| Business Expenditure on Research and Development (R&D) 2007-20141 | |||||

| €'000 | |||||

| 2007 | 2009 | 2011 | 2013 | 20141 | |

| Current Expenditure | 1,323,914 | 1,542,843 | 1,606,911 | 1,874,663 | 1,941,769 |

| Capital Expenditure | 279,271 | 325,613 | 150,314 | 147,200 | 165,022 |

| Total Expenditure | 1,603,185 | 1,868,456 | 1,757,225 | 2,021,863 | 2,106,791 |

| 1Expenditure for 2014 is estimated | |||||

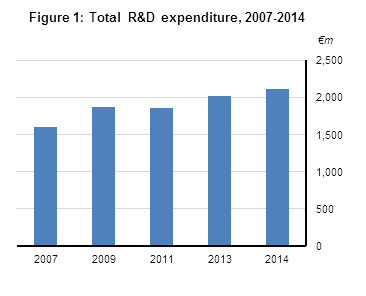

Results from the 2013 - 2014 Business Expenditure on Research and Development survey show that in excess of €2bn was spent on research and development (R&D) activities by enterprises in Ireland in 2013. This represents an increase of 15% compared with actual expenditure in 2011. Current expenditure, which comprises labour costs and other current costs, accounted for 93% of all expenditure in 2013 with capital expenditure accounting for the remaining 7% or €147m of total expenditure. Please note that capital expenditure for 2011 has been revised downwards from €253m to €150m. This is due to a re-classification of certain R&D expenditure at enterprise level.

Enterprises were asked for their estimated R&D expenditure in 2014. These estimates indicate that R&D expenditure increased to €2.1bn in 2014 with the split between current and capital expenditure similar to data reported for 2013. See Headline Table and Figure 1.

Large enterprises share of R&D expenditure at 50% in 2013

Enterprises that employ 250 persons or more had the greatest share of R&D expenditure in 2013 with just under 50% of all actual expenditure attributed to large enterprises. This accounted for €1bn of the total spend. Small enterprises with less than 50 persons engaged spent almost €445m on R&D in 2013 which accounted for 22% of the spend. Medium sized enterprises employing between 50 and 249 persons spent €576m in the same period which represents over 28% of total spend.

The breakdown of R&D expenditure in 2014 by employment size class shows a similar distribution to 2013 with small enterprises estimating that they would spend almost €481m. Medium enterprises forecast a spend of €544m. Large enterprises estimating that they would spend just under €1.1bn in 2014. See Figure 2 and Table 1.

| For long labels below use to display on multiple lines | Share of total R&D expenditure |

|---|---|

| Small (<50) | 21.985169123724 |

| Medium (50-249) | 28.4720577012389 |

| Large (250+) | 49.5427731750371 |

Labour Costs account for 61% of all R&D expenditure

In 2013, enterprises reported that over €1.2bn was spent on labour costs, which accounted for 61% of all R&D expenditure. Other current costs, which include materials, supplies, equipment and overheads associated with R&D, had a spend of nearly €636m which accounted for 31% of total expenditure. The remaining expenditure of €147m was accounted for by capital expenditure with just over 50% of capital expenditure being spent on Instruments and Equipment wholly acquired for R&D purposes. See Figure 3 and Tables 2 and 3.

| For long labels below use to display on multiple lines | Share of total R&D expenditure |

|---|---|

| Labour costs | 61.3 |

| Other current costs | 31.4 |

| Capital expenditure | 7.3 |

Two-thirds of R&D expenditure is by Foreign owned enterprises

Foreign owned enterprises accounted for 65% of all R&D expenditure, with just over €1.2bn being spent on current expenditure which represented 93% of all expenditure of foreign owned enterprises. The remaining 7% or €90m was spent on capital expenditure. Irish owned enterprises in comparison spent just over €700m on R&D with current expenditure at €645m accounting for nearly 92% of this expenditure. The remaining 8% or €58m was spent on capital expenditure. See Figure 4 and Table 1.

The largest 100 enterprises in terms of R&D spend accounted for over €1.4bn, or 70%, of the total R&D expenditure in 2013. Of these top 100 enterprises, 80% of the spend can be attributed to foreign owned enterprises. The spend of all other enterprises amounted to over €600m. Of this spend, €179m, or 30%, can be attributed to foreign owned enterprises with Irish owned enterprises accounting for over €426m, or 70%, of the spend.

| For long labels below use to display on multiple lines | Share of total R&D expenditure |

|---|---|

| Irish owned enterprises | 34.8 |

| Foreign owned enterprises | 65.2 |

Services sector accounted for 57% of total R&D expenditure

R&D spending was highest in the services sector which accounted for 57% of all expenditure. Spending in this sector was just under €1.2bn in 2013 while the manufacturing sector spent over €864m on R&D. For the purposes of this survey it should be noted that spending in the services sector includes the spend from all other non-manufacturing sectors. The value of this contribution to the services sector total is not significant.

Service sector enterprises reported that labour costs accounted for nearly 75% of all current expenditure while manufacturing enterprises stated that 54% of current expenditure was related to labour costs. In terms of capital expenditure, manufacturing enterprises spent just over €93m which represents over 63% of all capital expenditure on R&D. See Figure 5 and Tables 2 and 3.

| For long labels below use to display on multiple lines | Share of total R&D expenditure |

|---|---|

| Manufacturing sector | 42.7 |

| Services sector | 57.3 |

Southern and Eastern region account for 80% of all R&D expenditure

Total R&D spending in the Southern and Eastern region (SE) region was in excess of €1.6bn in 2013 which accounted for 80% of all R&D expenditure. The remainder of all R&D expenditure (20%), which accounted for €400m of the total spend, was spent in the Border, Midland and Western (BMW) region. 94% of all R&D spending in the SE region can be attributed to current expenditure while the corresponding figure for the BMW region was 89%. See Figure 6 and Table 1.

| For long labels below use to display on multiple lines | Share of total R&D Expenditure |

|---|---|

| Border, Midland and Western region | 19.5 |

| Southern and Eastern region | 80.5 |

Funding of R&D expenditure by enterprises

Enterprises were asked to report on how R&D expenditure was funded. 90% of all R&D expenditure was funded by enterprises’ own company/internal funds, while 6% of expenditure was funded from public funds. Small enterprises were more likely to use public funds, with 9% of funding for these enterprises attributed to public funding. See Figure 7.

| Small (<50) | Medium (50-249) | Large (250+) | |

| Own company/internal funds | 18.3 | 26.8 | 44.9 |

| Public funding | 1.9 | 1.3 | 3.2 |

| All other sources | 1.7 | 0.4 | 1.4 |

Ireland ranked 11th in EU-28 in terms of R&D intensity in 2011

The Business Expenditure on Research and Development survey is carried out in all EU-28 member states. The most recent data available from Eurostat is taken from the 2011-2012 survey, and allows comparisons across the EU. R&D intensity for a country is defined as the R&D expenditure as a percentage of Gross Domestic Product. In 2011, the R&D intensity for Ireland at 1.03% was below the EU-28 average of 1.24%. Finland has the highest R&D intensity in the EU with a figure of 2.56% while Cyprus has the lowest R&D intensity at 0.07%. Comparable figures for 2013 show that the R&D intensity for Ireland has increased to 1.16%. 2013 data for the EU-28 is not available at time of publication. See Figure 8.

| % of GDP | |

| Finland | 2.56 |

| Sweden | 2.22 |

| Denmark | 1.98 |

| Germany | 1.89 |

| Austria | 1.84 |

| Slovenia | 1.79 |

| Belgium | 1.48 |

| Estonia | 1.48 |

| France | 1.4 |

| EU28 | 1.24 |

| Ireland (2013) | 1.16 |

| Ireland (2011) | 1.03 |

| United Kingdom | 1.08 |

| Netherlands | 1.06 |

| Luxembourg | 0.98 |

| Czech Republic | 0.86 |

| Hungary | 0.75 |

| Spain | 0.69 |

| Portugal | 0.69 |

| Italy | 0.66 |

| Malta | 0.46 |

| Croatia | 0.34 |

| Bulgaria | 0.29 |

| Slovakia | 0.25 |

| Lithuania | 0.24 |

| Greece | 0.23 |

| Poland | 0.23 |

| Latvia | 0.19 |

| Romania | 0.18 |

| Cyprus | 0.07 |

Researchers account for 55% of all R&D staff

Enterprises were asked to indicate the numbers of staff who devoted any of their time to R&D activities. R&D personnel includes researchers (PhD qualified and others), technicians and other support staff. In total, there were 24,785 persons engaged in R&D in Ireland in 2013. Of this total, 55% or 13,750 persons were employed as researchers, of which 2,181 were PhD qualified researchers. In addition, there were 5,893 technicians which accounted for 24% of all staff and the remaining 21% of R&D personnel were accounted for by 5,142 support staff. See Figure 9 and Table 4.

| For long labels below use to display on multiple lines | Percentage of research personnel |

|---|---|

| PhD qualified researchers | 8.8 |

| Other researchers | 46.7 |

| Technicians | 23.8 |

| Support staff | 20.7 |

33% of all researchers employed by small enterprises

The number of R&D personnel engaged in small enterprises in 2013 was 8,291 which accounted for 33% of all research personnel. The number of research personnel in medium sized enterprises was 7,777. This accounted for 31% of all R&D personnel. 8,718 R&D staff were engaged in large enterprises. This accounted for 35% of all R&D personnel. Small enterprises accounted for 821 PhD qualified researchers which equates to nearly 38% of all PhD qualified researchers, large enterprises accounted for 43% of all PhD qualified researchers with 933 persons employed as PhD researchers in these enterprises. Just one in five PhD qualified researchers or 427 persons were employed in medium sized enterprises. See Figure 10 and Table 4.

13,248 research staff were engaged in Irish owned enterprises while 11,538 research staff were engaged in foreign owned enterprises , accounting for 53% and 47% of research staff respectively. There were more research staff engaged in the services sector (67%) than in the industrial sector (33%).

20,256 people were engaged as research staff in the Southern and Eastern (SE) region in 2013 compared to 4,528 in the Border, Midland and Western (BMW) region. The SE region accounted for 82% of all research staff while the BMW region accounted for 18%. See Table 4.

| PhD qualified researchers | |

| Small (<50) | 37.6 |

| Medium (50-249) | 19.6 |

| Large (250+) | 42.8 |

Males account for 77% of all R&D staff

The number of male research personnel in 2013 was 19,049 which accounted for 77% of all R&D staff. This compares with a 2011 figure of 76%. Support staff has the largest share of female employment with 30% of staff being female while Technicians have the lowest share of female staff at just 18%. See Figure 11 and Table 4.

| Male | Female | |

| 2007 | 74.8 | 25.2 |

| 2009 | 73.5 | 26.5 |

| 2011 | 75.9 | 24.1 |

| 2013 | 76.9 | 23.1 |

R&D active enterprises

R&D active enterprises are those enterprises who self reported that they either performed in-house R&D, had R&D performed on their behalf or controlled branches engaged in R&D activity. There were nearly 2,000 enterprises engaged in R&D activities in Ireland in 2013. More than 74% of all enterprises spent less than €500,000 on R&D activities. Just over one sixth spent between €500,000 and €2m, while only 10% of enterprises spent €2m or more on R&D activities.

| % of enterprises | |

| €0 - €99,999 | 38.8 |

| €100,000 - €499,999 | 34.9 |

| €500,000 - €1,999,999 | 17.6 |

| €2,000,000 - €4,999,999 | 4.8 |

| > €5,000,000 | 3.8 |

Small enterprises account for 73% of R&D active enterprises

In 2013, nearly 1,500 small enterprises were engaged in R&D. They accounted for 73% of all R&D active enterprises compared with 378 medium enterprises which accounted for 19% of R&D active enterprises and 143 large enterprises which accounted for 7% of all R&D active enterprises.

Most recent figures available from the "Business in Ireland 2012 (PDF 3,329KB) " CSO report indicates that there are 481 enterprises in Ireland classified as large. Of these 481 enterprises nearly 30%, or 143 large enterprises, consider themselves as being R&D active. In contrast, there are over 2,400 enterprises classified as medium size enterprises in Ireland, with under 16% or 378 of these medium considered to be R&D active. There are over 182,600 enterprises in Ireland classified as small enterprises. 1,458 small enterprises considered themselves to be R&D active. This accounts for less than 1% of all small enterprises. The vast majority (98%) of all small enterprises spent less than €2m on R&D activities compared to 79% of medium size enterprises and 57% of large enterprises.

| For long labels below use to display on multiple lines | Enterprises engaged in R&D |

|---|---|

| Small (<50) | 1458 |

| Medium (50-249) | 378 |

| Large (250+) | 143 |

| Small (<50) | Medium (50-249) | Large (250+) | |

| €0 - €99,999 | 686 | 67 | 15 |

| €100,000 - €499,999 | 519 | 144 | 27 |

| €500,000 - €1,999,999 | 222 | 89 | 37 |

| €2,000,000 - €4,999,999 | 28 | 42 | 25 |

| >€5,000,000 | 3 | 36 | 37 |

80% of R&D active enterprises are Irish

There were 1,574 Irish owned enterprises engaged in R&D activities in 2013 which equates to 80% of all R&D active enterprises compared to 405 foreign owned enterprises which accounts for the 20% of all R&D active enterprises. Over 80% of all Irish owned enterprises spent less than €500,000 on research and development compared to 45% of all foreign owned enterprises.

| Irish owned enterprises | Foreign owned enterprises | |

| €0 - €99,999 | 704 | 64 |

| €100,000 - €499,999 | 570 | 120 |

| €500,000 - €1,999,999 | 245 | 104 |

| €2,000,000 - €4,999,999 | 34 | 62 |

| >€5,000,000 | 21 | 55 |

Services sector account for 60% of R&D active enterprises

Of the nearly 2,000 enterprises that considered themselves as being R&D active, just under 1,200 enterprises were classified to the services sector. This accounted for 60% of R&D active enterprises. Just under 800 enterprises (or 40%) of R&D active enterprises are in the Manufacturing sector. Over 90% of both manufacturing and service sectors enterprises spent less than €2m on R&D in 2013.

| Manufacturing sector | Services sector | |

| €0 - €99,999 | 333 | 434 |

| €100,000 - €499,999 | 261 | 430 |

| €500,000 - €1,999,999 | 129 | 219 |

| €2,000,000 - €4,999,999 | 37 | 59 |

| >€5,000,000 | 36 | 40 |

| Table 1 Total expenditure on research and development by size of enterprise, nationality of ownership, sector of activity and region, 2013 | |||

| €'000 | |||

| Total current expenditure | Total capital expenditure | Total R&D expenditure | |

| Size of enterprise | |||

| Small (<50 persons engaged) | 409,882 | 34,628 | 444,510 |

| Medium (50 - 249 persons engaged) | 540,322 | 35,344 | 575,666 |

| Large (250+ persons engaged) | 924,459 | 77,228 | 1,001,687 |

| Nationality of ownership | |||

| Irish owned enterprises | 645,065 | 58,056 | 703,121 |

| Foreign owned enterprises | 1,229,598 | 89,144 | 1,318,742 |

| Sector of activity | |||

| Manufacturing sector | 770,987 | 93,290 | 864,277 |

| Services sector | 1,103,677 | 53,909 | 1,157,586 |

| Region | |||

| Border, Midland and Western region | 351,336 | 42,886 | 394,222 |

| Southern and Eastern region | 1,523,327 | 104,314 | 1,627,641 |

| Total - all enterprises | 1,874,663 | 147,200 | 2,021,863 |

| Table 2 Current expenditure on research and development by size of enterprise, nationality of ownership, sector of activity and region, 2013 | |||

| €'000 | |||

| Labour costs | Other current costs | Total current expenditure | |

| Size of enterprise | |||

| Small (<50 persons engaged) | 302,038 | 107,844 | 409,882 |

| Medium (50 - 249 persons engaged) | 369,294 | 171,027 | 540,322 |

| Large (250+ persons engaged) | 567,570 | 356,889 | 924,459 |

| Nationality of ownership | |||

| Irish owned enterprises | 451,967 | 193,098 | 645,065 |

| Foreign owned enterprises | 786,936 | 442,663 | 1,229,598 |

| Sector of activity | |||

| Manufacturing sector | 416,516 | 354,471 | 770,987 |

| Services sector | 822,387 | 281,290 | 1,103,677 |

| Region | |||

| Border, Midland and Western region | 214,152 | 137,185 | 351,336 |

| Southern and Eastern region | 1,024,751 | 498,576 | 1,523,327 |

| Total - all enterprises | 1,238,903 | 635,761 | 1,874,663 |

| Table 3 Capital expenditure on research and development by size of enterprise, nationality of ownership, sector of activity and region, 2013 | ||||||

| €'000 | ||||||

| Land and buildings | Payments made for licences to use intellectual products | Instruments and equipment excluding software | Software purchased wholly for R&D purposes | Software development by company in-house and used in-house | Total capital expenditure | |

| Size of enterprise | ||||||

| Small (<50 persons engaged) | 7,298 | 4,073 | 12,861 | 7,788 | 2,608 | 34,628 |

| Medium (50 - 249 persons engaged) | 13,424 | 4,966 | 13,681 | 2,866 | 407 | 35,344 |

| Large (250+ persons engaged) | 8,942 | 862 | 48,400 | 5,140 | 13,884 | 77,228 |

| Nationality of ownership | ||||||

| Irish owned enterprises | 11,233 | 4,325 | 18,571 | 10,145 | 13,781 | 58,056 |

| Foreign owned enterprises | 18,431 | 5,575 | 56,370 | 5,650 | 3,118 | 89,144 |

| Sector of activity | ||||||

| Manufacturing sector | 16,132 | 6,372 | 50,101 | 9,194 | 11,492 | 93,290 |

| Services sector | 13,533 | 3,529 | 24,840 | 6,601 | 5,407 | 53,909 |

| Region | ||||||

| Border, Midland and Western region | 4,923 | 1,042 | 23,621 | 1,489 | 11,810 | 42,886 |

| Southern and Eastern region | 24,742 | 8,858 | 51,320 | 14,305 | 5,089 | 104,314 |

| Total - all enterprises | 29,664 | 9,901 | 74,941 | 15,794 | 16,899 | 147,200 |

| Table 4 Total headcount of research personnel by size of enterprise, nationality of ownership, sector of activity and region, 2013 | |||||||||||||||

| No. | |||||||||||||||

| PhD qualified researchers | Other researchers | Technicians | Support staff | All R&D staff | |||||||||||

| Male | Female | Total | Male | Female | Total | Male | Female | Total | Male | Female | Total | Male | Female | Total | |

| Size of enterprise | |||||||||||||||

| Small (<50 persons engaged) | 669 | 152 | 821 | 2,982 | 651 | 3,633 | 1,882 | 250 | 2,132 | 1,234 | 470 | 1,705 | 6,767 | 1,524 | 8,291 |

| Medium (50 - 249 persons engaged) | 323 | 104 | 427 | 2,896 | 845 | 3,741 | 1,579 | 341 | 1,920 | 1,262 | 426 | 1,688 | 6,060 | 1,717 | 7,777 |

| Large (250+ persons engaged) | 611 | 322 | 933 | 3,160 | 1,035 | 4,195 | 1,341 | 499 | 1,841 | 1,109 | 640 | 1,749 | 6,221 | 2,496 | 8,718 |

| Nationality of ownership | |||||||||||||||

| Irish owned enterprises | 873 | 316 | 1,188 | 4,352 | 1,350 | 5,702 | 2,624 | 475 | 3,098 | 2,360 | 900 | 3,260 | 10,208 | 3,039 | 13,248 |

| Foreign owned enterprises | 731 | 263 | 993 | 4,686 | 1,182 | 5,868 | 2,179 | 616 | 2,795 | 1,245 | 637 | 1,882 | 8,841 | 2,697 | 11,538 |

| Sector of activity | |||||||||||||||

| Manufacturing sector | 543 | 208 | 751 | 2,520 | 763 | 3,283 | 1,407 | 358 | 1,765 | 1,763 | 594 | 2,357 | 6,233 | 1,922 | 8,155 |

| Services sector | 1,060 | 370 | 1,430 | 6,518 | 1,769 | 8,287 | 3,396 | 733 | 4,128 | 1,842 | 943 | 2,785 | 12,816 | 3,814 | 16,630 |

| Region | |||||||||||||||

| Border, Midland and Western region | 283 | 73 | 355 | 1,788 | 558 | 2,345 | 741 | 163 | 904 | 685 | 239 | 923 | 3,497 | 1,033 | 4,528 |

| Southern and Eastern region | 1,320 | 505 | 1,825 | 7,250 | 1,974 | 9,224 | 4,061 | 927 | 4,989 | 2,920 | 1,298 | 4,218 | 15,551 | 4,705 | 20,256 |

| Total - all enterprises | 1,603 | 578 | 2,181 | 9,038 | 2,532 | 11,569 | 4,803 | 1,090 | 5,893 | 3,605 | 1,536 | 5,142 | 19,049 | 5,737 | 24,785 |

Introduction: The Business Expenditure on Research and Development (BERD) Survey 2013 - 2014 is a survey of the research and development activities of enterprises in Ireland and other EU Member States.

The BERD Survey is carried out under Commission Regulation (EC) No 995/2012 implementing Decision No 1608/2003/EC. The survey collected information about the research and development activities of enterprises across all business sectors of the economy. Most questions gather information on the spending and performance of research and development.

The BERD Survey is an On-Line Only Survey conducted by the CSO under Section 11 of the Statistics Act, 1993 to increase efficiency in the collection of statistical data and to reduce the burden on the participating enterprises. Data were collected in accordance with Section 33 of the Statistics Act, 1993 and with EU law and the survey was carried out under the agreed set of international rules as laid out in the OECD Frascati manual. Data are strictly confidential and will be used only for statistical purposes.

Survey: The BERD Survey is a targeted survey which is issued to all enterprises which are believed to be actively engaged in research and development across all business sectors of the economy. These enterprises were identified from various sources which included previous responses to the survey, other CSO data and other administrative sources.

Questionnaire: The BERD questionnaire is available from the CSO website.

Definition of Research and Development: Research and Development (R&D) is creative work undertaken on a systematic basis in order to create new or improved products, processes, services or other applications. R&D is distinguishable from other activities by the presence of an appreciable element of novelty and by the resolution of problems and uncertainties using scientific or technological means. Routine activities, such as routine software development, routine monitoring/analysis or preproduction preparation, where there is no appreciable novelty or problem resolution, are not considered to be R&D for the purpose of this survey.

Hide Background Notes

Hide Background Notes

Scan the QR code below to view this release online or go to

http://www.cso.ie/en/releasesandpublications/er/berd/businessexpenditureonresearchdevelopment2013-2014/