| International sourcing by type of enterprise group structure, 2009-2011 | |||||||

| Number of enterprises | Percentage of enterprises engaged in international sourcing | ||||||

| Engaged in international sourcing | Not engaged in international sourcing | All enterprises | |||||

| In enterprise group | 143 | 662 | 805 | 17.8 | |||

| Enterprise group head | 15 | 111 | 126 | 11.9 | |||

| Subsidiary | 127 | 552 | 679 | 18.7 | |||

| - Subsidiary with global group head in Ireland | 18 | 182 | 200 | 9.0 | |||

| - Subsidiary with global group head within EU27 | 52 | 179 | 231 | 22.5 | |||

| - Subsidiary with global group head outside EU27 | 57 | 191 | 248 | 23.0 | |||

| Not in enterprise group | 6 | 448 | 454 | 1.3 | |||

| Total | 148 | 1,111 | 1,259 | 11.8 | |||

The purpose of the International Sourcing Survey is to establish data on the movement of Irish business activity abroad during the reference period 2009-2011. It provides information on the level and pattern of international sourcing in the Irish business economy. International sourcing involves the movement of one or more business functions abroad to an enterprise within or outside the enterprise group.

Almost 12% of large Irish enterprises (100 or more employees) engaged in international sourcing during the period 2009-2011. Around three-quarters of these enterprises were part of multinational enterprise groups with the head of the group residing outside of Ireland. The vast majority of international sourcing from Ireland was to other Member States of the EU.

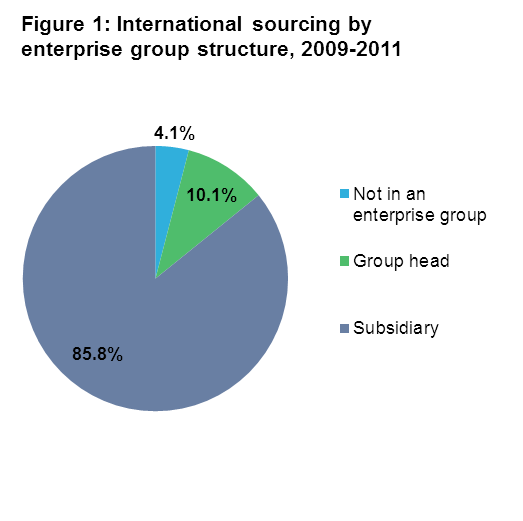

Of those enterprises that engaged in international sourcing between 2009 and 2011, almost 86% were subsidiaries controlled by other enterprises; just over 10% were enterprise group heads; and just over 4% were standalone enterprises.

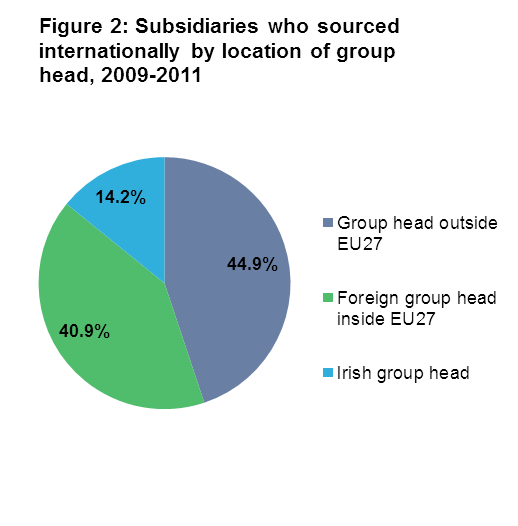

Looking specifically at the subsidiaries who engaged in international sourcing between 2009 and 2011, almost 86% were controlled by group heads outside of Ireland. This consists of almost 45% with a group head outside of the EU27 and almost 41% with a group head inside the EU27. See Figure 2 and Headline Table.

Therefore, of the 148 enterprises that sourced business functions abroad between 2009 and 2011, 109 enterprises were part of multinational enterprise groups with a foreign group head. See Headline Table.

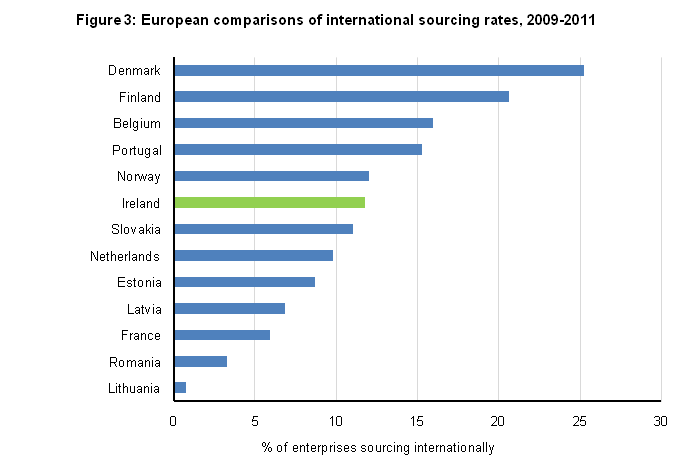

Similar surveys on international sourcing were carried out by a number of countries across the EU27. EU aggregates are not available as not every EU country participated in the survey. Using these international comparisons, it can be seen the Nordic countries of Denmark and Finland had the highest rates of international sourcing between 2009 and 2011 at over 25% and almost 21% respectively. Romania and Lithuania had the lowest rates of international sourcing at over 3% and almost 1% respectively. At almost 12%, Ireland had a similar international sourcing rate to both Norway and Slovakia. See Figure 3 and Table 7.

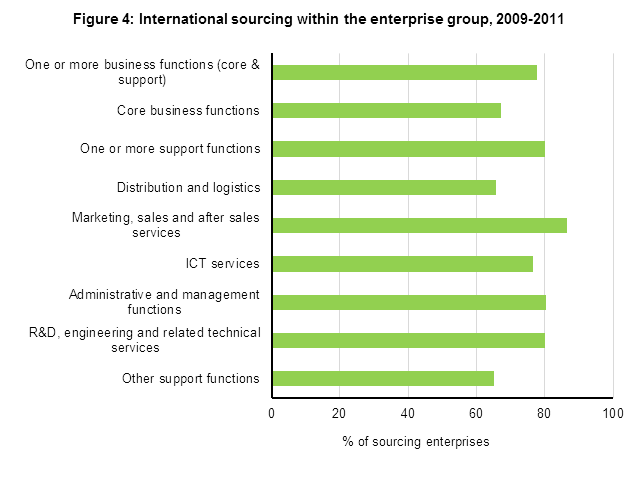

Almost 78% of enterprises who engaged in international sourcing in Ireland tended to source business functions to enterprises within their enterprise group. This highlights that the nature of international sourcing in Ireland between 2009 and 2011 was largely based around foreign multinationals moving business functions abroad to other enterprises within their own enterprise group.

When the enterprises that sourced within their own enterprise group across the different business functions was examined, there were high proportions in evidence across both core and support business functions. The business function with the highest proportion of enterprises sourcing within the enterprise group was “Marketing, sales and after sales services” at over 86%. See Figure 4 and Table 1.

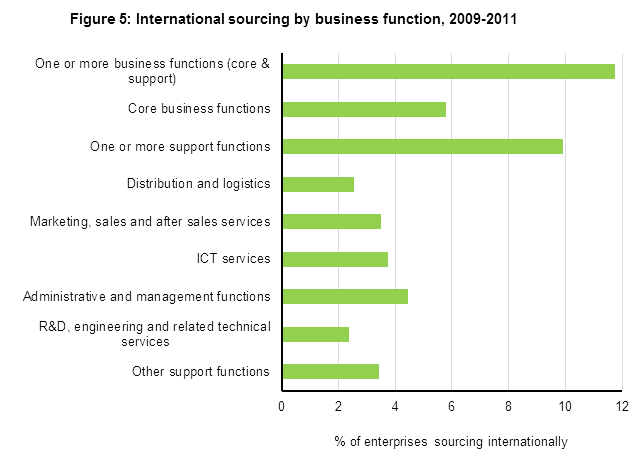

As already shown, almost 12% of large Irish enterprises sourced one or more business functions abroad during the period 2009 to 2011. Almost 6% of enterprises sourced their core business function and almost 10% sourced one or more support functions. Of the individual support business functions, the rate of international sourcing ranged from over 2% for "Research & development, engineering and related technical services" to over 4% for “Administrative and management functions”. See Figure 5 and Table 2

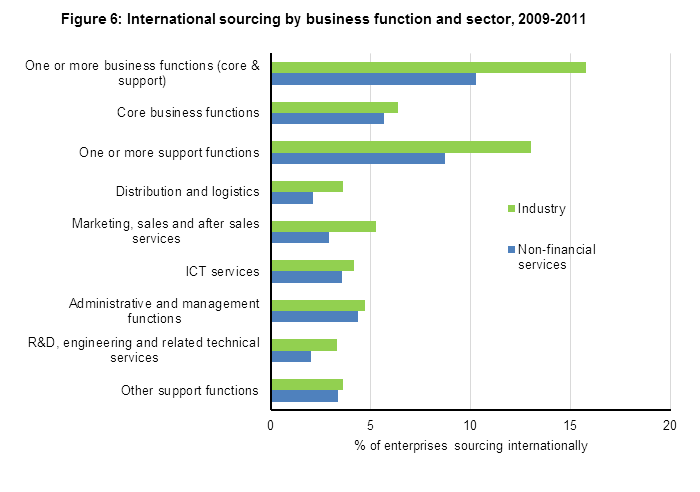

When comparing the rate of international sourcing within the sectors of "Industry" and "Non-Financial Services", it can be seen that within every category of business function "Industry" displayed a higher rate of international sourcing. At the overall level, almost 16% of large industrial enterprises engaged in international sourcing during 2009 to 2011 while the equivalent rate for large services enterprises was just over 10% See Figure 6 and Table 2.

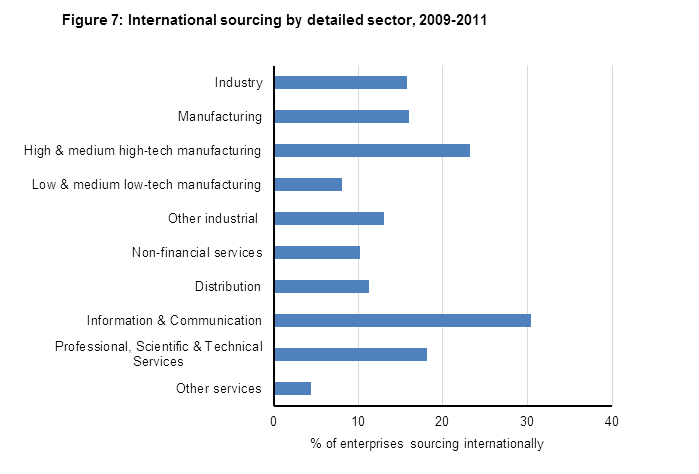

There was some variability in the rates of international sourcing among large Irish enterprises when the detailed sectoral breakdown was examined. Two sectors with particularly high rates of international sourcing were "High & Medium High-Tech Manufacturing" at over 23% and "Information & Communication" at over 30%. See Figure 7 and Table 3.

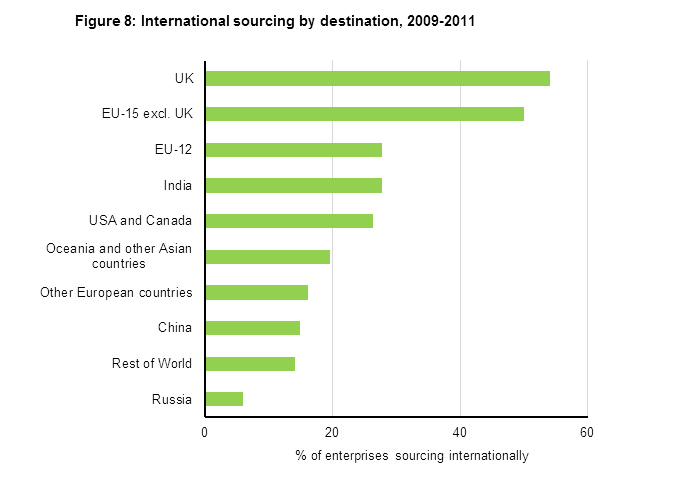

Of the 148 large Irish enterprises that engaged in international sourcing, 80 enterprises or over 54% sourced at least one business function to the UK and 74 enterprises or 50% sourced at least one business function to one of the other EU15 countries. Other popular destinations for international sourcing were the EU12, India, USA and Canada. Note that an enterprise may have sourced business functions to more than one destination during the period 2009 to 2011. Therefore, the total number of enterprises who sourced internationally is not equal to the sum of the geographical breakdown. See Figure 8 and Table 4.

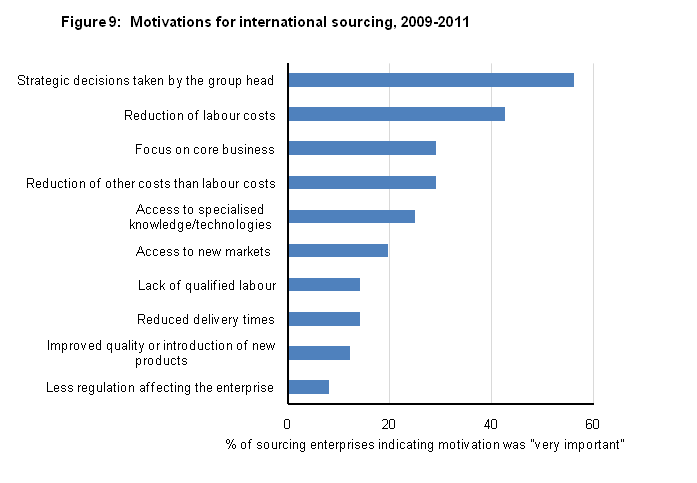

Over 56% of enterprises indicated that a strategic decision taken by the group head was a very important motivation for international sourcing during the period 2009 to 2011. The majority of Irish enterprises that sourced business functions abroad were subsidiaries within enterprise groups. The second most cited motivation for international sourcing, at almost 43%, was a reduction of labour costs. See Figure 9 and Table 5.

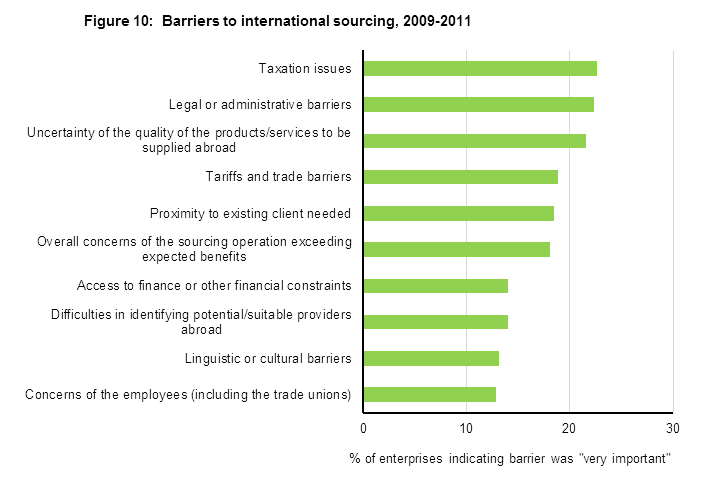

The survey enquired of all responding enterprises about the barriers to international sourcing. Almost 23% of enterprises indicated that taxation issues were a very important barrier to international sourcing during the period 2009 to 2011. The next two strongest barriers to international sourcing were legal or administrative barriers and uncertainty over the quality of the products/services to be supplied abroad. See Figure 10 and Table 6.

| Table 1: International sourcing by type of business partner, 2009-2011 | ||||||

| Number of enterprises | Percentage to enterprises within own enterprise group abroad | |||||

| To enterprises within own enterprise group abroad | To enterprises outside own enterprise group abroad | No answer | Total 1 | |||

| One or more business functions (core & support) 2 | 115 | 42 | 6 | 148 | 77.7 | |

| Core business functions | 49 | 19 | 6 | 73 | 67.1 | |

| One or more support functions | 100 | 28 | 6 | 125 | 80.0 | |

| - Distribution and logistics | 21 | 6 | 4 | 32 | 65.6 | |

| - Marketing, sales and after sales services | 38 | 2 | 4 | 44 | 86.4 | |

| - ICT services | 36 | 9 | 2 | 47 | 76.6 | |

| - Administrative and management functions | 45 | 7 | 4 | 56 | 80.4 | |

| - Research & Development, engineering and related technical services | 24 | 2 | 4 | 30 | 80.0 | |

| - Other support functions | 28 | 7 | 8 | 43 | 65.1 | |

| 1 Enterprises can source to other enterprises both inside and outside the enterprise group for the categories "one or more business functions" and "one or more support functions". Hence the sum of the columns does not equal the total for these categories. | ||||||

| 2 Enterprises can source more than one business function. Hence the sum of the individual business functions do not equal the totals. | ||||||

| Table 2: International sourcing by business function and broad sector, 2009-2011 | |||

| Industry | Non-financial services | Total | |

| All enterprises | 361 | 898 | 1259 |

| Number of enterprises engaged in international sourcing | |||

| One or more business functions (core & support) 1 | 57 | 92 | 148 |

| Core business function | 23 | 51 | 73 |

| One or more support functions | 47 | 78 | 125 |

| - Distribution and logistics | 13 | 19 | 32 |

| - Marketing, sales and after sales services | 19 | 26 | 44 |

| - ICT services | 15 | 32 | 47 |

| - Administrative and management functions | 17 | 39 | 56 |

| - Research & Development, engineering and related technical services | 12 | 18 | 30 |

| - Other support functions | 13 | 30 | 43 |

| Percentage of enterprises engaged in international sourcing | |||

| One or more business functions (core & support) 1 | 15.8 | 10.2 | 11.8 |

| Core business function | 6.4 | 5.7 | 5.8 |

| One or more support functions | 13.0 | 8.7 | 9.9 |

| - Distribution and logistics | 3.6 | 2.1 | 2.5 |

| - Marketing, sales and after sales services | 5.3 | 2.9 | 3.5 |

| - ICT services | 4.2 | 3.6 | 3.7 |

| - Administrative and management functions | 4.7 | 4.3 | 4.4 |

| - Research & Development, engineering and related technical services | 3.3 | 2.0 | 2.4 |

| - Other support functions | 3.6 | 3.3 | 3.4 |

| 1 Enterprises can source more than one business function. Hence the sum of the individual business functions do not equal the totals. | |||

| Table 3: International sourcing by detailed sector, 2009-2011 | |||

| Number of enterprises | Percentage of enterprises engaged in international sourcing | ||

| Sector 1 | Enterprises engaged in international sourcing | All enterprises | |

| Industry (B-E) | 57 | 361 | 15.8 |

| Manufacturing (C) | 54 | 338 | 16.0 |

| - High & medium high-tech manufacturing | 41 | 177 | 23.2 |

| - Low & medium low-tech manufacturing | 13 | 161 | 8.1 |

| Other industrial (B,D,E) | 3 | 23 | 13.0 |

| Non-financial services (F-N excl K) | 92 | 898 | 10.2 |

| Distribution (G) | 32 | 283 | 11.3 |

| Information & Communication (J) | 24 | 79 | 30.4 |

| Professional, Scientific & Technical Services (M) | 15 | 83 | 18.1 |

| Other services (F, H, I, L, N) | 20 | 453 | 4.4 |

| Total | 148 | 1259 | 11.8 |

| 1 Please see background notes for NACE Rev. 2 classifications | |||

| Table 4: International sourcing by destination and business function, 2009-2011 | |||||||||||

| Number of enterprises | Percentage of enterprises | ||||||||||

| Sourcing core business functions | Sourcing support business functions | Sourcing any business function | Sourcing core business functions | Sourcing support business functions | Sourcing any business function | ||||||

| UK | 30 | 68 | 80 | 41.1 | 54.4 | 54.1 | |||||

| EU-15 excl. UK | 32 | 55 | 74 | 43.8 | 44.0 | 50.0 | |||||

| EU-12 | 19 | 28 | 41 | 26.0 | 22.4 | 27.7 | |||||

| India | 11 | 30 | 41 | 15.1 | 24.0 | 27.7 | |||||

| USA and Canada | 15 | 28 | 39 | 20.5 | 22.4 | 26.4 | |||||

| Oceania and other Asian countries | 17 | 17 | 29 | 23.3 | 13.6 | 19.6 | |||||

| Other European countries | 18 | 8 | 24 | 24.7 | 6.4 | 16.2 | |||||

| China | 15 | 11 | 22 | 20.5 | 8.8 | 14.9 | |||||

| Rest of World | 14 | 12 | 21 | 19.2 | 9.6 | 14.2 | |||||

| Russia | 5 | 4 | 9 | 6.8 | 3.2 | 6.1 | |||||

| All destinations 1 | 73 | 125 | 148 | ||||||||

| 1 Enterprises can source a business function to more than one destination. Hence the sum of the regions does not equal the total. | |||||||||||

| Table 5: Motivating factors for international sourcing, 2009-2011 | ||||||

| Number of enterprises | Percentage very important | |||||

| No answer | Not important | Important | Very important | Total | ||

| Strategic decisions taken by the group head | 4 | 23 | 39 | 83 | 148 | 56.1 |

| Reduction of labour costs | 4 | 40 | 42 | 63 | 148 | 42.6 |

| Focus on core business | 14 | 54 | 37 | 43 | 148 | 29.1 |

| Reduction of other costs than labour costs | 6 | 42 | 57 | 43 | 148 | 29.1 |

| Access to specialised knowledge/technologies | 11 | 75 | 25 | 37 | 148 | 25.0 |

| Access to new markets | 13 | 79 | 27 | 29 | 148 | 19.6 |

| Lack of qualified labour | 11 | 96 | 20 | 21 | 148 | 14.2 |

| Reduced delivery times | 17 | 88 | 22 | 21 | 148 | 14.2 |

| Improved quality or introduction of new products | 14 | 92 | 24 | 18 | 148 | 12.2 |

| Less regulation affecting the enterprise | 16 | 102 | 18 | 12 | 148 | 8.1 |

| Table 6: Barriers to international sourcing, 2009-2011 | ||||||

| Number of enterprises | Percentage very important | |||||

| No answer | Not important | Important | Very important | Total | ||

| Taxation issues | 157 | 402 | 415 | 285 | 1259 | 22.6 |

| Legal or administrative barriers | 174 | 402 | 402 | 281 | 1259 | 22.3 |

| Uncertainty of the quality of the products/services to be supplied abroad | 177 | 416 | 394 | 272 | 1259 | 21.6 |

| Tariffs and trade barriers | 165 | 473 | 385 | 237 | 1259 | 18.8 |

| Proximity to existing client needed | 167 | 459 | 400 | 233 | 1259 | 18.5 |

| Overall concerns of the sourcing operation exceeding expected benefits | 179 | 371 | 482 | 228 | 1259 | 18.1 |

| Access to finance or other financial constraints | 173 | 577 | 332 | 177 | 1259 | 14.1 |

| Difficulties in identifying potential/suitable providers abroad | 168 | 463 | 451 | 177 | 1259 | 14.1 |

| Linguistic or cultural barriers | 165 | 498 | 430 | 166 | 1259 | 13.2 |

| Concerns of the employees (including the trade unions) | 186 | 476 | 436 | 162 | 1259 | 12.9 |

| Table 7: European comparisons of international sourcing by broad sector1, 2009-2011 | |||||||||||

| Number of enterprises engaged in international sourcing | Total number of enterprises | Percentage of enterprises engaged in international sourcing | |||||||||

| Industry | Non-financial services | All sectors | Industry | Non-financial services | All sectors | Industry | Non-financial services | All sectors | |||

| Denmark | 152 | 162 | 314 | 452 | 792 | 1,244 | 33.6 | 20.5 | 25.2 | ||

| Finland | 144 | 102 | 247 | 502 | 696 | 1,198 | 28.7 | 14.7 | 20.6 | ||

| Belgium | 81 | 50 | 131 | 362 | 460 | 822 | 22.4 | 10.9 | 15.9 | ||

| Portugal | 190 | 191 | 381 | 1,045 | 1,451 | 2,496 | 18.2 | 13.2 | 15.3 | ||

| Norway | 80 | 92 | 172 | 445 | 986 | 1,431 | 18.0 | 9.3 | 12.0 | ||

| Ireland | 57 | 92 | 148 | 361 | 898 | 1,259 | 15.8 | 10.2 | 11.8 | ||

| Slovakia | 73 | 68 | 141 | 723 | 554 | 1,277 | 10.1 | 12.3 | 11.0 | ||

| Netherlands | 203 | 244 | 447 | 1,282 | 3,278 | 4,560 | 15.8 | 7.5 | 9.8 | ||

| Estonia | 36 | 8 | 45 | 247 | 267 | 514 | 14.7 | 3.1 | 8.7 | ||

| Latvia | 17 | 24 | 41 | 208 | 392 | 600 | 8.2 | 6.1 | 6.8 | ||

| France | 473 | 327 | 800 | 4,507 | 9,024 | 13,531 | 10.5 | 3.6 | 5.9 | ||

| Romania | 78 | 68 | 146 | 2,283 | 2,163 | 4,445 | 3.4 | 3.1 | 3.3 | ||

| Lithuania | 0 | 7 | 7 | 383 | 562 | 945 | 0.0 | 1.2 | 0.7 | ||

| 1 Please see background notes for NACE Rev. 2 classifications | |||||||||||

International Sourcing Survey 2009-2011

Background Notes

Survey Design

The International Sourcing Survey was carried out between July and December 2012. It used the CSO eForms which allows respondents to complete the questionnaire via an internet portal. It was a census of all enterprises in Ireland with 100 or more employees in the Irish business economy (NACE Rev. 2 sectors B to N excluding K). Enterprises were identified using the CSO Central Business Register. The survey was issued to 1259 enterprises and the overall response rate was 44.3 per cent. Full details of the response rates for the main sectors are outlined in the table below.

|

International Sourcing Survey 2009-2011 – target population and response rates by sector. |

|||

|

Sector (NACE Rev. 2) |

Total number of enterprises with 100+ persons employed |

Number of responding enterprises |

Response rates |

|

Mining and quarrying (B) |

5 |

2 |

40.00% |

|

Manufacturing (C) |

338 |

161 |

47.60% |

|

Electricity, gas, steam and air conditioning supply (D) |

6 |

3 |

50.00% |

|

Water supply; sewerage, waste management and remediation activities (E) |

12 |

4 |

33.30% |

|

Construction (F) |

51 |

16 |

31.40% |

|

Wholesale and retail trade; repair of motor vehicles and motorcycles (G) |

283 |

132 |

46.60% |

|

Transportation and storage (H) |

65 |

36 |

55.40% |

|

Accommodation and food service activities (I) |

191 |

65 |

34.00% |

|

Information and communication (J) |

79 |

34 |

43.00% |

|

Real estate activities (L) |

10 |

4 |

40.00% |

|

Professional, scientific and technical activities (M) |

83 |

49 |

59.00% |

|

Administrative and support service activities (N) |

136 |

52 |

38.20% |

|

All sectors |

1,259 |

558 |

44.30% |

Definitions

International Sourcing

Sourcing refers to the movement of business functions from an enterprise to another enterprise within or outside the enterprise group. The movement of business functions within Ireland is referred to as domestic sourcing and the movement of business functions outside Ireland (including previously domestically sourced functions) is referred to as international sourcing.

Please note that this survey enquired specifically about international sourcing of business functions during the period 2009-2011. Therefore, an enterprise was not counted as having engaged in international sourcing if the movement of the activity occurred previous to 2009.

Enterprise group

An enterprise group is a set of enterprises controlled by the group head. It is an association of enterprises bound together by legal and/or financial links. A group of enterprises can have more than one decision-making centre, especially for policy on production, sales and profits. It may centralise certain aspects of financial management and taxation. It constitutes an economic entity which is empowered to make choices, particularly concerning the units which it comprises. The most extensive version of an enterprise group includes affiliates, sister enterprises, the parent enterprise and even joint ventures.

Control

Control means the ability to determine the general policy of an enterprise by choosing appropriate directors, if necessary. In this context, enterprise A is deemed to be controlled by enterprise B, when B controls, whether directly or indirectly, more than half of the shareholders voting power or more than half of the shares in enterprise A.

Indirect control means than an enterprise may have control through another affiliate which has control over enterprise A.

Control can be exerted via effective minority control without owning more than half of the shareholders voting power or more than half of the shares.

Group Head

The group head is a parent legal unit, which is not controlled either directly or indirectly by any other legal unit, controlling one or more enterprises. In the case of multinational enterprise groups global and domestic group heads can be identified. The global group head is the group head of the multinational enterprise group, the domestic group head is on the top of the truncated national part of the multinational enterprise group.

Subsidiary

A subsidiary is a legal unit which is controlled either directly or indirectly by another legal unit in an enterprise group.

Business Functions

Core business function:

This function is the primary activity of the enterprise and will in most cases equate with the main activity of the enterprise. It includes production of final goods or services intended for the market/for third parties carried out by the enterprise and yielding income. The core business function equals in most cases the primary activity of the enterprise. It may also include other (secondary) activities if the enterprise considers these to comprise part of their core functions.

Support business functions:

Support business functions (ancillary activities) are carried out in order to permit or facilitate production of goods or services intended for the market/for third parties by the enterprise. The outputs of the support business functions are not themselves intended directly for the market/for third parties.

The support business functions are divided into:

Classifications

Geographical Areas

The geographical areas used in this survey are as follows:

NACE Rev.2 is the statistical classification of economic activities. NACE is an acronym for 'Nomenclature Généraile des Activities Économiques dams les Communautés Eurpéenes' (General Industrial Classification of Economic Activities withn the European Communities).

|

Industry (Sections B to E): |

|

|

|

|

Manufacturing (Section C): |

|

|

|

High-technology manufacturing: |

|

|

|

Division 21 |

Pharmaceuticals |

|

|

Division 26 |

Computers, electronic & optical products |

|

|

Group 30.3 |

Air spacecraft |

|

|

Medium-high-technology manufacturing: |

|

|

|

Division 20 |

Chemicals |

|

|

Group 25.4 |

Weapons & ammunition |

|

|

Division 27 |

Electrical equipment |

|

|

Division 28 |

Machinery |

|

|

Division 29 |

Motor vehicles |

|

|

Division 30_X_30.1_30.3 |

Transport equipment excluding ships, boats, excluding air & spacecraft |

|

|

Group 32.5 |

Medical & dental instruments |

|

|

Medium-low-technology manufacturing: |

|

|

|

Group 18.2 |

Reproduction recorded media |

|

|

Division 19 |

Coke and petroleum products |

|

|

Division 22 |

Rubber and plastic products |

|

|

Division 23 |

Other non-metallic mineral products |

|

|

Division 24 |

Basic metals |

|

|

Division 25_X_25.4 |

Fabricated metal products excluding machinery |

|

|

Group 30.1 |

Ships and boats |

|

|

Division 33 |

Repair & installation machinery |

|

|

Low-technology manufacturing: |

|

|

|

Division 10 |

Food |

|

|

Division 11 |

Beverages |

|

|

Division 12 |

Tobacco |

|

|

Division 13 |

Textiles |

|

|

Division 14 |

Clothing |

|

|

Division 15 |

Leather products |

|

|

Division 16 |

Wood products |

|

|

Division 17 |

Paper products |

|

|

Division 18.1 |

Printing |

|

|

Division 31 |

Furniture |

|

|

Division 32_X_32.5 |

Other manufacturing excluding medical and dental instruments |

|

|

Other industrial: |

|

|

|

Section B |

Mining and quarrying |

|

|

Section D |

Electricity, gas, steam and air conditioning supply |

|

|

Section E |

Water supply; sewerage, waste management and remediation services |

|

Non-financial services (Sections F to N excluding K): |

|

|

|

|

Distribution: |

|

|

|

Section G |

Wholesale and retail trade; repair of motor vehicles and motorcycles |

|

Information & Communication: |

|

|

|

|

Section J |

Information and communication |

|

Professional, Scientific & Technical Services: |

|

|

|

|

Section M |

Professional, scientific and technical activities |

|

Other services: |

|

|

|

|

Section F |

Construction |

|

|

Section H |

Transportation and storage |

|

|

Section I |

Accommodation and food service activities |

|

|

Section L |

Real estate activities |

|

|

Section N |

Administrative and support service activities |

Hide Background Notes

Hide Background Notes

Scan the QR code below to view this release online or go to

http://www.cso.ie/en/releasesandpublications/er/intss/internationalsourcingsurvey2009-2011/