The amendment of STS-Regulation requires short term statistics on import prices (340, hereafter MPI) under the provisions of Annex A. Member States that have adopted the euro as their currency are required to distinguish import prices from the euro zone and from the non-euro-zone, but at a lower level a detail.

Import price indices seek to measure the gross monthly change in the import price of products coming from the Rest of the World. This gross monthly change corresponds to a given product, and through aggregation, groups of products, up to main industrial groupings (MIGs). Monthly measurements of changes in import prices meet a need for information on the short- and medium-term economic activity linked to external trade of the Member States, the EU and the euro zone. They permit monthly monitoring of prices for different categories of products, and they are a means of distinguishing real growth of imports from price changes in the foreign trade statistics and the national accounts. They can provide information to the business community on particular areas (euro-zone / non-euro-zone split) and different product categories of interest to them.

The scope of the import price index is defined in terms of products imported, institutional sector of the importer and flows covered: (a) Products - the product coverage is limited the CPA C, D and E products. Related services are excluded. The STS-Regulations require coverage of Sections C to E of the CPA excluding Groups 12.0, 22.1, 23.3, 29.6, 35.1, 35.3, 37.1 and 37.2. (b) Institutional sectors of the importers - according to ESA 95 definition [3.129], all transactions in goods and services from non-residents to residents are import flows, whatever the institutional sector or industry of the importer. However, it has been agreed to exclude imports by households, government units and non-profit institutions. As a result, importers to be covered include all other producers of goods and services - including traders - irrespectively of their classification according to NACE Rev.1.1. (c) Trade regimes - the underlying trade regimes and statistical procedure are the special trade system and normal imports as well as imports for inward processing are included. Imports for repair are not to be covered.

The following rules apply for the definition of import prices: Cost, Insurance, Freight (C.i.f.) excluding import duties and taxes - the appropriate price is the c.i.f. price at the national border excluding all duties and taxes on imports to be shouldered by the reporting unit. This is in conformity with the ESA 95 recommendation to use basic prices. Actual transaction price - in order to show the true development of price movements, it should be an actual transaction price, and not a list price, therefore discounts should be deducted from the price; list prices may be acceptable only if actual transaction prices cannot be obtained. Transactions in foreign currencies - the MPI displays the development of prices of products in national currency. The price of a transaction made in another currency must be converted on this basis by the national statistical authority. Price changes thus partially reflect exchange rate fluctuations. Specification/quality - it is essential that all price-determining characteristics of the products transactions be taken into account, including (if relevant) the quantity of units imported, transport provided, rebates, service conditions, guarantee conditions and country of consignment. The specification must be such that in subsequent reference periods the observation unit is able uniquely to identify the product and to provide the appropriate price per unit. If transport costs are included, this should be part of the product specification. The price index should take into account quality changes in products. Time of recording - following ESA 95 recommendations, the time of recording for the “import transaction price” must be understood when the ownership of the goods is transferred (i.e. when the parties record transaction in their books or account). The price collected for period t should therefore refer to transactions involving a change of ownership realised during period t. Collection period - a price index should reflect in principle the average price level during the reference period. In practice, the information actually collected may refer to a particular day in the middle of the reference period that should be determined as a representative figure for the reference period.

The transfer of ownership - of boats and aircraft or similar products from a person established in a non-member country to a person established in the Member State in question is counted as import. This follows directly from the definition of imports. Intra-firm trade and transfer prices - intra firm trade should be taken into account as long as these transfers are based on prices, which are market based or market influenced; transfer prices, i.e., prices used to value international transactions between enterprises belonging to the same enterprise group, may behave as market prices between unaffiliated units in a pure competitive environment. They may also be used as a means to effect a hidden income payment or receipt between the enterprises involved. Such transfer prices should be avoided, where possible, and replaced by market prices. If no market prices are available (or if their share is not significant) non-market transfer prices can be used. If indices for transfer prices actually differ from indices for arm's length prices, care must be exercised in using the resulting index as deflator of trade flows, since the resulting volume index would be biased. The total value of imports includes goods exchanged through market prices as well as goods using non-market transfer prices, and should not be deflated by a "purely market" import price index to get volume data. However, the latter import price index can be used – at least in theory – to deflate imports values after adjustment for the part corresponding to hidden subsidies (received or given) among affiliated enterprises. Therefore, the weights used for the MPI do not need to be restricted to arm’s length transactions but should include as well intra-firm trade value data properly adjusted. Euro / non-euro indices - the euro-zone and non-euro-zone price indices will be compiled or estimated according to the country of consignment of the product. The residency of the third party that has sold the product determines the country of consignment. The non-euro-zone area is defined as third parties non-resident in one of the euro-zone-Member States territories. As indicated in the Annex to the Regulation, the Commission may determine in accordance with the Committee procedure.

31 the terms for applying European sample scheme, 32which may limit the scope of the import price variable to the import of products from non-euro zone countries.

The monthly monitoring of changes in prices of products imported by national importers33 is done by means of a statistical survey of the importers in the product in question. Regular collection of prices data normally flows from a sample of products, reporting units and representative commodities.

31 STS-Regulation: article 1832 STS-Regulation: article 433 It is not strictly possible to define uniformly a “national importer” in the EU. Regulations mention “external trade operators”, which can be enterprises, KAUs, local KAUs, etc., depending on Member State concerned.

The basic sampling method used varies between national statistical authorities. It generally involves a three-stages sampling process of products, enterprises or similar units and specific representative commodities to be priced. The first stage - consists of selecting a sample of product groups - import headings. The second stage - consists of selecting a sample of enterprises (or similar units) under each import heading. The third stage - is the selection of specific commodities (items) to be priced. This third stage may be done by the enterprise (or similar unit). For import prices, the import headings and the surveyed units may be selected beyond a cut-off point if they are deemed representative for the overall import values for concerned (group of) product(s)34 . The sampling frame used may vary depending on quality of external foreign trade information (mainly Intrastat and Extrastat databases). A probabilistic (usually proportional to size) or a judgmental (purposive) method is used to ensure a representative sample. For each of the product groups of the enterprise (or similar unit), specific commodities (or transactions) are selected for re-pricing. Selected items should ideally be available for monthly re-pricing and account for a significant share of imports within the commodity group and/or be broadly representative of the commodity group. Rather than using a field officer to collect this information, most of Member States undertake this work by telephone or by post or by email. The use of a detailed level of the product classification to select the commodities ensures greater accuracy of the index at CPA 4-digit level. In most countries, commodity data is gathered at CPA 6-digit level or even finer. Every commodity selected for monthly monitoring needs to be described in great accuracy, together with its import price and all price-determining characteristics of the transaction.

34 Concerning sampling issue, the relation between external trade registers (when they exist) and business registers is not always clear.

A number of difficulties may arise: a reporting unit may cease to be active; a product may cease to be imported by the reporting unit; the price determining characteristics of a product may change.

When there is no import of a product according to the selected specification in a given month, a solution is to maintain the price at its last level until the next period when an import takes place. An alternative is to apply the price change of other products (matched models approach to changes in the products described below).

If a product ceases be imported, or if a new imported product appears in the economy, it is impossible to directly compare the price between a period in which the product exists and one in which it does not. This situation is essentially an extreme case of a quality change in a product and the methods of treating it can be considered the same as those where a product has changed. These are described below. New products should be introduced into the compilation of the index as soon as they have achieved a significant share of the value of imported goods.

A change of product specification is defined as when product i’ replaces product i, both being representative of the same family (or group) of products but being sufficiently different to distinguish them one from the other from an economic point of view. In practice, a change of product becomes known if the importer advises the national statistical authority of the fact, or if the price seems to change too much (or too little) for the product in question. Most Member States have set up a price change monitoring method. The acceptable range (for example +/- 5%) may vary according to the product or area. For example, for product coming from the non-euro zone area, changes can be much wider because of exchange rate fluctuations. The variation in price between pi (t-1) and pi '(t) results from the difference between the two in nature, composition, market positioning and so on. A breakdown of the change between pi (t-1) and pi'(t) must therefore be made, with one component, the "quality effect" measuring the price change attributable to changes in the specification and a second quality component. Market prices do not always properly reflect quality differences. The closer the market for a product is to perfect competition the better the quality evaluation from market prices. As such, the appropriateness of a particular method depends in part on the characteristics of the market for the product.

Any product change must be quantified in terms of pure price development. In the case of imports, (with relevant splits, in particular euro-zone and non-euro-zone), the country of consignment factor can also lead to a change in product external to all the other characteristics of the selected product. When a product i’ replaces product i, both should be representative of the same family of products, and thus of the same (group of) country of consignment. A change in price between the two products i and i’ may be due to no more than a change in the product's country of consignment. For this reason, every effort must be made to quantify the pure price effect of this change of country of consignment.

Various methods may be considered, depending on the data available, the type of product involved and the type of quality change involved.The main methods are hedonic econometric methods, option prices, overlap pricing, resampling, matched models only, judgmental approaches, link to show no change (automatic linking)35 .

Import price indices are constructed from successive aggregations in which each level of aggregation uses the arithmetic mean of indices at the level below, duly weighted. The weights of the lower level indices (below the Class level) are mostly given by external trade data. Intrastat and Extrastat distinguish the euro-zone and non-euro zone areas and the system of weights is obtained normally from the sample of “products/enterprise or similar units/representative commodities” concerning the Rest of the World area. The formulas used at different level of aggregations correspond to Laspeyres-type indices, either annually chained from the last (or any) month of the year with a weight structure updated annually and referring to a resent year or computed with a fixed structure of weights, which is that of the base year. The computation formulae are set out below (see 7.4. 6 Technical annexes).

(35 For more information about all these methods see on IMF website “Export and Import Price Index Manual”).

MPIs are destined for dissemination at the 4-digit level of the CPA, at least for manufactured products for larger Member States. For data at a more detailed level, there exists an aggregation procedure allowing the change from products to CPA 4-digit level. The weights then used may be external or foreign trade statistics (Intrastat & Extrastat) but it is possible also use national accounts data. When required, MPIs for euro-zone and non-euro-zone products are to be produced at two-digit level of the CPA.

The detail required for the indices depend upon the Section (more detail is required from Section D) and from the economic size of the country (small countries may provide less detailed series). A lower degree of detail is also required for the breakdown of the indices between euro-zone and non-euro zone, such indices being required only from those Member States that have adopted the euro as their currency. The precise description of the series to be compiled for the import price indices (MPIs) as well as the deadlines can be seen in Associated documents of the Methodological Manual available on CIRCA site /Library/ Methodology/STS Methodological Manual /“STS-Requirements”.

The European Central Bank (ECB) has on several occasions expressed the need for separate price indices for imports (arrivals) from the non-euro zone countries. Therefore, according to Annex A of the STS -Regulations, import price indices are to be transmitted according to the distinction into euro-zone and non-euro-zone, although this is not required from member States that have not adopted the euro as their currency. The Annex also indicates that, for the distinction into the euro-zone and the non-euro-zone, the Commission may determine in accordance with the Committee procedure36 the terms for applying European sample scheme37. The European sample scheme may limit the scope of the import price variable to the import of products from non-euro zone countries. Until such a European sample is set up, the ideal solution is, for euro-zone Member States, to price separately representative samples of items imported from the euro-zone and from the non-euro-zone, respectively, and to compute the two series of indices separately. However, several Member States are concerned, among others, by the increase in the cost of data collection and processing, and by the additional burden that would be put on enterprises.

For a given group of products, there are several reasons for the asymmetry, within a given country or area, between indices of output prices for the non-domestic market and import price indices. The major reason is probably the difference in institutional coverage. Import prices indices exclude imports by general government, non-profit institutions and households, but do not set any restriction on the institutional sector of the exporter. Indices of output prices for the non-domestic market cover the sales abroad of units classified in NACE C, D and E activities, with no restriction on the institutional sector of the importer, including all goods and related services resulting from these activities. A second cause of asymmetry is the valuation mode: CIF for the MPI, FOB for the index of output prices on the non-domestic market. The MPI therefore includes transport and insurance costs from the border of the exporting country to the border on the importing country. Another cause of asymmetry is the exclusion of services associated to goods in the MPI, while these are considered within scope of the index of output prices on the non-domestic market. There are also other minor causes of asymmetry. For example, the methodology of data collection for output prices for the non-domestic market implies in practice the items priced to the main production of the data providing units (products with CPA corresponding to the NACE Rev.1.1 of the unit). On the other hand, import price indices may cover items that are secondary productions of the exporter. There are also minor discrepancies due to difference in the time at which prices are to be reported or to differences in the exchange rates used by the importing and exporting countries.

36 STS-Regulation: article 18 37 STS-Regulation: article 4.

If the indicator of import prices is not available, the STS-Regulations permit this to be approximated by an indicator of the unit value, only if this does not imply any significant deterioration in quality compared to specific price information. An import unit value is the ratio, for a given group of products, of the value of non-domestic imports and their volume. Changes in unit value thus reflect both specific price changes, changes in the composition of products within the group and changes in quality. Monthly changes in the product composition of the group may lead to erratic movements of the unit value index. Quality improvements make the unit value index systematically over-estimate the specific price index.

For the latest version of overview of national methods, see STS Sources available on CIRCA site/Library/Methodology/STS Sources.

The total value of imports during the reference period is M. Ideally, imports by households, government units and non-profit institutions should be excluded. There are n commodity groups {i =1, … n} in reference to the CPA38 nomenclature. For each commodity group (type i) the value of imports during the reference period is Mi , representing a share wi of total imports;

The import prices indices will be calculated based on the following Laspeyres formula:

For practical computations purposes, the formula is modified as follows:

where:

pi(t) = price of commodity groups (variant i) in the current (or comparison) month (t).

pi(0) = price of commodity groups (variant i) in base year (0).

represents the weight of commodity groups (type i)39.

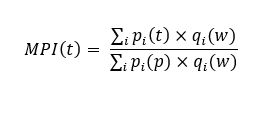

For a chain index the corresponding formulas (for the index links) are:

where: pi(t) = price of commodity groups (variant i) in the current (or comparison) month (t).

pi( p) = price of commodity groups (variant i) in the price reference period (p) (often december of year Y-1).

represents the weight of commodity groups (type i)40.

38 For the purposes of this manual, it is assumed that the indices are calculated first at the (Group of) product(s) level of CPA and then aggregated to higher levels.

The import prices indices (index links) are the arithmetic mean of the “individual” price relatives weighted with the weight period import quantities at price reference period prices, which are calculated for a representative selection of import transactions on a monthly basis. Elementary indices can be calculated as arithmetic means as well as geometric means. Import price indices (index links) at higher levels of aggregation are computed in the same way.

39 i.e. relation of the import value in base year (0) of commodity groups (type i) to the total import value in base year (0)40 i.e. relation of the weight period (w) imports at price reference period (p) prices of commodity groups (type i) to the total weight period (w) imports at price reference period (p) prices) .