Your feedback can help us improve and enhance our services to the public. Tell us what matters to you in our online Customer Satisfaction Survey.

Taxes are compulsory payments to Government or to the EU. Most taxes are clearly labelled as such, like ‘value added tax’ but some taxes are called a ‘levy’ ‘charge’, ‘licence’ or ‘fee’.

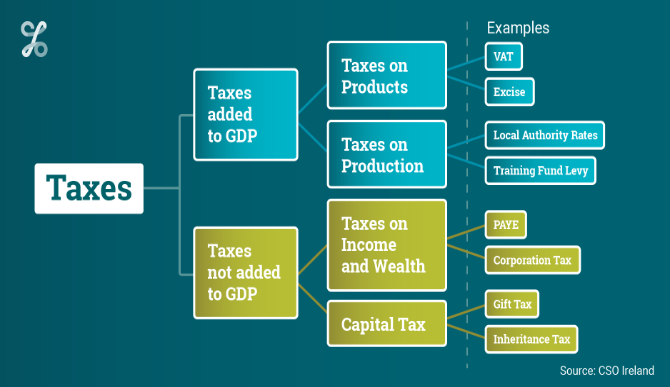

In National Accounts there are three groups of taxes, each of which is deducted in a different part of the Sequence of Accounts.

These are taxes that have to be paid irrespective of the profits made. They are taxes on production of goods or services, taxes on employment (but not taxes on income from employment), taxes on land or buildings. Taxes on products and production are added in the transition from Gross Value Added at Factor Cost to Gross Domestic Product.

1(a) Taxes on Products

These taxes are things like Value Added Tax (VAT) Import Duties, Excise Duty, and Stamp Duty. Since these are taxes on the product irrespective of who pays the tax, in the National Accounts, the payment of these taxes is Not Sectorised, that is, it is not allocated to specific Sectors. All other taxes paid are allocated to Sectors as costs.

Taxes on products are added to Gross Value Added at Basic Prices to get Gross Domestic Product at Market Prices.

1(b)Taxes on Production

These are taxes that have to be paid irrespective of the quantity of goods sold or the profits made. These include Local Authority Rates on businesses (a tax on the building used for production), Motor Taxes on business (a tax on the vehicles used in production), the National Training Fund Levy (a tax on employment used in production) and the Public Service Obligation Levy (a tax on the energy used in production). The Local Property Tax is also a tax on production, because for National Accounts purposes, owning a house is considered production of dwelling services, even if you are providing those dwelling services to yourself (see Imputed Rent).

Taxes on production are added to Gross Value Added at Factor Cost to get Gross Value Added at Basic Prices.

The largest of the taxes on income paid by households are Income Tax (PAYE) and the Universal Social Charge. Capital Gains Tax, which is a tax on difference between the price you paid for an asset and the price you disposed of it for, is also in this category (a tax on holding gains). Motor Tax paid by households, and the Television Licence Fee are taxes on the wealth of households (but these are taxes on production for businesses).

For businesses, the biggest tax on income and wealth is Corporation Tax, which is assessed based on their net profits. Capital Gains Tax paid by businesses is also in this category but it is dwarfed by the Corporation Tax.

Taxes on Income and Wealth are Secondary Transfers, along with Social Transfers and Other Transfers.

Capital taxes are those taxes paid when an asset is acquired or disposed of, and are based on the value of the asset. The main capital tax in Ireland is Capital Acquisitions Tax (CAT), which is a tax on gifts and inheritance and which is all paid by households.

Any exceptional or occasional levies on assets or net worth would also be classified as capital taxes; if they are not occasional taxes but regular, then they are classified as taxes on income and wealth.