Multinationals play an important role in the economies of many countries. Increasingly, multinationals create a physical presence in several countries around the world in order to maximise their global earnings.

This chapter presents statistics on the activities of the affiliates of Irish multinationals abroad and the contribution made by the affiliates of Foreign multinationals in Ireland. See Tables 7.1, 7.2 and 7.3 at the end of this section for more detail on the data in the graphs.

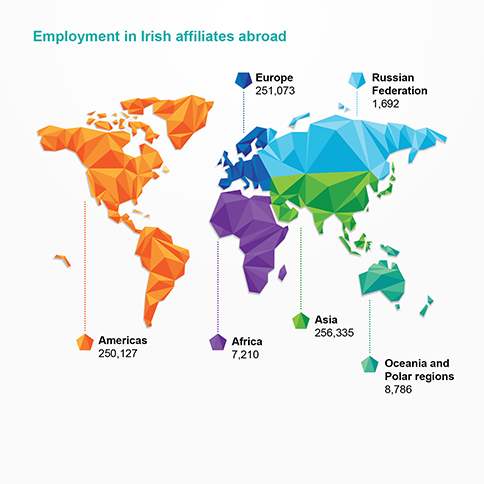

Figure 7.1 Employment in Irish affiliates abroad, 2015

Figure 7.2 Irish MNEs abroad and foreign MNEs in Ireland, 2015

| For long labels below use to display on multiple lines | Active enterprises |

|---|---|

| United States | 34.6 |

| United Kingdom | 26.1 |

| Other countries | 39.2 |

| For long labels below use to display on multiple lines | Active enterprises |

|---|---|

| United States | 21.7 |

| United Kingdom | 13.3 |

| Other countries | 65 |

| 2015 | |

| China | 27326 |

| Germany | 22494 |

| Mexico | 20838 |

| France | 20610 |

| Brazil | 18062 |

| Spain | 17849 |

| Italy | 16455 |

| Netherlands | 16142 |

| Canada | 12635 |

| Argentina | 9633 |

| 2015 | |

| Germany | 6.2 |

| Netherlands | 5.6 |

| France | 4.4 |

| Australia | 4 |

| Spain | 2.8 |

| Canada | 2.7 |

| Italy | 2.7 |

| Switzerland | 2.6 |

| Belgium | 2.1 |

| Sweden | 2 |

| For long labels below use to display on multiple lines | Active enterprises |

|---|---|

| Manufacturing | 20.2 |

| Other industrial | 0.6 |

| Construction | 0.1 |

| Services | 79.1 |

| For long labels below use to display on multiple lines | Active enterprises |

|---|---|

| Manufacturing | 23.2 |

| Other industrial | 2.3 |

| Construction | 0.4 |

| Services | 74 |

| Turnover | |

| Other | 6.3 |

| Construction | 0.6 |

| Information and Communication | 6.8 |

| Financial and Insurance activities | 5.8 |

| Professional, Scientific and Technical activities | 34.2 |

| Manufacturing | 23.2 |

| Distribution | 23.1 |

| Services | Manufacturing | |

| Irish | 61 | 38.1 |

| British | 45.3 | 30.6 |

| French | 46.3 | 39.1 |

| German | 57.5 | 40.7 |

| Italian | 30.5 | 55.1 |

| 0 | 0 | |

| EU28 | 49.4 | 39.5 |

The Financial and Insurance sector is excluded from this section. Accordingly, all the measures below relate to the non-financial business economy only (which encompasses the broad sectors of Industry, Services, Distribution and Construction).

| 2014 | 2015 | |

| Number of enterprises | 1.5 | 1.3 |

| Persons engaged | 24.3 | 22.2 |

| Turnover | 52.7 | 56.4 |

| GVA | 52.1 | 63.3 |

| 2014 | 2015 | |

| Number of enterprises | 3.6 | 3.9 |

| Persons engaged | 39.2 | 41.7 |

| Turnover | 72.9 | 86 |

| GVA | 72.6 | 89.2 |

| 2014 | 2015 | |

| Number of enterprises | 2.2 | 1.8 |

| Persons engaged | 25.6 | 24.5 |

| Turnover | 38.6 | 32.8 |

| GVA | 40.7 | 36.4 |

| 2014 | 2015 | |

| Number of enterprises | 1.5 | 1.3 |

| Persons engaged | 21.6 | 18.1 |

| Turnover | 52.3 | 43.2 |

| GVA | 44.8 | 38.9 |

| Gross Value Added | |

| Hungary | 52.7 |

| Ireland | 52.1 |

| Luxembourg | 47 |

| Romania | 43.9 |

| Slovakia | 43.4 |

| Czech Republic | 42.3 |

| Bulgaria | 33 |

| Latvia | 31.1 |

| United Kingdom | 29.9 |

| Poland | 29.1 |

| Belgium | 27.5 |

| Sweden | 27.4 |

| Netherlands | 27.3 |

| Lithuania | 26.5 |

| Estonia | 26.4 |

| Austria | 26.3 |

| Croatia | 24.9 |

| EU28 | 24.1 |

| Slovenia | 24.1 |

| Malta | 22.6 |

| Portugal | 22.3 |

| Germany | 21.8 |

| Finland | 21.6 |

| Denmark | 21.3 |

| Spain | 21.1 |

| France | 16 |

| Italy | 14.7 |

| Greece | 12 |

| Cyprus | 11.2 |

Go to next chapter >>> Financial Sector

Learn about our data and confidentiality safeguards, and the steps we take to produce statistics that can be trusted by all.