Your feedback can help us improve and enhance our services to the public. Tell us what matters to you in our online Customer Satisfaction Survey.

Investment Income is the revenue stream on Financial Assets. For example, if you have money on deposit you can earn interest on it and that interest is a form of Investment Income. Similarly, if you own shares in a company, you receive dividends on those shares, which is part of your Investment Income. If the shares go up in value and are worth more, that is not part of the Investment Income, it is a holding gain. If you sell the shares, that is not Investment Income, that is changing one asset for another. Of course, the Investment Income might not come in as a revenue stream but as a lump sum, but regardless of how lumpy it is, if it is income on the financial asset, then it is Investment Income.

On the other hand, if you have a loan you must pay interest on, then that interest is 'Investment Income paid', which may be confusing, because it is an out-going to you, and not income. Nonetheless, it is all Investment Income.

Different kinds of financial assets have different Investment Income as the table shows:

| Asset | Investment Income |

| Deposits, debt securities and loans | Interest |

| Shares (equity) | Dividends, Reinvested Earnings |

| Insurance, pensions, standardised guarantees Other accounts payable | Other Investment Income |

In International Accounts, Investment Income is sometimes simply referred to as Income.

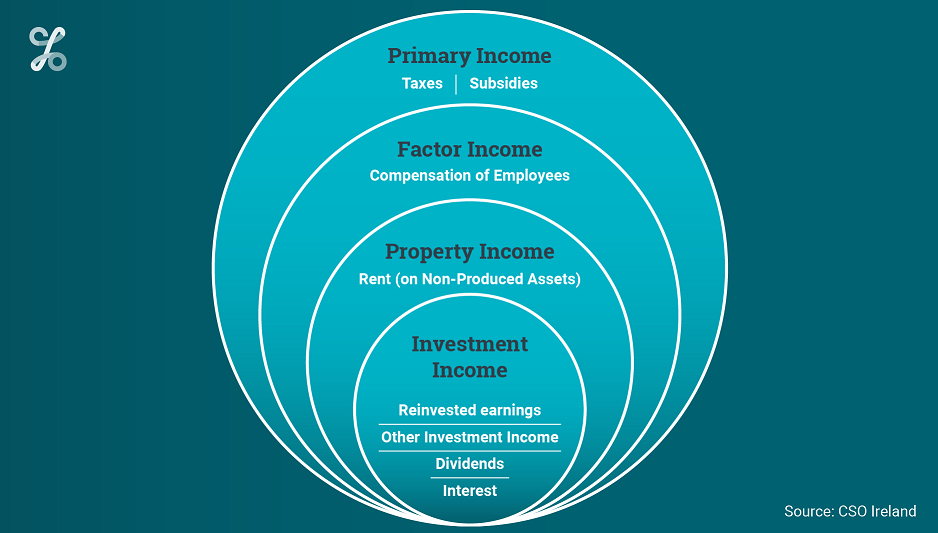

Property Income is made up of Investment Income plus income on renting out Non-Produced Assets such as land or radio spectra. In National Accounts, the strict definition of the word ‘Rent’ means this rent on the use of natural resources or other non-produced assets.

If you rent houses, cars, airplanes, or any other Fixed Capital Asset (that is, you rent out a Produced Asset), then you are providing ‘rental services’ or leasing services, and your income is not 'Rent' and it is not included in Property Income. Instead, rental services are part of Output, just like producing any other kind of service.

So Property Income is the total of Investment Income and Rent.

Investment Income and Rent are part of Net Factor Income with the rest of the world, the rest of Net Factor Income being Compensation of Employees paid across borders. In Ireland, negligible amounts of rent are paid to and from the rest of the world, so for transactions with the rest of the world, total Property Income equals total Investment Income. This means the Net Factor Income is really the net Compensation of Employees across our borders plus the net Investment Income into and out of the country. Furthermore, Compensation of Employees is tiny compared to Investment Income across our borders, so any significant changes in Net Factor Income are due to changes in Investment Income.