the course prematurely.

The HEA student records system data contains a record for each individual graduation and enrolment at Irish Higher Education Institutions. Details include the name of the course, the NFQ level, the degree class, and the field of study (broad, narrow and detailed fields as classified using the International Standard Classification of Education (ISCED) framework). Details on the graduates themselves include age, sex, nationality and the county in which they lived at the time of enrolment. The HEA also provide an enrolment data set that provides data on learners for each year that they continue their studies in a particular course. This release covers NFQ levels from 6 to 10.

The Primary Care Reimbursement Service (PCRS) is responsible for reimbursing GPs, Dentists, Pharmacists, Optometrists/Ophthalmologists, and other contractors who provide free or reduced-cost services to the public across a range of primary care schemes.

PCRS supports the delivery of primary healthcare by providing reimbursement services to primary care contractors for the provision of health services to members of the public in their own community. Almost all payments for publicly funded healthcare services provided in the community by GPs, community pharmacies, dentists and optometrists/ophthalmologists are made by the PCRS.

The General Medical Services (GMS) Scheme provides access to medical and surgical services to persons for whom acquiring such services would present undue hardship. They may be granted a medical card or GP visit card and receive free general medical services for themselves and their dependants. All GMS claims are processed and paid by the PCRS.

The data in the Health section of this release relates to the GMS scheme only.

The data relates to details of all tenancies, tenants, properties and landlords that have been involved in the HAP scheme since its introduction in 2014. The dataset used in this release contains tables from 2024, containing all relevant records since the inception of the scheme until this date. However, only active HAP tenancies within 2024 are used in this analysis.

The data includes the SSHA (Summary of Social Housing Assessments – annual report) data that the Housing Agency received from LGMA in 2016, up to and including 2022. In this release, 2022 data is used.

The dataset contains details of gross persons on the social housing waiting lists (gross lists) for local authorities within Ireland. This dataset contains individual-level data on each person that is part of the household. This data includes persons whose current tenure type is LA rented accommodation, Voluntary/Co-operative housing, RAS or HAP and have applied for a transfer.

This is then reduced to a ‘Net Need’ list, whereby Net lists include households qualified for social housing support across the country at a certain count date but excludes those who have been provided with some social housing support (such as local authority rented accommodation, Voluntary/Co-operative housing, RAS or HAP) and are waiting for a transfer. The data in this release is of those households that are considered to be the ‘Net Need’ of social housing support. The 2022 count date was 1st November.

For analysis within this release, 2022 data is used to capture tenure type, basis of need and classification of need (i.e. capturing their reasons and requirements for being on the housing list).

In this release, where the term disability is used, it refers to the experience of at least one long-lasting condition or difficulty as reported in Census 2022. Data on experiencing long-lasting conditions or difficulties was derived from answers to Questions 15 and 16 of the Census questionnaire.

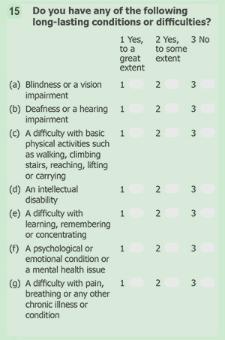

Question 15 was a seven-part question that asked about the experience of the following long lasting conditions: (a) blindness or a vision impairment, (b) deafness or a hearing impairment, (c) a difficulty with basic physical activities such as walking, climbing stairs, reaching, lifting or carrying, (d) an intellectual disability, (e) a difficulty with learning, remembering or concentrating, (f) a psychological or emotional condition or a mental health issue and (g) a difficulty with pain, breathing or any other chronic illness or condition.

Respondents were required to indicate whether they experienced each of these conditions in Q15 to some extent, to a great extent or not at all.

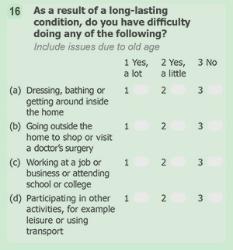

Question 16 was a four-part question that asked whether as a result of a long-lasting condition, respondents had a difficulty doing any of the following activities: (a) dressing, bathing or getting around inside the home (self-care disability), (b) going outside the home alone to shop or visit a doctor’s surgery (going outside the home disability), (c) working at a job or business or attending school or college (employment disability) and (d) participating in other activities, such as leisure or using transport.

Similar to Question 15, respondents had the option to indicate they experienced each of the difficulties in Q16 a little, a lot or not at all.

Census 2022 Question 15 Census 2022 Question 16

Unlike in Census 2016, there was no filter between Q15 and Q16, meaning that all respondents were expected to answer both questions. Respondents were also instructed to answer ‘Yes’ to any of the difficulties listed in Q16 which were experienced due to old age.

For the release of the results, three categories were created based on the response options in Q15 and Q16. These are as follows:

Respondents who ticked any of the 'Yes' boxes in Q15 or Q16 were also included in the 'disability to any extent' rate.

Respondents who ticked at least one of the boxes for 'Yes, to some extent' in Q15 or 'Yes, a little' in Q16 but did not tick any of the 'Yes to a great extent' in Q15 or 'Yes, a lot' in Q16 were used as part of the calculation of the 'Long-lasting condition or difficulty experienced to some extent' category.

Respondents who ticked at least one of the 'Yes, to a great extent' boxes in Q15 or 'Yes, a lot' boxes in Q16 were used as part of the calculation of the 'Long-lasting condition or difficulty experienced to a great extent' category.

Using Census 2022 data, this release concentrates on people experiencing long-lasting conditions and difficulties to a great extent, or to any extent.

The working age of 15 years up to 65 years old is used throughout this report. The reason for this being that the focus here is mainly on employment outcomes, DSP disability, income and employment supports and education and training outcomes.

Persons with less than €500 annual gross pay from P35 employee income are not considered to be in PAYE employment nor are those with less than 2 weeks of PAYE employment.

Persons with less than €500 IT form 11 self-employed trading income are not considered to be self-employed nor are those with less than 2 weeks of self-employed trading.

The annual gross income before deductions such as tax and social insurance which was measured in nominal terms and includes:

Excluded from the income measure are:

Income outputs are produced at individual level. Income has been capped at €200,000 at individual level to remove the top 1% of income earners for confidentiality purposes.

Annual gross earnings for 2023 from P35 employee income and IT form 11 self-employed trading income before deductions such as tax and PRSI from Revenue unadjusted for hours and/or weeks worked.

Total annual payments from the Department of Social Protection (unless otherwise stated), categorised into the following:

Individuals who were identified as living in Ireland in COPA but could not be linked to administrative income data in the PIR in 2023.

There is a further break down of employment status in the Income and Employment chapter as follows:

The economic sector classification (NACE) is based on the ‘Statistical Classification of Economic Activities in the European Community, which can be accessed on the Eurostat website. NACE codes were allocated accordingly as provided in P35 data.

Leaving Certificate Examinations: The SEC includes data on exam type, subjects, level of subject and accommodations for students sitting the leaving certificate. This was linked to census for the long-lasting condition or difficulty indicator. This release looks at students who sat the leaving certificate in 2022.

SUSI Grants: There are two main categories of grant available from SUSI - the fee grant which covers university registration fees and is paid directly to the institute, and the maintenance grant to cover living expenses which is paid to the student. The amount of maintenance grant received has four levels, depending on financial circumstances and distance to university.

ISCED: The fields of study referred to in this report are based on the International Standard Classification of Education (ISCED) broad fields.

NFQ level: The Irish National Framework of Qualifications (NFQ) is a 10-level, single national entity through which all learning achievements may be measured and related to each other.

New Entrants: A new entrant is a student enrolled in year 1 of a full-time undergraduate course with a student code of 'New Entrant', who is entering higher education for the first time.

Graduates: Graduates are students from full or part-time courses with the enrolment status 'Graduate'.

SOLAS/Further Education: It is not unusual for a student to be enrolled in multiple SOLAS/Further Education courses. In this release, to include a SOLAS/Further Education student once (after linking to Census), the most recent course they started in the 2023 cohort was selected, and if they had not started a course in that year, the most recent course they finished in the 2023 cohort was selected.

Medical Card: With a medical card issued by the HSE, one can receive certain health services free of charge. To qualify for a medical card, an individual’s weekly income must be below a certain figure. If an individual does not qualify for a medical card, they may qualify for a GP visit card.

GP Visit Card: With a GP visit card issued by the HSE, one can receive care from their GP free of charge. To qualify for a GP visit card, if an individual is under 70, their income is assessed. However, the basic rates of income for the GP visit card are higher than the limits for the medical card.

Cost of Pharmacy Claims: Total expenditure includes ingredient costs, fees and VAT on pharmacy claims for GMS patients only, and is exclusive of Stock costs, fees and VAT.

Basis of Need: Local authority housing is allocated according to eligibility and need. The housing authority considers a number of criteria to assess if an applicant has a need for local authority housing. The primary reason a person is being included on the housing list is the 'Basis of Need' variable used in this report.

Classification of Need: The classification of need captures any specific requirements that were included in the application for local authority housing. This includes for example wheelchair accessibility for people with a disability or elderly people, or any other specific need.

Learn about our data and confidentiality safeguards, and the steps we take to produce statistics that can be trusted by all.