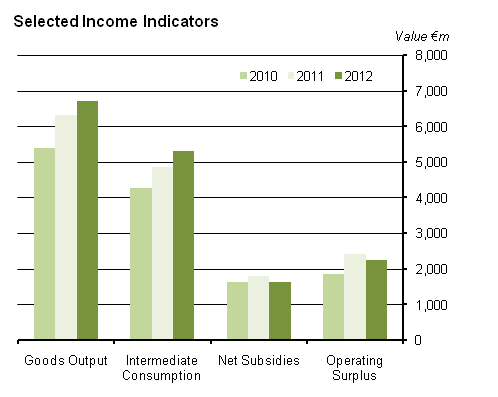

| Goods Output | Intermediate Consumption | Net Subsidies | Operating Surplus | |

| 2010 | €5,380m | €4,271m | €1,641m | €1,843m |

| 2011 | €6,307m | €4,847m | €1,804m | €2,424m |

| 2012 | €6,717m | €5,293m | €1,639m | €2,241m |

| % Change ('11 on '10) | 17.2% | 13.5% | 9.9% | 31.5% |

| % Change ('12 on '11) | 6.5% | 9.2% | -9.2% | -7.5% |

The CSO's final estimate of operating surplus in agriculture in 2012 shows an annual decrease of 7.5%. This follows an increase of 31.5% in 2011. The drop in operating surplus in 2012 can be mostly attributed to an increase in intermediate consumption by 9.2%. See Table1.

Further comparison of 2012 to 2011 shows the following changes in estimated value

These figures are based on the final annual data and update preliminary estimates published by the CSO in February 2013.

| Table 1 Output, Input and Income in Agriculture, 2010 - 2012 | €m | ||||

| Description | Estimated Value (at current prices) | ||||

| 2010 | 2011 | 2012 | |||

| Livestock (incl. stock changes) | 2,282.4 | 2,654.7 | 3,118.7 | ||

| Cattle | 1,502.3 | 1,794.9 | 2,119.6 | ||

| Pigs | 333.7 | 394.2 | 441.5 | ||

| Sheep | 165.6 | 189.8 | 204.4 | ||

| Horses | 150.8 | 136.6 | 194.7 | ||

| Poultry | 130.1 | 139.2 | 158.4 | ||

| Livestock products | 1,590.9 | 1,894.0 | 1,701.5 | ||

| Milk | 1,541.9 | 1,834.8 | 1,629.8 | ||

| Other products | 49.0 | 59.2 | 71.8 | ||

| Crops (incl. stock changes) | 1,506.8 | 1,758.1 | 1,896.3 | ||

| Barley | 118.8 | 163.2 | 210.1 | ||

| Wheat | 60.8 | 104.9 | 102.9 | ||

| Oats | 14.3 | 20.8 | 23.6 | ||

| Potatoes | 105.6 | 80.3 | 79.5 | ||

| Mushrooms | 98.5 | 100.3 | 111.9 | ||

| Other fresh vegetables | 94.0 | 94.7 | 89.1 | ||

| Fresh fruit | 35.2 | 35.7 | 46.4 | ||

| Turf | 34.2 | 35.0 | 32.6 | ||

| Other crops | 58.4 | 72.3 | 67.0 | ||

| Forage plants | 887.0 | 1,050.9 | 1,133.2 | ||

| Goods output at producer prices | 5,380.1 | 6,306.8 | 6,716.6 | ||

| Contract work | 277.7 | 335.7 | 360.4 | ||

| Subsidies on products | 31.8 | 31.0 | 28.5 | ||

| Taxes on products | 42.3 | 42.0 | 56.7 | ||

| Agricultural output at basic prices | 5,647.3 | 6,631.4 | 7,048.8 | ||

| Intermediate consumption | 4,271.1 | 4,846.6 | 5,293.4 | ||

| Feedingstuffs | 1,041.1 | 1,175.1 | 1,434.1 | ||

| Fertilisers | 450.3 | 493.7 | 492.0 | ||

| Financial intermediation services indirectly measured (FISIM)1 | 60.0 | 47.0 | 42.0 | ||

| Seeds | 61.9 | 71.5 | 72.3 | ||

| Energy and lubricants | 386.9 | 480.7 | 501.3 | ||

| Maintenance and repairs | 405.1 | 434.6 | 458.2 | ||

| Other Goods and services | 419.3 | 455.7 | 468.8 | ||

| Crop protection products | 54.1 | 58.3 | 66.2 | ||

| Veterinary expenses | 240.3 | 259.6 | 281.4 | ||

| Forage plants | 874.5 | 1,034.8 | 1,116.7 | ||

| Contract work | 277.7 | 335.7 | 360.4 | ||

| Gross value added at basic prices | 1,376.2 | 1,784.8 | 1,755.4 | ||

| Fixed capital consumption | 750.4 | 723.1 | 720.0 | ||

| Machinery, equipment, etc. | 459.9 | 443.5 | 439.3 | ||

| Farm buildings | 290.5 | 279.7 | 280.7 | ||

| Net value added at basic prices | 625.8 | 1,061.7 | 1,035.5 | ||

| Other subsidies less taxes on production | 1,651.8 | 1,815.4 | 1,666.9 | ||

| Factor income | 2,277.6 | 2,877.1 | 2,702.4 | ||

| Compensation of employees | 434.8 | 453.4 | 461.2 | ||

| Operating surplus | 1,842.8 | 2,423.7 | 2,241.2 | ||

| Interest less FISIM | 304.5 | 310.9 | 312.0 | ||

| Land rental | 151.1 | 201.0 | 202.0 | ||

| Entrepreneurial income | 1,387.2 | 1,911.8 | 1,727.3 | ||

| 1FISIM : Financial Intermediation Services Indirectly Measured. (See Background Notes). | |||||

| Table 2 Selected Volume Indices, 2010 - 2012 | |||||

| Base year: 2005=100 | |||||

| Description | 2010 | 2011 | 2012 | ||

| Goods output at producer prices | 96.8 | 99.7 | 99.5 | ||

| Livestock1 | 95.6 | 96.0 | 98.8 | ||

| Cattle | 94.9 | 96.7 | 97.3 | ||

| Pigs | 114.5 | 122.8 | 124.6 | ||

| Sheep | 63.3 | 67.1 | 76.8 | ||

| Horses | 109.5 | 89.2 | 101.1 | ||

| Poultry | 85.5 | 84.4 | 86.5 | ||

| Livestock products | 102.2 | 105.4 | 102.6 | ||

| Milk | 102.5 | 105.6 | 102.2 | ||

| Crops1 | 93.0 | 99.9 | 97.6 | ||

| Barley | 102.3 | 129.8 | 137.8 | ||

| Wheat | 78.1 | 128.3 | 98.6 | ||

| Potatoes | 109.6 | 108.5 | 70.3 | ||

| Fresh vegetables | 78.7 | 91.5 | 90.9 | ||

| Intermediate consumption | 97.9 | 100.1 | 104.0 | ||

| Feedingstuffs | 103.2 | 100.5 | 115.1 | ||

| Fertilisers | 95.9 | 86.8 | 83.5 | ||

| Financial intermediation services indirectly measured (FISIM) | 70.1 | 54.8 | 48.1 | ||

| Seeds | 119.8 | 92.0 | 80.4 | ||

| Energy and lubricants | 106.0 | 115.6 | 112.0 | ||

| Maintenance and repairs | 99.3 | 107.7 | 112.9 | ||

| Other goods and services | 106.9 | 117.7 | 115.2 | ||

| Crop protection products | 94.0 | 103.4 | 118.5 | ||

| Veterinary expenses | 94.8 | 101.5 | 108.3 | ||

| Gross value added at basic prices | 74.4 | 80.0 | 71.6 | ||

| 1Including changes in stocks | |||||

This release contains final estimates of agricultural accounts for 2012. Three estimates are prepared in each 12-month period for the agricultural accounts. The first or advance estimates are generally released in early December of the reference year for which the accounts are prepared. In February of the year following the reference year preliminary estimates are prepared. In June of the year following the reference year the final estimates of the agricultural accounts are prepared. The estimates are based on a methodology arising from the revision of the System of National Accounts in 1995. For details of this methodology see the “Output, Input and Income in Agriculture” release of 2 July 2002. For details of data sources see the corresponding release of 24 June 2004.

Producer price

This is the price received by the farmer for his agricultural produce. It is sometimes referred to as the farm-gate or ex-farm price. It excludes VAT.

Subsidies and taxes on products

Subsidies and taxes on agricultural products are those paid or levied per unit on a good or service produced or imported. Examples of subsidies on products are the suckler cow premium and the special beef premium. The bovine disease eradication levy is an example of a tax on products. These subsidies and taxes are included in the calculation of agricultural output.

Other subsidies and taxes on production

Other subsidies on production are subsidies other than those on products. Examples are the single payment scheme, the rural environmental protection scheme and the area based compensatory allowance scheme. Taxes on production consist of VAT over-/under-compensation from farmers who have opted for the flat rate VAT system, and motor taxation paid by farmers. Other subsidies less taxes on production are not included in the calculation of output, but are included in the calculation of operating surplus.

Net subsidies

Net subsidies are subsidies on products plus subsidies on production less taxes on products and taxes on production.

Basic price

The basic price corresponds to the producer price plus any subsidies directly linked to a product minus any taxes on products. VAT is excluded.

Valuation of stock changes

For each category, the difference between closing year stocks and opening yearstocks is valued at the average producer price for the year. The changes for cattle are obtained from the Department of Agriculture, Food and Marine’s (DAFM) Animal Identification and Movement (AIM) system (formerly known as the Cattle Movement Monitoring System (CMMS)). This system involves electronically recording data on animal movements.

Forage plants

The production of forage plants is valued as part of output. Silage and hay are the main items in this category. Direct sales of cereals between farms and use of cereals within farms are also included under forage plants. These items are also treated as intermediate consumption with minor exceptions, such as sales of straw to racing stables.

Contract work

Activities performed by agricultural contractors directly linked to the production of agricultural products (for example harvesting) are an integral part of agriculture. The value of such work is included as output and also as intermediate consumption. Estimates of the input costs incurred by agricultural contractors in the provision of their agricultural service are included under the appropriate intermediate consumption categories, as well as in the compensation of employees figure.

FISIM

Financial intermediaries (mainly banks) charge explicit commissions and fees for their services to customers, as well as implicit ones by paying and charging different rates of interest to borrowers and lenders. The revenue from the margin on lending and borrowing by financial intermediaries is described as financial intermediation services indirectly measured (FISIM). The inclusion of FISIM in the table is in line with recommended EU national accounting conventions. It is a reallocation to intermediate consumption of part of the interest paid by farmers. While the inclusion of FISIM will increase intermediate consumption and decrease gross value added, it will decrease, by the same amount, the figure shown for interest paid.

Fixed capital consumption

This relates to the foreseeable wear and tear and obsolescence of fixed capital goods. It is calculated on the basis of the probable economic life of the asset. It is not calculated for breeding livestock or for non-produced assets such as land.

Compensation of employees

This includes remuneration in cash and in kind. It does not include the remuneration of work undertaken by the farmer or by non-salaried family farm members.

Operating surplus

The operating surplus figure is comprised of the operating surplus earned by farmers and that earned by agricultural contractors. It is calculated before deductions for interest payments on borrowed capital and before deductions for land annuities and for rent paid by farmers to landowners for the use of their land.

Entrepreneurial Income

Entrepreneurial income is comprised of operating surplus less interest payments on borrowed capital and land rental paid by farmers to landowners.

Volume indices

These are calculated by applying base year prices (2005) to current year quantities. The volume index for 2012 is calculated by comparing the total value in 2012 at average 2005 prices against the total value in 2005 at average 2005 prices.

Hide Background Notes

Hide Background Notes

Scan the QR code below to view this release online or go to

http://www.cso.ie/en/releasesandpublications/er/oiiaf/outputinputandincomeinagriculture-finalestimate2012/