| € million | ||||

| Merchandise Balance | Invisibles Balance | Current Account Balance | Current Account Balance as % of GDP | |

| Q3 2014 | 12,359 | -8,511 | 3,847 | 8.2 |

| Q3 2013 | 9,583 | -6,896 | 2,687 | 6.0 |

| Q1-Q3 2014 | 34,684 | -26,933 | 7,749 | 5.7 |

| Q1-Q3 2013 | 28,547 | -23,753 | 4,794 | 3.7 |

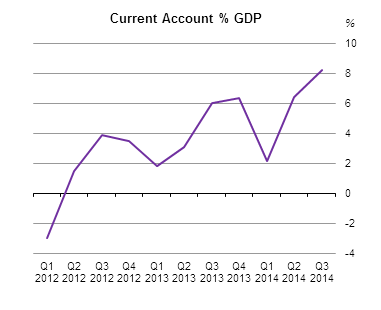

The Balance of Payments current account surplus in the third quarter of 2014 was €3,847m – an increase from the €2,687m surplus in the third quarter of 2013 - see Table 1. A surplus of €12,359m on merchandise was offset by a deficit of €8,511m on invisibles in the quarter.

| X-axis label | Merchandise | Services | Primary Income |

|---|---|---|---|

| Q1 2012 | 9935 | -1732 | -8698 |

| Q2 2012 | 11606 | -2482 | -7928 |

| Q3 2012 | 11056 | -911 | -7843 |

| Q4 2012 | 9808 | -1853 | -5840 |

| Q1 2013 | 8671 | -232 | -6786 |

| Q2 2013 | 10293 | -232 | -8095 |

| Q3 2013 | 9583 | 520 | -6929 |

| Q4 2013 | 7635 | 242 | -4454 |

| Q1 2014 | 10146 | -1166 | -7284 |

| Q2 2014 | 12179 | -1006 | -7696 |

| Q3 2014 | 12359 | -839 | -7266 |

Other points of note are:

Current account (see Table 2a)

Financial account (see Tables 2b and 3)

| Table 1 Summary of Current, Capital and Financial Account Balances | € million | ||||||||||||||||||

| Period | Balance on Current Account | Balance on Capital Account | Direct Investment | Portfolio Investment | Other2 Investment | Reserve Assets | Balance on Financial Account | Net errors and omissions | |||||||||||

| Merchandise1 | Invisibles | ||||||||||||||||||

| Services | Primary Income | Secondary Income | Total | ||||||||||||||||

| 1998 | Year | 17,510 | -8,426 | -9,776 | 1,319 | -16,883 | 627 | 840 | -4,422 | 8,466 | -7,459 | 2,280 | -1,135 | -2,602 | |||||

| 1999 | Year | 22,170 | -9,723 | -13,398 | 1,177 | -21,944 | 226 | 560 | -11,359 | 14,342 | 974 | -1,746 | 2,211 | 1,425 | |||||

| 2000 | Year | 27,266 | -13,312 | -15,327 | 994 | -27,645 | -379 | 1,182 | -22,957 | 5,358 | 9,037 | 142 | -8,420 | -9,223 | |||||

| 2001 3 | Year | 30,494 | -12,412 | -18,340 | -497 | -31,249 | -755 | 779 | -6,241 | 25,158 | -19,039 | 441 | 319 | 295 | |||||

| 2002 3 | Year | 35,442 | -13,242 | -22,806 | -720 | -36,768 | -1,326 | 588 | -19,444 | 37,979 | -19,263 | -343 | -1,071 | -333 | |||||

| 2003 3 | Year | 32,604 | -10,590 | -21,450 | -890 | -32,930 | -326 | 445 | -15,270 | 39,977 | -21,567 | -1,770 | 1,370 | 1,251 | |||||

| 2004 3 | Year | 33,903 | -11,906 | -21,973 | -967 | -34,846 | -942 | 355 | 23,095 | -14,287 | -11,430 | -1,177 | -3,799 | -3,212 | |||||

| 2005 3 | Year | 32,236 | -12,391 | -24,270 | -1,384 | -38,045 | -5,809 | 340 | 36,992 | -52,698 | 17,665 | -1,472 | 487 | 5,956 | |||||

| 2006 3 | Year | 30,332 | -11,300 | -23,813 | -1,746 | -36,859 | -6,526 | 299 | 16,634 | -8,135 | -13,182 | -87 | -4,770 | 1,457 | |||||

| 2007 3 | Year | 28,627 | -9,043 | -27,910 | -2,210 | -39,163 | -10,535 | 115 | -2,602 | 7,283 | -16,744 | 12 | -12,051 | -1,631 | |||||

| 2008 3 | Year | 31,179 | -14,875 | -24,664 | -2,328 | -41,867 | -10,689 | 119 | 24,167 | 45,749 | -86,128 | 78 | -16,134 | -5,564 | |||||

| 2009 3 | Year | 39,864 | -15,049 | -27,154 | -2,785 | -44,988 | -5,125 | 14 | 649 | -22,626 | 23,116 | -79 | 1,060 | 6,171 | |||||

| 2010 3 | Year | 42,877 | -14,091 | -25,334 | -2,507 | -41,932 | 945 | 91 | -15,446 | -85,965 | 94,140 | -5 | -7,276 | -8,312 | |||||

| 2011 3 | Year | 43,321 | -8,634 | -30,844 | -2,466 | -41,945 | 1,377 | 234 | -17,775 | -26,908 | 34,937 | -329 | -10,075 | -11,686 | |||||

| 2012 | Year | 42,405 | -6,978 | -30,309 | -2,417 | -39,704 | 2,702 | 86 | -23,288 | 4,080 | 19,101 | -12 | -120 | -2,907 | |||||

| 2013 | Year | 36,182 | 178 | -26,264 | -2,462 | -28,548 | 7,633 | 100 | -9,835 | 46,301 | -25,374 | 10 | 11,103 | 3,370 | |||||

| 2008 3 | Quarter 1 | 6,303 | -3,361 | -6,291 | -773 | -10,425 | -4,123 | 42 | 3,191 | -8,182 | -3,140 | -74 | -8,205 | -4,124 | |||||

| Quarter 2 | 7,699 | -3,258 | -6,603 | -531 | -10,392 | -2,693 | 66 | 3,077 | 5,541 | -18,414 | 46 | -9,749 | -7,122 | ||||||

| Quarter 3 | 7,696 | -3,137 | -7,219 | -462 | -10,818 | -3,121 | 0 | 9,276 | 12,083 | -21,835 | 39 | -437 | 2,684 | ||||||

| Quarter 4 | 9,481 | -5,119 | -4,551 | -562 | -10,232 | -752 | 11 | 8,623 | 36,307 | -42,739 | 67 | 2,259 | 3,000 | ||||||

| 2009 3 | Quarter 1 | 9,688 | -3,996 | -7,230 | -844 | -12,070 | -2,382 | -3 | 1,107 | 2,331 | -429 | -41 | 2,969 | 5,354 | |||||

| Quarter 2 | 10,715 | -3,635 | -7,560 | -754 | -11,949 | -1,234 | -1 | -1,148 | 15,776 | -23,345 | 62 | -8,654 | -7,419 | ||||||

| Quarter 3 | 10,019 | -2,317 | -7,466 | -590 | -10,373 | -354 | -10 | 7,508 | -26,570 | 22,020 | -3 | 2,954 | 3,318 | ||||||

| Quarter 4 | 9,442 | -5,101 | -4,898 | -597 | -10,596 | -1,155 | 28 | -6,818 | -14,163 | 24,870 | -97 | 3,791 | 4,918 | ||||||

| 2010 3 | Quarter 1 | 10,296 | -2,922 | -7,603 | -803 | -11,328 | -1,032 | 50 | -4,547 | -19,821 | 32,131 | -32 | 7,731 | 8,713 | |||||

| Quarter 2 | 11,372 | -3,435 | -7,545 | -561 | -11,541 | -169 | 4 | -2,972 | 8,568 | -16,773 | 19 | -11,158 | -10,993 | ||||||

| Quarter 3 | 11,880 | -3,204 | -6,649 | -657 | -10,510 | 1,370 | 14 | 1,354 | 19,581 | -25,635 | 76 | -4,624 | -6,008 | ||||||

| Quarter 4 | 9,329 | -4,530 | -3,536 | -486 | -8,552 | 777 | 23 | -9,281 | -94,293 | 104,417 | -68 | 775 | -25 | ||||||

| 2011 3 | Quarter 1 | 10,172 | -2,926 | -7,800 | -770 | -11,496 | -1,323 | 24 | -8,203 | -7,063 | 11,577 | -65 | -3,754 | -2,455 | |||||

| Quarter 2 | 10,931 | -1,532 | -8,358 | -483 | -10,373 | 557 | 1 | -7,373 | -22,344 | 28,928 | 29 | -760 | -1,318 | ||||||

| Quarter 3 | 11,854 | -1,665 | -8,070 | -593 | -10,328 | 1,526 | -1 | -6,622 | 19,456 | -15,888 | -24 | -3,078 | -4,603 | ||||||

| Quarter 4 | 10,364 | -2,511 | -6,617 | -620 | -9,748 | 616 | 210 | 4,423 | -16,957 | 10,320 | -269 | -2,483 | -3,309 | ||||||

| 2012 | Quarter 1 | 9,935 | -1,732 | -8,698 | -734 | -11,164 | -1,228 | 61 | -15,890 | 46,456 | -28,100 | -12 | 2,453 | 3,621 | |||||

| Quarter 2 | 11,606 | -2,482 | -7,928 | -564 | -10,974 | 632 | 1 | 2,591 | -31,560 | 23,823 | 6 | -5,140 | -5,773 | ||||||

| Quarter 3 | 11,056 | -911 | -7,843 | -602 | -9,356 | 1,700 | 5 | -14,887 | -5,003 | 19,228 | -1 | -663 | -2,368 | ||||||

| Quarter 4 | 9,808 | -1,853 | -5,840 | -517 | -8,210 | 1,598 | 19 | 4,898 | -5,813 | 4,150 | -5 | 3,230 | 1,613 | ||||||

| 2013 | Quarter 1 | 8,671 | -352 | -6,786 | -752 | -7,890 | 781 | 53 | -3,535 | 21,668 | -12,225 | 0 | 5,909 | 5,074 | |||||

| Quarter 2 | 10,293 | -232 | -8,095 | -640 | -8,967 | 1,326 | 12 | -7,358 | 4,742 | 1,178 | 1 | -1,437 | -2,774 | ||||||

| Quarter 3 | 9,583 | 520 | -6,929 | -487 | -6,896 | 2,687 | 1 | -462 | 2,439 | 96 | 4 | 2,077 | -611 | ||||||

| Quarter 4 | 7,635 | 242 | -4,454 | -583 | -4,795 | 2,839 | 34 | 1,520 | 17,452 | -14,423 | 5 | 4,554 | 1,681 | ||||||

| 2014 | Quarter 1 | 10,146 | -1,166 | -7,284 | -735 | -9,185 | 960 | 35 | 7,126 | -11,660 | 4,252 | 0 | -283 | -1,278 | |||||

| Quarter 2 | 12,179 | -1,006 | -7,696 | -535 | -9,237 | 2,942 | 9 | -859 | 8,468 | 1,153 | 1 | 8,763 | 5,811 | ||||||

| Quarter 3 | 12,359 | -839 | -7,266 | -406 | -8,511 | 3,847 | 77 | 7,609 | -1,225 | -7,407 | 2 | -1,021 | -4,945 | ||||||

| 1Adjusted for balance of payments purposes. | |||||||||||||||||||

| 2Includes financial derivatives and also life insurance liabilities to non-residents. Occasionally includes large capital transactions which cannot be shown in the Capital Account Balance due | |||||||||||||||||||

| to confidentiality constraints. | |||||||||||||||||||

| 3 Revised | |||||||||||||||||||

| Table 2a Current and Capital Accounts | € million | |||||||||||

| 2012 | 2013 | 2013 | 2014 | |||||||||

| Item | Year | Quarter 1 | Quarter 2 | Quarter 3 | Quarter 4 | Quarter 1 | Quarter 2 | Quarter 3 | ||||

| Current Account | ||||||||||||

| Merchandise 1 | Exports | 96,976 | 91,763 | 22,467 | 24,092 | 23,172 | 22,032 | 24,320 | 27,196 | 27,319 | ||

| Imports | 54,571 | 55,580 | 13,796 | 13,798 | 13,589 | 14,397 | 14,174 | 15,017 | 14,961 | |||

| of which: Merchanting (net export) | Exports | 5,261 | 3,751 | 799 | 965 | 944 | 1,043 | 850 | 828 | 1,222 | ||

| Services | Exports | 85,527 | 92,292 | 21,220 | 23,406 | 22,710 | 24,956 | 22,349 | 25,926 | 25,750 | ||

| Imports | 92,504 | 92,113 | 21,571 | 23,638 | 22,190 | 24,714 | 23,515 | 26,932 | 26,589 | |||

| Repairs and Processing | Exports | 1,322 | 1,406 | 362 | 329 | 356 | 359 | 346 | 467 | 338 | ||

| Imports | 1,167 | 726 | 223 | 151 | 187 | 165 | 138 | 228 | 219 | |||

| Transport | Exports | 4,609 | 4,396 | 777 | 1,242 | 1,420 | 957 | 746 | 1,296 | 1,440 | ||

| Imports | 1,675 | 1,640 | 421 | 414 | 402 | 403 | 458 | 448 | 449 | |||

| Tourism and Travel 2 | Exports | 3,022 | 3,370 | 566 | 904 | 1,211 | 689 | 558 | 1,043 | 1,327 | ||

| Imports | 4,609 | 4,669 | 871 | 1,143 | 1,706 | 949 | 788 | 1,216 | 1,679 | |||

| Insurance | Exports | 8,986 | 9,021 | 2,335 | 2,260 | 2,090 | 2,336 | 2,299 | 2,414 | 2,240 | ||

| Imports | 6,516 | 5,922 | 1,650 | 1,551 | 1,349 | 1,372 | 1,451 | 1,699 | 1,553 | |||

| Financial services | Exports | 7,732 | 8,157 | 1,938 | 2,096 | 2,055 | 2,068 | 1,945 | 2,153 | 2,134 | ||

| Imports | 5,077 | 5,172 | 1,253 | 1,302 | 1,298 | 1,319 | 1,584 | 1,665 | 1,841 | |||

| Royalties/Licences | Exports | 3,879 | 4,140 | 962 | 1,140 | 940 | 1,098 | 979 | 962 | 976 | ||

| Imports | 33,847 | 35,796 | 8,713 | 8,953 | 8,417 | 9,713 | 10,281 | 11,274 | 11,532 | |||

| Communications | Exports | 569 | 591 | 152 | 157 | 133 | 149 | 143 | 146 | 144 | ||

| Imports | 1,087 | 1,076 | 214 | 295 | 300 | 267 | 256 | 267 | 254 | |||

| Computer services 3 | Exports | 36,150 | 38,956 | 9,354 | 10,001 | 8,825 | 10,776 | 9,529 | 11,434 | 9,829 | ||

| Imports | 349 | 346 | 100 | 82 | 83 | 81 | 69 | 76 | 69 | |||

| Business services | Exports | 17,750 | 20,575 | 4,413 | 4,917 | 5,317 | 5,928 | 5,438 | 5,696 | 6,859 | ||

| Imports | 37,967 | 36,550 | 8,071 | 9,694 | 8,394 | 10,391 | 8,438 | 10,011 | 8,940 | |||

| Research and development | Exports | 766 | 1,060 | 230 | 256 | 275 | 299 | 288 | 313 | 848 | ||

| Imports | 7,094 | 5,181 | 1,144 | 1,098 | 1,402 | 1,537 | 1,319 | 1,393 | 1,477 | |||

| Operational leasing | Exports | 7,537 | 7,497 | 1,804 | 1,858 | 1,953 | 1,882 | 1,846 | 1,907 | 2,021 | ||

| Imports | 1,434 | 1,393 | 357 | 392 | 337 | 307 | 289 | 339 | 339 | |||

| Misc. business services 4 | Exports | 9,445 | 12,018 | 2,379 | 2,803 | 3,089 | 3,747 | 3,304 | 3,476 | 3,990 | ||

| Imports | 29,438 | 29,976 | 6,570 | 8,204 | 6,655 | 8,547 | 6,830 | 8,279 | 7,124 | |||

| Other services n.e.s. | Exports | 1,511 | 1,681 | 361 | 360 | 363 | 597 | 366 | 316 | 464 | ||

| Imports | 214 | 217 | 54 | 54 | 55 | 54 | 53 | 47 | 53 | |||

| Primary Income | Inflows | 58,416 | 56,282 | 13,614 | 13,889 | 13,972 | 14,807 | 14,162 | 15,435 | 16,408 | ||

| Outflows | 88,726 | 82,546 | 20,400 | 21,984 | 20,901 | 19,261 | 21,446 | 23,131 | 23,674 | |||

| Compensation of Employees | Inflows | 541 | 544 | 136 | 136 | 136 | 136 | 136 | 138 | 136 | ||

| Outflows | 743 | 706 | 167 | 179 | 179 | 181 | 175 | 184 | 180 | |||

| Investment Income | Inflows | 56,242 | 54,287 | 13,416 | 13,713 | 13,724 | 13,434 | 13,980 | 15,214 | 16,242 | ||

| Outflows | 87,566 | 81,411 | 20,101 | 21,705 | 20,620 | 18,985 | 21,135 | 22,894 | 23,435 | |||

| Direct investment income | Inflows | 17,791 | 17,883 | 4,624 | 4,383 | 4,598 | 4,278 | 4,066 | 4,549 | 4,833 | ||

| Outflows | 43,299 | 40,395 | 10,417 | 10,894 | 10,660 | 8,424 | 10,520 | 10,377 | 10,826 | |||

| Income on equity | Inflows | 14,092 | 14,395 | 3,646 | 3,634 | 3,692 | 3,423 | 3,106 | 3,620 | 3,899 | ||

| Outflows | 38,742 | 34,901 | 9,301 | 9,757 | 9,393 | 6,450 | 9,483 | 9,235 | 9,636 | |||

| Dividends & distributed | Inflows | 3,178 | 3,857 | 221 | 1,335 | 109 | 2,192 | 80 | * | 164 | ||

| branch profits | Outflows | 17,882 | 17,106 | 4,786 | 5,487 | 3,306 | 3,527 | 3,853 | 3,018 | 3,276 | ||

| Reinvested earnings | Inflows | 10,915 | 10,538 | 3,425 | 2,299 | 3,583 | 1,231 | 3,027 | * | 3,735 | ||

| Outflows | 20,859 | 17,794 | 4,515 | 4,271 | 6,086 | 2,922 | 5,630 | 6,218 | 6,360 | |||

| Income on debt | Inflows | 3,697 | 3,488 | 978 | 749 | 906 | 855 | 960 | 929 | 934 | ||

| Outflows | 4,556 | 5,494 | 1,116 | 1,137 | 1,267 | 1,974 | 1,036 | 1,142 | 1,189 | |||

| Portfolio investment income | Inflows | 24,936 | 26,044 | 6,118 | 6,695 | 6,658 | 6,573 | 7,613 | 8,388 | 9,119 | ||

| Outflows | 31,809 | 31,092 | 7,031 | 8,380 | 7,635 | 8,046 | 8,432 | 10,013 | 10,178 | |||

| Income on equity | Inflows | 6,364 | 6,920 | 1,560 | 1,908 | 1,832 | 1,620 | 1,806 | 2,415 | 2,556 | ||

| Outflows | 18,748 | 20,046 | 4,138 | 5,617 | 4,926 | 5,365 | 6,061 | 7,340 | 7,694 | |||

| Income on debt | Inflows | 18,570 | 19,125 | 4,558 | 4,787 | 4,826 | 4,954 | 5,807 | 5,973 | 6,563 | ||

| Outflows | 13,061 | 11,048 | 2,894 | 2,764 | 2,709 | 2,681 | 2,371 | 2,673 | 2,484 | |||

| Other investment income | Inflows | 13,517 | 10,358 | 2,674 | 2,634 | 2,468 | 2,582 | 2,300 | 2,277 | 2,290 | ||

| Outflows | 12,457 | 9,925 | 2,654 | 2,431 | 2,326 | 2,514 | 2,184 | 2,504 | 2,432 | |||

| Other primary income | Inflows | 1,632 | 1,451 | 62 | 40 | 112 | 1,237 | 46 | 83 | 29 | ||

| Outflows | 416 | 427 | 132 | 99 | 101 | 95 | 136 | 53 | 59 | |||

| Secondary Income | Inflows | 3,918 | 3,246 | 909 | 760 | 866 | 711 | 694 | 728 | 800 | ||

| Outflows | 6,336 | 5,708 | 1,660 | 1,400 | 1,354 | 1,294 | 1,429 | 1,263 | 1,206 | |||

| Current Account - Total | Inflows | 244,839 | 243,582 | 58,210 | 62,146 | 60,720 | 62,506 | 61,525 | 69,285 | 70,277 | ||

| Outflows | 242,137 | 235,948 | 57,428 | 60,820 | 58,033 | 59,667 | 60,565 | 66,343 | 66,430 | |||

| Current Account Balance | 2,702 | 7,633 | 781 | 1,326 | 2,687 | 2,839 | 960 | 2,942 | 3,847 | |||

| Capital Account Balance | 86 | 100 | 53 | 12 | 1 | 34 | 35 | 9 | 77 | |||

| Memorandum Item: | ||||||||||||

| Government Income | Inflows | 115 | 141 | 28 | 48 | 37 | 28 | 13 | 28 | 40 | ||

| Outflows | 4,621 | 4,644 | 1,194 | 1,148 | 1,157 | 1,145 | 1,154 | 1,289 | 1,181 | |||

| 1Adjusted for balance of payments purposes | ||||||||||||

| 2Under the credit item, passenger fare receipts of resident carriers from foreign visitors are excluded; such receipts are included under transport | ||||||||||||

| credits - see Background Notes. | ||||||||||||

| 3Covers exports and imports of software that was not incorporated as part of computer hardware or physical media but separately transmited by electronic | ||||||||||||

| means. The value of sales and purchases of additional software licences is also included. | ||||||||||||

| 4Covers mainly advertising and inter-affiliate management charges. | ||||||||||||

| *Suppressed for confidentiality reasons | ||||||||||||

| Table 2b Financial Account¹ | € million | |||||||||||

| 2012 | 2013 | 2013 | 2014 | |||||||||

| Item | Year | Quarter 1 | Quarter 2 | Quarter 3 | Quarter 4 | Quarter 1 | Quarter 2 | Quarter 3 | ||||

| Direct Investment | Abroad | 11,897 | 18,057 | 14,182 | -2,037 | 4,004 | 1,908 | -547 | -1,147 | 21,441 | ||

| In Ireland | 35,184 | 27,892 | 17,717 | 5,321 | 4,466 | 388 | -7,673 | -288 | 13,832 | |||

| Equity | Abroad | 6,845 | 7,566 | 14,435 | -8,255 | 372 | 1,014 | -5,085 | * | 12,967 | ||

| In Ireland | 18,473 | 6,825 | 11,167 | -465 | -1,774 | -2,103 | -2,958 | 28 | 5,871 | |||

| Reinvested Earnings | Abroad | 10,915 | 10,538 | 3,425 | 2,299 | 3,583 | 1,231 | 3,027 | * | 3,735 | ||

| In Ireland | 20,859 | 17,794 | 4,515 | 4,271 | 6,086 | 2,922 | 5,630 | 6,218 | 6,360 | |||

| Other Capital | Abroad | -5,864 | -47 | -3,678 | 3,918 | 49 | -336 | 1,512 | -82 | 4,739 | ||

| In Ireland | -4,147 | 3,273 | 2,034 | 1,516 | 154 | -431 | -10,346 | -6,533 | 1,602 | |||

| Portfolio Investment | Assets | 74,522 | 100,923 | 57,692 | 1,550 | 19,809 | 21,872 | 32,667 | 54,706 | 54,578 | ||

| Liabilities | 70,442 | 54,622 | 36,024 | -3,192 | 17,370 | 4,420 | 44,327 | 46,238 | 55,802 | |||

| Equity | Assets | 13,182 | 60,653 | 16,266 | 8,997 | 11,263 | 24,127 | 15,667 | 17,219 | 17,394 | ||

| Liabilities | 80,080 | 82,260 | 33,154 | 4,893 | 27,181 | 17,032 | 42,694 | 47,990 | 59,716 | |||

| Debt Instruments | Assets | 61,339 | 40,271 | 41,427 | -7,447 | 8,546 | -2,255 | 16,999 | 37,488 | 37,184 | ||

| Liabilities | -9,638 | -27,638 | 2,870 | -8,085 | -9,811 | -12,612 | 1,633 | -1,752 | -3,914 | |||

| Bonds and notes | Assets | 55,246 | 45,604 | 27,900 | 2,247 | 4,843 | 10,614 | 1,380 | 23,146 | 11,455 | ||

| Liabilities | -11,614 | -19,039 | 1,186 | -7,781 | -7,510 | -4,934 | 783 | -646 | -4,958 | |||

| Money market instruments | Assets | 6,096 | -5,333 | 13,527 | -9,694 | 3,703 | -12,869 | 15,620 | 14,342 | 25,728 | ||

| Liabilities | 1,976 | -8,596 | 1,684 | -303 | -2,300 | -7,677 | 850 | -1,105 | 1,045 | |||

| Other Investment | Assets | -82,026 | -51,470 | -7,658 | -7,687 | -6,103 | -30,022 | 33,526 | 2,882 | -6,410 | ||

| Liabilities | -101,126 | -26,098 | 4,566 | -8,865 | -6,199 | -15,600 | 29,275 | 1,729 | 997 | |||

| Loans, currency and deposits | Assets | -80,270 | -46,049 | -15,255 | -8,982 | -6,626 | -15,186 | 13,717 | -6,668 | -18,859 | ||

| Liabilities | -90,212 | -16,269 | -11,703 | -685 | -2,382 | -1,499 | -3,091 | -4,316 | -10,414 | |||

| Other 2 | Assets | -1,756 | -5,421 | 7,596 | 1,295 | 524 | -14,836 | 19,809 | 9,550 | 12,449 | ||

| Liabilities | -10,915 | -9,828 | 16,270 | -8,180 | -3,817 | -14,101 | 32,366 | 6,045 | 11,411 | |||

| Reserve Assets | -12 | 10 | 0 | 1 | 4 | 5 | 0 | 1 | 2 | |||

| Monetary gold | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | |||

| Special drawing rights | 8 | 10 | 1 | 2 | 3 | 4 | 0 | 0 | 0 | |||

| Reserve position in the IMF | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||

| Foreign exchange | -1 | 0 | -1 | -1 | 1 | 1 | 0 | 0 | 2 | |||

| Other | -19 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||

| Balance on Financial Account | -120 | 11,103 | 5,909 | -1,437 | 2,077 | 4,554 | -283 | 8,763 | -1,021 | |||

| Net errors and omissions | -2,907 | 3,370 | 5,074 | -2,774 | -611 | 1,681 | -1,278 | 5,811 | -4,945 | |||

| Memorandum Item: | ||||||||||||

| Government financial | Assets | 2,734 | 3,017 | 961 | -9 | 377 | 1,688 | 175 | -2,041 | -175 | ||

| transactions | Liabilities | 20,475 | 4,940 | 6,972 | -852 | 2,224 | -3,404 | 3,536 | 1,993 | 1,164 | ||

| 1Financial account transactions are categorised under two headings 'Assets' and 'Liabilities' for Portfolio Investment, Other Investment and Reserve | ||||||||||||

| Assets. For Direct Investment, a 'directional ' categorisation is used: 'Abroad' indicates direct investment by Irish investors in foreign companies; | ||||||||||||

| Direct investment into Ireland is indicated by the heading 'In Ireland'. | ||||||||||||

| 2Includes financial derivatives; in the case of liabilities this category also includes life insurance liabilities to non-residents. Occasionally includes large | ||||||||||||

| capital transactions which cannot be shown in the Capital Account Balance due to confidentiality constraints. | ||||||||||||

| *Suppressed for confidentiality reasons | ||||||||||||

| Table 3 Current, Capital and Financial Accounts showing IFSC¹ and Non–IFSC activity | € million | |||||||||||

| 2012 | 2013 | 2013 | 2014 | |||||||||

| Item | Year | Quarter 1 | Quarter 2 | Quarter 3 | Quarter 4 | Quarter 1 | Quarter 2 | Quarter 3 | ||||

| Current Account - Total | Inflows | 244,839 | 243,582 | 58,210 | 62,146 | 60,720 | 62,506 | 61,525 | 69,285 | 70,277 | ||

| Outflows | 242,137 | 235,948 | 57,428 | 60,820 | 58,033 | 59,667 | 60,565 | 66,343 | 66,430 | |||

| Merchandise 2 | Exports | 96,976 | 91,763 | 22,467 | 24,092 | 23,172 | 22,032 | 24,320 | 27,196 | 27,319 | ||

| Imports | 54,571 | 55,580 | 13,796 | 13,798 | 13,589 | 14,397 | 14,174 | 15,017 | 14,961 | |||

| Services | Exports | 85,527 | 92,292 | 21,220 | 23,406 | 22,710 | 24,956 | 22,349 | 25,926 | 25,750 | ||

| Imports | 92,504 | 92,113 | 21,571 | 23,638 | 22,190 | 24,714 | 23,515 | 26,932 | 26,589 | |||

| IFSC | Exports | 24,740 | 25,863 | 6,266 | 6,491 | 6,380 | 6,726 | 6,661 | 7,010 | 6,969 | ||

| Imports | 15,195 | 15,298 | 3,852 | 3,909 | 3,737 | 3,800 | 4,049 | 4,458 | 4,330 | |||

| Non-IFSC | Exports | 60,786 | 66,428 | 14,954 | 16,914 | 16,330 | 18,230 | 15,688 | 18,916 | 18,781 | ||

| Imports | 77,309 | 76,815 | 17,719 | 19,729 | 18,453 | 20,914 | 19,466 | 22,474 | 22,259 | |||

| Primary Income | Inflows | 58,416 | 56,282 | 13,614 | 13,889 | 13,972 | 14,807 | 14,162 | 15,435 | 16,408 | ||

| Outflows | 88,726 | 82,546 | 20,400 | 21,984 | 20,901 | 19,261 | 21,446 | 23,131 | 23,674 | |||

| IFSC | Inflows | 38,277 | 37,370 | 9,072 | 9,438 | 9,438 | 9,422 | 10,254 | 10,966 | 11,741 | ||

| Outflows | 42,053 | 38,565 | 9,444 | 9,845 | 9,790 | 9,486 | 10,566 | 11,558 | 12,045 | |||

| Non-IFSC | Inflows | 20,140 | 18,910 | 4,542 | 4,450 | 4,533 | 5,385 | 3,908 | 4,469 | 4,666 | ||

| Outflows | 46,673 | 43,981 | 10,956 | 12,139 | 11,111 | 9,775 | 10,881 | 11,573 | 11,629 | |||

| Secondary Income | Inflows | 3,918 | 3,246 | 909 | 760 | 866 | 711 | 694 | 728 | 800 | ||

| Outflows | 6,336 | 5,708 | 1,660 | 1,400 | 1,354 | 1,294 | 1,429 | 1,263 | 1,206 | |||

| IFSC3 | Inflows | 3,360 | 2,742 | 748 | 649 | 747 | 598 | 608 | 613 | 674 | ||

| Outflows | 3,360 | 2,742 | 748 | 649 | 747 | 598 | 608 | 613 | 674 | |||

| Non-IFSC | Inflows | 558 | 503 | 161 | 110 | 119 | 113 | 86 | 115 | 126 | ||

| Outflows | 2,976 | 2,965 | 912 | 751 | 606 | 696 | 822 | 650 | 532 | |||

| Balance on Current Account | 2,702 | 7,633 | 781 | 1,326 | 2,687 | 2,839 | 960 | 2,942 | 3,847 | |||

| Balance on Capital Account | 86 | 100 | 53 | 12 | 1 | 34 | 35 | 9 | 77 | |||

| Financial Account 4 | ||||||||||||

| Direct investment | Abroad | 11,897 | 18,057 | 14,182 | -2,037 | 4,004 | 1,908 | -547 | -1,147 | 21,441 | ||

| In Ireland | 35,184 | 27,892 | 17,717 | 5,321 | 4,466 | 388 | -7,673 | -288 | 13,832 | |||

| IFSC | Abroad | 1,303 | 3,141 | 670 | 609 | 975 | 887 | -3,576 | 221 | 264 | ||

| In Ireland | 9,605 | 17,148 | 9,163 | 4,453 | 3,201 | 331 | -6,038 | 1,356 | 11,751 | |||

| Non-IFSC | Abroad | 10,595 | 14,918 | 13,512 | -2,646 | 3,030 | 1,022 | 3,029 | -1,368 | 21,177 | ||

| In Ireland | 25,579 | 10,746 | 8,554 | 868 | 1,266 | 58 | -1,635 | -1,644 | 2,081 | |||

| Portfolio investment | Assets | 74,522 | 100,923 | 57,692 | 1,550 | 19,809 | 21,872 | 32,667 | 54,706 | 54,578 | ||

| Liabilities | 70,442 | 54,622 | 36,024 | -3,192 | 17,370 | 4,420 | 44,327 | 46,238 | 55,802 | |||

| IFSC | Assets | 81,322 | 96,211 | 57,599 | 918 | 18,638 | 19,056 | 34,948 | 49,728 | 53,780 | ||

| Liabilities | 83,694 | 62,606 | 31,059 | 4,793 | 19,819 | 6,935 | 40,697 | 46,789 | 35,600 | |||

| Non-IFSC | Assets | -6,799 | 4,711 | 93 | 632 | 1,171 | 2,815 | -2,282 | 4,979 | 798 | ||

| Liabilities | -13,252 | -7,984 | 4,965 | -7,985 | -2,449 | -2,515 | 3,629 | -551 | 20,202 | |||

| Other investment 5 | Assets | -82,026 | -51,470 | -7,658 | -7,687 | -6,103 | -30,022 | 33,526 | 2,882 | -6,410 | ||

| Liabilities | -101,126 | -26,098 | 4,566 | -8,865 | -6,199 | -15,600 | 29,275 | 1,729 | 997 | |||

| IFSC | Assets | -61,851 | -38,464 | 522 | -3,263 | -2,629 | -33,094 | 40,276 | 3,876 | -4,185 | ||

| Liabilities | -52,338 | -8,068 | 22,687 | -10,495 | -7,468 | -12,792 | 45,320 | 13,879 | 8,811 | |||

| Non-IFSC | Assets | -20,176 | -13,006 | -8,180 | -4,424 | -3,474 | 3,072 | -6,749 | -993 | -2,225 | ||

| Liabilities | -48,787 | -18,029 | -18,120 | 1,630 | 1,269 | -2,808 | -16,045 | -12,150 | -7,814 | |||

| Reserve Assets | -12 | 10 | 0 | 1 | 4 | 5 | 0 | 1 | 2 | |||

| Balance on Financial Account | -120 | 11,103 | 5,909 | -1,437 | 2,077 | 4,554 | -283 | 8,763 | -1,021 | |||

| Net errors and omissions | -2,907 | 3,370 | 5,074 | -2,774 | -611 | 1,681 | -1,278 | 5,811 | -4,945 | |||

| 1From the start of 2000 new international financial service projects are no longer subject to the earlier certification and licensing procedures in operation | ||||||||||||

| for location in the IFSC and such projects can, therefore, locate anywhere in Ireland. Additions to existing IFSC projects, however, are still subject to the | ||||||||||||

| formal procedures . For statistical analysis purposes this table still shows the 'IFSC/non-IFSC' breakdown and the activities of all international financial | ||||||||||||

| service enterprises are covered under the IFSC heading. | ||||||||||||

| 2Adjusted for balance of payments purposes. | ||||||||||||

| 3Secondary income flows to and from IFSC enterprises relate solely to non-life insurance transactions (see Background Notes). | ||||||||||||

| 4See footnote 1 on Table 2b. | ||||||||||||

| 5Includes financial derivatives; in the case of liabilities this category also includes life insurance liabilities to non-residents. Occasionally includes large | ||||||||||||

| capital transactions which cannot be shown in the Capital Account Balance due to confidentiality constraints. | ||||||||||||

| Table 4a Current and Capital Accounts showing geographical¹ detail | € million | |||||||||||

| 2012 | 2013 | 2013 | 2014 | |||||||||

| Item | Year | Quarter 1 | Quarter 2 | Quarter 3 | Quarter 4 | Quarter 1 | Quarter 2 | Quarter 3 | ||||

| Current Account - Total | Inflows | 244,839 | 243,582 | 58,210 | 62,146 | 60,720 | 62,506 | 61,525 | 69,285 | 70,277 | ||

| Outflows | 242,137 | 235,948 | 57,428 | 60,820 | 58,033 | 59,667 | 60,565 | 66,343 | 66,430 | |||

| Merchandise 2 | Exports | 96,976 | 91,763 | 22,467 | 24,092 | 23,172 | 22,032 | 24,320 | 27,196 | 27,319 | ||

| Imports | 54,571 | 55,580 | 13,796 | 13,798 | 13,589 | 14,397 | 14,174 | 15,017 | 14,961 | |||

| EMU | Exports | 35,777 | 33,976 | 7,852 | 8,928 | 8,675 | 8,521 | 9,109 | 9,268 | 10,443 | ||

| Imports | 11,915 | 13,933 | 3,511 | 3,521 | 3,356 | 3,545 | 3,655 | 3,723 | 3,662 | |||

| Non-EMU | Exports | 61,200 | 57,787 | 14,615 | 15,164 | 14,497 | 13,511 | 15,212 | 17,927 | 16,876 | ||

| Imports | 42,654 | 41,646 | 10,285 | 10,277 | 10,232 | 10,852 | 10,519 | 11,294 | 11,298 | |||

| EU | Exports | 54,819 | 51,942 | 12,180 | 13,702 | 13,369 | 12,691 | 13,374 | 14,002 | 15,454 | ||

| Imports | 34,393 | 38,305 | 9,473 | 9,374 | 9,489 | 9,969 | 9,632 | 9,874 | 9,921 | |||

| Non-EU | Exports | 42,158 | 39,821 | 10,287 | 10,390 | 9,803 | 9,341 | 10,946 | 13,194 | 11,865 | ||

| Imports | 20,178 | 17,275 | 4,324 | 4,424 | 4,099 | 4,428 | 4,542 | 5,143 | 5,040 | |||

| Services | Exports | 85,527 | 92,292 | 21,220 | 23,406 | 22,710 | 24,956 | 22,349 | 25,926 | 25,750 | ||

| Imports | 92,504 | 92,113 | 21,571 | 23,638 | 22,190 | 24,714 | 23,515 | 26,932 | 26,589 | |||

| EMU | Exports | 28,996 | 29,702 | 7,126 | 8,055 | 6,678 | 7,843 | 7,142 | 8,807 | 8,341 | ||

| Imports | 34,416 | 33,729 | 7,830 | 8,444 | 8,320 | 9,135 | 7,707 | 8,507 | 8,610 | |||

| Non-EMU | Exports | 56,532 | 62,590 | 14,094 | 15,351 | 16,032 | 17,113 | 15,207 | 17,119 | 17,409 | ||

| Imports | 58,088 | 58,383 | 13,741 | 15,194 | 13,869 | 15,579 | 15,808 | 18,425 | 17,979 | |||

| EU | Exports | 49,581 | 51,398 | 12,070 | 13,418 | 12,260 | 13,650 | 12,404 | 15,283 | 14,639 | ||

| Imports | 45,802 | 44,766 | 10,386 | 11,171 | 10,834 | 12,375 | 10,431 | 11,662 | 11,687 | |||

| Non-EU | Exports | 35,946 | 40,894 | 9,150 | 9,988 | 10,450 | 11,306 | 9,945 | 10,644 | 11,111 | ||

| Imports | 46,703 | 47,346 | 11,186 | 12,466 | 11,355 | 12,339 | 13,084 | 15,270 | 14,902 | |||

| Primary Income | Inflows | 58,416 | 56,282 | 13,614 | 13,889 | 13,972 | 14,807 | 14,162 | 15,435 | 16,408 | ||

| Outflows | 88,726 | 82,546 | 20,400 | 21,984 | 20,901 | 19,261 | 21,446 | 23,131 | 23,674 | |||

| EMU | Inflows | 20,131 | 18,187 | 4,778 | 4,311 | 4,397 | 4,701 | 4,921 | 5,179 | 5,011 | ||

| Outflows | 30,809 | 27,286 | 6,536 | 7,077 | 7,104 | 6,569 | 7,316 | 6,418 | 7,811 | |||

| Non-EMU | Inflows | 38,285 | 38,095 | 8,836 | 9,578 | 9,575 | 10,106 | 9,241 | 10,256 | 11,396 | ||

| Outflows | 57,917 | 55,260 | 13,865 | 14,907 | 13,797 | 12,691 | 14,130 | 16,713 | 15,863 | |||

| EU | Inflows | 31,824 | 28,667 | 7,144 | 6,477 | 6,790 | 8,256 | 7,744 | 8,153 | 8,130 | ||

| Outflows | 47,626 | 43,503 | 10,805 | 11,181 | 11,209 | 10,308 | 11,836 | 11,691 | 13,347 | |||

| Non-EU | Inflows | 26,592 | 27,615 | 6,470 | 7,412 | 7,182 | 6,551 | 6,418 | 7,283 | 8,278 | ||

| Outflows | 41,102 | 39,043 | 9,596 | 10,802 | 9,692 | 8,953 | 9,610 | 11,440 | 10,327 | |||

| Secondary Income | Inflows | 3,918 | 3,246 | 909 | 760 | 866 | 711 | 694 | 728 | 800 | ||

| Outflows | 6,336 | 5,708 | 1,660 | 1,400 | 1,354 | 1,294 | 1,429 | 1,263 | 1,206 | |||

| EMU | Inflows | 1,013 | 1,062 | 306 | 244 | 295 | 217 | 244 | 203 | 283 | ||

| Outflows | 1,105 | 1,148 | 327 | 266 | 317 | 238 | 265 | 225 | 304 | |||

| Non-EMU | Inflows | 2,905 | 2,183 | 603 | 515 | 571 | 494 | 449 | 525 | 518 | ||

| Outflows | 5,232 | 4,561 | 1,333 | 1,135 | 1,037 | 1,056 | 1,165 | 1,039 | 902 | |||

| EU | Inflows | 2,296 | 2,368 | 722 | 537 | 620 | 489 | 506 | 467 | 595 | ||

| Outflows | 4,069 | 4,429 | 1,369 | 977 | 1,055 | 1,028 | 1,196 | 963 | 962 | |||

| Non-EU | Inflows | 1,622 | 877 | 187 | 222 | 246 | 222 | 188 | 261 | 205 | ||

| Outflows | 2,267 | 1,280 | 291 | 423 | 299 | 267 | 233 | 300 | 244 | |||

| Balance on Current Account | 2,702 | 7,633 | 781 | 1,326 | 2,687 | 2,839 | 960 | 2,942 | 3,847 | |||

| Balance on Capital Account | 86 | 100 | 53 | 12 | 1 | 34 | 35 | 9 | 77 | |||

| 1The term ‘EMU’ means the area represented by the 18 Member States participating in Monetary Union since the enlargement of the Euro area on 1 January 2014 | ||||||||||||

| to include Latvia. With the expansion of the EU on 1 July 2013 to include Croatia the term ‘EU’ relates to transactions between residents of Ireland and other | ||||||||||||

| residents of the of the EU28 area. For comparison purposes data shown for 2012 and 2013 also relates to EMU 18 and EU 28. | ||||||||||||

| 2Adjusted for balance of payments purposes | ||||||||||||

| Table 4b Financial Account¹ showing geographical² detail | € million | |||||||||||

| 2012 | 2013 | 2013 | 2014 | |||||||||

| Item | Year | Quarter 1 | Quarter 2 | Quarter 3 | Quarter 4 | Quarter 1 | Quarter 2 | Quarter 3 | ||||

| Direct Investment | Abroad | 11,897 | 18,057 | 14,182 | -2,037 | 4,004 | 1,908 | -547 | -1,147 | 21,441 | ||

| In Ireland | 35,184 | 27,892 | 17,717 | 5,321 | 4,466 | 388 | -7,673 | -288 | 13,832 | |||

| EMU | Abroad | -2,519 | 7,259 | 3,955 | 271 | 2,183 | 850 | 624 | -424 | 18,926 | ||

| In Ireland | 19,728 | 14,066 | 5,731 | 5,904 | 2,673 | -242 | -4,302 | -3,067 | 7,169 | |||

| Non-EMU | Abroad | 14,415 | 10,799 | 10,227 | -2,308 | 1,821 | 1,059 | -1,170 | -723 | 2,515 | ||

| In Ireland | 15,458 | 13,827 | 11,986 | -584 | 1,794 | 631 | -3,370 | 2,780 | 6,663 | |||

| EU | Abroad | -162 | 12,823 | 6,817 | 174 | 3,373 | 2,459 | -2,151 | -3,450 | 20,765 | ||

| In Ireland | 22,783 | 14,264 | 10,136 | 5,177 | 3,077 | -4,126 | -7,506 | -2,922 | 4,871 | |||

| Non-EU | Abroad | 12,060 | 5,234 | 7,366 | -2,212 | 631 | -551 | 1,604 | 2,303 | 676 | ||

| In Ireland | 12,401 | 13,628 | 7,581 | 143 | 1,389 | 4,515 | -167 | 2,634 | 8,962 | |||

| Portfolio Investment | Assets | 74,522 | 100,923 | 57,692 | 1,550 | 19,809 | 21,872 | 32,667 | 54,706 | 54,578 | ||

| Liabilities | 70,442 | 54,622 | 36,024 | -3,192 | 17,370 | 4,420 | 44,327 | 46,238 | 55,802 | |||

| EMU | Assets | 28,962 | 23,001 | 19,599 | 6,822 | -2,079 | -1,341 | 20,603 | 10,994 | 8,809 | ||

| Liabilities | -9,732 | 9,113 | 9,452 | 1,825 | 468 | -2,632 | 14,740 | 9,449 | 6,952 | |||

| Non-EMU | Assets | 45,561 | 77,923 | 38,093 | -5,272 | 21,888 | 23,214 | 12,063 | 43,712 | 45,768 | ||

| Liabilities | 80,173 | 45,509 | 26,572 | -5,017 | 16,902 | 7,052 | 29,587 | 36,789 | 48,850 | |||

| EU | Assets | 37,955 | 45,135 | 17,599 | 5,974 | 15,257 | 6,305 | 22,442 | 31,860 | 12,451 | ||

| Liabilities | -6,632 | 39,223 | 23,178 | 3,928 | 13,073 | -956 | 40,762 | 38,339 | 26,053 | |||

| Non-EU | Assets | 36,568 | 55,790 | 40,094 | -4,424 | 4,552 | 15,568 | 10,224 | 22,846 | 42,127 | ||

| Liabilities | 77,072 | 15,400 | 12,847 | -7,120 | 4,297 | 5,376 | 3,565 | 7,899 | 29,749 | |||

| Other Investment 3 | Assets | -82,026 | -51,470 | -7,658 | -7,687 | -6,103 | -30,022 | 33,526 | 2,882 | -6,410 | ||

| Liabilities | -101,126 | -26,098 | 4,566 | -8,865 | -6,199 | -15,600 | 29,275 | 1,729 | 997 | |||

| EMU | Assets | -108,477 | -17,279 | 3,766 | -4,589 | -10,893 | -5,563 | 5,808 | 9,555 | 1,444 | ||

| Liabilities | -99,590 | -34,647 | -13,247 | -5,069 | -7,517 | -8,814 | 797 | -4,337 | -11,188 | |||

| Non-EMU | Assets | 26,451 | -34,191 | -11,424 | -3,098 | 4,790 | -24,459 | 27,718 | -6,673 | -7,854 | ||

| Liabilities | -1,535 | 8,549 | 17,813 | -3,796 | 1,318 | -6,786 | 28,478 | 6,066 | 12,184 | |||

| EU | Assets | -166,215 | -27,783 | -4,225 | -5,512 | -2,779 | -15,267 | 19,055 | -520 | 7,097 | ||

| Liabilities | -122,077 | -24,918 | -9,873 | -8,468 | 962 | -7,539 | 6,945 | -4,420 | -6,539 | |||

| Non-EU | Assets | 84,189 | -23,687 | -3,433 | -2,175 | -3,324 | -14,755 | 14,472 | 3,402 | -13,507 | ||

| Liabilities | 20,950 | -1,180 | 14,439 | -397 | -7,161 | -8,061 | 22,330 | 6,150 | 7,536 | |||

| Reserve Assets | -12 | 10 | 0 | 1 | 4 | 5 | 0 | 1 | 2 | |||

| Balance on Financial Account | -120 | 11,103 | 5,909 | -1,437 | 2,077 | 4,554 | -283 | 8,763 | -1,021 | |||

| Net errors and omissions | -2,907 | 3,370 | 5,074 | -2,774 | -611 | 1,681 | -1,278 | 5,811 | -4,945 | |||

| 1See footnote 1 on Table 2b. | ||||||||||||

| 2The term ‘EMU’ means the area represented by the 18 Member States participating in Monetary Union since the enlargement of the Euro area on 1 January 2014 to | ||||||||||||

| include Latvia. With the expansion of the EU on 1 July 2013 to include Croatia the term ‘EU’ relates to transactions between residents of Ireland and other residents | ||||||||||||

| of the EU28 area. For comparison purposes data shown for 2012 and 2013 also relates to EMU 18 and EU 28. | ||||||||||||

| 3Includes financial derivatives; in the case of liabilities this category also includes life insurance liabilities to non-residents. Occasionally includes large capital | ||||||||||||

| transactions which cannot be shown in the Capital Account Balance due to confidentiality constraints. | ||||||||||||

The balance of payments (BOP) is a statistical statement that summarises, for a specific time period, the economic transactions of the residents of an economy with the rest of the world.

The balance of payments presentation consists of three tables or accounts, the Current Account, the Capital Account and the Financial Account. The current account consists of trade in merchandise and services, as well as primary and secondary income account inflows and outflows. The capital account covers capital transfers and the acquisition and disposal of non-produced, non-financial assets. The financial account is concerned with transactions in foreign financial assets and liabilities, distinguishing the functional type of investment i.e. direct, portfolio and other investment (including transactions in financial derivatives) and reserve assets.

BOP transactions, in principle, should be recorded on an accruals basis using market valuation. In practice, the collection system (see below) is designed to adhere to this approach and, for the most part, the valuations reported are either market values or a close approximation.

For more detailed methodological information see the http://www.cso.ie/en/surveysandmethodology/balanceofpayments/methodologydocuments/BOP Quarterly Statistical Compilation Methodology (PDF 239KB)

Hide Background Notes

Hide Background Notes

Scan the QR code below to view this release online or go to

http://www.cso.ie/en/releasesandpublications/er/bop/balanceofinternationalpaymentsq32014/