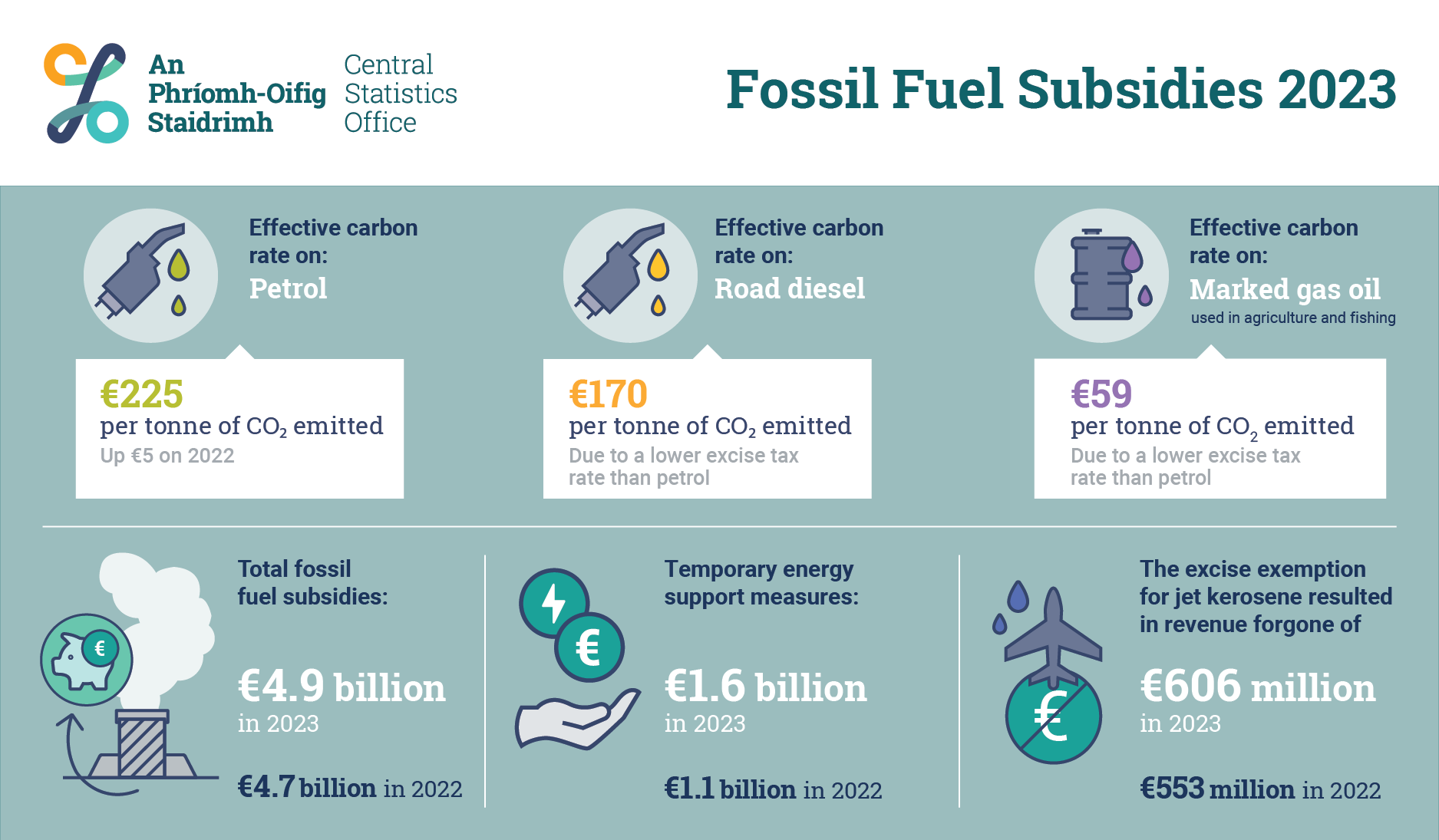

Fossil Fuel Subsidies 2023

Effective carbon rate on:

Petrol €225 per tonne of CO2 emitted

Up €5 on 2022

Effective carbon rate on:

Road diesel €170 per tonne of CO2 emitted

Due to a lower excise tax rate than petrol

Effective carbon rate on:

Marked gas oil used in agriculture and fishing €59 per tonne of CO2 emitted

Due to a lower excise tax rate than petrol

Total fossil fuel subsidies:

€4.9 billion in 2023

€4.7 billion in 2022

Temporary energy support measures:

€1.6 billion in 2023

€1.1 billion in 2022

The excise exemption for jet kerosene resulted in revenue forgone of

€606 million in 2023

€553 million in 2022