This release has been compiled during the COVID-19 crisis. The results contained in this release reflect some of the economic aspects of the COVID-19 situation.

It is important to note that the results presented in the survey represent responding enterprises only. The CSO acknowledges that non-response may be related to whether businesses are adversely impacted by COVID-19. If this were the case, there is potential for bias in these estimates that weighting procedures would not correct for. As such, the results presented here are unweighted.

For further information see Background Notes. Business Impact of COVID-19

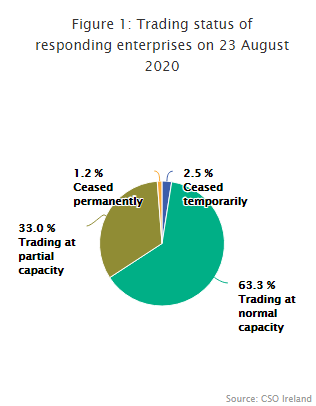

| Trading status of responding enterprises on 23 August 2020 | |

| % of responding enterprises | |

| Trading at normal capacity | 63.3 |

| Trading at partial capacity | 33.0 |

| Ceased trading temporarily | 2.5 |

| Ceased trading permanently | 1.2 |

| Total | 100.0 |

The Business Impact of COVID-19 Survey (BICS) has been created to measure and report quickly on the impact of COVID-19 on business in Ireland. The sixth wave of the survey was collected in the week commencing 24 August 2020.

A total of 3,000 enterprises were surveyed online for the sixth wave of the BICS, with 25.5% of sampled enterprises completing the survey. The survey reports that of responding enterprises:

For further information, see Infographic

| Please note that not all businesses may be in a position to respond to the Business Impact of COVID-19 Survey. Therefore, the results will only reflect the characteristics of those who responded. |

A quarter of partially trading enterprises trading at more than 75% of normal capacity

| For long labels below use to display on multiple lines | Trading capacity |

|---|---|

| Up to 25% capacity | 15 |

| 25% to 50% capacity | 19.4 |

| 50% to 75% capacity | 38.3 |

| Over 75% capacity | 24.9 |

| Don't know | 2.4 |

| X-axis label | 27 Jul-23 Aug | 24 Aug-20 Sep |

|---|---|---|

| 75 to 100% less than normal | 10.1 | 8.1 |

| 50 to 74% less than normal | 7.8 | 8.6 |

| 25 to 49% less than normal | 13.7 | 12.9 |

| 10 to 24% less than normal | 18.9 | 19.8 |

| At or close to normal expectation | 40 | 45.2 |

| Higher than normal | 9.6 | 5.4 |

More than half of respondents had lower than normal turnover

| For long labels below use to display on multiple lines | Turnover exceeded operating costs | Turnover about equal to operating costs | Operating costs exceeded turnover | Don't know |

|---|---|---|---|---|

| Micro (<10) | 48.7 | 24.8 | 7.7 | 18.8 |

| Small (10-49) | 55.8 | 25.3 | 9.6 | 9.3 |

| Medium (50-249) | 61.2 | 13.7 | 14.2 | 10.9 |

| Large (250+) | 57.6 | 13.9 | 18.8 | 9.7 |

| Total | 56.4 | 20.1 | 12.2 | 11.3 |

Turnover exceeded operating costs for more than half of responding enterprises

| X-axis label | Imports | Exports |

|---|---|---|

| Decreased | 21.8 | 30.3 |

| Increased | 3.7 | 2.4 |

| Not affected | 66.3 | 59.3 |

| Don't know | 8.3 | 7.9 |

Exports decreased for 30.3% of responding exporters

Almost half of respondents expecting to be negatively impacted by Brexit believe that COVID-19 will worsen the impact

| For long labels below use to display on multiple lines | Brexit impact |

|---|---|

| Positive impact | 1.1 |

| Negative impact | 43.9 |

| No impact | 18 |

| Don't know | 37 |

| For long labels below use to display on multiple lines | Brexit |

|---|---|

| Stronger negative impact | 47.6 |

| Neither stronger or weaker negative impact | 30.9 |

| Weaker negative impact | 21.5 |

| X-axis label | Staff working at their normal place of work | Staff working remotely | Not currently working | Other (deployed elsewhere etc.) |

|---|---|---|---|---|

| Office based enterprises | 34.5 | 57.7 | 6.3 | 1.5 |

| Non-office based enterprises | 76.1 | 12.9 | 6.3 | 4.7 |

| Total | 65.2 | 24.6 | 6.3 | 3.9 |

Non-office based enterprises had an average of 76.1% of staff working at their normal place of work

Note: Office based enterprises in this release refer to enterprises in NACE sectors J-N. For further information see Background Notes. Business Impact of COVID-19

| For long labels below use to display on multiple lines | Returned from temporary leave | Returned from remote working |

|---|---|---|

| Office based enterprises | 5.1 | 8.4 |

| Non-office based enterprises | 21.1 | 6.5 |

| Total | 16.9 | 7 |

An average of 7.0% of staff returned from remote working from 27 July to 23 August 2020

| For long labels below use to display on multiple lines | Yes | No | Don't know | Not applicable |

|---|---|---|---|---|

| Office based | 40.1 | 16.2 | 40.6 | 3.1 |

| Non-office based | 17.2 | 37.8 | 25.6 | 19.4 |

| Total | 23.2 | 32.2 | 29.5 | 15.1 |

Almost a quarter of enterprises plan to make remote working, in some capacity, a permanent fixture

| X-axis label | Workplace measures |

|---|---|

| Staff remote working | 55.6 |

| Rearranging workspace to facilitate social distancing | 79.9 |

| Staggering shifts to facilitate social distancing | 37.4 |

| Occupancy limits in the workplace | 42.4 |

| Mandatory PPE (face covering, gloves, etc.) in the workplace | 63.4 |

| Maintaining log of personal interactions to facilitate contact tracing | 50.1 |

| Temperature screening | 37.2 |

| Increased hygiene measures | 81.6 |

| Protective screening for staff | 49.5 |

| Other | 4.6 |

| No measures | 1.6 |

More than four in five enterprises have increased hygiene measures in the workplace

| X-axis label | % of business expenditure |

|---|---|

| Micro (<10) | 6.1 |

| Small (10-49) | 4.3 |

| Medium (50-249) | 3.9 |

| Large (250+) | 3.9 |

| Total | 4.4 |

An average of 4.4% of expenditure spent on measures to comply with COVID-19 requirements for trading

More than a quarter of enterprises had higher than projected non-personnel costs

| For long labels below use to display on multiple lines | Personnel costs |

|---|---|

| 50-100% lower | 5.4 |

| 20-50% lower | 7.2 |

| Up to 20% lower | 16.1 |

| No change | 40.5 |

| Up to 20% higher | 16.7 |

| Over 20% higher | 2.1 |

| Don't know | 12 |

| For long labels below use to display on multiple lines | Non-personnel costs |

|---|---|

| 50-100% lower | 3.9 |

| 20-50% lower | 4.9 |

| Up to 20% lower | 16.4 |

| No change | 32.2 |

| Up to 20% higher | 26.4 |

| Over 20% higher | 1.2 |

| Don't know | 14.9 |

| X-axis label | Measures taken |

|---|---|

| Deferred or changed loan repayments | 11.5 |

| Deferred or changed property payments (including rent, utilities and local authority rates) | 17 |

| Deferred or changed revenue payments | 18.4 |

| Deferred or changed payments to suppliers | 13 |

| Increased overdraft facilities | 5.6 |

| Other | 3.3 |

| No measures taken | 62.6 |

Over six in ten enterprises took no measures to manage cashflow because of COVID-19

| For long labels below use to display on multiple lines | Business concerns |

|---|---|

| Reduced demand due to lower consumer confidence | 36.7 |

| Reduced workforce productivity | 10.5 |

| Increased costs of business | 16.4 |

| Maintaining cashflow | 19.9 |

| An increase of COVID-19 cases leading to another lockdown | 48.6 |

| Reduced availability of Government supports | 7.9 |

| Future staff layoffs | 8.6 |

| Staff well-being | 29.4 |

| Other | 2.6 |

| No immediate concerns | 5.8 |

Almost half of enterprises concerned about an increase in COVID-19 cases leading to another lockdown

Six in ten enterprises expressed confidence in having the financial resources to continue operating for longer than six months

| For long labels below use to display on multiple lines | Continue to operate |

|---|---|

| Up to 1 month | 3.4 |

| Up to 3 months | 11.9 |

| Up to 6 months | 16.2 |

| Longer than 6 months | 60.4 |

| Not confident | 1.6 |

| Don't know | 6.5 |

Less than half of responding enterprises availed of Government supports from 27 July to 23 August 2020

| For long labels below use to display on multiple lines | Government support |

|---|---|

| Yes | 45.7 |

| No | 54.3 |

| Table 1 Enterprises trading at partial capacity due to COVID-19 | |

| % of responding enterprises | |

| Up to 25% capacity | 15.0 |

| Between 25% and 50% capacity | 19.4 |

| Between 50% and 75% capacity | 38.3 |

| More than 75% capacity | 24.9 |

| Don’t know | 2.4 |

| Total | 100.0 |

| Table 2 Estimated impact on turnover in the previous (27 Jul - 23 Aug) and forthcoming (24 Aug - 20 Sep) four week periods | ||

| % of responding enterprises | ||

| Estimated impact on turnover | 27 Jul-23 Aug | 24 Aug-20 Sep |

| 75-100% less than normal | 10.1 | 8.1 |

| 50-74% less than normal | 7.8 | 8.6 |

| 25-49% less than normal | 13.7 | 12.9 |

| 10-24% less than normal | 18.9 | 19.8 |

| At or close to normal expectation | 40.0 | 45.2 |

| Higher than normal | 9.6 | 5.4 |

| Total | 100.0 | 100.0 |

| Table 3 Turnover versus operating costs in the four weeks from 27 Jul to 23 Aug 2020 | |||||

| % of responding enterprises | |||||

| Turnover versus costs | Micro | Small | Medium | Large | Total |

| (<10) | (10-49) | (50-249) | (250+) | ||

| Turnover exceeded operating costs | 48.7 | 55.8 | 61.2 | 57.6 | 56.4 |

| Turnover about equal to operating costs | 24.8 | 25.3 | 13.7 | 13.9 | 20.1 |

| Operating costs exceeded turnover | 7.7 | 9.6 | 14.2 | 18.8 | 12.2 |

| Don't know | 18.8 | 9.3 | 10.9 | 9.7 | 11.3 |

| Total | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

| Table 4 COVID-19 impact on international trade, 27 Jul to 23 Aug 2020 | ||

| % of responding enterprises | ||

| Impact on international trade | Exports | Imports |

| Decreased | 30.3 | 21.8 |

| Increased | 2.4 | 3.7 |

| Not affected | 59.3 | 66.3 |

| Don't know | 7.9 | 8.3 |

| Total | 100.0 | 100.0 |

| Table 5a Expected impact of Brexit on business | |

| Impact | % of responding enterprises |

| Positive impact | 1.1 |

| Negative impact | 43.9 |

| No impact | 18.0 |

| Don't know | 37.0 |

| Total | 100.0 |

| Table 5b Changes to the expected negative impact of Brexit due to COVID-19 | |

| Negative impact | % of responding enterprises |

| Stronger | 47.6 |

| Weaker | 21.5 |

| Neither stronger or weaker | 30.9 |

| Total | 100.0 |

| Table 6 Average percentage of workforce by location in the week ending 23 Aug 2020 | |||

| % of responding enterprises | |||

| Location | Office based | Non-office based | Total |

| Staff working at their normal place of work | 34.5 | 76.1 | 65.2 |

| of which: | |||

| Returned from temporary leave (27 Jul - 23 Aug) | 5.1 | 21.1 | 16.9 |

| Returned from remote working (27 Jul - 23 Aug) | 8.4 | 6.5 | 7.0 |

| Staff working remotely | 57.7 | 12.9 | 24.6 |

| Not currently working | 6.3 | 6.3 | 6.3 |

| Other (deployed elsewhere etc.) | 1.5 | 4.7 | 3.9 |

| Table 7 Plans to make remote working permanent in some capacity | |||

| % of responding enterprises | |||

| Permanent remote working | Office based | Non-office based | Total |

| Yes | 40.1 | 17.2 | 23.2 |

| No | 16.2 | 37.8 | 32.2 |

| Don't know | 40.6 | 25.6 | 29.5 |

| Not applicable | 3.1 | 19.4 | 15.1 |

| Total | 100.0 | 100.0 | 100.0 |

| Table 8 Workplace measures implemented due to COVID-19 up to 23 Aug 2020 | |

| % of responding enterprises | |

| Staff remote working | 55.6 |

| Rearranging workspace to facilitate social distancing | 79.9 |

| Staggering shifts to facilitate social distancing | 37.4 |

| Occupancy limits in the workplace | 42.4 |

| Mandatory PPE (face covering, gloves, etc.) in the workplace | 63.4 |

| Maintaining log of personal interactions to facilitate contact tracing | 50.1 |

| Temperature screening | 37.2 |

| Increased hygiene measures | 81.6 |

| Protective screening for staff | 49.5 |

| Other | 4.6 |

| No measures | 1.6 |

| Table 9 Proportion of business expenditure spent on measures to comply with COVID-19 requirements for trading from 27 Jul to 23 Aug 2020 | |

| Size class | % of business expenditure |

| Micro (<10) | 6.1 |

| Small (10-49) | 4.3 |

| Medium (50-249) | 3.9 |

| Large (250+) | 3.9 |

| Total | 4.4 |

| Table 10 Estimated changes in operating costs up to 23 Aug 2020 | ||

| % of responding enterprises | ||

| Estimated changes | Personnel costs | Non-personnel costs |

| 50-100% lower | 5.4 | 3.9 |

| Between 20-50% lower | 7.2 | 4.9 |

| Up to 20% lower | 16.1 | 16.4 |

| No change | 40.5 | 32.2 |

| Up to 20% higher | 16.7 | 26.4 |

| More than 20% higher | 2.1 | 1.2 |

| Don't know | 12.0 | 14.9 |

| Total | 100.0 | 100.0 |

| Table 11 Measures taken to manage cashflow as a result of the COVID-19 crisis in the four weeks 27 Jul to 23 Aug 2020 | |

| % of responding enterprises | |

| Deferred or changed loan repayments | 11.5 |

| Deferred or changed property payments (including rent, utilities and local authority rates) | 17.0 |

| Deferred or changed revenue payments | 18.4 |

| Deferred or changed payments to suppliers | 13.0 |

| Increased overdraft facilities | 5.6 |

| Other | 3.3 |

| No measures taken | 62.6 |

| Table 12 Business concerns while currently operating during the COVID-19 pandemic | |

| % of responding enterprises | |

| Reduced demand due to lower consumer confidence | 36.7 |

| Reduced workforce productivity | 10.5 |

| Increased costs of business | 16.4 |

| Maintaining cashflow | 19.9 |

| An increase of COVID-19 cases leading to another lockdown | 48.6 |

| Reduced availability of Government supports | 7.9 |

| Future staff layoffs | 8.6 |

| Staff well-being | 29.4 |

| Other | 2.6 |

| No immediate concerns | 5.8 |

| Table 13 Confidence in financial resources to continue operating throughout the COVID-19 crisis, 27 Jul to 23 Aug 2020 | |

| % of responding enterprises | |

| Up to 1 month | 3.4 |

| Up to 3 months | 11.9 |

| Up to 6 months | 16.2 |

| Longer than 6 months | 60.4 |

| Not confident | 1.6 |

| Don't know | 6.5 |

| Total | 100.0 |

| Table 14 Availing of Government supports, 27 Jul to 23 Aug 2020 | |

| % of responding enterprises | |

| Availed of Government support* | 45.7 |

| of which: | |

| Revenue Temporary COVID-19 Wage Subsidy Scheme | 39.9 |

| COVID-19 Working Capital Loan Scheme (SBCI) | 1.6 |

| COVID-19 Business Financial Planning Grant (Enterprise Ireland) | 2.1 |

| Restart Grant (Local Authority) | 13.6 |

| Other | 4.0 |

| Not availed of Government support | 54.3 |

| Total | 100.0 |

| * Note that some enterprises have availed of more than one type of government support. | |

The Business Impact of COVID-19 Survey (BICS) has been created to measure and report quickly on key features of the impact of the COVID-19 crisis on business in Ireland.

The survey is being conducted online and covers a sample of approximately 3,000 enterprises. The first wave of the survey was collected in the week commencing 20 April 2020 while the most recent sixth wave of the survey was collected 24 August 2020.

| Wave | Period Covered | Response Rate |

| 1 | 16 March to 19 April 2020 | 26.0% |

| 2 | 20 April to 3 May 2020 | 24.5% |

| 3 | 4 May to 31 May 2020 | 27.9% |

| 4 | 1 June to 28 June 2020 | 27.1% |

| 5 | 29 June to 26 July 2020 | 24.9% |

| 6 | 27 July to 23 August 2020 | 25.5% |

The survey was collected from enterprises on a voluntary basis under Section 24 of the Statistics Act, 1993.

The information collected in the survey is confidential under the Statistics Act and will only be used by the Central Statistics Office for the compilation of aggregate statistics. The CSO has checked the statistical outputs of the survey to ensure that tables do not disclose details of any company. The raw data will not be shared with any other organisations.

The CSO would like to thank businesses that responded to the Business Impact of COVID-19 Survey.

The reporting statistical unit for the BICS is the enterprise. The sample size for the BICS is 3,000 enterprises. The enterprise is defined as the smallest combination of legal units that is an organisational unit producing goods and/or services, which benefits from a certain degree of autonomy in decision-making.

There was a response rate of 25.5% to the sixth wave of the survey. It is important to note that the results of the survey apply to respondents only, and that no imputation or estimation procedures have been used in the case of non-response. The CSO acknowledges that not all businesses may be in a position to respond to the survey. Therefore, as the results of the survey are unweighted, they may only reflect the characteristics of those who have responded.

Enterprises of all size classes were surveyed. The sectors of economic activity included in the survey were determined in accordance with the NACE Rev. 2 classification scheme, which is the European Commission’s classification system for economic activity. The NACE Rev. 2 sectors included in the survey were as follows:

Sector B: Mining and quarrying

Sector C: Manufacturing

Sector D: Electricity, gas, steam and air conditioning supply

Sector E: Water supply; sewerage, waste management and remediation activities

Sector F: Construction

Sector G: Wholesale and retail trade; Repair of motor vehicles and motorcycles

Sector H: Transportation and storage

Sector I: Accommodation and food service activities

Sector J: Information and communication

Sector K: Financial and insurance activities

Sector L: Real estate activities

Sector M: Professional, scientific and technical activities

Sector N: Administrative and support service activities

Sector R: Arts, entertainment and recreation

Sector S: Other service activities

Please note that some more granular NACE Rev. 2 descriptions were also referenced in the text of this release. For further information on the NACE Rev. 2 classification scheme, please click Classifications

The survey is collected via an online questionnaire. The topics covered are about how the COVID-19 crisis has affected business and what steps have been taken as a result – e.g. in relation to the level of business, workforce and organisational changes, access to finance, and availing of Government support schemes.

The following is a link to the questionnaire for each wave of the BICS survey:Business Impact of COVID-19 Survey

Size Class

For the BICS, the size class of an enterprise is determined by the number of persons engaged associated with the enterprise as follows:

| Size Class | Number of Persons Engaged |

| Micro | 0 - 9 |

| Small | 10 - 49 |

| Medium | 50 - 249 |

| SMEs | 0 - 249 |

| Large | 250+ |

A Small or Medium Enterprise (SME) is an amalgamation of the Micro, Small and Medium categories, i.e. having 0-249 persons engaged.

Sector

In the above results, there are cases where several NACE Rev. 2 categories are presented in aggregate form as follows:

| Sector | NACE Rev. 2 Category |

| Industry | B-E |

| Construction | F |

| Wholesale and Retail | G |

| Services | H-N, R-S |

| Office-based | J-N |

| Non-office-based | B-I, R-S |

Note: Some of the data presenting in the release separate Accommodation and Food Services (NACE I) from Services.

Other Breakdowns

Many of the breakdowns in this release are based on the enterprise’s own best estimate at a point in time. The qualitative nature of these breakdowns has been chosen to limit burden on respondents.

Hide Background Notes

Hide Background Notes

Scan the QR code below to view this release online or go to

http://www.cso.ie/en/releasesandpublications/er/bic19/businessimpactofcovid-19survey27julto23aug2020/