| Biggest Brexit concern for 2021 by sector | |||

| Decline in business from UK customer | Difficulty transporting goods to/from the UK | Increase in prices | |

| NACE sector | % | % | % |

| Industry (B-E) | 11 | 47 | 41 |

| Construction (F) | 6 | 30 | 65 |

| Services (G to N, R, S) | 26 | 38 | 36 |

| All sectors | 21 | 38 | 42 |

This release is based on data collected during the Business Impact of COVID-19 on SMEs in 2020 Survey (BICS). The data was collected to measure and report on key features of the impact of both the COVID-19 crisis and impact of Brexit on small and medium enterprises in Ireland in 2020. A Small or Medium Enterprise (SME) is an enterprise having 1-249 persons engaged. This release focuses on the impact of Brexit on SMEs in 2020. Respondents were asked their biggest Brexit concerns and actions they were taking in 2020 in preparation for Brexit.

It is important to note that the results of the survey apply to respondents only, and that no imputation or estimation procedures have been used in the case of non-response. Therefore, as the results of the survey are unweighted, they may only reflect the characteristics of those who have responded. Due to the low response rate (24%) by businesses to this survey, the feasible breakdown of results is very limited. The distribution of respondents was not evenly spread across the size classes and micro enterprises are more strongly represented compared to other size classes.

For further information see Infographic.

Key Findings

Pausing or cancelling investment was one of the most common steps taken by respondents to mitigate COVID-19 and Brexit uncertainty

In terms of steps taken to mitigate COVID-19 and Brexit uncertainty, 39% of responding enterprises took no steps. Among those that did, the most common were pausing/cancelling investment (13%), implementing a pay freeze (13%), increasing digitisation (12%) and reducing their work force (11%). Many respondents took multiple steps. See Figure 2 and Table 1.

| X-axis label | Implement a pay freeze | Reduce work force | Renegotiate commercial rent | Renegotiate terms of supply chain | Pause or cancel investment | Develop new products | Increase digitisation | New markets | No steps | Other steps |

|---|---|---|---|---|---|---|---|---|---|---|

| 13 | 11 | 7 | 5 | 13 | 9 | 12 | 8 | 39 | 3 |

In all sectors, 5% or less respondents believed that Brexit would have a positive impact on business in 2021

More than half of respondents in the Wholesale and Retail Trade and the Industry sectors believed that Brexit would have a negative impact on business in 2021, this was 46% for respondents in the Construction sector.

This compares to between 30% and 38% of respondents in the Professional and IT, Finance and Administration, Transportation and Storage, Accommodation and Food Service Activities and Other Service Activities sectors.

In all sectors, 5% or less respondents believed that Brexit would have a positive impact on their business in 2021. See Figure 3 and Table 2.

| Negative | None | Not applicable | Positive | |

| Industry (B-E) | 58 | 31 | 11 | 1 |

| Construction (F) | 46 | 37 | 16 | 1 |

| Wholesale and Retail Trade (G) | 60 | 26 | 10 | 5 |

| Transportation and Storage (H) | 34 | 34 | 29 | 2 |

| Accommodation and Food Service Activities (I) | 38 | 39 | 20 | 3 |

| Professional and IT (J, M) | 31 | 49 | 18 | 3 |

| Finance and Administration (K, L, N) | 32 | 41 | 23 | 4 |

| Other Service Activities (S) | 34 | 40 | 24 | 2 |

| All Sectors | 41 | 38 | 18 | 3 |

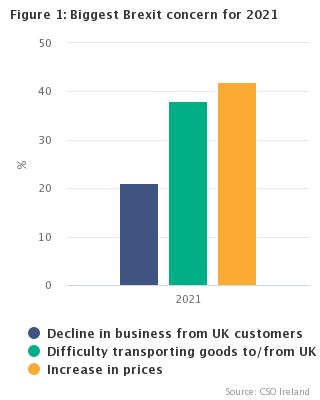

Two thirds of respondents in Construction reported an increase in prices as their biggest Brexit concern

Almost two thirds of respondents in the Construction sector (65%) reported an increase in prices as their biggest Brexit concern for 2021.

In the Services sector, 38% of respondents reported that difficulty in transporting goods to/from the UK is their biggest concern, followed by an increase in prices (36%) and a decline in business from UK customers (26%).

Almost half (47%) of respondents in Industry reported that transporting goods to/from the UK is their biggest concern. See Figure 4 and Headline Table.

| Decline in business from UK customer | Difficulty in transporting goods to/from the UK | Increase in prices | |

| Industry (B-E) | 11 | 47 | 41 |

| Construction (F) | 6 | 30 | 65 |

| Services (G to N, R, S) | 26 | 38 | 36 |

Six in ten responding SMEs took no steps in preparation for Brexit

In preparation for Brexit, new suppliers were sought by 13% of respondents, 8% have increased preparedness for new custom procedures/duties while 60% have taken no steps. See Figure 5 and Table 3.

| Availed of government Brexit related financial support | Taken steps to reduce exposure to currency volatility | Increased preparedness for new custom procedures/duties | Sought new suppliers outside the UK | Changed route to market | Started selling/buying to new markets | No steps taken | Other prepared steps taken | |

| 1 | 2 | 8 | 13 | 3 | 3 | 60 | 2 |

| Table 1 Steps taken by enterprises to mitigate COVID-19 and Brexit uncertainty | ||||

| % | ||||

| Implement a pay freeze | 13 | |||

| Reduce work force | 11 | |||

| Renegotiate commercial rent | 7 | |||

| Renegotiate terms of supply chain | 5 | |||

| Pause or cancel investment | 13 | |||

| Develop new products | 9 | |||

| Increase digitisation | 12 | |||

| New markets | 8 | |||

| No steps | 39 | |||

| Other steps | 3 | |||

| Table 2 Impact of Brexit on business in 2021 by sector | ||||

| Negative | None | Not applicable | Positive | |

| NACE Sector | % | % | % | % |

| Industry (B-E) | 58 | 31 | 11 | 1 |

| Construction (F) | 46 | 37 | 16 | 1 |

| Wholesale and Retail Trade (G) | 60 | 26 | 10 | 5 |

| Transportation and Storage (H) | 34 | 34 | 29 | 2 |

| Accommodation and Food Service Activities (I) | 38 | 39 | 20 | 3 |

| Professional and IT (J, M) | 31 | 49 | 18 | 3 |

| Finance and Administration (K, L, N) | 32 | 41 | 23 | 4 |

| Other Service Activities (S) | 34 | 40 | 24 | 2 |

| All sectors | 41 | 38 | 18 | 3 |

| Table 3 Steps taken by enterprises in preparation for Brexit | |

| % | |

| Availed of government Brexit related financial support | 1 |

| Taken steps to reduce exposure to currency volatility | 2 |

| Increased preparedness for new custom procedures/duties | 8 |

| Sought new suppliers outside the UK | 13 |

| Changed route to market | 3 |

| Started selling/buying to new markets | 3 |

| No steps taken | 60 |

| Other prepared steps taken | 2 |

Introduction

The data for this release was collected as part of the Business Impact of COVID-19 on SMEs in 2020 survey. One section of this survey focused on the impact of Brexit on small and medium enterprises in Ireland in 2020. A Small or Medium Enterprise (SME) is an enterprise having 1-249 persons engaged.

The survey was conducted online. The release examines the calendar year 2020. The initial base population of enterprises in this release comprises enterprises with between 1 and 249 persons engaged from within the NACE Rev. 2 Sectors 05-82 and 90-96 (see more details on NACE sectors below) which were active on the 2019 Central Business Register. A sample was drawn from this population.

Statistical Confidentiality

The survey was collected from enterprises on a voluntary basis under Section 24 of the Statistics Act, 1993.

The information collected in the survey is confidential under the Statistics Act and will only be used by the Central Statistics Office for the compilation of aggregate statistics. The CSO has checked the statistical outputs of the survey to ensure that tables do not disclose details of any company. The raw data will not be shared with any other organisations.

The CSO would like to thank businesses that responded to the Business Impact of COVID-19 on SMEs in 2020 Survey.

Sample

The reporting statistical unit for the survey is the enterprise. The sample size for the BICS is 8,000 enterprises. The enterprise is defined as the smallest combination of legal units that is an organisational unit producing goods and/or services, which benefits from a certain degree of autonomy in decision-making.

The sample was stratified by NACE sector and size class, with the four size classes described below. The survey was conducted online, and the sample size was approximately 8,000 enterprises. It is important to note that the results of the survey apply to respondents only, and that no imputation or estimation procedures have been used in the case of non-response. Therefore, as the results of the survey are unweighted, they may only reflect the characteristics of those who have responded. Due to the low response rate (24%) by businesses to this survey, the feasible breakdown of results is very limited. The distribution of respondents was not evenly spread across the size classes and micro enterprises are more strongly represented compared to other size classes. The sectors of economic activity included in the survey were determined in accordance with the NACE Rev. 2 classification scheme, which is the European Commission’s classification system for economic activity. The NACE Rev. 2 sectors included in the survey were as follows:

Section B - Mining & Quarrying (05 - 09)

Section C - Manufacturing (10 - 33)

Section D - Electricity, Gas, Steam & Air Conditioning Supply (35)

Section E - Water Supply; Sewerage, Waste Management & Remediation Activities (36 - 39)

Section F - Construction (41 - 43)

Section G - Wholesale and retail trade; repair of motor vehicles and motorcycles (45 - 47)

Section H - Transporting and storage (49 -53)

Section I - Accommodation and food service activities (55 -56)

Section J - Information and communication (58 - 63)

Section K - Financial and insurance activities (64 -66)

Section L - Real estate activities (68)

Section M - Professional, scientific and technical activities (39 -75)

Section N - Administrative and support service activities (77 - 82)

Section R - Arts, entertainment and recreation (90 - 93)

Section S - Other services activities (94 - 96)

For further information on the NACE Rev. 2 classification scheme, please see Classifications.

Data Collection and Questionnaire

The survey is collected via an online questionnaire . The topics relevant to this release are about how businesses perceived the impact of Brexit in 2020 and what steps have been taken as a result – e.g. in relation to the level of business, workforce and organisational changes.

Output Classifications - Definitions

Size Class

For this survey, the size class of an enterprise is determined by the number of persons engaged associated with the enterprise as follows:

| Size Class | Number of Persons Engaged |

| Micro a | 1 - 2 |

| Micro b | 3 - 9 |

| Small | 10 - 49 |

| Medium | 50 - 249 |

| SMEs | 0 - 249 |

| Large | 250+ |

A Small or Medium Enterprise (SME) is an amalgamation of the Micro, Small and Medium categories, i.e. having 1-249 persons engaged.

Sector

In the above results, there are cases where several NACE Rev. 2 categories are presented in aggregate form as follows:

| Sector | NACE Rev. 2 Category |

| Industry | B-E |

| Construction | F |

| Wholesale and Retail Trade | G |

| Services | H-N, R-S |

| Finance and Administration | K, L, N |

| Professional and IT | J, M |

Other Breakdowns

Many of the breakdowns in this release are based on the enterprise’s own best estimate at a point in time. The qualitative nature of these breakdowns has been chosen to limit burden on respondents.

Hide Background Notes

Hide Background Notes

Scan the QR code below to view this release online or go to

http://www.cso.ie/en/releasesandpublications/er/bibs/businessimpactofbrexitonsmes2020/