Your feedback can help us improve and enhance our services to the public. Tell us what matters to you in our online Customer Satisfaction Survey.

The accrued-to-date liability (ADL) concept used in the publication can be interpreted as the amount of money which needs to be set aside in order to finance all pension rights which have been earned or accrued up to 31 December 2015. Entitlements accruing after that date are not included. This measure is not suitable for the assessment of the sustainability of a pension system as it does not take into account the pension benefits and PRSI contributions in future years.

In contrast, the open-system liability (OSL) measure of pension liabilities includes future entitlements earned over the remaining career of the current workforce and future entitlements of people who are not yet working today. This measure also takes future PRSI contributions into account and is the approach more suited to measuring the sustainability of a pension system.

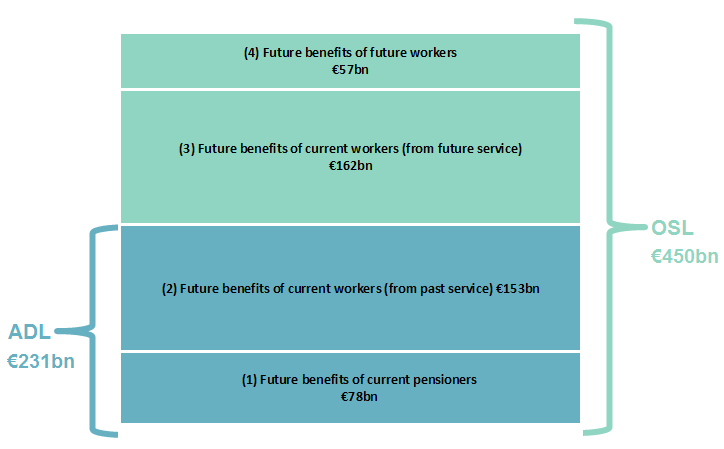

This section outlines the accrued-to-date liability (ADL) concept and the open-system liability (OSL) concept and uses the social security pension scheme to illustrate how these two approaches can be related.

Government state pension expenditure can be divided into four groups:

1) for each year, pensions have to be paid to people who are already retired today. Payments to this group will gradually decline and become zero upon the death of the last person who is already retired today;

2) pensions have to be paid in future to people working today, in relation to the entitlement they have built up to the present day. Payments to this group will increase for several years, as people currently working will increasingly retire. It will then decrease in line with mortality;

3) pensions have to be paid to people already in the labour market, in relation to the entitlements they will accumulate from the present day until their retirement; and

4) pensions have to be paid in the distant future to people who are not yet in the labour market.

Figure 5.1 illustrates the relationship between the ADL (groups 1 and 2) and OSL (groups 1 - 4) measures for the Irish state pension as it is defined in this publication. At 31 December 2015, the total liability using the OSL approach was €450bn whereas the component based on past service (ADL) was €231bn. Note that these are gross values and therefore no assets (or PRSI contributions) are taken into account.

Source: Actuarial Review of the Social Insurance Fund 2015 (PDF)

The ADL is an appropriate measure to be reported in the National Accounts as it is useful for economic analyses. It also provides valuable statistical information on household wealth in terms of assets at a point in time.

However, the ADL is not an appropriate indicator of fiscal sustainability as it only takes into account current pensioners and current workers (past service benefits earned). The OSL considers the long-term development of the overall population as it also includes current workers (future service benefits earned) and future workers.

Furthermore, the ADL measure is compiled on a gross basis without including the net present value of future PRSI contributions. To assess economic sustainability it is important to compare pension obligations with respective assets. In the case of the Irish public system the assets are the present value of future PRSI receipts which would be deemed attributable to pension expenditure plus the value of future Exchequer subventions.1

The Actuarial Review of the Social Insurance Fund2 looks at the net present value of shortfalls3 of the fund over a 55 year projection period. This is equivalent to the OSL measure but takes into account the assets or future PRSI contributions to the Social Insurance Fund (SIF). It can therefore be referred to as the Open System Net Liability (OSNL). Chapter 7 (Table 7.5, pg. 75) of the SIF Review illustrates the net present value of shortfalls of the Fund (or OSNL) over the period using various discount rates. With the exception of the mortality assumption4 both the OSNL and ADL are calculated using common assumptions and can therefore be reconciled in value terms. Figure 5.2 illustrates the reconciliation of the OSNL to the ADL both using a 3% discount rate in real terms.

| Reconciliation of OSNL with ADL | |

| Open System Net Liability (OSNL) end-2015 | 197 |

| Exclude non-pension related schemes | -32 |

| Difference in mortality assumption (Eurostat v CSO) | -4 |

| Future PRSI contributions from future contributors | 67 |

| Future pension benefits paid to future contributors | -57 |

| Future PRSI contributions from current contributors | 222 |

| Future pension benefits paid to current contributors | -162 |

| Accrued-to-date liability (ADL) end-2015 | 231 |

Source: Actuarial Review of the Social Insurance Fund 2015 (PDF)

The OSNL value of €197bn is the present value of the balances projected to be required from future Exchequer subventions. It is an important and relevant measure to ascertain the sustainability of the SIF as it represents the value which has to be set aside today to sustain the present social insurance expenditure system (in its legal status quo) over the 55 year projection period.

The ADL, in contrast, is a suitable measure for national accounts purposes as it is backward looking in terms of pension benefits earned but is not an appropriate measure of sustainability. It allows for comparison between countries but it is important to keep in mind that where a country records a large ADL this does not necessarily infer an unsustainable pension scheme. These countries may have a mature pension system where pension entitlements have accumulated over time but these liabilities are not expected to increase in the future. By the same token, a country reporting a low value ADL does not mean that the respective pension schemes are fiscally stable in the long term as these countries may have larger obligations to pensioners in the future.

This is further illustrated by comparing Ireland’s dependency ratio5 with other EU countries. Although still relatively young by EU standards, the population of Ireland is ageing and the projected old-age dependency ratio is to increase to 45 in 2080, an increase of 25 when compared to the 2015 ratio of 20. In contrast the old-age dependency ratio for Sweden will increase by just over 14 during the same period.

| Ireland | Sweden | UK | EU28 | |

| 2015 | 20 | 31.1 | 27.5 | 28.8 |

| 2020 | 22.8 | 32.5 | 29.1 | 31.7 |

| 2030 | 28.7 | 34.6 | 34.1 | 39.1 |

| 2040 | 36.6 | 36.9 | 38.5 | 46.4 |

| 2050 | 45.5 | 37.9 | 40 | 50.3 |

| 2060 | 44.5 | 42.6 | 43.4 | 51.6 |

| 2070 | 41.3 | 43.1 | 45.8 | 51.2 |

| 2080 | 45 | 45.2 | 49.1 | 52.3 |

Source: Eurostat

As illustrated in Chapter 2, Ireland’s ADL appears low in comparison to other EU countries and this is largely due to the relatively young population. As demographic developments take effect and the number of people aged 65 and over continues to increase in Ireland, the ADL will grow to reflect the growing numbers accruing rights to and in receipt of a pension. In contrast, those EU countries with a more mature population will experience a more gradual growth in their ADL.

Footnotes

1Legally the Exchequer is the residual financier of the Social Insurance Fund (SIF). Exchequer subventions were the norm for over 40 years. From 2016, the SIF has returned to surplus.

2Department of Employment Affairs and Social Protection (2017). Actuarial Review of the Social Insurance Fund 2015 (PDF). Undertaken by KPMG.

3Difference between projected contribution income and expenditure.

4The Actuarial Review of the Social Insurance Fund net present value of future shortfalls uses CSO mortality assumptions whereas the ADL estimate for Column H is based on Eurostat mortality assumptions.

5The demographic old-age dependency ratio is defined as the number of individuals aged 65 and over per 100 people of working age defined as those aged between 15 and 64.

Go to next chapter >> Background Notes

Learn about our data and confidentiality safeguards, and the steps we take to produce statistics that can be trusted by all.